April 2025

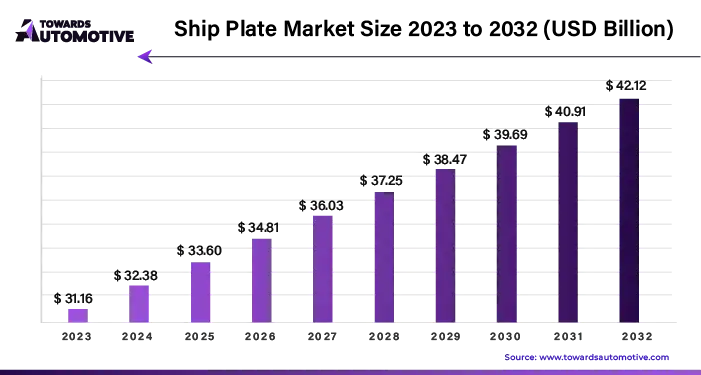

The ship plate market is set to grow from USD 33.04 billion in 2025 to USD 42.99 billion by 2034, with an expected CAGR of 2.97% over the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The rapid expansion of international trade and commerce has led to a growing need for new and efficient ships to transport cargo across the world's oceans. Ship plating, a critical component of the shipbuilding industry, plays a vital role in ensuring the strength, durability, and reliability of vessels. As global trade volumes continue to rise, there is increasing pressure on shipbuilders to construct vessels that can withstand the rigors of maritime transportation while maximizing efficiency and safety.

The growth of e-commerce and cross-border trade has been particularly influential in driving demand for containerships and cargo vessels. With the proliferation of online shopping platforms and the globalization of supply chains, the movement of goods has become more vital than ever before. This trend has led to an increased need for ships capable of transporting large quantities of cargo across vast distances efficiently and cost-effectively.

Ship plating is essential for constructing vessels that can withstand the harsh marine environment and heavy loads associated with cargo transportation. High-quality steel plates are used to construct ship hulls and other structural components, providing strength and integrity to the vessel. These plates undergo rigorous testing and certification to ensure they meet stringent standards for strength, durability, and corrosion resistance.

Advancements in ship plating technology have enabled the development of lighter yet stronger materials, allowing for the construction of more fuel-efficient and environmentally friendly vessels. Innovative manufacturing processes, such as thermomechanical control processing (TMCP), have enhanced the mechanical properties of ship plates, making them better suited to withstand the dynamic forces encountered at sea.

The growth of international trade and commerce, fueled by factors such as e-commerce expansion and globalization, has driven demand for new and efficient ships. Ship plating plays a crucial role in meeting this demand by providing the foundation for constructing strong, reliable, and environmentally sustainable vessels capable of navigating the world's oceans with efficiency and safety.

The increasing military tensions and the growing demand for military vessels, submarines, and reconnaissance ships worldwide are poised to fuel the growth of the shipbuilding industry. Military fleets require constant modernization and expansion to maintain strategic capabilities and ensure national security, driving demand for new vessels with advanced technologies and capabilities.

However, the shipbuilding industry is susceptible to price fluctuations in key materials such as steel, which can significantly impact production costs. Sudden increases in material prices can strain shipyards' profit margins, disrupt the supply chain, and lead to delays in shipbuilding projects. These uncertainties surrounding material costs may deter investment in the shipbuilding sector and impede its growth trajectory.

Despite these challenges, advancements in manufacturing processes and technologies are enabling shipbuilders to enhance efficiency, reduce costs, and mitigate risks associated with material price volatility. Additionally, strategic partnerships and collaborations within the industry can help address supply chain disruptions and promote innovation, driving sustainable growth in the shipbuilding sector.

The COVID-19 pandemic has significantly disrupted the cruise industry, resulting in widespread construction delays and transportation challenges that have affected ship production and delivery. Closures and restrictions imposed to curb the spread of the virus have led to economic downturns and uncertainties in the maritime sector, causing delays in ship orders and investments.

However, as the world gradually emerges from the pandemic and economic activities resume, there are opportunities for recovery and growth in the shipbuilding industry. With the restarting of economies, there is renewed demand for cruise ships and other vessels, providing a much-needed boost to shipbuilding companies.

Moreover, the pandemic has highlighted the importance of resilience and adaptability in the maritime sector. Shipbuilders are expected to leverage this experience to enhance their capabilities and processes, ensuring smoother operations and quicker recovery from future disruptions.

COVID-19 pandemic has posed significant challenges to the shipbuilding industry, the gradual recovery of the global economy and the resumption of maritime activities offer opportunities for growth and revival in the sector.

The demand for carbon steel ship plates in the shipbuilding industry continues to grow steadily due to their excellent mechanical strength, cost-effectiveness, and ease of production. With the ongoing expansion of the international maritime industry, there is an increasing need for new ships, driving the demand for shipbuilding materials like carbon steel plates.

The maritime sector's growing focus on energy efficiency and environmental sustainability is further bolstering the demand for lightweight and durable ship plates made from carbon steel. As regulations tighten and environmental concerns become more prominent, shipbuilders are increasingly turning to materials that offer both strength and eco-friendliness.

The combination of increased demand for new ships and the emphasis on energy efficiency and sustainability in the maritime industry is driving the growth of the carbon steel ship plate segment. This trend is expected to continue as the industry evolves and strives to meet evolving regulatory standards and environmental challenges.

The global demand for trucks used in the transportation of oil, chemicals, and other liquids is on the rise due to increasing energy consumption and globalization trends. Additionally, there is a growing need for larger ships to replace older, less fuel-efficient tankers, driven by efforts to improve environmental sustainability in the maritime industry.

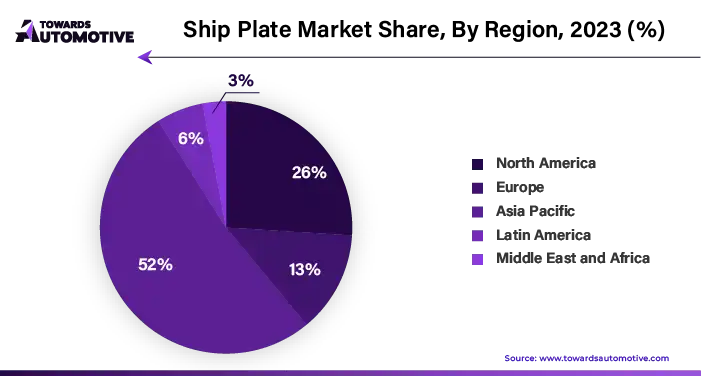

This increase in demand for larger ships is particularly evident in regions such as Asia Pacific, the Middle East, and Europe, where the performance of the large tanker market is a significant contributing factor to the expansion of this segment. As these regions play crucial roles in global trade and energy transportation, the demand for efficient and environmentally friendly transportation solutions continues to grow.

The combination of rising energy consumption, globalization, and efforts to enhance environmental sustainability is driving the demand for both trucks and larger ships used in the transportation of oil, chemicals, and other liquids worldwide.

The Asia-Pacific region dominates the global cruise ship market, commanding over 90% of its share. This dominance can be attributed to several factors, including the region's growing demand for shipping services, the expansion of the shipbuilding industry, and the increasing volume of international trade.

Furthermore, the implementation of stringent maritime safety regulations has spurred the development and modernization of existing ships and ports in the region. These efforts not only enhance safety standards but also contribute to the overall growth of the economy.

A notable example is Singapore's ambitious plan announced in June 2030. The country unveiled a S$20 billion initiative aimed at transforming its port into the world's largest by 2040. This initiative includes doubling the port's size and integrating advanced technologies such as drones and autonomous vehicles, showcasing the region's commitment to innovation and infrastructure development in the maritime sector.

Some of the key companies in the ship plate industry include:

By Product

By Application

By Geography

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us