April 2025

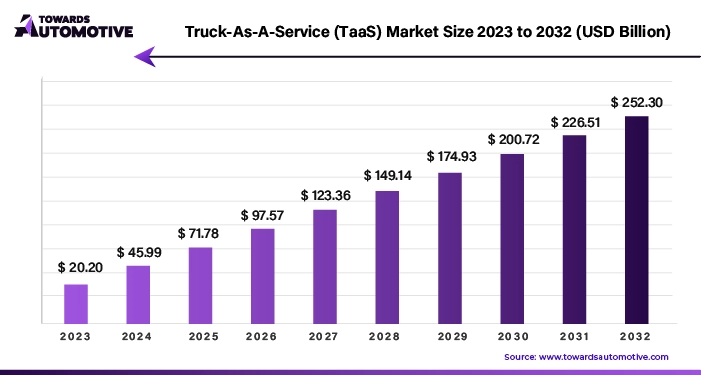

The truck-as-a-service (TaaS) market is forecasted to expand from USD 29.49 billion in 2025 to USD 161.76 billion by 2034, growing at a CAGR of 20.82% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The truck-as-a-service (TaaS) market is gaining significant traction as a result of the growing demand for cost-efficient and flexible transportation solutions in the logistics and freight industry. TaaS is a business model where trucking companies provide commercial vehicles on a subscription basis, allowing businesses to access vehicles without the need for upfront investments or long-term commitments. This model offers significant advantages, including reduced maintenance costs, fuel management, and fleet optimization, all of which are highly appealing to logistics providers, e-commerce companies, and third-party logistics (3PL) operators.

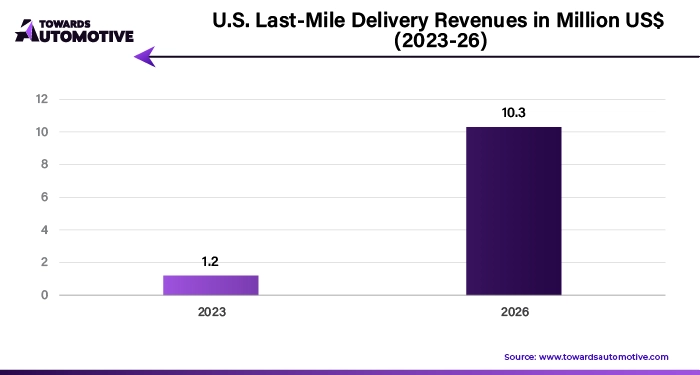

The rise of e-commerce and the increasing need for last-mile delivery services have further accelerated the demand for TaaS solutions. Businesses are seeking to optimize their supply chains by reducing operational complexities, and TaaS offers a cost-effective alternative to traditional vehicle ownership. Additionally, the growing emphasis on sustainability and the push for electric vehicles (EVs) in the trucking industry are opening new opportunities for TaaS providers to offer eco-friendly fleet options, contributing to environmental goals.

Technological advancements, such as telematics and fleet management software, are enhancing the functionality and efficiency of TaaS platforms by enabling real-time monitoring, route optimization, and predictive maintenance. As logistics networks continue to evolve and demand for flexible, scalable solutions rises, the TaaS market is expected to experience significant growth, providing businesses with the opportunity to meet evolving transportation needs while optimizing costs and improving overall operational efficiency.

AI plays a crucial role in the Truck-as-a-Service (TaaS) market by enhancing operational efficiency, improving fleet management, and enabling data-driven decision-making. Through the integration of AI technologies, TaaS providers can optimize their fleets, reduce costs, and offer more flexible and efficient services to customers.

One of the key applications of AI in the TaaS market is route optimization. AI-powered algorithms analyze real-time traffic data, weather conditions, and other relevant factors to determine the most efficient routes for trucks. This not only reduces fuel consumption and delivery times but also enhances overall fleet performance. AI can also predict potential maintenance needs by analyzing data from sensors embedded in the trucks. This predictive maintenance capability allows TaaS providers to address issues before they result in costly repairs or breakdowns, minimizing downtime and improving vehicle reliability.

Additionally, AI can enhance driver safety by monitoring driving patterns and providing real-time feedback. It can detect risky behaviors, such as harsh braking or speeding, and suggest corrective actions, leading to fewer accidents and better overall safety records.

Furthermore, AI enables better customer experience by allowing TaaS platforms to dynamically adjust pricing, delivery times, and fleet availability based on real-time demand and supply, ensuring higher service levels and customer satisfaction. As AI technologies continue to evolve, their role in the TaaS market will become even more vital, driving further innovations and efficiencies.

The increasing use of Truck-as-a-Service (TaaS) in the Fast-Moving Consumer Goods (FMCG) sector is a significant driver of growth in the TaaS market. FMCG companies require a reliable and efficient transportation system to meet the high demand for quick deliveries, especially given the rapid turnover of products and the need to manage large volumes of shipments. TaaS provides a flexible and cost-effective solution by offering access to a wide range of vehicles without the burden of fleet ownership and maintenance. This flexibility is especially valuable for FMCG businesses that face fluctuating demand, as they can scale their transportation needs up or down based on market conditions.

Moreover, TaaS allows FMCG companies to improve supply chain efficiency by leveraging advanced technologies such as real-time tracking, route optimization, and fleet management systems. These technologies help reduce delivery times, enhance customer satisfaction, and optimize fuel consumption, contributing to cost savings. Additionally, the FMCG sector's need for last-mile delivery solutions is driving the adoption of TaaS, as these services can provide a more agile and localized approach to distribution. The growing reliance on e-commerce and the demand for faster, more efficient deliveries further fuel the adoption of TaaS in the FMCG sector, supporting the growth of the Truck-as-a-Service (TaaS) market.

The Truck-as-a-Service (TaaS) market faces several restraints, primarily the high upfront costs associated with the acquisition of advanced technology, such as autonomous systems and electric trucks. These technologies require substantial investment, which may limit their adoption, particularly among smaller businesses. Additionally, the complexity of integrating TaaS with existing logistics systems poses challenges for both service providers and customers. Regulatory hurdles, including compliance with safety standards and emission regulations, can further complicate the market's growth. Moreover, concerns over data security and privacy, especially with the increased use of AI and IoT, may hinder wider adoption of TaaS solutions.

The rising adoption of autonomous trucks is creating significant opportunities in the Truck-as-a-Service (TaaS) market. Autonomous trucks, equipped with cutting-edge technologies such as artificial intelligence (AI), sensors, and advanced safety features, have the potential to transform the logistics and transportation industries. With the ability to operate without human drivers, these trucks offer several advantages, including reduced labor costs, increased operational efficiency, and improved safety.

As autonomous technology continues to evolve and become more reliable, TaaS providers are increasingly incorporating autonomous vehicles into their fleets, which can be deployed on long-haul routes and during off-peak hours to optimize fleet utilization. This trend is particularly appealing to businesses that seek to reduce transportation costs while maintaining high service levels.

Moreover, autonomous trucks have the potential to increase fuel efficiency through optimized driving patterns, reducing both costs and environmental impact. The integration of autonomous vehicles into the TaaS model also offers greater flexibility, allowing businesses to scale operations quickly without the need for additional drivers. As governments and regulatory bodies work towards establishing standards for autonomous vehicles, the expansion of autonomous truck fleets within TaaS platforms is expected to accelerate. This shift presents substantial opportunities for TaaS providers, as well as for companies seeking innovative, cost-effective, and sustainable logistics solutions.

The light duty trucks segment led the industry. Light-duty trucks are driving significant growth in the Truck-as-a-Service (TaaS) market due to their increasing demand in urban logistics, last-mile delivery services, and small business transportation needs. These trucks are ideal for TaaS models because they offer flexibility, lower operating costs, and the ability to navigate congested urban environments, making them a popular choice for e-commerce companies, retailers, and delivery service providers. With the growth of e-commerce and the need for rapid, efficient deliveries, businesses are turning to light-duty trucks on a subscription basis to scale their fleets without large upfront investments.

TaaS providers offering light-duty trucks enable companies to access modern, well-maintained vehicles with the latest fuel-efficient or electric technology, reducing operational costs. Additionally, the flexible nature of TaaS, with its pay-per-use or short-term rental options, is appealing for businesses with fluctuating demand, as it allows them to adjust fleet sizes based on seasonality or changing delivery requirements. The growing trend toward sustainability is also pushing the adoption of electric light-duty trucks within TaaS, as these vehicles align with green transportation goals. As urbanization and demand for quick deliveries continue to rise, the light-duty truck segment in the TaaS market is expected to experience robust growth, providing businesses with cost-effective, efficient, and sustainable transportation solutions.

The rental and leasing segment dominated the market. The rental and leasing segment is a major driver of growth in the Truck-as-a-Service (TaaS) market, as it offers businesses a flexible, cost-effective solution for acquiring and managing trucks. This segment allows companies to access a variety of vehicles without the burden of purchasing or maintaining a fleet. With rental and leasing models, businesses can scale their transportation capabilities based on demand fluctuations, seasonality, or specific project requirements, without long-term commitments. This flexibility is especially appealing for small and medium-sized enterprises (SMEs) that may not have the capital to invest in their own trucks.

Moreover, rental and leasing services typically provide well-maintained, up-to-date vehicles, reducing operational risks associated with owning older trucks. Businesses can choose from a range of vehicle types, including electric and fuel-efficient models, which aligns with sustainability goals and reduces environmental impact. The TaaS model in the rental and leasing segment also eliminates the need for fleet management, as providers handle maintenance, insurance, and compliance, allowing businesses to focus on their core operations. With the growing trend of outsourcing logistics services and the increasing demand for efficient, flexible transportation solutions, the rental and leasing segment continues to expand, driving the overall growth of the TaaS market by offering businesses a practical, cost-saving alternative to traditional vehicle ownership.

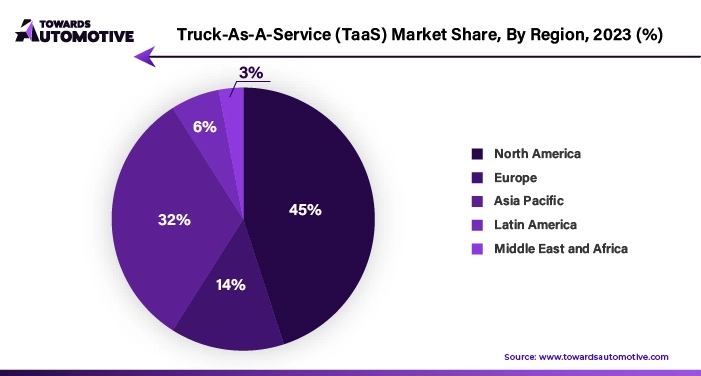

North America dominated the truck-as-a-service (TaaS) market. The growth of the Truck-as-a-Service (TaaS) market in North America is significantly driven by the rise of e-commerce, technological advancements, and the need for cost-effective and flexible logistics solutions. The e-commerce boom has increased the demand for quick and reliable delivery services, particularly in last-mile logistics. TaaS models enable businesses to scale their fleets rapidly to meet the fluctuating demand during peak seasons, without the need for significant capital investment. This flexibility is particularly valuable for businesses looking to enhance efficiency and reduce operational costs. Technological advancements, including the integration of artificial intelligence (AI), Internet of Things (IoT), and telematics, further drive the growth of TaaS in North America. These innovations optimize route planning, monitor vehicle performance, and provide real-time tracking, resulting in more efficient fleet management. This technological integration improves service reliability while reducing costs, making TaaS an attractive option for businesses in various sectors. Additionally, TaaS provides cost-effectiveness by allowing companies to avoid the financial burden of purchasing, maintaining, and insuring trucks. This flexibility, combined with the scalability of TaaS solutions, enables businesses to manage logistics operations more efficiently and economically. As companies seek to meet the demands of an expanding e-commerce market while optimizing logistics and reducing costs, TaaS is becoming an essential solution in North America's transportation landscape.

Europe is expected to grow with a significant CAGR during the forecast period. The growth of the Truck-as-a-Service (TaaS) market in Europe is driven by several key factors, including the shift towards outsourcing logistics, stringent environmental regulations, and a well-developed trucking infrastructure. Many businesses in Europe are increasingly outsourcing their logistics operations to focus on core activities, leading to a higher demand for flexible and scalable transportation solutions. TaaS offers companies the ability to access a wide range of trucks without the financial commitment of fleet ownership, making it an attractive option for businesses seeking operational efficiency and cost savings.

Furthermore, Europe’s strict environmental regulations, particularly regarding carbon emissions and air quality, are prompting businesses to adopt cleaner and more sustainable transportation solutions. TaaS providers are responding by incorporating electric and hybrid vehicles into their fleets, helping companies comply with these regulations while reducing their carbon footprint. Additionally, Europe’s well-developed trucking infrastructure supports the efficient deployment of TaaS models. The extensive network of highways, ports, and logistics hubs across the continent facilitates the seamless movement of goods, making TaaS a viable and efficient option for businesses. Thus, the above-mentioned factors drives the growth of the TaaS market in Europe.

By Truck Type

By Service Type

By End Use

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us