March 2025

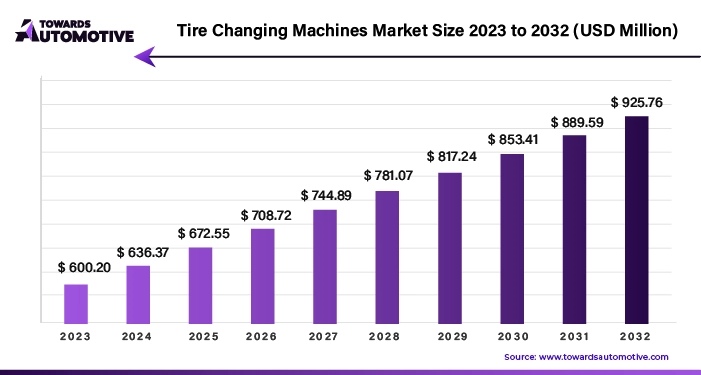

The tire changing machines market is set to grow from USD 652.30 million in 2025 to USD 948.71 million by 2034, with an expected CAGR of 4.25% over the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The tire changing machines market has seen significant growth in recent years, driven by various factors including the increasing popularity of recreational activities such as motorcycling and the expanding presence of commercial vehicles worldwide. These trends have contributed to a surge in demand for tire changing machines, particularly in sectors like automotive repair, maintenance, and tire replacement services.

One key driver of market growth is the rise in recreational activities such as motorcycling. As more individuals engage in off-road adventures, road trips, and leisure riding, the demand for motorcycle tires has seen a corresponding increase. Tire changing machines play a crucial role in efficiently and safely replacing tires on motorcycles, making them essential equipment for motorcycle repair shops and enthusiasts.

Additionally, the growing presence of commercial vehicles on roads worldwide has further fueled the demand for tire changing machines. Factors such as the rise of e-commerce, increased logistics activities, and urbanization have led to a surge in commercial vehicle usage. This includes electric buses and medium- to heavy-duty trucks, with China emerging as a dominant player in electric vehicle sales. The need for regular maintenance and tire replacement for these vehicles has driven the demand for tire changing machines in commercial vehicle service centers and fleet management operations.

Despite the positive growth outlook, the market faces challenges, particularly related to the high initial cost of tire changing machines. Investing in these machines can be a substantial financial commitment, especially for small businesses or start-ups with limited capital. The cost of purchasing and installing tire changing machines, coupled with ongoing maintenance and training expenses, presents a significant barrier to entry for some potential buyers. This cost challenge may hinder market penetration, particularly among businesses operating on tight budgets or with limited access to financing options.

While the tire changing machines market continues to experience growth driven by factors such as the popularity of recreational activities and the expansion of commercial vehicle fleets, challenges related to high initial costs remain a significant consideration for businesses looking to invest in this equipment. Efforts to address these challenges through cost-effective solutions and financing options may help stimulate further market growth and expansion.

The COVID-19 pandemic had a profound and multifaceted impact on the tire changing machines market, presenting several challenges to manufacturers, suppliers, and end-users alike. One of the primary effects of the pandemic was the disruption to automotive services and operations, stemming from lockdown measures and economic uncertainties.

As governments implemented lockdowns and restricted movement to curb the spread of the virus, automotive service centers experienced a significant decline in foot traffic. With fewer vehicles on the roads and consumers staying home, the demand for routine maintenance and tire replacement services plummeted. This decline in demand directly affected the investments and purchasing decisions of automotive service centers, leading to a slowdown in the acquisition of tire changing machinery.

Furthermore, the pandemic-induced supply chain disruptions had a notable impact on the tire changing machines market. Restrictions on manufacturing activities, disruptions in logistics and transportation, and shortages of raw materials and components hampered the production and availability of tire changing equipment. Manufacturers faced challenges in sourcing essential parts and components, leading to delays in production and delivery schedules.

Moreover, the economic repercussions of the pandemic, including widespread job losses, income uncertainty, and financial strain, resulted in budget constraints for businesses across various industries. Many automotive service centers and businesses in the automotive aftermarket sector faced financial challenges, leading them to prioritize essential expenditures and postpone investments in new equipment, including tire changing machines.

Overall, the COVID-19 pandemic exerted significant downward pressure on the tire changing machines market, disrupting supply chains, reducing demand for automotive services, and constraining investments in new equipment. However, as the global economy gradually recovers and automotive activities resume, the market is expected to rebound, albeit at a slower pace, with manufacturers and suppliers adapting to the evolving landscape and consumer demands.

Advanced automation is indeed a prominent trend in the tire changing machines industry, driven by the need for efficiency, precision, and improved customer service. Robotic tire changers represent a significant advancement in tire changing technology, offering faster service and reduced reliance on manual labor. These machines are equipped with sophisticated robotic arms and sensors that can swiftly and accurately remove and install tires without the need for human intervention. By automating the tire changing process, automotive workshops can increase productivity, minimize downtime, and enhance overall service quality.

Furthermore, as the industry embraces the principles of Industry 4.0, tire changing machines are increasingly being integrated with IoT (Internet of Things) and AI (Artificial Intelligence) technologies. These advanced features enable tire changers to collect and analyze data in real-time, allowing for predictive maintenance, remote monitoring, and proactive troubleshooting. By harnessing the power of data analytics and machine learning, automotive service providers can optimize their operations, minimize equipment downtime, and deliver superior service to their customers.

Additionally, the integration of tire sensors is another noteworthy trend in the tire changing machines market. With the widespread adoption of Tire Pressure Monitoring Systems (TPMS) and other sensor technologies in modern vehicles, tire changers must be capable of handling tires equipped with these sensors. Specialized equipment and procedures are required to ensure that tire sensors are not damaged during the tire changing process. By accommodating the needs of vehicles equipped with advanced sensor systems, tire changing machines can cater to a wider range of customers and provide a more comprehensive service.

Overall, advanced automation and sensor integration are driving significant advancements in the tire changing machines industry, revolutionizing the way automotive service providers perform tire maintenance and repair tasks. By embracing these trends, businesses can stay ahead of the curve, enhance their competitiveness, and meet the evolving needs of their customers in the rapidly changing automotive landscape.

The fully automatic tire changing machines segment is experiencing steady growth, with a projected CAGR of around 3% through 2032. This growth is driven by the increasing demand for efficient and rapid tire changing services. Automotive service providers are increasingly investing in automated solutions to streamline their operations and enhance customer satisfaction. The integration of technologies such as robotics and AI into fully automatic machines further enhances their productivity and performance, aligning with the industry's push towards greater automation. These advancements are expected to drive the expansion of the fully automatic tire changing machines segment in the market, catering to the evolving needs of automotive service providers and their customers.

On the other hand, the automotive service centers segment is a significant end user of tire changing machines, accounting for a substantial market share. With the global expansion of the automotive industry, the demand for tire maintenance and replacement services has seen a corresponding increase. Automotive service centers play a crucial role in meeting this demand by providing efficient and advanced tire changing equipment to their customers. Additionally, the trend towards more frequent tire maintenance and preventive care, as well as the growing popularity of electric and hybrid vehicles, further amplifies the importance of service centers in the market. As a result, the adoption of specialized tire changing machines in automotive service centers is expected to continue to rise, driving growth in this segment.

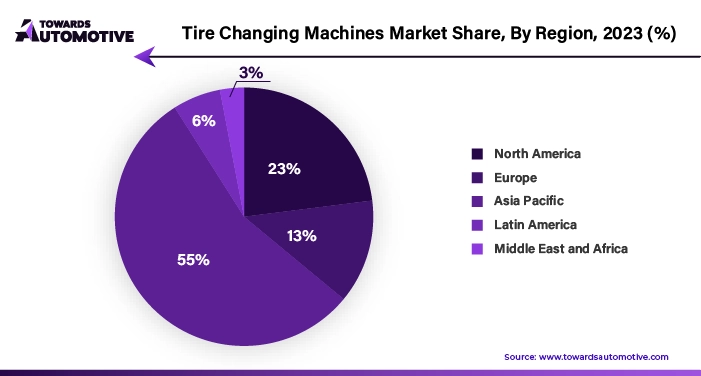

In 2022, the Asia Pacific region emerged as a significant player in the tire changing machines market, holding approximately 40% of the market share. This dominance can be attributed to several key factors driving demand for tire changing equipment across various sectors within the region.

Rapid urbanization and industrialization in countries across the Asia Pacific region have led to a surge in automotive activity, both in commercial and residential settings. As cities expand and industrial hubs develop, the need for efficient tire changing solutions becomes paramount to support the growing automotive infrastructure.

Furthermore, the expanding automotive sector in the Asia Pacific region is fueling demand for tire changing equipment. With increasing vehicle ownership and a growing automotive aftermarket, there is a rising need for tire maintenance and replacement services. This trend is particularly pronounced in emerging economies where rising disposable incomes are driving vehicle sales and aftermarket services.

Moreover, heightened awareness of vehicle maintenance and safety standards among consumers is contributing to the demand for modernized tire service solutions. As drivers become more conscious of the importance of regular tire maintenance in ensuring vehicle safety and performance, the demand for advanced tire changing equipment is expected to rise.

Additionally, the emergence of advanced automotive technologies, such as tire pressure monitoring systems (TPMS) and run-flat tires, necessitates specialized equipment for tire service and maintenance. This further drives the adoption of modern tire changing machines equipped with advanced features to cater to the evolving needs of the automotive industry in the Asia Pacific region.

Overall, the confluence of rapid urbanization, industrialization, expanding automotive sector, increased awareness of vehicle maintenance, and technological advancements is propelling the demand for tire changing machines in the Asia Pacific region, positioning it as a significant market player in the global landscape.

The major players operating in the tire changing machines industry are:

In 2022, Bosch Automotive Service Solutions and Hunter Engineering Company emerged as dominant players in the global tire changing machines market, collectively holding over 8% market share. Both companies are renowned for their industry-leading products and innovative solutions that cater to the evolving needs of automotive service providers worldwide.

Bosch Automotive Service Solutions offers a comprehensive range of advanced equipment, including tire changers and wheel balancers, renowned for their precision, durability, and reliability. The company's tire changing machines are equipped with cutting-edge technology designed to streamline the tire service process, ensuring optimal performance and customer satisfaction. Bosch's commitment to quality and customer-centric approach has solidified its position as a trusted partner for automotive service providers seeking best-in-class equipment.

On the other hand, Hunter Engineering Company specializes in state-of-the-art tire changing technology, with a strong emphasis on innovation and efficiency. The company's tire changers are known for their advanced features, intuitive operation, and exceptional performance, setting industry benchmarks for quality and reliability. Hunter Engineering's relentless pursuit of innovation and dedication to advancing tire changing technology have earned it a reputation as a leader in the field, trusted by automotive professionals worldwide.

Together, Bosch Automotive Service Solutions and Hunter Engineering Company leverage their combined expertise, global presence, and unwavering commitment to quality to address the diverse needs of automotive service providers across the globe. Their dominance in the tire changing machines market is a testament to their relentless pursuit of excellence and their ability to deliver superior solutions that drive efficiency, productivity, and customer satisfaction in the automotive service industry.

By Machine Type

By Vehicle Type

By Distribution Channel

By End-User

By Geography

March 2025

March 2025

March 2025

March 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us