April 2025

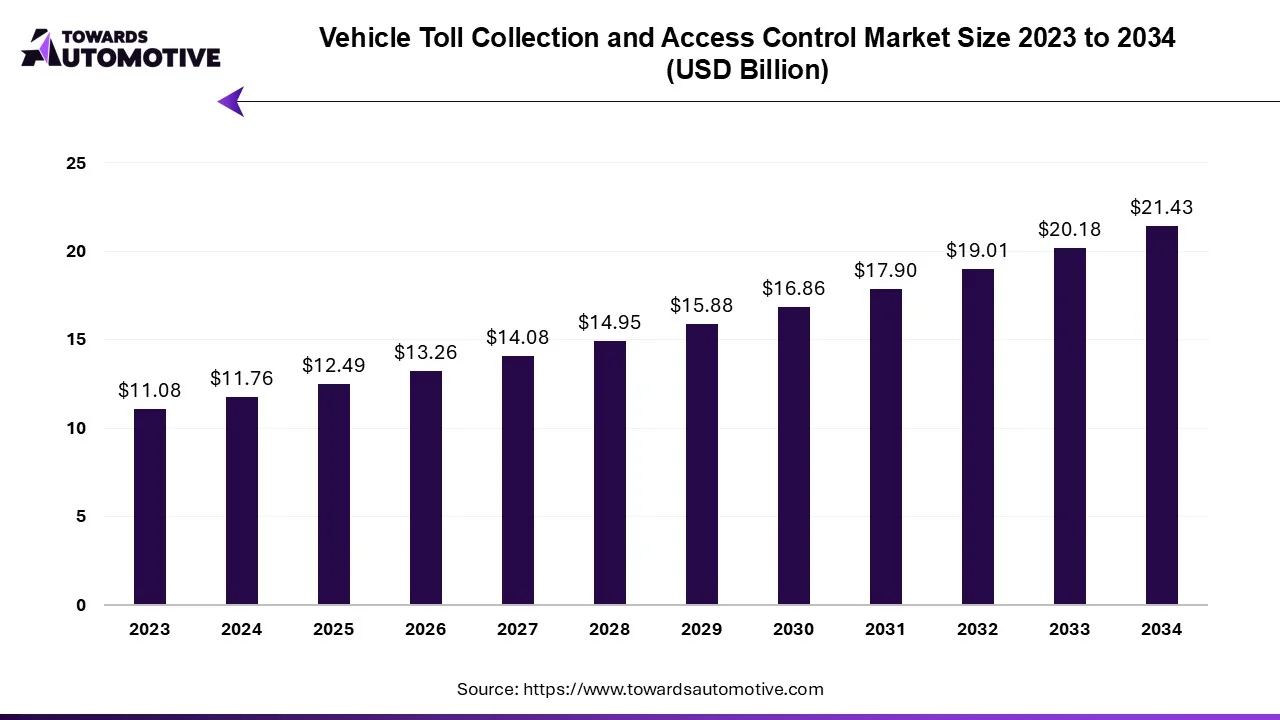

The vehicle toll collection and access control market is projected to reach USD 21.43 billion by 2034, growing from USD 12.49 billion in 2025, at a CAGR of 6.18% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

This growth is underpinned by several key factors driving economic development, including infrastructure advancements such as road and highway development, initiatives to combat vehicle theft, regulations concerning fuel usage, and traffic management policies. However, in developing nations, limited awareness about new technologies may pose challenges to market expansion.

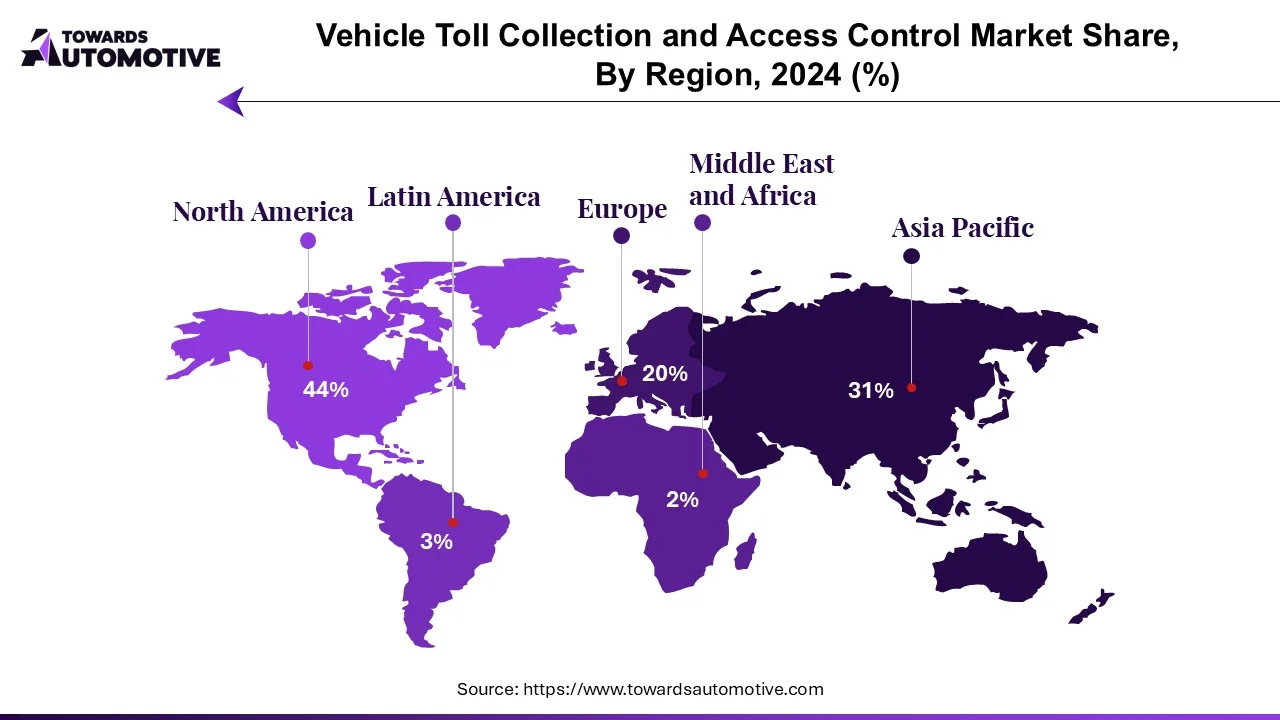

The market dynamics are chiefly influenced by advancements in toll collection systems, particularly in North America and Europe. These systems encompass the manufacturing and installation of both hardware and software components. Currently, North America leads the market, closely followed by Europe and the Asia-Pacific region.

Traditionally, toll collection mechanisms were centered around specific usage or infrastructure. However, technological advancements have revolutionized payment strategies, enabling the implementation of diverse payment policies tailored to varying needs. These strategies encompass payment targets, rules, integration capabilities, and other factors, accommodating a range of requirements.

In summary, the vehicle collection and access control market are poised for substantial growth driven by infrastructure development, technological innovations, and evolving payment strategies. As regions worldwide continue to invest in modernizing transportation systems, the market is expected to witness significant expansion, particularly in North America, Europe, and the Asia-Pacific region.

Automatic toll collection systems help alleviate traffic congestion at toll plazas by facilitating cashless transactions and enabling smoother vehicle flow. These systems employ various technologies, including Dedicated Short Range Communication (DSRC) and Automatic Number Plate Recognition (ANPR).

DSRC technology utilizes RFID (Radio Frequency Identification) to identify vehicles entering or exiting toll booths, whereas ANPR systems use cameras to capture and identify vehicle license plates. These technologies streamline the toll collection process, minimizing queues at toll plazas. Moreover, they enhance vehicle security by aiding in theft detection and enabling vehicle tracking at traffic signals.

Furthermore, drivers benefit from reduced fuel consumption and emissions due to decreased acceleration, deceleration, and idling time while waiting at toll booths. RFID tags have gained global acceptance for electronic toll collection, outpacing other technologies. In regions grappling with toll-related challenges, such as congestion and inefficiency, the divergence between pulse-based Toll Tag Method (TTM) and Open Road Tolling (ORT) operated by toll authorities is widening.

Overall, automatic toll collection technologies offer significant advantages in terms of traffic management, vehicle security, and environmental impact, contributing to more efficient and sustainable transportation systems.

In 2018, North America dominated the global market with over 30% market share. However, Asia Pacific is poised to achieve the fastest Compound Annual Growth Rate (CAGR) during the forecast period. India, in particular, has witnessed significant developments in its toll collection infrastructure. According to data from the Ministry of Road Transport and Highways, India's national highway network expanded from 92,581 kilometers in 2014 to 103,933 kilometers in 2017. To address traffic concerns, India introduced FASTag, an Electronic Toll Collection (ETC) system utilizing RFID technology.

FASTag was launched by the National Highways Authority of India (NHAI) in September 2014. By August 2017, NHAI had announced plans to implement FASTag at 371 toll plazas nationwide, with nearly 365 toll booths operational by the end of 2017, serving FASTag users.

In November 2017, the Ministry of Road Transport and Highways mandated FASTag for all new four-wheelers sold on or after December 1, 2017. By the end of 2017, the number of RFID FASTags issued had reached 750,000, with the government aiming to increase this figure to 2.5 million by 2018.

Furthermore, in July 2018, the aforementioned authorities made FASTag installation and vehicle tracking mandatory for all commercial vehicles, aiming to promote national uniformity.

In China, significant advancements were also observed in toll road infrastructure. Approximately 8,130 kilometers of new roads were added to China's toll road network in 2017, bringing the total length of toll roads to over 171,100 kilometers. These toll roads cover 60% of the country's major roadways and approximately 3.6% of its total road network. Toll rates vary across different highways, with examples such as the Jinji Expressway charging a higher toll of 0.66 yuan per kilometer compared to the Beijing-Shijiazhuang Expressway's lower toll of 0.33 yuan per kilometer.

All infrastructure, including highways, roads, bridges, and tunnels, requires regular maintenance and repair. These maintenance and repair expenses are typically funded by the public either directly or indirectly through tolls and other fees.

To effectively manage toll collection and ensure the recovery of costs associated with sourcing, repair, maintenance, and operation of toll facilities, Toll Management Systems (TMS) are established. These systems are implemented by government agencies or private organizations to streamline toll collection processes, reduce users' travel time, and enhance service levels for road users.

By Toll Collection Type

By Application Type

By Geography

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us