April 2025

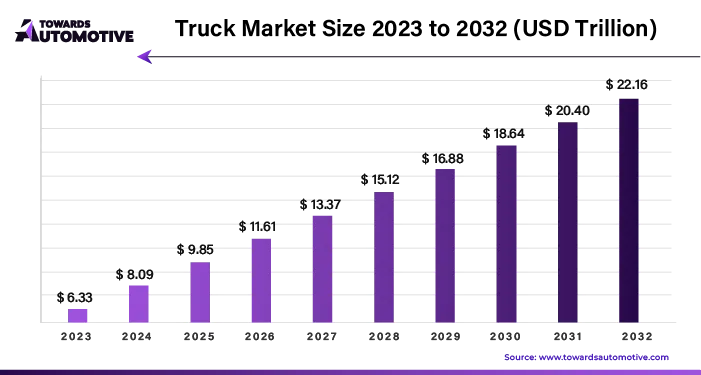

The truck market is projected to reach USD 21.70 trillion by 2034, growing from USD 7.92 trillion in 2025, at a CAGR of 11.85% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Expanding infrastructure and enhancing transportation operations are pivotal strategies that render freight transportation more viable and cost-effective. This fosters a favorable environment for businesses to rely on truckloads for their logistical needs, subsequently driving up the demand for trucking services. A well-maintained transportation system not only minimizes wear and tear on trucks but also extends their operational lifespan, ultimately bolstering profitability for trucking companies.

Moreover, the integration of cutting-edge technologies such as telematics, autonomous driving, advanced driver assistance systems, and energy-efficient mechanisms significantly enhances the efficiency and cost-effectiveness of trucking operations. Innovations in trailer tracking, predictive maintenance, and real-time data analysis further optimize fleet management processes, making trucks more operationally efficient, competitive, and environmentally sustainable in the realm of business logistics.

However, escalating maintenance expenses pose a notable challenge for trucking companies, as they increase operational costs and impede profitability. These elevated costs may constrain companies from meeting the burgeoning demand for trucking services and hinder their capacity to expand their fleets. Furthermore, the prospect of high maintenance expenditures may dissuade potential newcomers from entering the industry, exacerbating existing driver shortages and dampening the attractiveness of trucking as a viable career option. Consequently, these factors collectively limit the overall growth potential of the trucking market.

The COVID-19 pandemic has presented significant challenges for the automotive industry, with notable impacts on various sectors, particularly passenger and non-essential transport services. Lockdown measures and economic uncertainties led to a downturn in demand for these services, reflecting shifts in consumer behavior and mobility patterns during the pandemic.

However, amidst these challenges, the pandemic underscored the indispensable role of trucks in transporting essential goods, including medical supplies and equipment. The surge in demand for these critical items highlighted the resilience and importance of the trucking industry in facilitating vital supply chain operations during times of crisis.

Supply chain disruptions and production restrictions further compounded the challenges faced by the trucking sector. Delays in manufacturing and distribution processes disrupted the flow of goods, necessitating agile responses and adaptability from trucking companies to navigate these uncertainties effectively.

Overall, while the pandemic emphasized the critical role of the trucking industry, it also posed short-term challenges due to economic uncertainties and transportation disruptions. Moving forward, stakeholders in the automotive and trucking sectors must continue to innovate and collaborate to address ongoing challenges and build resilience in the face of future disruptions.

By addressing sustainability and efficiency concerns, the adoption of electric trucks for e-commerce delivery presents significant business benefits. E-commerce companies are increasingly turning to electric vehicles to align with environmental objectives and lower operational expenses. An illustrative example of this trend is the partnership between Eicher Trucks, a subsidiary of VE Commercial Vehicles Ltd. (VECV), and Amazon, announced in August 2023. This collaboration aims to deploy up to 1,000 zero-emission electric vehicles across various charging infrastructures for Amazon delivery operations over the next five years. Leveraging Amazon's extensive network of shipping partners, these electric trucks will play a pivotal role in enhancing the sustainability of e-commerce logistics.

Furthermore, the adoption of electric trucks offers substantial advantages in terms of lower maintenance and fuel costs, particularly for last-mile delivery services. As the e-commerce industry continues to experience rapid growth, last-mile delivery has emerged as a critical component, driving economic progress and market expansion. Electric trucks are ideally suited for last-mile delivery operations due to their efficiency, reduced environmental impact, and cost-effectiveness. By embracing electric vehicles, e-commerce companies can optimize their delivery networks, improve service reliability, and contribute to a more sustainable future.

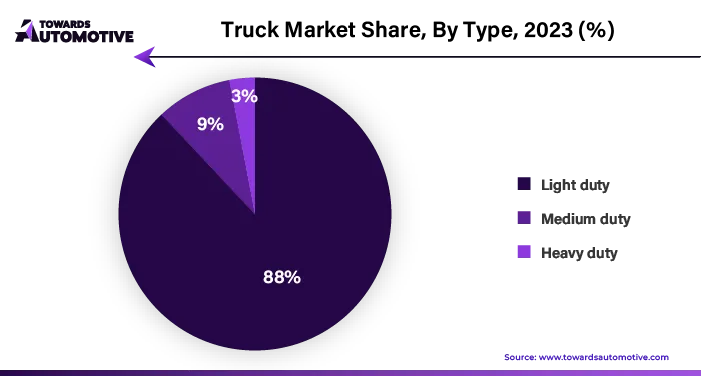

The commercial truck market is segmented into three categories: light, medium, and heavy trucks. Together, these segments comprised over 85% of the automotive lighting industry market share in 2023, and this market is anticipated to continue growing through 2032. The emphasis is on developing vehicle lighting solutions that are efficient, environmentally sustainable, and cost-effective.

A noteworthy development in this regard occurred in July 2023, when Isuzu Motors, Toyota, Hino Motors, and Japan Technology Cooperative Corporation announced their collaboration to produce gas-electric vehicles for the general consumer goods market. This joint effort is geared towards supporting the transition to a hydrogen-based society and achieving carbon neutrality objectives. By expanding consumer options and fostering increased demand for hydrogen energy, this initiative aims to advance the adoption of sustainable transportation solutions.

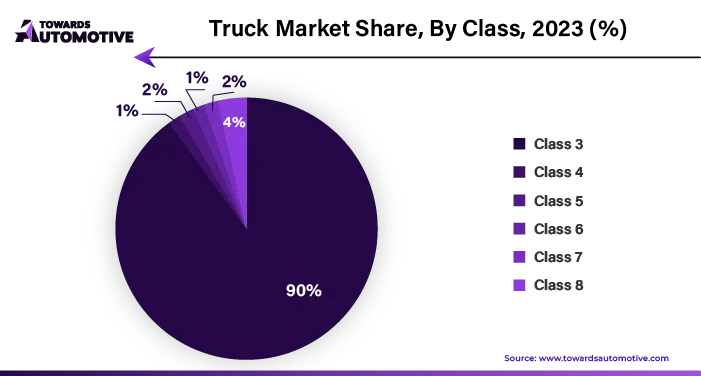

The truck market is segmented into various classes, including Class 3, Class 4, Class 5, Class 6, Class 7, and Class 8, each with its own growth trajectory. These vehicles are prized for their environmentally friendly and efficient transportation solutions, bolstered by their robust cargo capacity.

An illustrative example of this trend is evident in the actions of emerging electric vehicle (EV) manufacturer Mullen Automotive. In August 2023, Mullen Automotive introduced its inaugural production vehicle, the Mullen Three. Positioned as a Class 3 low-cab-height electric truck, the Mullen Three boasts a gross vehicle weight of 11,000 pounds, a tight 38-foot turning radius, and exceptional visibility for maneuverability on narrow roads. Produced at Mullen's automotive assembly facility in Tunica, Mississippi, this vehicle is designed to appeal to mariners and businesses seeking to reduce operating costs and environmental impact.

By offering compelling features and addressing the needs of businesses and individuals alike, vehicles like the Mullen Three are poised to drive segment expansion across the truck market. With a focus on sustainability, efficiency, and versatility, these vehicles play a pivotal role in shaping the future of transportation.

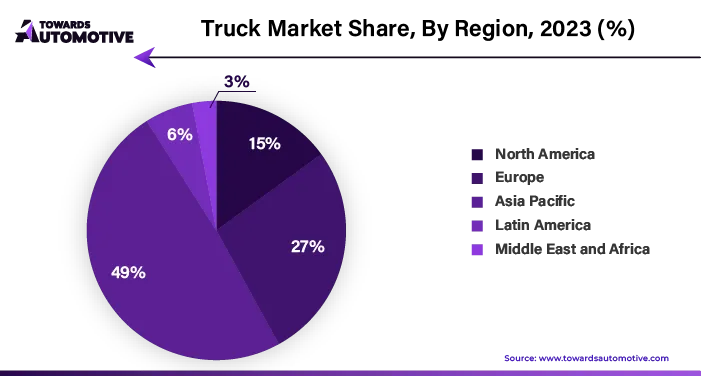

The Asia Pacific region has emerged as a dominant force in the truck market, commanding over 49% of the market share by 2023. Chinese companies, in particular, are at the forefront of innovation, leveraging technologies such as electric and autonomous vehicles to enhance the fuel efficiency and safety of trucks. This technological advancement has intensified competition among buyers in the Asia-Pacific region, resulting in a surge in demand for trucks equipped with these cutting-edge features.

Moreover, China's pivotal role as a manufacturing hub further bolsters the region's market economy. With access to a wide range of trucking equipment manufactured in China, countries across the Asia-Pacific region benefit from increased availability and affordability of essential transportation infrastructure. This accessibility to quality trucking equipment contributes to the overall growth and development of the truck market in the Asia Pacific, solidifying the region's position as a leader in the global automotive industry.

Major players operating in the trucks market are

By Class

By Propulsion Type

Ву Туре

By Application

By Geography

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us