April 2025

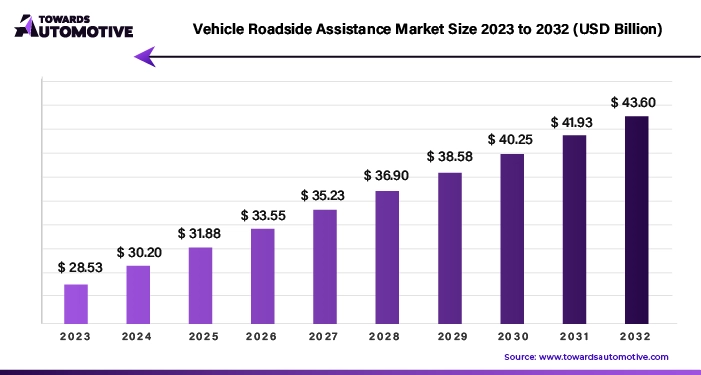

The vehicle roadside assistance market is forecasted to expand from USD 30.95 billion in 2025 to USD 44.67 billion by 2034, growing at a CAGR of 4.16% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

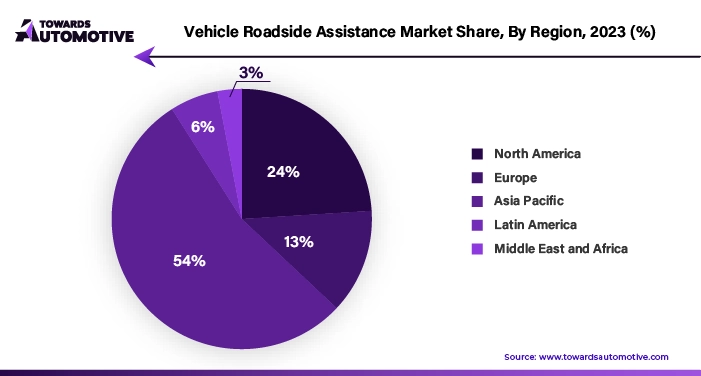

The European automotive industry has experienced rapid growth, establishing the region as a dominant force in the global automotive landscape by 2023. This remarkable growth trajectory can be attributed to several key factors, including the increasing per capita income, shifting consumer preferences towards luxury products, elevated lifestyles, and rising demand for premium vehicles across the region. Moreover, the expansion of transportation services has further fueled the demand for automotive products in Europe.

Simultaneously, the North American on-road vehicle market has also witnessed substantial growth, driven by factors such as aging vehicle fleets and challenging weather conditions in certain regions. The burgeoning demand for vehicle safety features and diagnostic solutions, coupled with the adoption of advanced vehicle repair products, has spurred the expansion of vehicle service offerings in North America.

The European automotive service industry benefits from a robust economy, abundant resources, and a skilled workforce, which collectively contribute to its sustained growth. With Germany at the forefront, the European market is poised to maintain its leadership position in the automotive sector, driving innovation and setting industry benchmarks for excellence.

The COVID-19 pandemic indeed inflicted significant challenges upon the transportation industry, leading to temporary closures of factories, widespread unemployment, and dwindling business confidence. These disruptions stemmed from the stringent measures implemented to curb the spread of the virus, causing adverse effects on various sectors of the economy, including transportation.

Despite the setbacks experienced during the pandemic, the transportation market is anticipated to rebound and continue its growth trajectory in the years ahead. While navigating through the challenges posed by the novel virus, the industry is poised to adapt and evolve, leveraging innovative solutions to overcome hurdles and capitalize on emerging opportunities.

As economies gradually recover and restrictions are eased, the transportation sector is expected to witness renewed momentum, driven by increased consumer demand, revitalized business activities, and a resurgence in global trade. While the road to recovery may pose its own set of challenges, the industry remains resilient, poised to emerge stronger and more agile in the post-pandemic landscape.

The provision of towing services is essential for addressing a wide range of issues encountered by drivers, from flat tires to more serious mobility issues. According to data from the National Highway Traffic Safety Administration, car crashes claimed the lives of approximately 38,680 individuals in 2019, representing around 7.2% of the total 36,096 fatalities recorded that year. Research conducted by Triple-I underscores the correlation between speeding and an increase in fatalities per 100 miles traveled. Moreover, the alarming 24% rise in fatalities in 2018 marked the largest annual increase since the National Safety Council's prediction of 42,060 car crash-related deaths in 2020, an 8% increase compared to 2019.

Transportation assistance services, whether provided by vehicle manufacturers or other service providers, offer crucial support in the event of accidents or breakdowns. These services encompass on-site support for mechanical and electrical repairs, addressing issues like dead batteries and flat tires, particularly beneficial for trucks and other commercial vehicles. The emergence of US-based mobile fuel delivery startups like "Booster" reflects the growing demand for convenient services catering to businesses, homeowners, and maritime users. The increasing prevalence of electrical and mechanical problems among elderly drivers further underscores the importance of reliable transportation assistance services.

Integration of in-app services has led to improved response times from service providers, enhancing overall efficiency and facilitating business growth. Adverse weather conditions, especially in cold climates, pose additional challenges for drivers, increasing the risk of accidents and necessitating prompt assistance. Membership plans offered by service providers typically include service fees, with users also required to pay a fee for each service use, subject to varying terms and conditions.

As vehicle registrations and per capita income continue to rise, the demand for transportation services is expected to increase in the coming years, highlighting the importance of reliable and efficient roadside assistance solutions in ensuring road safety and driver convenience.

The escalating demand for car services is primarily driven by the government's heightened focus on addressing traffic issues such as worn tires, flat tires, and brake line failures. Highways England, in particular, is bracing itself for an additional 700 crashes this week alone, pushing the average weekly crash count close to 5,000 incidents. Consequently, as the number of vehicles experiencing breakdowns rises, so does the necessity for transportation services.

The surge in demand necessitates the provision of group and assistance services to effectively manage the increasing volume of incidents on the roads. With the burgeoning number of vehicles traversing the roadways, there is a greater need for assistance during emergencies or disasters beyond the scope of services typically provided by Highway Traffic Services.

In the fiscal year spanning April 2022 to March 2023, the automobile industry demonstrated remarkable growth, producing a total of 259,31,867 vehicles, which includes various categories such as passenger cars, commercial vehicles, three-wheelers, two-wheelers, and four-wheelers. This figure marks a significant increase from the 230,40,066 units produced in the preceding year (April 2021 to March 2022).

Breakdown of Sales Figures:

Urbanization Trends:

Impact of Rising Insurance Premiums:

Growing Demand for Energy and Electric Vehicles:

Service Insights:

Provider Insights:

The auto manufacturer segment is likely to dominate the global vehicle roadside assistance market in the next few years. This is mainly attributed to the warranty services and after sales assistance services offered by automobile manufacturers. Several auto manufacturers, for example Honda, provide vehicle roadside assistance services in many countries. Similarly, Toyota, Ford, Hyundai, General Motors, and many other auto manufacturers provide roadside assistance to their customers. Since this vehicle industry is rapidly evolving, offering a wide choice of fast, contemporary, efficient, cost-effective, and diverse solutions, this segment is projected to maintain its leadership in the near future.

Vehicle Insights:

Moreover, luxury car owners stand to benefit from premium and expedited service offerings, contributing to an enhanced customer experience and reinforcing brand loyalty. Additionally, the burgeoning sales of electric vehicles (EVs) are expected to drive heightened demand for vehicle maintenance services, creating additional revenue streams within the passenger vehicle ecosystem.

As consumer preferences continue to shift towards luxury and hybrid vehicles equipped with advanced safety systems, such as maintenance assistance features, the demand for vehicle support services is anticipated to expand across all income brackets, further solidifying the passenger vehicle segment's position as the primary revenue driver in the global auto industry.

The demand for passenger vehicles is poised for robust growth, maintaining its market dominance with a projected annual growth rate of 3.85% from 2019 to 2026. This growth trajectory underscores the enduring significance of passenger vehicles and reaffirms their status as the cornerstone of the global automotive landscape, with light commercial vehicles expected to maintain a significant market share throughout the forecast period.

The Asia Pacific region is poised to experience the highest CAGR compared to other regions in the foreseeable future, driven by a confluence of factors that are propelling its economic growth trajectory. One of the primary drivers of this growth is the escalating demand for transportation services, fueled by the region's burgeoning traffic demands and the steady rise in per capita income levels.

As economies across the Asia Pacific region continue to flourish, there is a corresponding increase in the disposable income of its populace. This rise in purchasing power translates into a greater propensity for individuals to invest in automobiles, driving up vehicle sales and fostering a vibrant automotive market landscape. Consequently, this surge in automotive ownership contributes to an uptick in the demand for transportation services, as individuals seek convenient and reliable mobility solutions to meet their evolving needs.

Moreover, the Asia Pacific region serves as a highly attractive automobile market for entrepreneurs and industry stakeholders alike, owing to its vast consumer base and burgeoning economic prospects. Entrepreneurs are drawn to the region's dynamic automotive landscape, which presents ample opportunities for innovation, growth, and market expansion.

The advent of advanced driver support technologies and the increasing adoption of electric vehicles (EVs) further contribute to the region's automotive growth story. These technological advancements not only enhance the driving experience but also align with global sustainability initiatives, driving consumer interest and accelerating vehicle sales.

As the demand for automobiles continues to soar in the Asia Pacific region, per capita income levels are expected to rise concomitantly, further bolstering the robustness of the automotive industry. This virtuous cycle of economic growth, rising income levels, and increased automotive demand underscores the region's pivotal role in driving the global automotive market forward.

By Service

By Provider

By Vehicle

By Geography

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us