October 2025

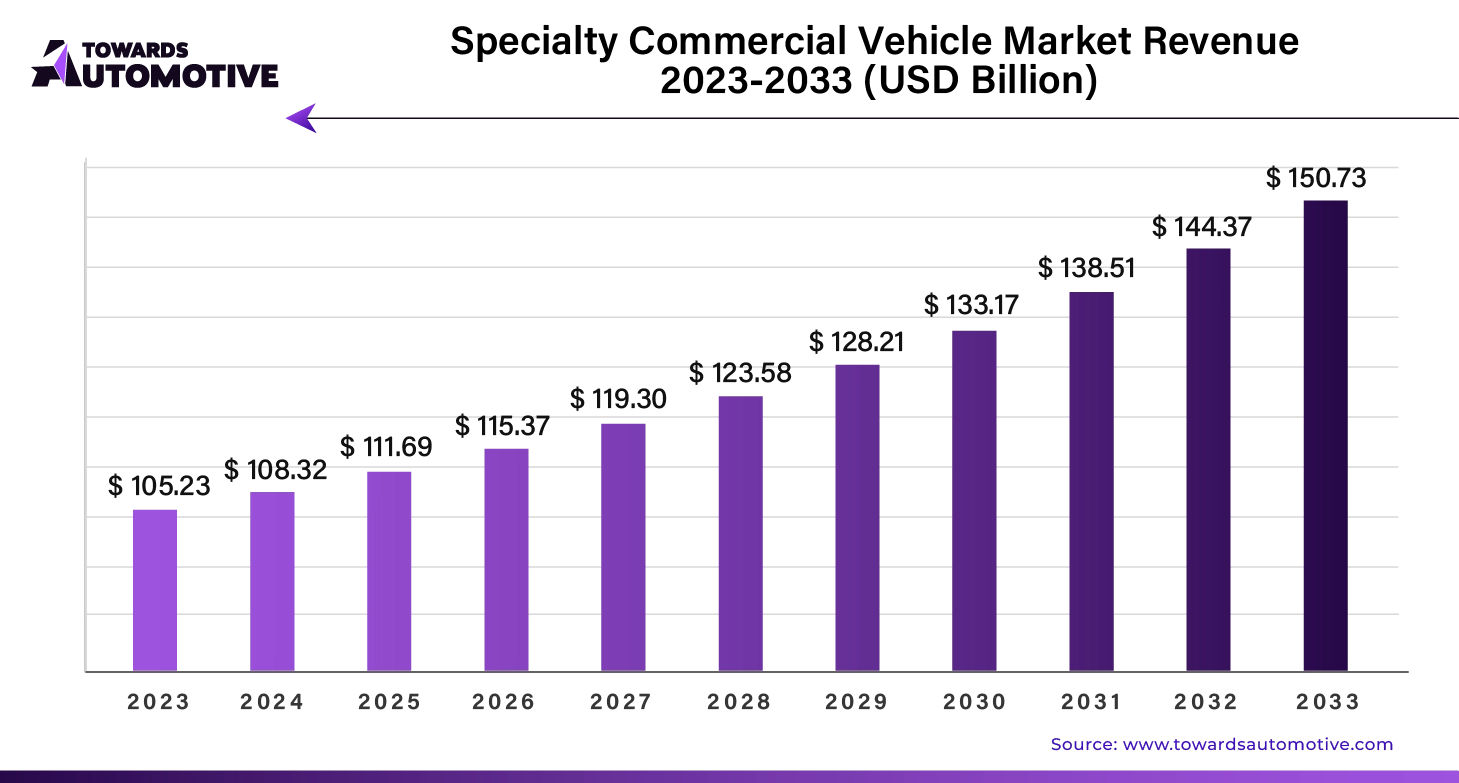

The global specialty commercial vehicle market is forecasted to expand from USD 113.25 billion in 2025 to USD 157.60 billion by 2034, growing at a CAGR of 3.74% from 2025 to 2034.

The specialty commercial vehicle market is witnessing robust growth due to the rising demand for customized vehicles across various industries. These vehicles are designed to meet specific operational requirements in sectors such as construction, agriculture, healthcare, and logistics. The increasing need for efficient and purpose-built vehicles in urbanization projects and infrastructure development is a key driver for this market. Additionally, advancements in technology, including the integration of telematics, electric drivetrains, and automation, are enhancing the functionality and performance of specialty commercial vehicles, further boosting demand. Governments across various regions are also providing favorable policies and incentives to promote the adoption of eco-friendly vehicles, driving growth in electric and hybrid specialty commercial vehicles. Furthermore, the rise of e-commerce has led to a surge in last-mile delivery services, creating a growing demand for specialized vehicles that cater to this sector. Manufacturers are focusing on developing versatile and durable vehicles that can handle diverse tasks while complying with stringent emission and safety regulations. In emerging economies, the expansion of industries such as mining, oil and gas, and public transportation is also contributing to market growth. As industries continue to evolve and face unique operational challenges, the specialty commercial vehicle market is poised to expand, driven by innovation and the need for tailored solutions.

AI plays a transformative role in the specialty commercial vehicle market by enhancing operational efficiency, safety, and vehicle performance. One of its primary applications is in optimizing fleet management through predictive analytics. AI-powered systems can analyze vast amounts of data to predict maintenance needs, reducing downtime and improving the overall lifecycle of vehicles. This helps businesses in sectors such as construction, logistics, and waste management minimize operational costs and increase productivity.

In specialty commercial vehicles, AI is also integral to advanced driver assistance systems (ADAS) and autonomous driving technologies. These AI-driven features help vehicles navigate complex environments, making them more efficient in tasks like precision delivery, mining operations, or emergency response. Autonomous specialty vehicles, powered by AI, are already being tested for specific industrial tasks, such as agricultural operations or port logistics, where repetitive and hazardous tasks can be automated, reducing human intervention and enhancing safety.

AI is also driving innovations in energy efficiency, especially in electric specialty commercial vehicles. AI algorithms can optimize power usage by adjusting performance based on real-time data, such as terrain, payload, and weather conditions, maximizing battery life and range. Additionally, AI plays a key role in optimizing routing and load management in logistics, helping companies meet the growing demand for specialized services like last-mile delivery more effectively.

The growth of the agricultural sector significantly drives the specialty commercial vehicle market, primarily due to the increasing demand for efficient and specialized vehicles that enhance productivity and streamline operations. As agricultural practices evolve with advancements in technology and a growing emphasis on sustainability, farmers and agribusinesses are turning to specialty vehicles tailored for specific tasks. This includes a wide range of vehicles such as tractors, harvesters, sprayers, and refrigerated trucks, all designed to meet the unique requirements of modern farming.

With the rising global population and the corresponding need for increased food production, there is a heightened focus on optimizing agricultural processes. Specialty commercial vehicles play a crucial role in this optimization by enabling more efficient planting, harvesting, and transportation of goods. For instance, specialized trucks equipped with temperature control systems are essential for transporting perishable products from farms to markets, ensuring food quality and reducing waste.

Moreover, the shift towards precision agriculture where technology is used to monitor and manage field variability has created a demand for vehicles integrated with advanced technologies such as GPS, drones, and data analytics tools. These innovations improve operational efficiency, allowing farmers to make data-driven decisions and maximize yield.

Government initiatives promoting modern agricultural practices and providing financial assistance for acquiring specialized vehicles further bolster market growth. As the agricultural sector continues to expand and modernize, the demand for specialty commercial vehicles will likely increase, driving innovation and investment in this vital segment of the market.

The specialty commercial vehicle market faces several restraints that may hinder its growth. One significant challenge is the high initial cost associated with acquiring specialized vehicles, which can deter small and medium-sized enterprises from investing in them. Additionally, the lack of skilled operators and technicians trained to manage advanced technologies in these vehicles can limit their adoption. Regulatory hurdles, including stringent emissions standards and safety regulations, can also pose challenges for manufacturers and operators. Finally, fluctuating fuel prices may impact the operational costs of specialty vehicles, affecting profitability and investment in new technologies.

The development of hybrid vehicles is creating significant opportunities in the specialty commercial vehicle market, primarily due to their ability to combine the benefits of both traditional internal combustion engines and electric powertrains. As businesses increasingly prioritize sustainability and seek to reduce their carbon footprints, hybrid specialty vehicles offer an attractive solution by delivering improved fuel efficiency and lower emissions without sacrificing performance. This is particularly beneficial in industries such as logistics, construction, and waste management, where vehicles often operate in stop-and-go environments, allowing for efficient use of electric power during low-speed operations while relying on the internal combustion engine for longer hauls.

Moreover, hybrid vehicles can help businesses navigate the growing regulatory landscape focused on emissions reduction. With many regions implementing stricter environmental standards, the adoption of hybrid technology enables companies to comply with regulations while minimizing potential penalties associated with higher-emission vehicles.

The integration of advanced technologies in hybrid vehicles, such as regenerative braking and intelligent energy management systems, enhances operational efficiency and reduces overall operational costs. As a result, companies can achieve better return on investment (ROI) from their vehicle fleets.

Furthermore, the growing demand for hybrid specialty vehicles is prompting manufacturers to innovate and diversify their offerings, leading to the development of customized solutions tailored to specific industry needs. This creates a competitive advantage for businesses willing to adopt hybrid technology, ultimately driving growth in the specialty commercial vehicle market as companies seek to enhance efficiency and sustainability.

The diesel segment led the industry. The diesel segment plays a significant role in driving the growth of the specialty commercial vehicle market, primarily due to its widespread use across industries such as construction, agriculture, logistics, and mining. Diesel engines are known for their high torque output, durability, and ability to handle heavy loads, making them ideal for specialty vehicles that require robust performance, such as dump trucks, excavators, and long-haul transport trucks. The reliability of diesel engines in demanding conditions such as rugged terrain or extreme weather adds to their continued preference in sectors where vehicle downtime can result in costly operational delays.

Another key factor supporting the growth of the diesel segment is the existing infrastructure. Diesel fueling stations are more prevalent than alternatives such as electric charging points or hydrogen refueling stations, especially in remote and rural areas where specialty vehicles are often deployed. This widespread availability of diesel fuel makes it easier for operators to rely on diesel-powered vehicles for their operations, ensuring uninterrupted service even in less accessible regions.

While there is a growing push toward electrification and alternative fuels, diesel engines continue to evolve with advancements in emissions control technologies. Modern diesel engines are becoming more fuel-efficient and environmentally friendly, with manufacturers incorporating technologies like selective catalytic reduction (SCR) and diesel particulate filters (DPF) to meet stringent emissions regulations. This balance between performance, availability, and evolving environmental standards ensures that the diesel segment remains a crucial growth driver in the specialty commercial vehicle market.

In February 2024, Tata Motors launched ultra trucks in South Africa. These are diesel trucks that comes with 3.5-litreengine for providing maximum fuel efficiency.

The box trucks segment held the dominant share of the market. The box truck segment is a key driver of growth in the specialty commercial vehicle market, particularly due to its versatility and widespread use across industries such as logistics, retail, and e-commerce. Box trucks, also known as cube vans or straight trucks, are essential for transporting goods, offering a secure, enclosed cargo area that protects items from weather and theft. Their ability to navigate both urban and suburban environments makes them ideal for last-mile delivery operations, which have surged in demand with the exponential growth of e-commerce and online shopping. Companies in sectors like furniture, appliances, and packaged goods increasingly rely on box trucks to meet customer expectations for fast, reliable delivery services.

The rising demand for temperature-sensitive deliveries, such as pharmaceuticals, perishable food items, and other refrigerated goods, is also fueling the growth of specialized box trucks equipped with refrigeration units. This trend is especially important in cold chain logistics, where box trucks play a critical role in maintaining product quality throughout the supply chain.

Additionally, box trucks are gaining traction in urban areas due to their compact size and lower emissions compared to larger commercial vehicles. Many municipalities are imposing stricter regulations on emissions and vehicle size in congested cities, leading to increased adoption of box trucks, especially electric and hybrid versions, which offer cleaner, quieter operations. With technological advancements, enhanced fuel efficiency, and a growing focus on sustainability, the box truck segment continues to be a crucial growth driver in the specialty commercial vehicle market.

The transportation and logistics segment held the largest share of the market. The transportation and logistics segment is a major driver of growth in the specialty commercial vehicle market, largely due to the increasing demand for efficient and reliable delivery solutions across industries. As global trade and e-commerce expand, companies require specialized vehicles that can handle diverse cargo types and adapt to varying delivery needs, from last-mile urban deliveries to long-haul freight. Specialty vehicles such as refrigerated trucks, flatbed trailers, and box trucks are critical in the logistics sector, enabling the safe and timely transport of goods, including temperature-sensitive items like food, pharmaceuticals, and medical supplies.

One of the key factors behind the growth of this segment is the rapid rise of e-commerce, which has created an urgent need for more last-mile delivery vehicles. Consumers’ growing expectation for fast and on-time deliveries is pushing logistics companies to expand their fleets of specialized vehicles designed for urban and suburban environments. Additionally, advancements in vehicle technology, such as real-time tracking, route optimization, and telematics, have improved the efficiency of transportation operations, making specialty commercial vehicles more appealing to logistics providers.

Furthermore, the shift towards sustainability in the logistics sector is boosting the demand for electric and hybrid specialty vehicles. As businesses aim to reduce their carbon footprint and comply with environmental regulations, electric delivery vans and eco-friendly commercial vehicles are gaining popularity. With logistics being a cornerstone of modern commerce, the transportation and logistics segment remains a key driver of the specialty commercial vehicle market’s ongoing growth.

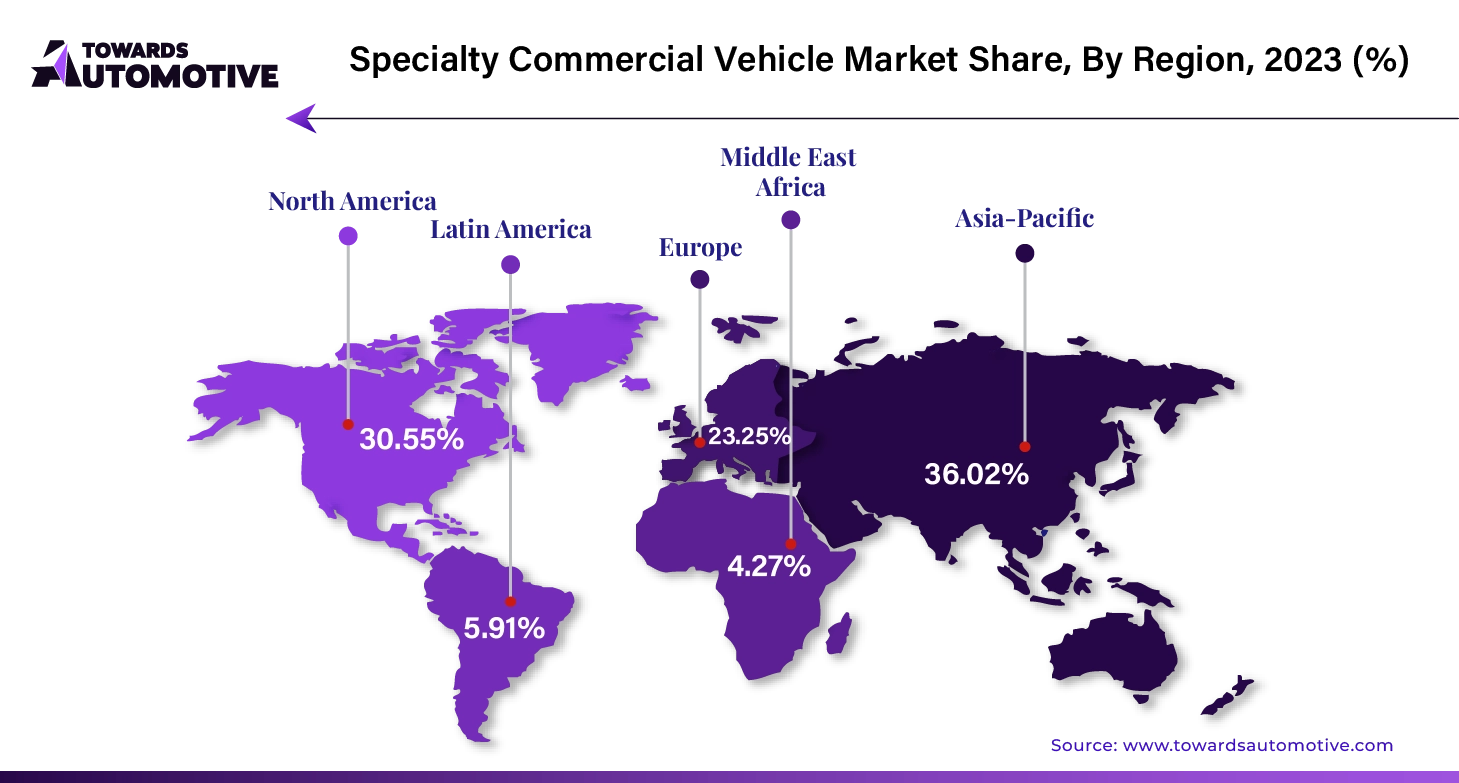

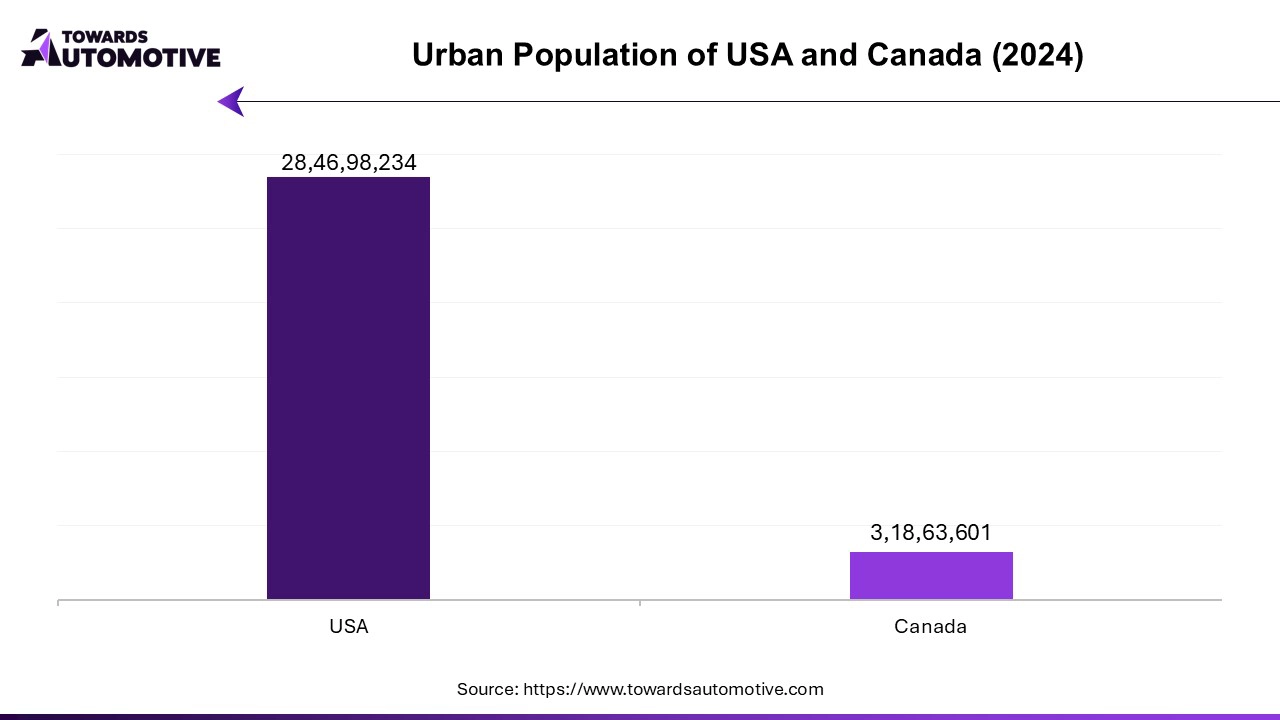

North America is expected to grow at the fastest rate in the specialty commercial vehicle market during the forecast period. The growth of the specialty commercial vehicle market in North America is significantly driven by increasing urbanization, the rising demand for last-mile delivery vehicles, and technological advancements. As cities expand and infrastructure projects intensify, the need for specialized commercial vehicles tailored for urban operations, such as waste management trucks, construction vehicles, and utility service vehicles, has surged. Urbanization is also reshaping consumer behavior, with more individuals relying on e-commerce, which in turn boosts the demand for last-mile delivery solutions. Specialty vehicles like refrigerated vans, light-duty trucks, and electric delivery vehicles are crucial for efficient transportation of goods within congested city environments, particularly for industries such as retail, pharmaceuticals, and food delivery.

Technological advancements are further propelling this growth by enhancing vehicle efficiency and sustainability. The integration of telematics, AI-powered systems, and automation allows for better fleet management, predictive maintenance, and route optimization, which helps businesses reduce operational costs and improve service delivery. In parallel, the shift toward electric and hybrid powertrains, driven by regulatory pressures and sustainability goals, is transforming the specialty commercial vehicle market. Electric specialty vehicles, in particular, are becoming increasingly popular in urban areas due to their lower emissions, quieter operation, and improved energy efficiency.

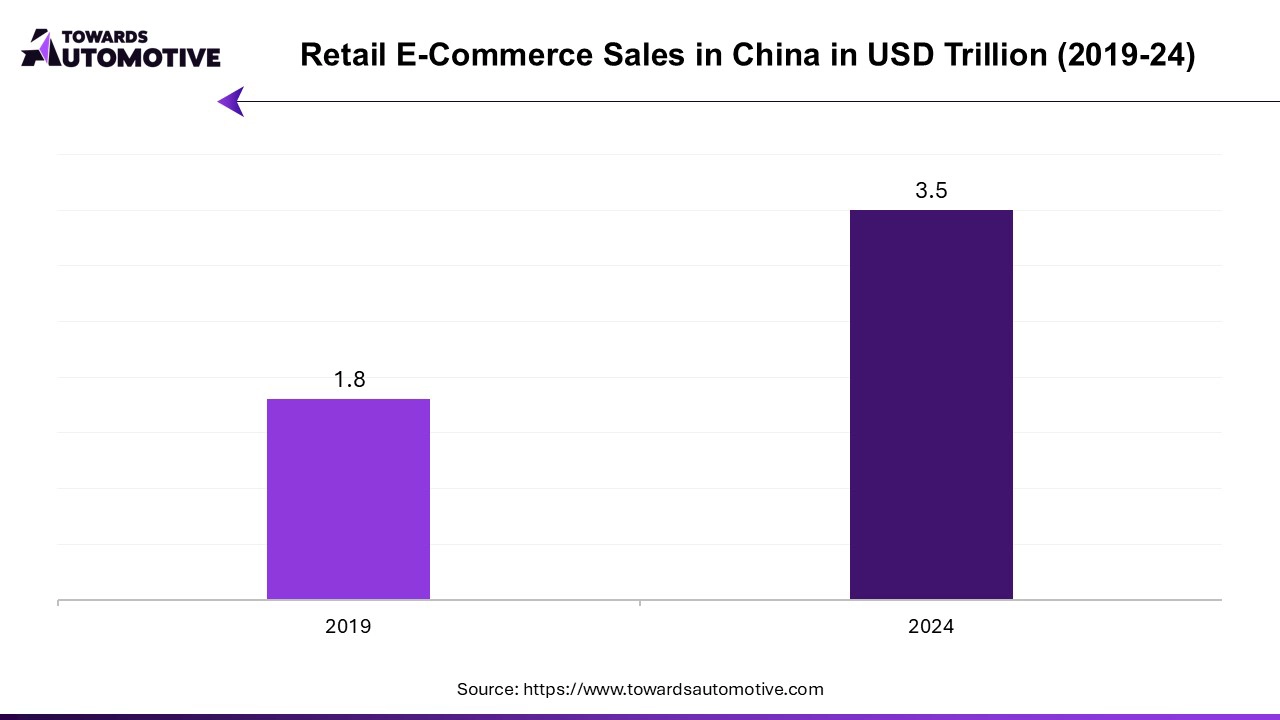

Asia Pacific dominated the specialty commercial vehicle market in 2023. The specialty commercial vehicle market in the Asia-Pacific (APAC) region is experiencing robust growth, largely driven by the booming e-commerce industry, supportive government policies, and rapid expansion in the construction sector. E-commerce has seen unprecedented growth across APAC, particularly in countries like China, India, and Southeast Asia, where online shopping has become a dominant trend. This surge has led to increased demand for last-mile delivery solutions, pushing the need for specialized vehicles such as electric delivery vans and refrigerated trucks to transport goods efficiently, especially in congested urban environments. The growing complexity of logistics operations, especially in temperature-sensitive sectors like pharmaceuticals and food delivery, is further boosting the demand for these vehicles.

Government policies are also playing a pivotal role in shaping the market. Many APAC countries are introducing regulations that promote sustainable and eco-friendly vehicles, offering incentives for adopting electric and hybrid commercial vehicles. These policies are aimed at reducing carbon emissions and enhancing energy efficiency, which is driving the adoption of advanced specialty vehicles in sectors like logistics, utilities, and public services.

The construction sector’s rapid growth, driven by urbanization and infrastructure development projects, is another key factor. Countries across APAC are investing heavily in building roads, bridges, and urban infrastructure, creating a rising demand for construction trucks, heavy-duty vehicles, and specialized utility vehicles. The need for purpose-built vehicles to meet the operational challenges of large-scale construction projects is fueling the expansion of the specialty commercial vehicle market in the region.

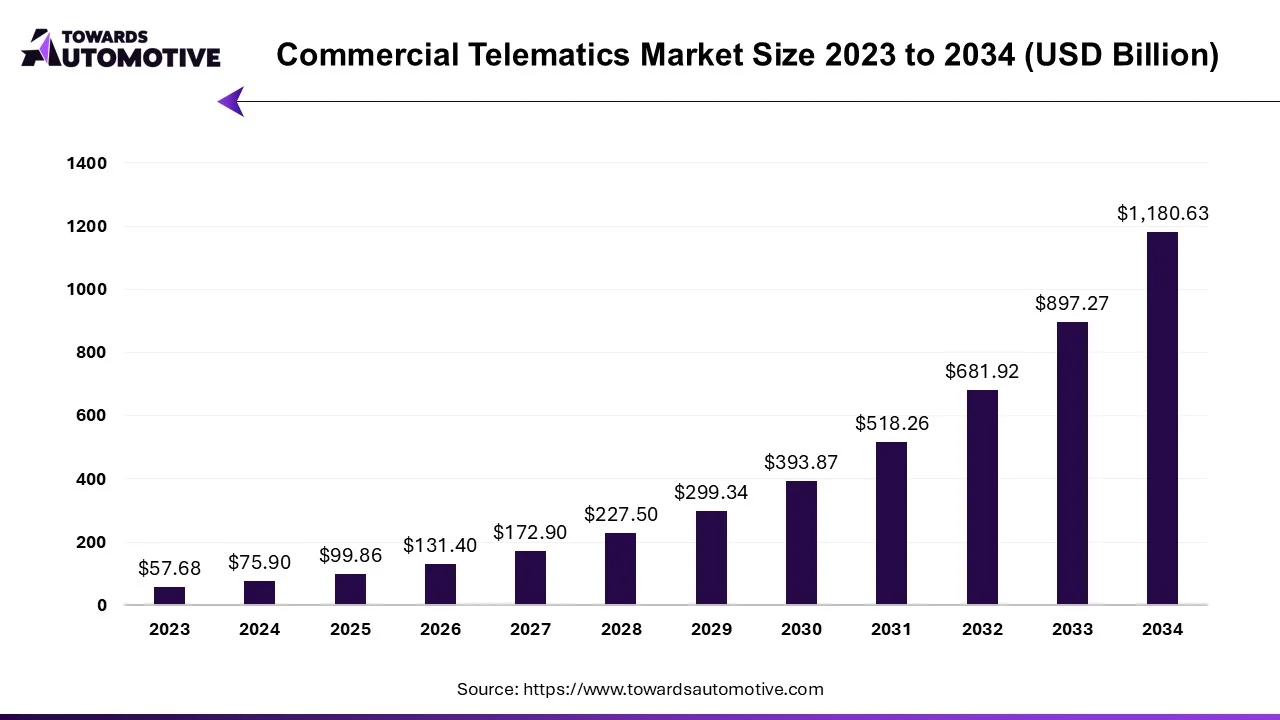

The commercial telematics market is expected to increase from USD 99.86 billion in 2025 to USD 1180.63 billion by 2034, growing at a CAGR of 31.58% throughout the forecast period from 2025 to 2034.

The commercial telematics market is a prominent sector of the automotive industry. This industry deals in developing advanced telematics solutions for commercial vehicles. There are several types of solutions developed in this sector consisting of OEM solutions and aftermarket solutions. It finds application in numerous end-user industries comprising of transportation & logistics, insurers, healthcare, media and entertainment, vehicle manufacturers/dealers and some others. The rising proliferation of 5G technology in different parts of the world has contributed to the industrial expansion. This market is predicted to rise significantly with the growth of the commercial vehicle industry across the world.

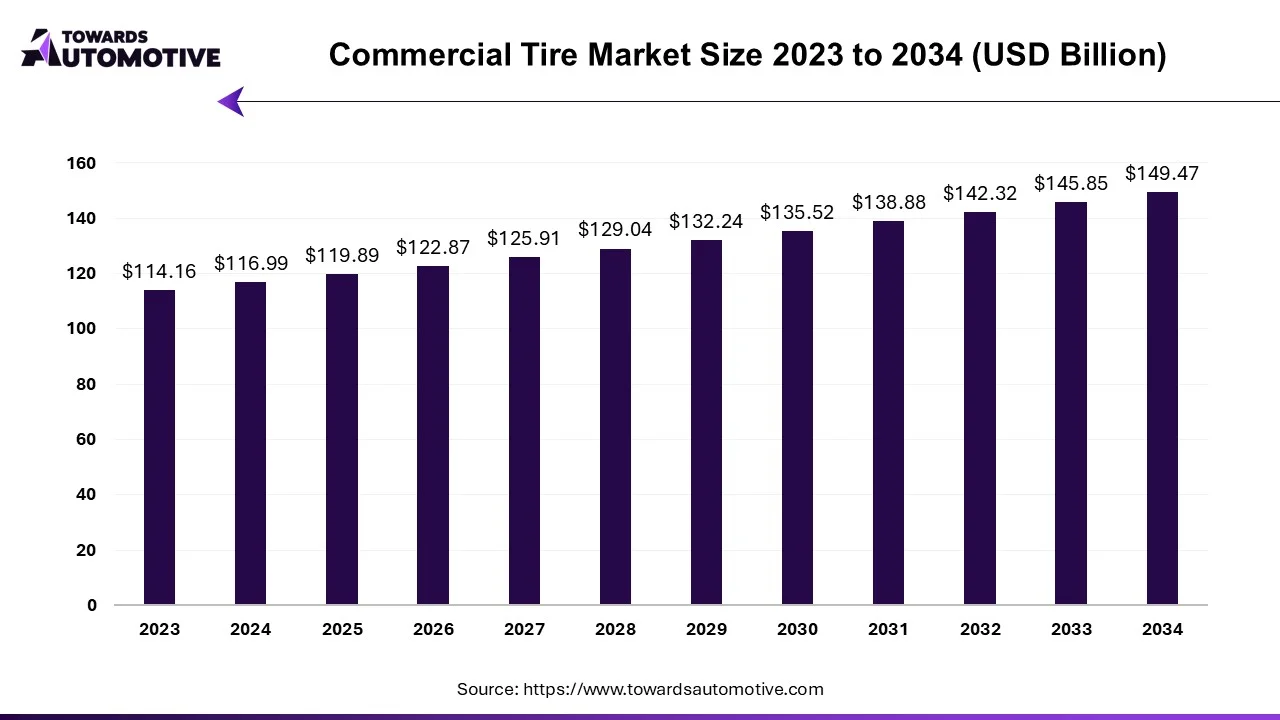

The commercial tire market is expected to increase from USD 119.89 billion in 2025 to USD 149.47 billion by 2034, growing at a CAGR of 2.48% throughout the forecast period from 2025 to 2034.

The commercial tire market is a crucial branch of the automotive materials industry. This industry deals in manufacturing and distribution of tires for commercial vehicles. There are different types of tires developed in this sector consisting of radial tires, bias tires and solid tires. These tires are designed for numerous vehicles such as light commercial vehicles, medium commercial vehicles and heavy commercial vehicles. It finds various application in several sectors including transportation, construction, agriculture, mining and some others. The growing demand for commercial vehicles in different parts of the world has contributed to the market expansion. This market is expected to grow drastically with the growth of the tire industry across the globe.

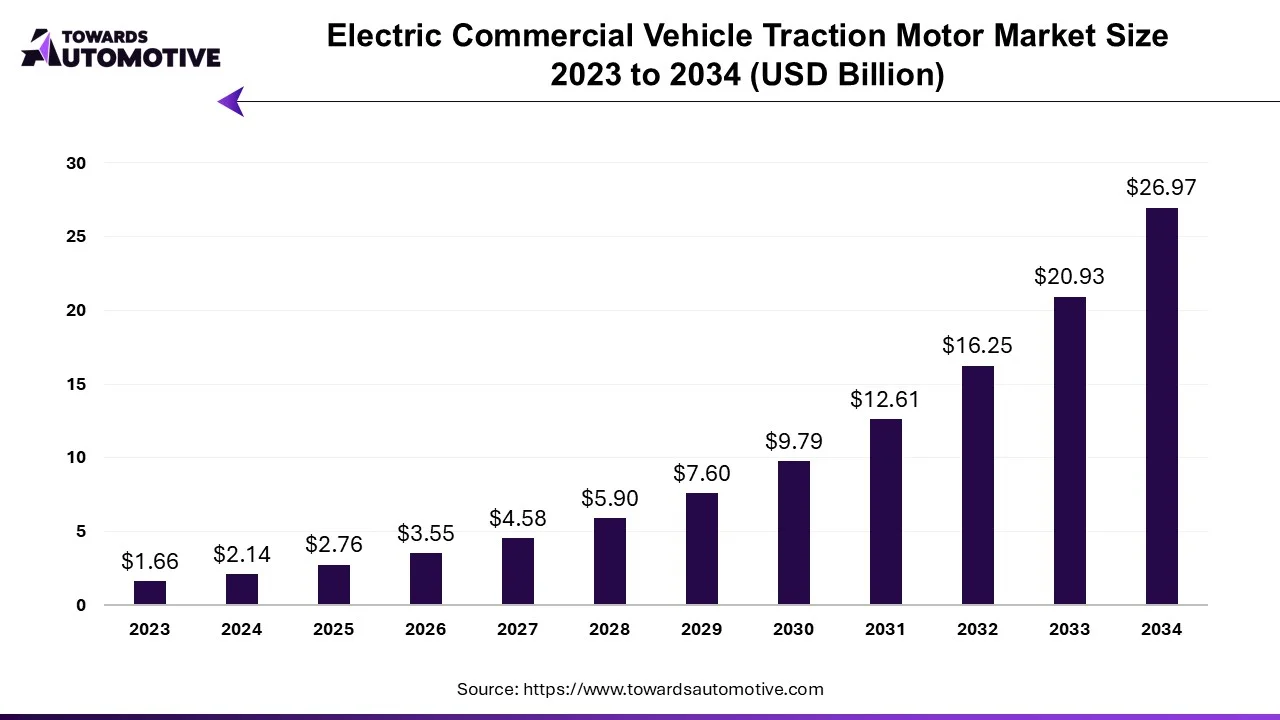

The electric commercial vehicle traction motor market is forecasted to expand from USD 2.76 billion in 2025 to USD 26.97 billion by 2034, growing at a CAGR of 28.84% from 2025 to 2034.

The electric commercial vehicle traction motor market is a prominent segment of the electric vehicle industry. This market deals in manufacturing and distribution of traction motors for commercial EVs. There are different types of traction motors developed in this sector consisting of permanent magnet synchronous motors, AC induction motors, DC traction motors and some others. These motors are designed for various types of vehicles including pickup trucks, trucks, vans, buses and some others. The growing sales of electric trucks in different parts of the world has boosted the market expansion. This market is expected to grow significantly with the rise of the automotive industry around the globe.

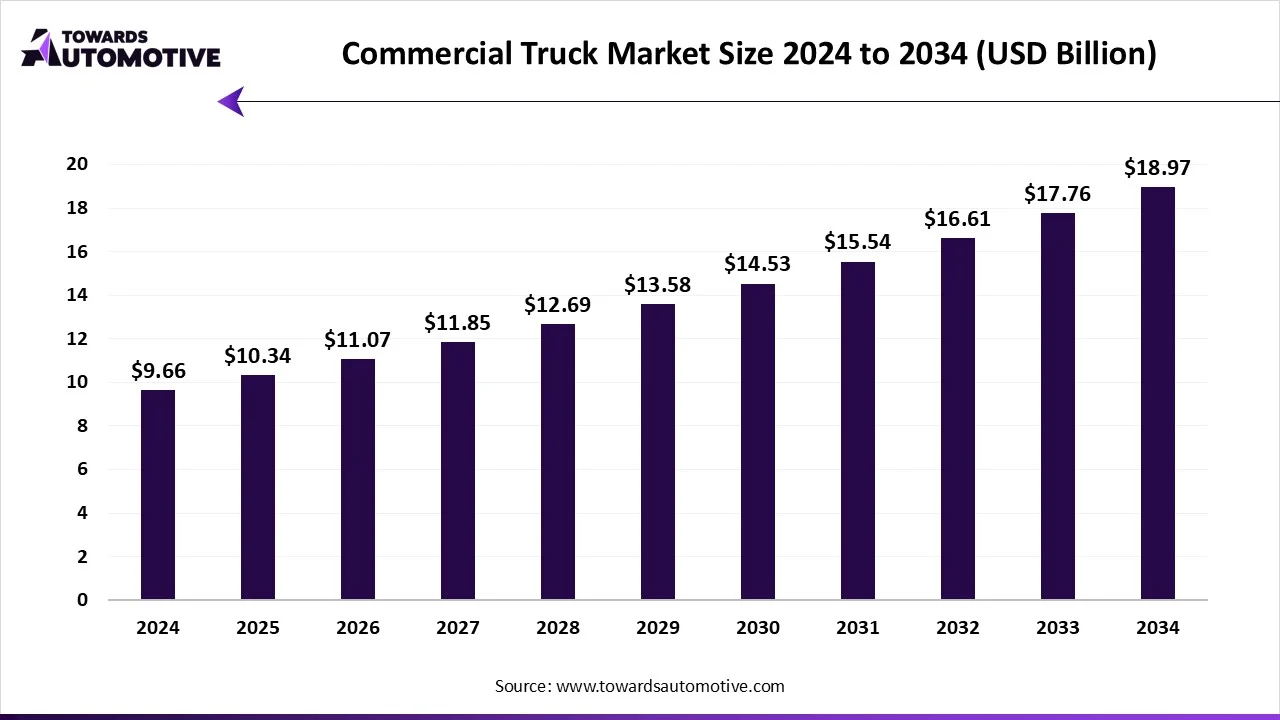

The commercial truck market is expected to increase from USD 10.34 billion in 2025 to USD 18.97 billion by 2034, growing at a CAGR of 7.03% throughout the forecast period from 2025 to 2034.

The commercial truck market is a prominent branch of the commercial vehicle industry. This industry deals in manufacturing and distribution of commercial trucks around the world. There are several types of trucks developed in this sector comprising of class 1 trucks, class 2 trucks, class 3 trucks, class 4 trucks, class 5 trucks, class 6 trucks, class 7 trucks, class 8 trucks and some others. These trucks are powered by different types of fuel consisting of diesel, natural gas, hydrogen, electric and some others. It is owned by numerous entities including fleet operator and owner operator. The commercial trucks find applications in various sectors such as freight delivery, utility services, construction & mining and some others. This market is expected to rise significantly with the growth of the automotive sector across the globe.

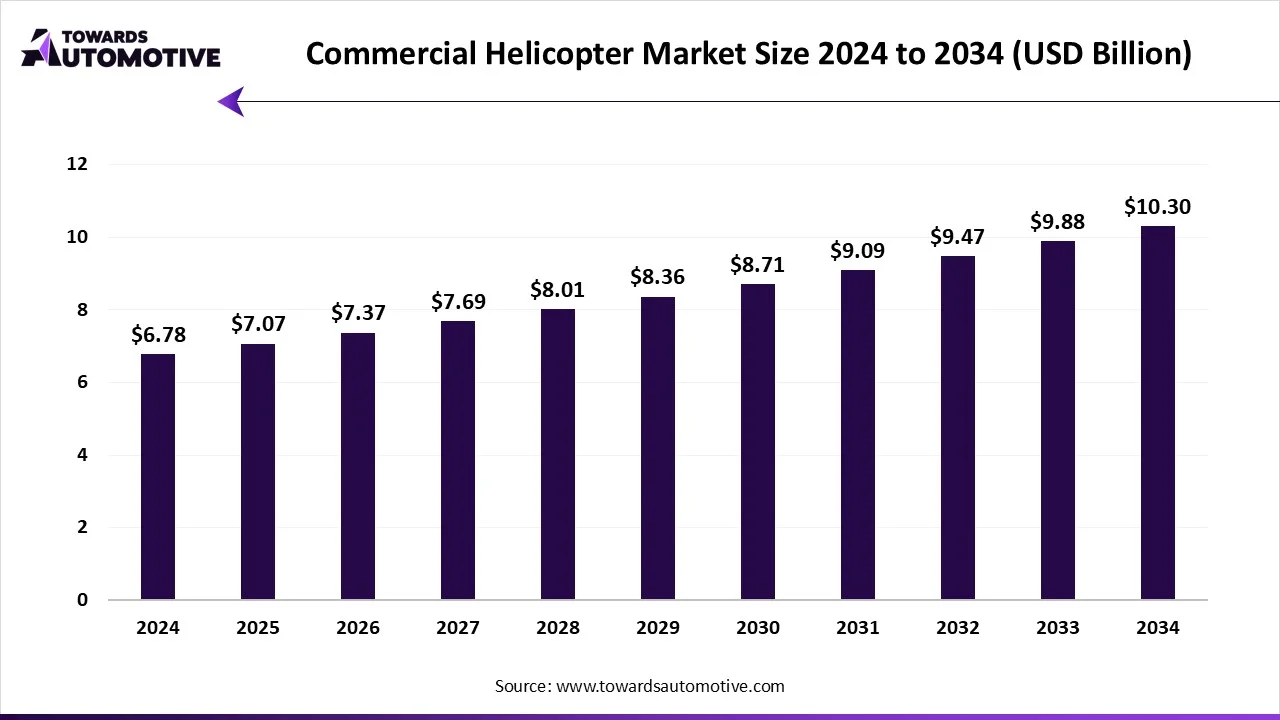

The commercial helicopter market is projected to reach USD 10.30 billion by 2034, expanding from USD 7.07 billion in 2025, at an annual growth rate of 4.27% during the forecast period from 2025 to 2034. The growing interest of tourist to adopt helicopter services for traveling in foreign countries coupled with the increasing emphasis of helicopter manufacturers on developing hybrid-electric propulsion systems for helicopters is playing a vital role in shaping the industrial landscape.

Moreover, rapid investment by government for strengthening the aviation sector along with surging adoption of electric helicopters by fleet operators has driven the market expansion. The rising use of sustainable composite materials in helicopters is expected to create ample growth opportunities for the market players in the upcoming years.

The commercial helicopter market is a prominent branch of the aerospace industry. This industry deals in development and distribution of commercial helicopters in different parts of the world. There are various types of helicopters manufactured in this sector comprising of light-weight helicopters, medium helicopters, heavy helicopters, very large helicopters and some others. These helicopters finds application in several sectors including oil & gas, transport, medical services, law enforcement & public safety, and some others. This market is expected to rise significantly with the growth of the commercial aviation sector around the globe.

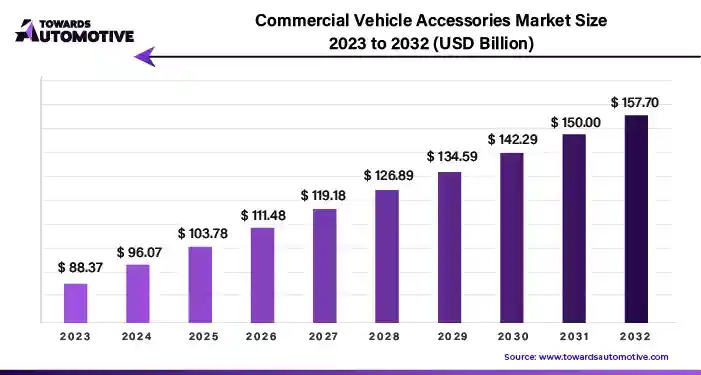

The commercial vehicle accessories market is projected to reach USD 179.42 billion by 2034, growing from USD 100.51 billion in 2025, at a CAGR of 6.65% during the forecast period from 2025 to 2034.

The commercial vehicle accessories market is witnessing robust growth, driven by the increasing demand for efficiency, safety, and customization in commercial fleets. With the rise of e-commerce, last-mile delivery, and logistics services, commercial vehicles play a vital role in supporting economic activities worldwide.

The commercial vehicle accessories market is poised for substantial growth, driven by the increasing demand for efficiency, safety, and customization in commercial fleets. With technological advancements, regulatory mandates, and evolving customer preferences shaping the market landscape, commercial vehicle accessory manufacturers and suppliers need to innovate, collaborate, and adapt to changing market dynamics to capitalize on emerging opportunities and maintain a competitive edge in the global marketplace.

The commercial vehicle accessories market is experiencing a period of transformation, driven by factors such as urbanization, digitalization, and sustainability initiatives. Commercial vehicle accessories encompass a wide range of products and solutions designed to enhance vehicle performance, functionality, and aesthetics. From safety equipment and cargo management systems to telematics solutions and aftermarket upgrades, commercial vehicle accessories cater to diverse needs and requirements across different industries.

By Fuel Type

By Body Style

By Application

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us