April 2025

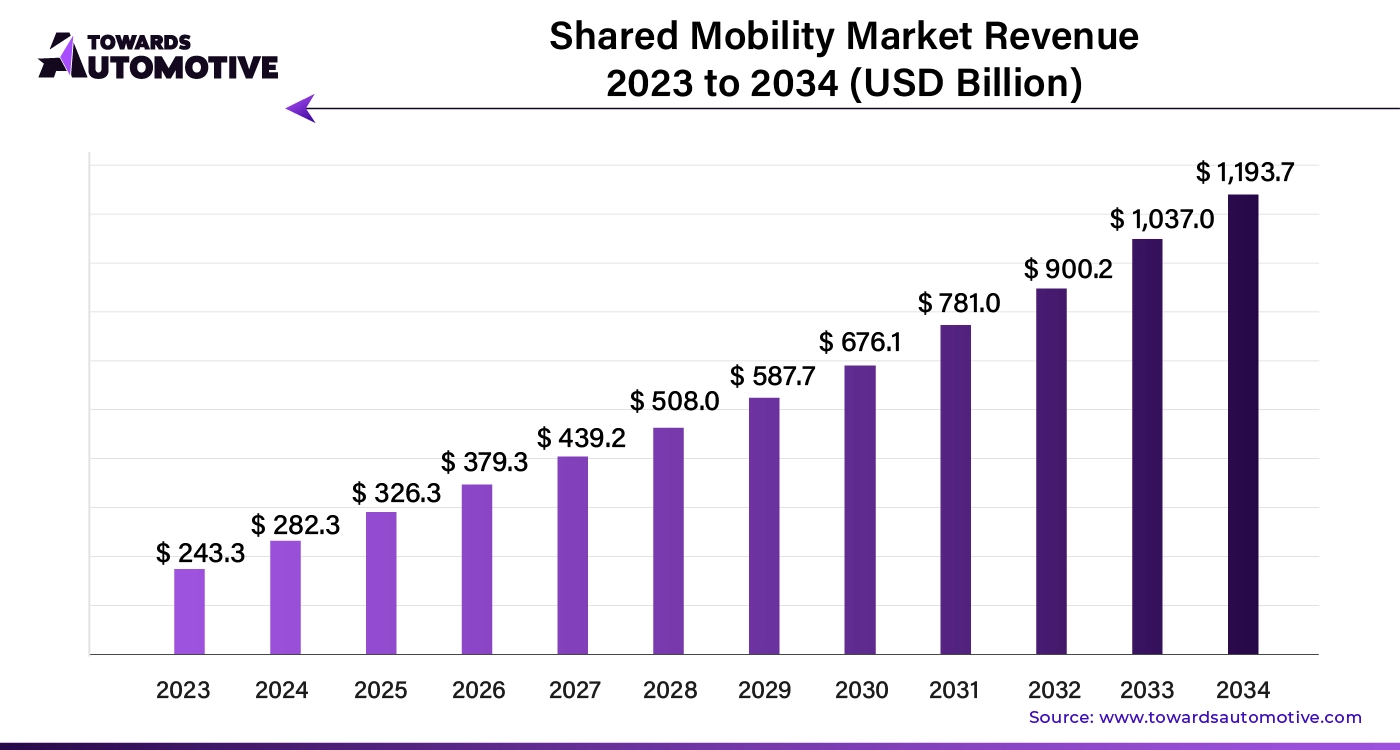

The global shared mobility market size is calculated at USD 243.3 billion in 2024 and is expected to be worth USD 1193.7 billion by 2034, expanding at a CAGR of 15.85% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The shared mobility market is rapidly transforming the way people travel by offering innovative, cost-effective, and eco-friendly alternatives to traditional transportation methods. This market encompasses a wide range of services, including ride-hailing, car-sharing, bike-sharing, and scooter-sharing, allowing users to access vehicles on demand rather than owning them. The shift toward shared mobility is driven by urbanization, increasing traffic congestion, environmental concerns, and changing consumer preferences for more flexible transportation options.

Advancements in technology, such as mobile apps and real-time data, have made shared mobility more accessible and convenient. Users can easily locate, book, and pay for shared vehicles through mobile platforms, streamlining the entire process. The rise of electric vehicles (EVs) and government incentives promoting sustainable transport are also bolstering the shared mobility market, particularly in urban areas aiming to reduce carbon emissions.

Additionally, the growth of shared mobility is fostering new business models, such as subscription-based services and partnerships between public transportation agencies and private mobility providers. As cities continue to evolve and prioritize sustainability, shared mobility is expected to play a crucial role in shaping the future of urban transportation, offering a scalable solution to address the challenges of congestion, pollution, and accessibility.

AI plays a transformative role in the shared mobility market, enhancing efficiency, safety, and user experience. Its integration is revolutionizing how shared mobility services, such as ride-hailing, car-sharing, bike-sharing, and scooter-sharing, operate by providing smart, data-driven solutions. One of the key contributions of AI is route optimization. By analyzing real-time traffic data, AI algorithms can suggest the fastest and most fuel-efficient routes for shared vehicles, reducing travel time and improving overall service efficiency.

AI also contributes to dynamic pricing models in the shared mobility market. By analyzing demand patterns, weather conditions, and traffic flows, AI helps operators adjust prices in real time, ensuring better utilization of vehicles while maximizing profitability. This also leads to better fleet management. AI can predict peak demand periods and optimize fleet deployment, ensuring that vehicles are available where and when they are needed most, reducing wait times for users.

In terms of safety, AI-powered systems, including driver monitoring technologies, enhance the security of passengers by detecting drowsiness, unsafe driving behaviors, or fatigue in real-time. This helps prevent accidents and improves the overall safety of shared mobility services.

Furthermore, predictive maintenance enabled by AI ensures that shared vehicles are maintained before they break down. By analyzing vehicle data, AI can predict when components are likely to fail, helping companies schedule maintenance proactively, reducing vehicle downtime, and improving service reliability.

AI also plays a role in personalizing user experiences by leveraging machine learning algorithms to study user preferences and recommend tailored transportation options, offering seamless and convenient service. As shared mobility services expand, AI's role will be even more pivotal, driving operational efficiency, cost savings, and enhanced customer satisfaction across the sector.

The growing number of ride-sharing platforms is a major driver of the shared mobility market’s growth, reshaping urban transportation and changing how people move within cities. Ride-sharing platforms, such as Uber, Lyft, and Grab, provide users with convenient and affordable alternatives to traditional car ownership, allowing them to book rides on demand via mobile apps. As these platforms expand their presence, they are offering a wide range of transportation options, from carpooling to luxury rides, meeting the diverse needs of consumers. This variety encourages more people to choose shared mobility services over owning personal vehicles, which can be costly in terms of maintenance, fuel, and parking.

One of the key factors driving the expansion of ride-sharing platforms is urbanization. With increasing population density in cities, traffic congestion and parking limitations have become major concerns. Ride-sharing services offer a solution by reducing the number of vehicles on the road, encouraging more efficient use of transportation infrastructure. Additionally, ride-sharing helps reduce carbon emissions by promoting shared rides and reducing the overall number of trips, aligning with sustainability goals and government efforts to minimize pollution.

The convenience of ride-sharing apps is another significant factor contributing to market growth. The user-friendly interface, real-time tracking, and cashless payments make it easy for consumers to book rides quickly and affordably. These platforms often offer promotions, discounts, and subscription-based models, further encouraging users to adopt shared mobility.

Moreover, the expansion of ride-sharing platforms into electric and autonomous vehicles is pushing the shared mobility market forward. As ride-sharing companies increasingly adopt electric vehicles (EVs) and explore autonomous driving technology, they are enhancing sustainability and driving technological innovation, further fueling market growth. Altogether, the rise of ride-sharing platforms is a cornerstone of the shared mobility market, offering convenience, affordability, and sustainability in modern urban transportation.

The shared mobility market faces several restraints that hinder its growth. One major challenge is regulatory uncertainty, as different regions impose varying laws and restrictions on ride-sharing and other mobility services. Additionally, safety concerns, including the risk of accidents and data privacy issues, deter some potential users. High operational costs, such as vehicle maintenance and driver wages, can limit profitability for mobility service providers. Furthermore, inadequate infrastructure, especially in emerging markets, and resistance from traditional transportation sectors such as taxis and public transit also pose barriers, slowing the widespread adoption of shared mobility solutions.

Autonomous vehicles (AVs) are poised to create significant opportunities in the shared mobility market by transforming the way people access transportation services. As ride-sharing and car-sharing platforms begin integrating self-driving cars into their fleets, the reliance on human drivers decreases, leading to lower operational costs and higher profit margins for service providers. This shift can also make shared mobility services more affordable for users, encouraging wider adoption of on-demand transportation options.

AVs bring the potential for enhanced efficiency, as they can operate 24/7 without the limitations of driver fatigue, reducing wait times for users and increasing fleet utilization. Additionally, autonomous technology offers improved safety through advanced sensors, AI-driven navigation, and real-time data processing, which can significantly reduce the risk of accidents compared to human-driven vehicles.

Moreover, AVs enable the optimization of routes, further improving operational efficiency and reducing energy consumption. This aligns with sustainability goals, as autonomous electric vehicles can be seamlessly integrated into shared mobility fleets, lowering carbon emissions. In the long term, autonomous vehicles will likely redefine urban transportation infrastructure, creating new business models and fostering partnerships between shared mobility platforms, technology developers, and municipalities, further expanding the market's growth potential.

The ride hailing service segment dominated the market. Ride-hailing services are a key driver of growth in the shared mobility market, providing convenient, on-demand transportation solutions that have transformed urban travel. Platforms like Uber, Lyft, and Grab have revolutionized the way people commute by offering flexible, app-based services that allow users to book rides with ease. The simplicity of accessing transportation via mobile devices, coupled with features like real-time tracking and cashless payments, has made ride-hailing services highly appealing to consumers, particularly in congested urban areas where car ownership is expensive and impractical.

The affordability of ride-hailing services compared to owning a personal vehicle also fuels their popularity, reducing the need for car ownership and encouraging more users to opt for shared mobility. Additionally, ride-hailing services often provide a variety of options, from budget-friendly carpooling to premium rides, catering to different needs and preferences.

Moreover, the expansion of ride-hailing services into electric and hybrid vehicles aligns with growing environmental awareness, promoting greener travel options that reduce urban pollution. By offering convenient, cost-effective, and sustainable alternatives to personal vehicles, ride-hailing services are significantly contributing to the expansion of the shared mobility market, driving adoption rates and transforming transportation landscapes across cities globally.

The car segment held the largest share of the market. The car segment plays a pivotal role in driving the growth of the shared mobility market by offering a flexible and convenient transportation alternative to car ownership. Car-sharing services, such as Zipcar and Turo, allow users to rent vehicles for short periods, providing an affordable and practical solution for those who need occasional access to a car. This flexibility appeals to urban dwellers who face high costs of ownership, such as parking fees, insurance, and maintenance. By eliminating these expenses, the car-sharing model encourages more people to embrace shared mobility, particularly in densely populated areas.

Additionally, ride-hailing services, including Uber and Lyft, also contribute to the growth of the car segment in shared mobility. These services enable users to access cars on demand without the commitment of ownership, making them a convenient option for short trips or commuting. The variety of options, ranging from budget-friendly rides to luxury vehicles, attracts a broad range of consumers, further boosting market growth.

The integration of electric and hybrid vehicles into car-sharing and ride-hailing fleets is also a significant factor. As more companies transition to greener vehicles, they align with growing environmental concerns and government sustainability initiatives, promoting an eco-friendly transportation ecosystem that accelerates the expansion of the shared mobility market.

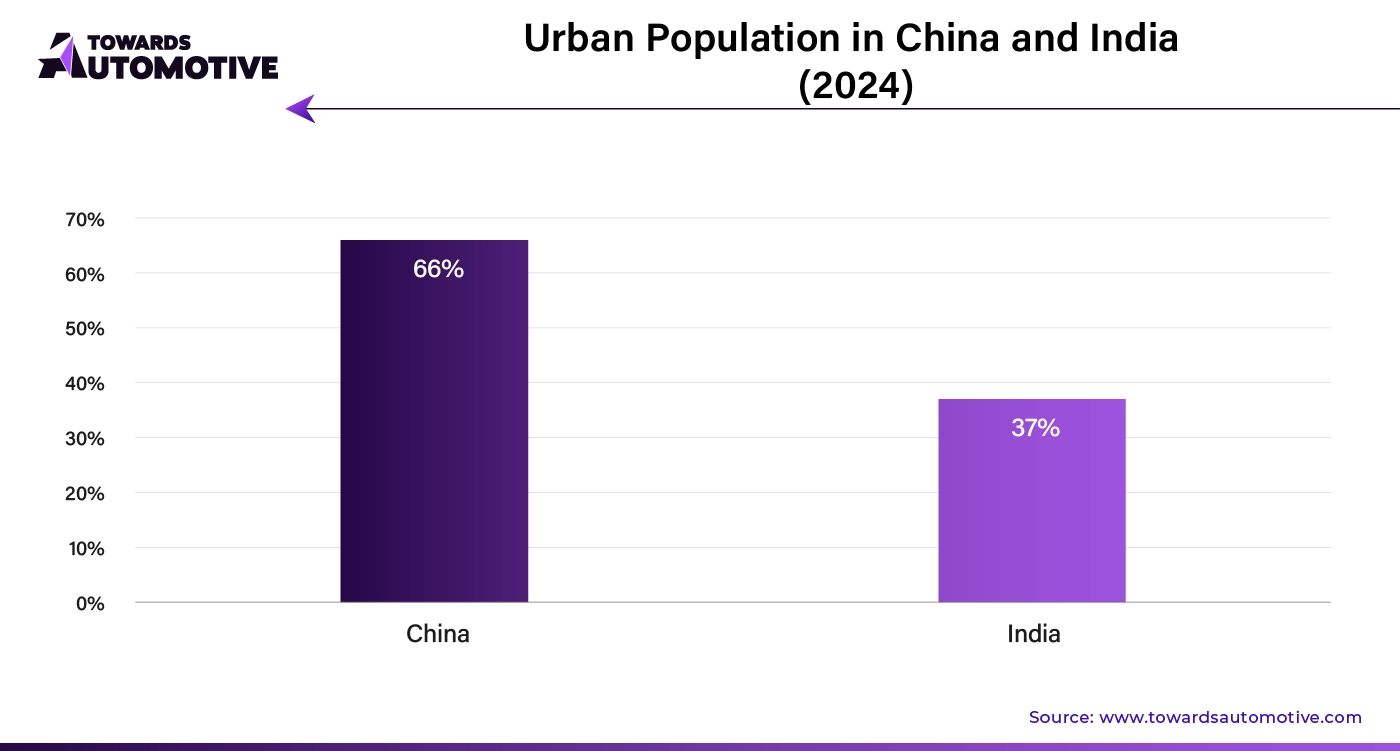

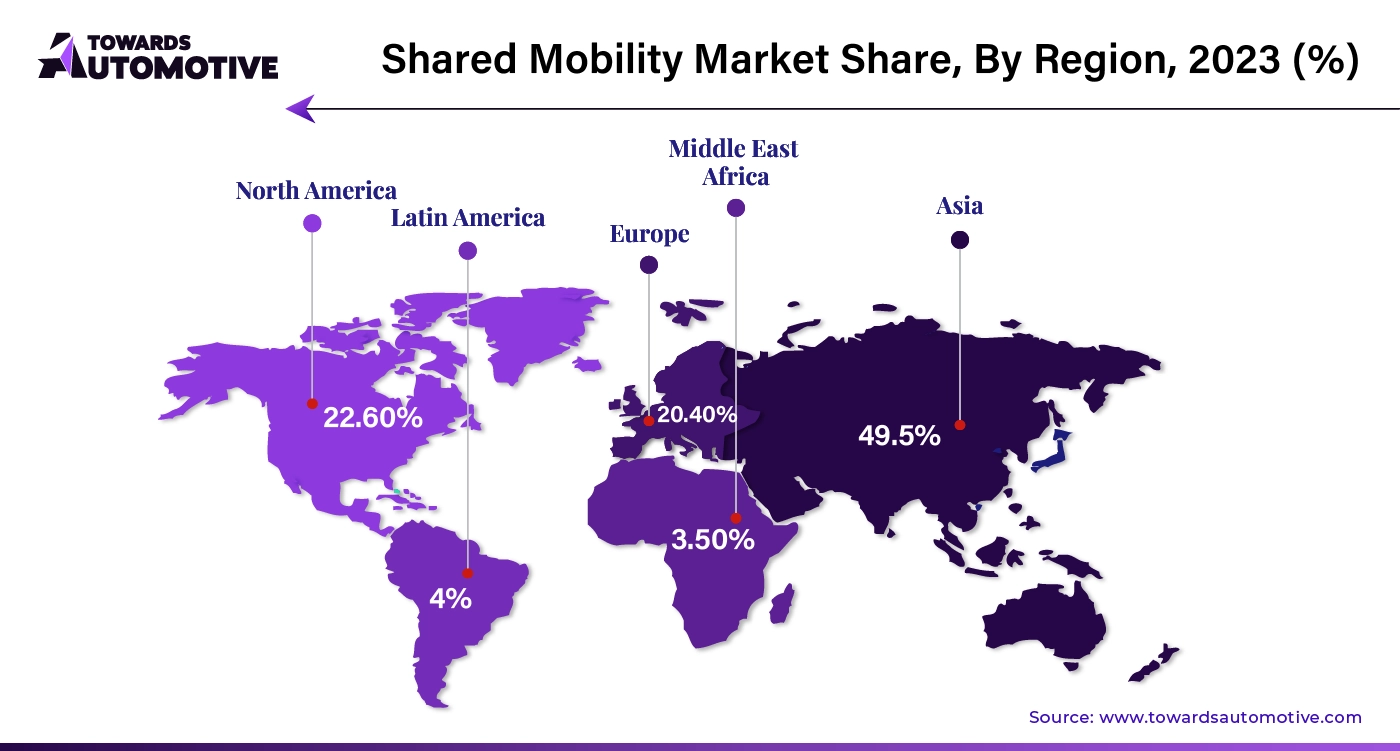

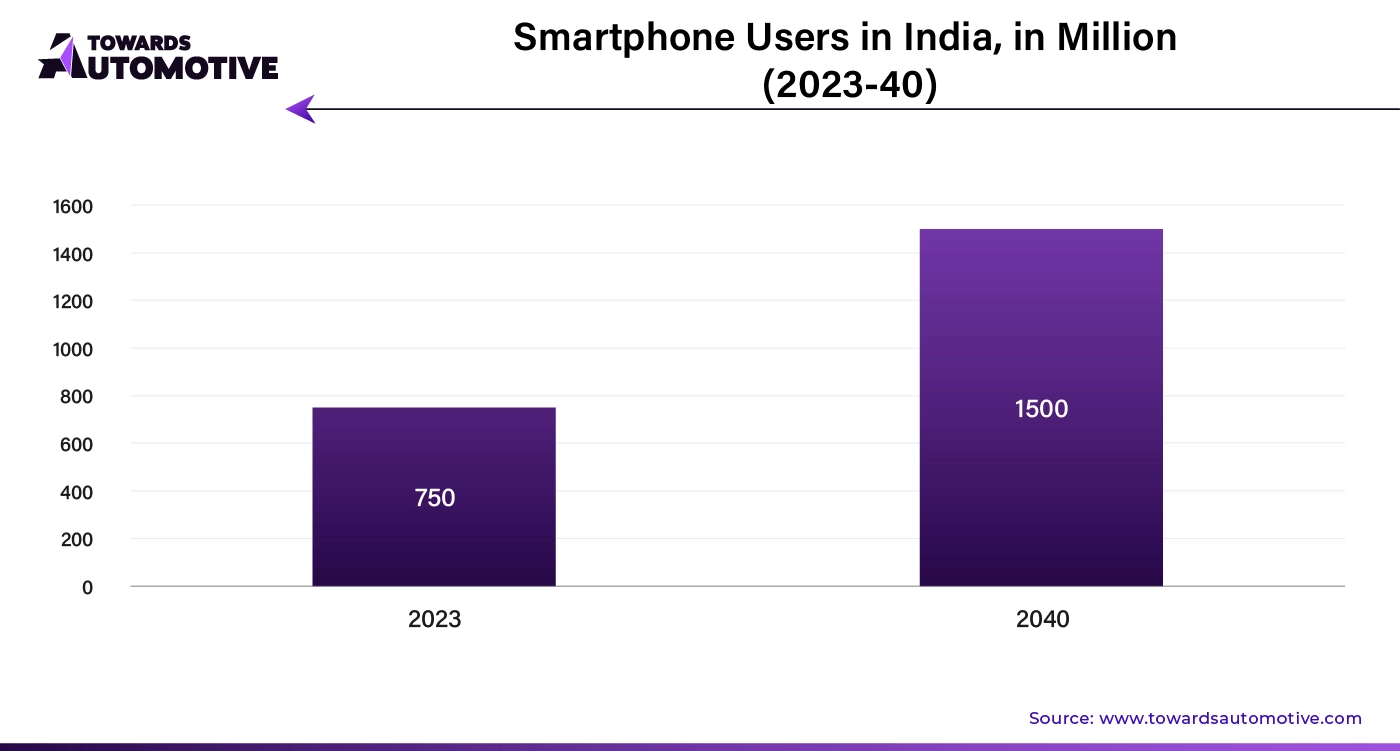

Asia Pacific dominated the shared mobility market share by 49.5% in 2023. The growth of the shared mobility market in Asia Pacific is significantly driven by increasing smartphone penetration, government initiatives, and rising disposable income. With the widespread use of smartphones and mobile internet, users can easily access shared mobility services like ride-hailing, car-sharing, and bike-sharing through mobile apps. The convenience of booking rides, tracking routes, and making cashless payments via smartphones has made shared mobility highly accessible, particularly in densely populated urban areas. This technological shift has allowed millions of people in the region to embrace on-demand transportation services, fueling market growth.

Additionally, government initiatives aimed at reducing traffic congestion and pollution are playing a pivotal role. Many countries in the region, such as China and India, are promoting the adoption of electric vehicles (EVs) and supporting shared mobility through subsidies, tax incentives, and investments in EV infrastructure. These policies not only encourage more eco-friendly transportation but also align with global sustainability goals, further boosting the shared mobility market.

The rise of the middle class and increasing disposable income across emerging markets in Asia Pacific are also key factors. As consumers have more financial flexibility, they are opting for convenient, on-demand transportation services that provide affordable alternatives to car ownership. Together, these drivers are contributing to the rapid expansion of the shared mobility market in the region.

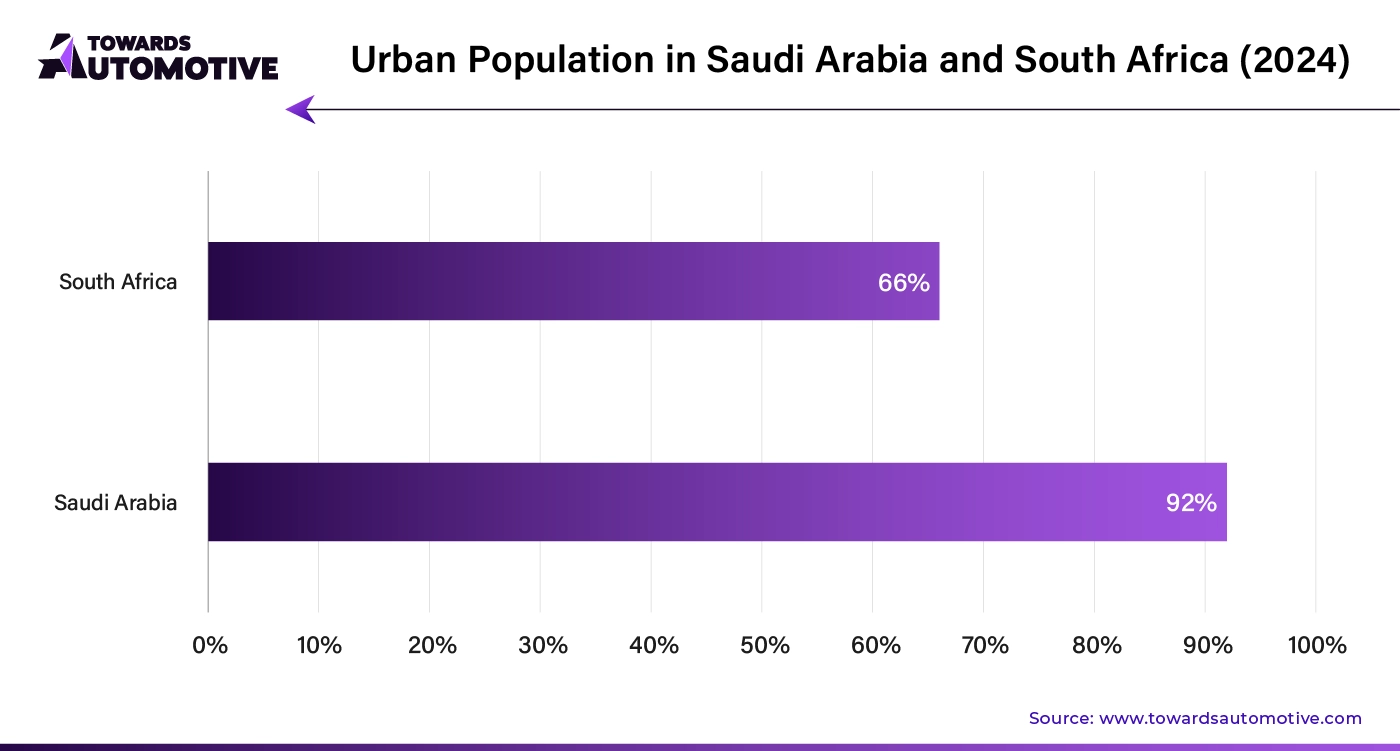

The Middle East and Africa is expected to rise with the highest CAGR during the forecast period. Urbanization, environmental and sustainability goals, and technology adoption are key drivers of the shared mobility market in the Middle East and Africa. Rapid urbanization across the region is creating densely populated cities where traditional transportation infrastructure struggles to keep up with increasing demand. Shared mobility solutions, such as ride-hailing and car-sharing, offer efficient alternatives to personal vehicle ownership, alleviating traffic congestion and improving urban mobility.

Environmental and sustainability goals are also shaping the market's growth. As governments and organizations in the region become more focused on reducing carbon emissions and promoting greener transportation options, shared mobility services are increasingly incorporating electric vehicles (EVs) into their fleets. These initiatives align with broader sustainability objectives and help address environmental concerns, making shared mobility a preferred choice for eco-conscious consumers and policy makers alike.

Technology adoption further drives the shared mobility market by enabling seamless access to transportation services. The widespread use of smartphones and mobile apps allows users to easily book rides, track vehicles, and make cashless payments, enhancing the convenience and attractiveness of shared mobility solutions. As digital platforms continue to evolve, they provide more integrated and user-friendly experiences, supporting the expansion of shared mobility services in the region and meeting the needs of a growing urban population.

By Service Model

By Channel

By Vehicle

By Region

April 2025

March 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us