April 2025

The global vehicle tracking device market is forecast to grow from USD 30.02 billion in 2025 to USD 119.13 billion by 2034, driven by a CAGR of 16.55% from 2025 to 2034.

![]()

Unlock Infinite Advantages: Subscribe to Annual Membership

The vehicle tracking device market is experiencing robust growth due to the rising demand for fleet management solutions and increasing concerns about vehicle safety and security. These devices, which use GPS technology to monitor the real-time location of vehicles, are widely adopted by businesses in logistics, transportation, and construction. The need for efficient route planning, fuel management, and real-time tracking of assets has driven the adoption of these systems in fleet management operations. Additionally, growing concerns over theft prevention, unauthorized vehicle use, and driver safety have led to the increased installation of tracking devices in personal and commercial vehicles alike. Advancements in telematics and connectivity technologies, such as 4G and 5G, are further driving market growth by enabling more accurate, real-time data collection and analysis, which helps businesses optimize operations and reduce costs. Governments across the globe are also implementing regulations that mandate the use of tracking devices in commercial vehicles to enhance road safety and compliance, particularly in regions like North America and Europe. Moreover, the rising trend of ride-hailing services and shared mobility solutions is creating new opportunities for vehicle tracking devices. As vehicle tracking technology becomes more affordable and accessible, the market is expected to expand further, particularly in developing regions where the logistics and transportation industries are booming. Overall, the vehicle tracking device market is poised for steady growth, driven by technological advancements, regulatory support, and the increasing need for efficient fleet management solutions.

AI plays a transformative role in the vehicle tracking device market by enhancing the capabilities of tracking systems through predictive analytics, real-time data processing, and automation. One of AI’s most significant contributions is improving route optimization. By analyzing vast amounts of real-time and historical data, AI-powered tracking devices can suggest the most efficient routes, reducing fuel consumption and delivery times for fleets. This not only improves operational efficiency but also lowers costs for businesses involved in logistics and transportation.

In addition, AI enhances predictive maintenance in vehicle tracking systems. By continuously monitoring vehicle performance data, AI algorithms can predict potential breakdowns or malfunctions before they occur. This helps fleet managers schedule timely maintenance, reducing downtime and extending the vehicle's lifespan. AI also plays a crucial role in driver behavior analysis, as tracking systems can detect patterns of risky driving, such as speeding or harsh braking, and alert fleet managers to take corrective action. This capability enhances safety, reduces accidents, and helps lower insurance premiums for fleet owners.

Furthermore, AI enables advanced theft detection and prevention in tracking devices. By learning normal usage patterns, AI can detect anomalies, such as unauthorized movement or tampering, and trigger real-time alerts to vehicle owners or authorities, improving security measures. The integration of AI also enhances the scalability of tracking solutions by enabling efficient data analysis and decision-making for larger fleets.

The growing trend of ride-hailing services is a significant driver of the vehicle tracking device market, as these services rely heavily on real-time location data and efficient fleet management. Ride-hailing platforms such as Uber, Lyft, and Grab have revolutionized urban transportation, leading to an increased demand for vehicle tracking systems that offer real-time tracking, route optimization, and safety monitoring. For ride-hailing companies, tracking devices are essential for ensuring that drivers are on the correct routes, reducing wait times for passengers, and optimizing fuel efficiency, all of which contribute to a seamless customer experience.

Vehicle tracking devices also enhance the safety and security of ride-hailing services. Real-time tracking allows ride-hailing platforms to monitor the location of vehicles throughout the journey, ensuring the safety of both passengers and drivers. In the event of an emergency or unexpected deviation from the planned route, these systems can trigger alerts, allowing for immediate action. This level of monitoring builds trust among users, making ride-hailing services more reliable and secure. Moreover, many ride-hailing companies use tracking data to analyze driver behavior, including speed, braking patterns, and adherence to traffic rules. By promoting safer driving practices, these platforms can reduce accident rates and enhance overall safety, which is a key concern for both consumers and regulatory bodies.

Additionally, the scalability of ride-hailing services, which often operate thousands of vehicles simultaneously, requires robust tracking infrastructure to manage large fleets efficiently. Vehicle tracking devices provide the necessary tools for fleet operators to monitor vehicle performance, manage driver schedules, and ensure timely vehicle maintenance. As the ride-hailing industry continues to expand globally, particularly in urban centers and developing markets, the demand for vehicle tracking devices is expected to grow. This trend is likely to drive further advancements in tracking technology, making the ride-hailing sector a key contributor to the vehicle tracking device market.

One key restraint of the vehicle tracking device market is concerns over privacy and data security. As tracking devices collect real-time data on vehicle location, driving behavior, and other sensitive information, there is a growing fear of data breaches and misuse. Additionally, the cost of implementing and maintaining advanced tracking systems can be prohibitive for small businesses, limiting broader market adoption. Complex regulatory requirements in different regions regarding data privacy and vehicle tracking usage also create barriers, making it challenging for manufacturers and service providers to expand globally. These factors collectively restrain the growth of the market.

The rollout of 5G technology is set to create significant opportunities in the vehicle tracking device market by revolutionizing how data is transmitted and processed in real time. Unlike previous generations of mobile networks, 5G offers faster data speeds, lower latency, and improved connectivity, which are crucial for the performance of vehicle tracking systems. With 5G, vehicle tracking devices can transmit large volumes of data instantly, enabling fleet operators to access real-time information on vehicle locations, driver behavior, and traffic conditions with unprecedented accuracy. This capability allows businesses to optimize routes, reduce fuel consumption, and improve overall operational efficiency.

Moreover, the enhanced connectivity provided by 5G supports the integration of advanced technologies such as the Internet of Things (IoT) and artificial intelligence (AI) in vehicle tracking systems. IoT-enabled devices can communicate seamlessly with each other and central management systems, providing comprehensive insights into vehicle performance and environmental factors. For instance, fleet managers can monitor multiple vehicles simultaneously, assess their status, and make informed decisions in real time, leading to more proactive fleet management strategies.

Additionally, 5G technology facilitates the development of innovative tracking applications, such as remote vehicle diagnostics and predictive maintenance. By continuously collecting and analyzing data on vehicle health and performance, these applications can predict potential issues before they arise, allowing for timely maintenance and reducing vehicle downtime. This capability is particularly valuable in industries like logistics and public transportation, where operational efficiency is critical.

Furthermore, the implementation of 5G enhances security features within vehicle tracking systems. With improved data encryption and secure transmission protocols, fleet operators can safeguard sensitive information against cyber threats, addressing concerns around data privacy and security. As a result, the rollout of 5G technology opens up new avenues for growth and innovation in the vehicle tracking device market, positioning businesses to capitalize on the evolving landscape of connected vehicles and smart transportation solutions.

The active segment held the largest share of the market. The active segment plays a crucial role in driving the growth of the vehicle tracking device market. Active tracking devices provide real-time location data, offering continuous updates on the position and status of a vehicle. This real-time capability has become indispensable for industries that rely on fleet management, such as logistics, transportation, construction, and emergency services. Unlike passive systems, which store data for later retrieval, active vehicle tracking devices offer immediate access to vital information, enabling businesses to make time-sensitive decisions that improve operational efficiency. Fleet managers can monitor vehicle routes, manage fuel consumption, and reduce idle times, which contributes to cost savings and enhanced productivity.

One of the key advantages of the active segment is its ability to offer real-time alerts and notifications, allowing businesses to address issues like route deviations, unauthorized vehicle use, or vehicle breakdowns promptly. This feature enhances security, as active trackers can immediately notify owners or fleet managers in the event of theft, unauthorized movement, or tampering, enabling swift recovery actions. This level of responsiveness is crucial for industries like ride-hailing, public transportation, and emergency response, where the safety of passengers and assets is paramount.

The increasing integration of advanced technologies such as artificial intelligence (AI), Internet of Things (IoT), and 5G connectivity has further amplified the demand for active tracking devices. These technologies enhance the accuracy and reliability of data, offering businesses actionable insights into vehicle performance, maintenance needs, and driver behavior. Moreover, as regulatory frameworks become more stringent in sectors such as commercial transportation, there is a growing demand for active tracking solutions that help companies comply with safety and operational standards.

The insurance telematics segment held the highest share of the market. The insurance telematics segment is a significant driver of growth in the vehicle tracking device market, as it offers innovative solutions that benefit both insurance companies and vehicle owners. Insurance telematics involves the use of tracking devices and telematics systems to monitor driving behavior, such as speed, acceleration, braking patterns, and distance traveled. This data is then used by insurers to create more personalized insurance policies, often referred to as usage-based insurance (UBI) or pay-as-you-drive (PAYD) models. These models reward safe driving behaviors with lower premiums, making them highly appealing to consumers seeking cost-effective coverage.

For insurance companies, telematics provides valuable insights into risk assessment, enabling them to more accurately price policies based on an individual's driving habits. This shift from traditional insurance pricing methods, which rely on general demographics, to behavior-based pricing is creating new opportunities for the insurance industry. As more drivers adopt telematics-based policies to reduce their premiums, the demand for vehicle tracking devices grows, boosting the overall market.

The ability to track and analyze driving behavior also helps reduce fraud, a major concern for insurers. By providing real-time data on vehicle usage and accident events, telematics can help validate claims, preventing fraudulent activities and reducing insurance losses. This capability is particularly important in regions with high vehicle insurance fraud rates, further driving the adoption of telematics-based tracking solutions.

In addition to cost savings and fraud prevention, the insurance telematics segment enhances road safety. By promoting safer driving behaviors through financial incentives, telematics encourages responsible driving, which can lead to fewer accidents and claims. As more insurers embrace telematics technology and integrate it into their policies, the demand for vehicle tracking devices is expected to rise, making insurance telematics a key growth driver in the vehicle tracking device market.

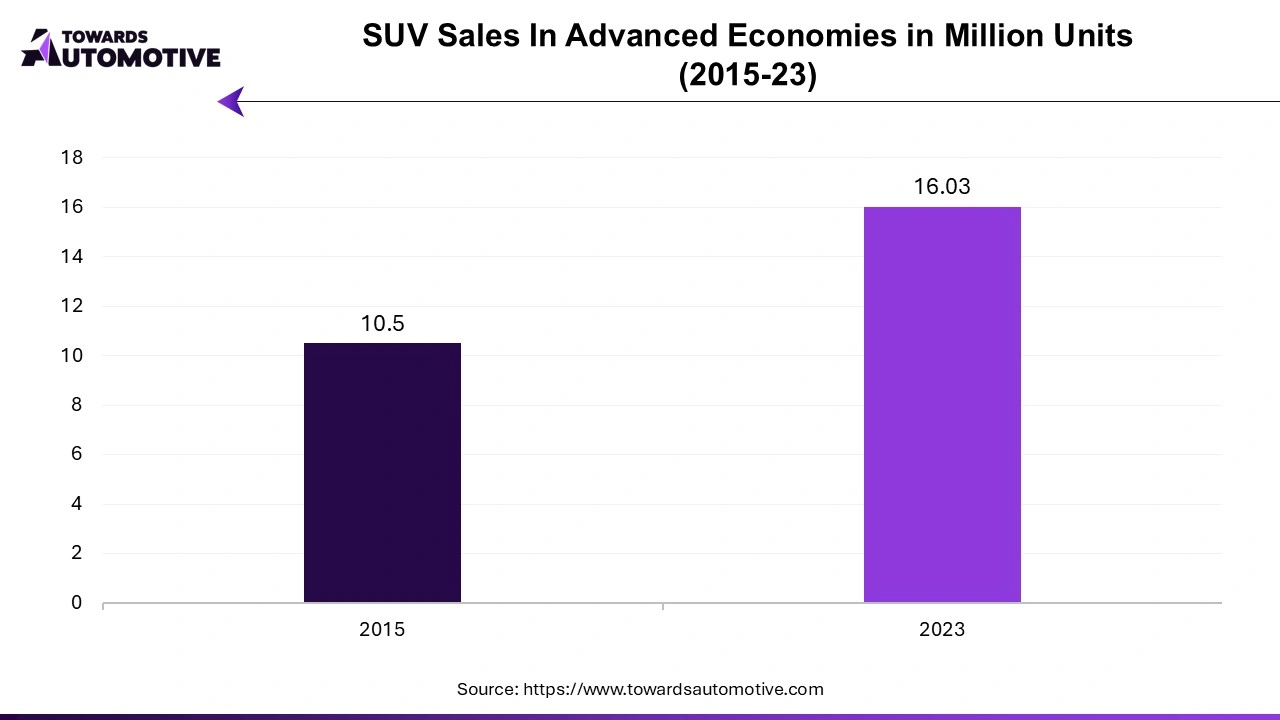

The SUVs segment led the industry. The SUV segment plays a pivotal role in driving the growth of the vehicle tracking device market, largely due to the increasing popularity of SUVs across both personal and commercial applications. SUVs, known for their larger size, enhanced safety features, and off-road capabilities, are becoming the preferred vehicle choice for a wide range of consumers, including families, adventure enthusiasts, and commercial operators. With the rising number of SUVs on the road, there is a growing need for tracking systems that provide enhanced security, real-time location monitoring, and vehicle performance data. Vehicle owners and fleet operators are increasingly turning to tracking devices to safeguard these high-value assets, contributing to the expansion of the vehicle tracking device market.

For fleet operators that use SUVs for business purposes, such as transportation services, ride-hailing, and tourism, vehicle tracking devices are essential for efficient fleet management. These devices enable real-time route optimization, fuel management, and driver behavior monitoring, which are critical for reducing operational costs and ensuring timely service delivery. Given the larger size and higher fuel consumption of SUVs, tracking devices help fleet managers monitor fuel usage and plan more efficient routes, driving down expenses.

In addition, the rising concerns over vehicle theft and the increasing value of SUVs have further propelled the adoption of vehicle tracking systems. SUVs are often targeted by thieves due to their high resale value, and vehicle tracking devices offer a strong deterrent by enabling immediate tracking and recovery of stolen vehicles. This security feature is especially attractive to SUV owners in both urban and rural areas.

Moreover, as more SUVs come equipped with advanced connectivity features, the integration of tracking devices is becoming more seamless, further fueling their adoption.

![]()

Europe dominated automotive vehicle tracking device market. The vehicle tracking device market in Europe is experiencing significant growth, driven by several key factors. One major contributor is the region's stringent regulatory framework that mandates the use of vehicle tracking systems, especially for commercial fleets. The European Union's ELD (Electronic Logging Device) regulations, which require tracking devices for monitoring driving hours in commercial vehicles, are boosting demand. These regulations aim to improve road safety, reduce accidents, and ensure compliance with transportation laws, thus propelling the adoption of tracking devices across various industries.

Another growth factor is the rising demand for advanced fleet management solutions in sectors such as logistics, transportation, and construction. Europe has a well-developed logistics industry that increasingly relies on real-time tracking systems to optimize operations, reduce fuel consumption, and improve route efficiency. As businesses strive to enhance their competitiveness and minimize operational costs, the use of vehicle tracking devices for fleet management has become indispensable.

Technological advancements, particularly the integration of artificial intelligence (AI) and telematics, are further driving the market in Europe. These innovations allow for more precise tracking, predictive maintenance, and real-time data analysis, improving the overall efficiency of fleet operations. The growing adoption of 5G networks across the region also supports faster and more reliable data transmission, enhancing the performance of tracking systems.

Moreover, the increasing focus on vehicle security, especially in response to rising vehicle theft rates, is encouraging individuals and businesses to install tracking devices. This trend is particularly prominent in urban areas and for high-value commercial vehicles. Additionally, the growing popularity of shared mobility solutions, such as ride-hailing services and car rentals, is creating new opportunities for vehicle tracking systems, further fueling market expansion.

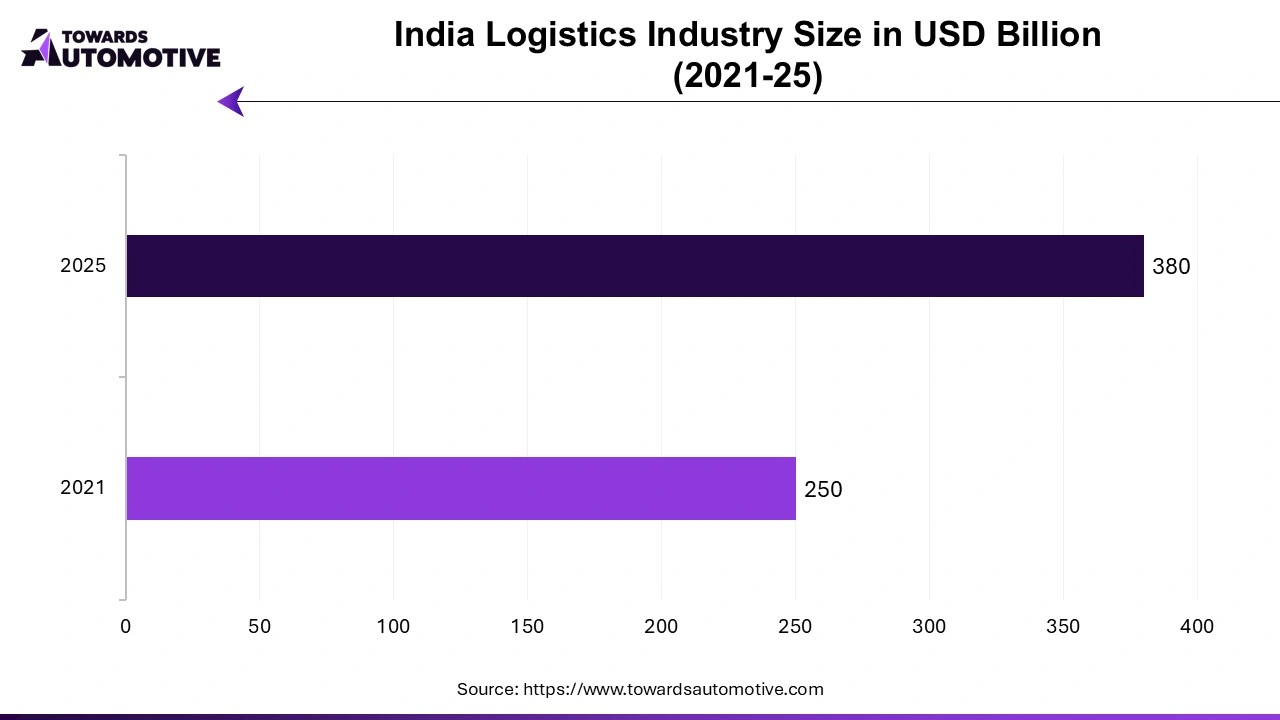

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The vehicle tracking device market in the Asia-Pacific (APAC) region is witnessing strong growth, driven by several crucial factors. One of the primary drivers is the rapid expansion of the logistics and transportation industry in APAC countries, such as China, India, and Japan. The booming e-commerce sector, coupled with increasing demand for efficient supply chain management, has accelerated the need for real-time tracking and fleet management solutions. Businesses are adopting vehicle tracking devices to optimize operations, improve delivery efficiency, and reduce operational costs.

Another significant growth factor is government initiatives aimed at improving road safety and vehicle compliance. Many APAC countries are implementing regulations that require the installation of GPS tracking systems in commercial vehicles, particularly in sectors like public transportation and freight services. In India, for example, government mandates have been introduced that require school buses and public transport vehicles to be equipped with GPS tracking devices to enhance passenger safety. These regulations are driving widespread adoption across the region.

The rise of smart cities and the growing focus on connected vehicles are also key contributors to market growth. APAC is witnessing significant investments in smart city projects, particularly in China, South Korea, and Japan, where IoT (Internet of Things) technology is being integrated into transportation infrastructure. This shift toward smarter, more connected urban environments is boosting the demand for vehicle tracking systems that offer real-time location monitoring, traffic management, and enhanced fleet management solutions.

Additionally, advancements in telematics and the increasing adoption of AI-driven solutions in vehicle tracking devices are further enhancing the capabilities of these systems. AI-powered analytics enable predictive maintenance, driver behavior monitoring, and real-time route optimization, which are highly valued by fleet operators looking to improve efficiency and reduce costs.

![]()

By Type

By Vehicle Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us