April 2025

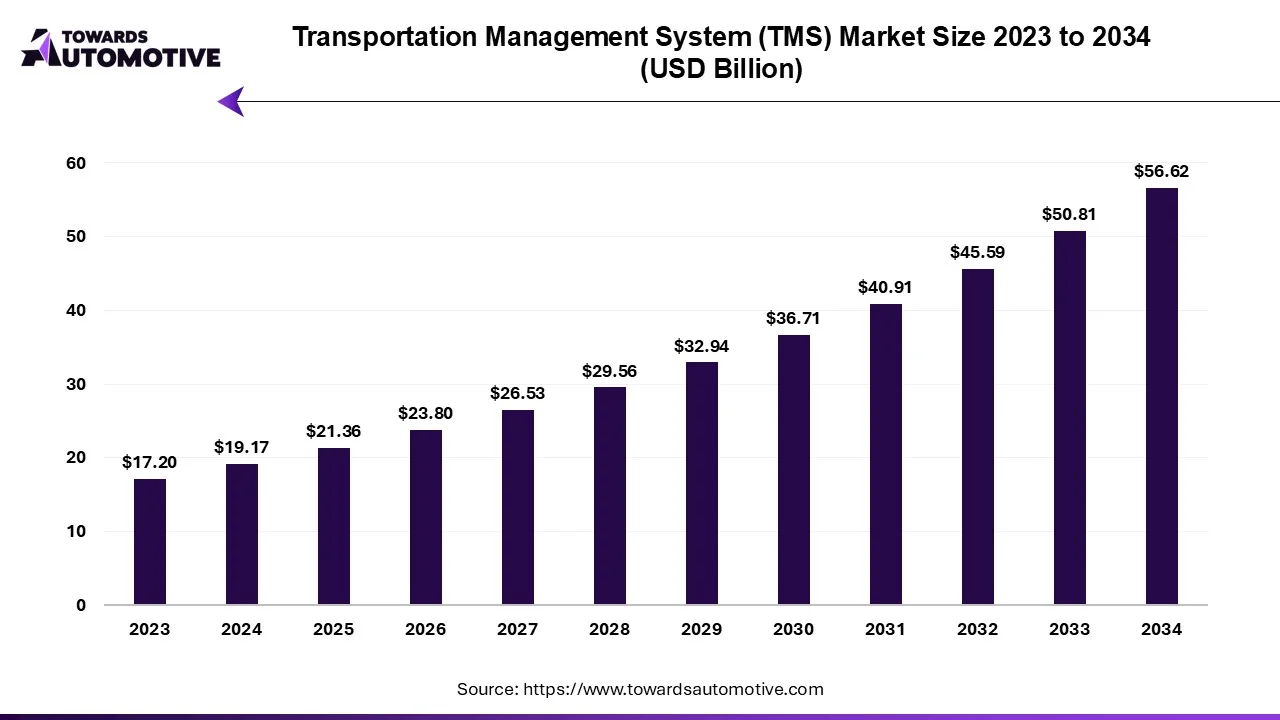

The global transportation management system market is projected to reach USD 56.62 billion by 2034, growing from USD 21.36 billion in 2025, at a CAGR of 11.44% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The transportation management system market is rapidly evolving, driven by the increasing need for businesses to optimize their logistics and supply chain operations. A TMS is a software platform that helps organizations plan, execute, and manage the transportation of goods across various modes, including roadways, railways, airways, and waterways. The market has witnessed significant growth due to factors such as the rise of e-commerce, global trade expansion, and the demand for cost-effective and efficient transportation solutions. As companies face increasing pressure to streamline operations, reduce transportation costs, and enhance customer service, TMS solutions have become essential tools for achieving these goals.

In recent years, technological advancements such as cloud computing, artificial intelligence (AI), and data analytics have further accelerated the adoption of TMS across industries. These innovations enable businesses to improve route optimization, monitor real-time shipment tracking, and gain actionable insights into transportation performance. The growing complexity of global supply chains, coupled with factors like fluctuating fuel prices and environmental sustainability concerns, has made the need for advanced TMS solutions more critical than ever.

The transportation management system market is also being driven by increasing demand for improved visibility, greater efficiency, and better integration across the supply chain. As companies continue to invest in digital transformation, the market for TMS is set to expand, with new opportunities emerging in various regions and sectors. From enhancing operational efficiencies to improving customer satisfaction, TMS plays a pivotal role in shaping the future of transportation and logistics worldwide.

Artificial Intelligence (AI) plays a pivotal role in transforming the transportation management system market by enhancing efficiency, optimization, and decision-making capabilities. AI integrates machine learning, predictive analytics, and real-time data processing into TMS, allowing businesses to streamline their transportation operations and gain a competitive edge.

One of the key ways AI contributes to the TMS market is through route optimization. AI-powered algorithms can analyze historical data, traffic patterns, weather conditions, and other variables to recommend the most efficient routes for deliveries. This not only reduces transportation costs but also improves delivery speed, ensuring customer satisfaction. By continually learning from data, AI systems can adapt to changing conditions, optimizing routes in real time.

AI also enhances predictive analytics within TMS, enabling businesses to forecast demand more accurately. By analyzing patterns in shipment data, customer orders, and external factors, AI can predict peak shipping periods and adjust logistics strategies accordingly. This helps businesses plan for capacity needs, allocate resources efficiently, and avoid bottlenecks in the supply chain.

Furthermore, AI facilitates improved fleet management by enabling predictive maintenance. By continuously monitoring vehicle conditions and analyzing performance data, AI can predict potential breakdowns, allowing businesses to proactively schedule maintenance and reduce downtime.

The increasing demand for Transportation Management System solutions from the manufacturing sector is a key driver of growth in the transportation management system market. Manufacturers face complex logistics challenges, including managing multi-modal transportation, optimizing supply chain processes, and ensuring timely delivery of raw materials and finished goods. TMS solutions address these challenges by providing advanced tools for route optimization, freight management, real-time tracking, and seamless integration with other supply chain systems. As manufacturing processes become more globalized, the need for efficient transportation management has intensified, making TMS a critical component of supply chain operations.

TMS solutions empower manufacturers to reduce operational costs by optimizing freight spend, improving fuel efficiency, and minimizing transit times. Additionally, the ability to gain real-time visibility into shipments enhances decision-making, allowing manufacturers to respond proactively to disruptions such as delays, fluctuating demand, or capacity constraints. This is particularly important in an era where just-in-time (JIT) manufacturing and lean supply chains are becoming industry norms.

Moreover, TMS solutions support compliance with regulatory requirements in cross-border logistics, ensuring that manufacturers can efficiently navigate complex trade regulations. The integration of AI and predictive analytics further enhances the value of TMS, enabling manufacturers to forecast demand, plan transportation capacity, and improve overall supply chain agility. As a result, the growing reliance of the TMS solutions on manufacturing sector is significantly driving the transportation management system market.

The Transportation Management System market faces several restraints that hinder its growth despite its increasing adoption. High initial investment and implementation costs remain significant barriers, particularly for small and medium-sized enterprises (SMEs). Additionally, the complexity of integrating TMS with existing legacy systems poses challenges for businesses looking to modernize their logistics operations. Data security concerns, especially for cloud-based TMS solutions, further limit adoption in industries dealing with sensitive information. Moreover, the lack of skilled professionals to manage and utilize advanced TMS solutions effectively adds to these challenges, collectively restraining the market's full potential for growth.

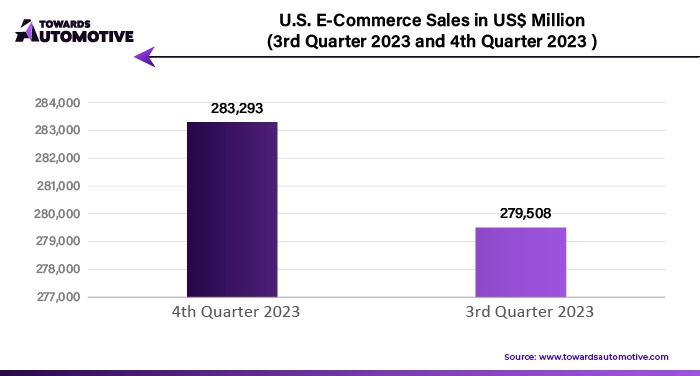

The increasing trend of last-mile delivery solutions is creating significant opportunities in the transportation management system market, driven by the rapid growth of e-commerce and the rising demand for fast, efficient, and reliable deliveries. Last-mile delivery, which refers to the final leg of the delivery process from a transportation hub to the end customer, has become a critical focus area for businesses as consumer expectations for speed and convenience continue to rise. TMS solutions play a pivotal role in addressing the unique challenges of last-mile logistics by enabling route optimization, real-time tracking, and seamless coordination of delivery operations.

The adoption of TMS for last-mile delivery is particularly evident in urban areas, where traffic congestion, limited delivery windows, and high-density stops require advanced logistics planning. AI-powered TMS platforms optimize delivery routes in real-time, ensuring timely deliveries while reducing fuel costs and operational inefficiencies. Furthermore, the integration of TMS with smart technologies, such as IoT-enabled devices and geolocation tools, provides enhanced visibility and transparency, improving customer satisfaction and operational efficiency.

As businesses increasingly adopt omnichannel retail strategies, the demand for TMS solutions tailored to last-mile delivery is growing rapidly. This trend is opening new growth opportunities for TMS providers to offer innovative solutions that address the complexities of last-mile logistics, driving the market’s expansion in the upcoming days.

The on-premises segment led the industry. The on-premises segment plays a crucial role in driving the growth of the Transportation Management System market by offering businesses enhanced control, security, and customization. Many large enterprises, especially in industries like manufacturing, retail, and automotive, prefer on-premises TMS solutions because they provide greater flexibility to tailor the system to meet their specific operational needs. These solutions enable companies to manage complex transportation operations, including multi-modal logistics, cross-border shipments, and adherence to local regulations, all while ensuring that the system can be fully aligned with their existing workflows.

One of the key advantages of on-premises TMS is the increased level of data security it offers. With rising concerns over data privacy and the threat of cyberattacks, businesses that handle sensitive information—such as customer data, financial records, or proprietary logistics strategies—opt for on-premises deployments to maintain full control over their data. This ensures compliance with industry-specific regulations and minimizes the risk of breaches associated with third-party cloud providers.

Moreover, on-premises solutions allow for seamless integration with other enterprise systems such as Enterprise Resource Planning (ERP), Warehouse Management Systems (WMS), and Customer Relationship Management (CRM) platforms. This integration leads to improved collaboration across departments and better overall supply chain visibility. The on-premises segment continues to drive growth in the TMS market as businesses seek robust, secure, and customized solutions that align with their strategic goals and operational complexity.

The roadways segment dominated the market. The roadways segment is a significant driver of growth in the transportation management system market due to the increasing reliance on road transportation for both domestic and international logistics. Road transportation remains one of the most widely used and cost-effective methods of moving goods, particularly in regions like North America, Europe, and Asia-Pacific. As demand for faster and more efficient delivery increases, businesses are turning to TMS solutions to optimize their road transportation operations. TMS systems help companies streamline route planning, manage fleets, track deliveries in real time, and improve overall operational efficiency, making them invaluable for businesses relying on roadways for transportation.

With the growing complexity of road-based logistics driven by factors like urbanization, regulatory requirements, and fluctuating fuel prices. TMS platforms are becoming essential for managing these challenges. Roadway networks are often congested, and timely delivery is a critical factor for maintaining customer satisfaction. TMS solutions assist businesses in overcoming these challenges by offering features like route optimization, traffic analysis, and predictive maintenance, which ensure that deliveries are made on time and at reduced operational costs.

Furthermore, the rise in e-commerce, which often depends on road transportation for last-mile delivery, is fueling the adoption of TMS in the roadways segment. As companies look to meet growing consumer expectations for faster and more reliable delivery, TMS systems enable logistics providers to increase delivery efficiency and reduce costs, driving the growth of the transportation management system market.

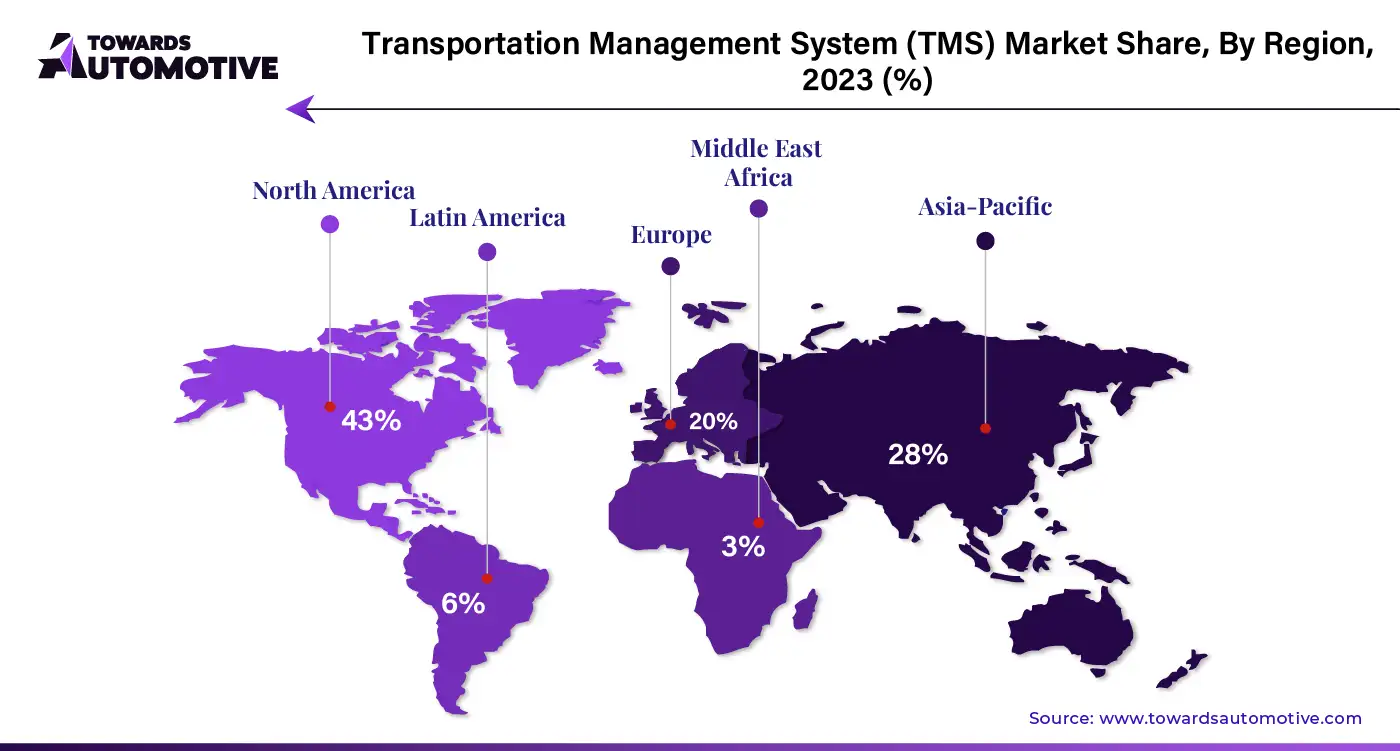

North America dominated the transportation management system market. E-commerce growth, supply chain optimization, and technological advancements are key drivers fueling the expansion of the transportation management system market in North America. The rapid rise of e-commerce, particularly in the United States and Canada, has significantly increased the demand for efficient transportation solutions. Online retailers and logistics providers require TMS platforms to streamline their delivery processes, optimize shipping routes, and ensure faster, more reliable deliveries to meet customer expectations. As e-commerce continues to grow, businesses are turning to TMS solutions to handle the complexity and volume of deliveries while managing costs effectively.

Supply chain optimization also plays a crucial role in the growth of the TMS market. Companies are increasingly focused on enhancing their supply chain operations to reduce inefficiencies, cut costs, and improve service levels. TMS solutions enable businesses to track shipments in real-time, optimize routes, and improve inventory management, ultimately leading to more efficient transportation networks and better customer service. As companies seek to improve their operational performance, TMS adoption has become essential.

Technological advancements are another key factor driving the TMS market in North America. The integration of cutting-edge technologies such as artificial intelligence (AI), machine learning, big data analytics, and cloud computing allows businesses to make data-driven decisions, optimize routes in real-time, predict demand, and ensure predictive maintenance of fleets. These innovations not only enhance the efficiency of transportation operations but also help businesses reduce costs, improve sustainability, and increase overall operational agility, further propelling the growth of the transportation management system market in the region.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The logistics and manufacturing boom, improved infrastructure and urbanization, and cost pressure and fuel efficiency are driving the growth of the transportation management system market in the Asia-Pacific (APAC) region. As APAC countries such as China, India, and Southeast Asia experience rapid growth in manufacturing and logistics, the need for advanced transportation management solutions has become more critical. Manufacturing hubs require efficient transportation networks to move goods across vast regions, making TMS a key tool for optimizing routes, managing shipments, and ensuring timely deliveries. With increasing trade volumes, the complexity of transportation operations also rises, and TMS solutions help streamline logistics, reduce delays, and improve overall supply chain efficiency.

Improved infrastructure and rapid urbanization in APAC further contribute to the demand for TMS. As cities expand and population densities increase, managing transportation systems becomes more challenging. TMS helps businesses optimize route planning, manage traffic congestion, and improve fleet utilization, especially in urban areas where demand for goods and services is rising. With better infrastructure, such as advanced road networks and port facilities, companies in the region can leverage TMS to enhance supply chain visibility and ensure smooth transportation operations.

Cost pressure and fuel efficiency are also major driving forces. Rising fuel costs in APAC countries are prompting businesses to seek ways to reduce transportation expenses. TMS platforms help optimize fuel usage, improve route planning, and reduce empty miles, enabling companies to lower operational costs while enhancing fuel efficiency. These factors combined are accelerating the adoption of TMS solutions in the APAC region.

By Solution

By Deployment

By Mode of Transportation

By End-User

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us