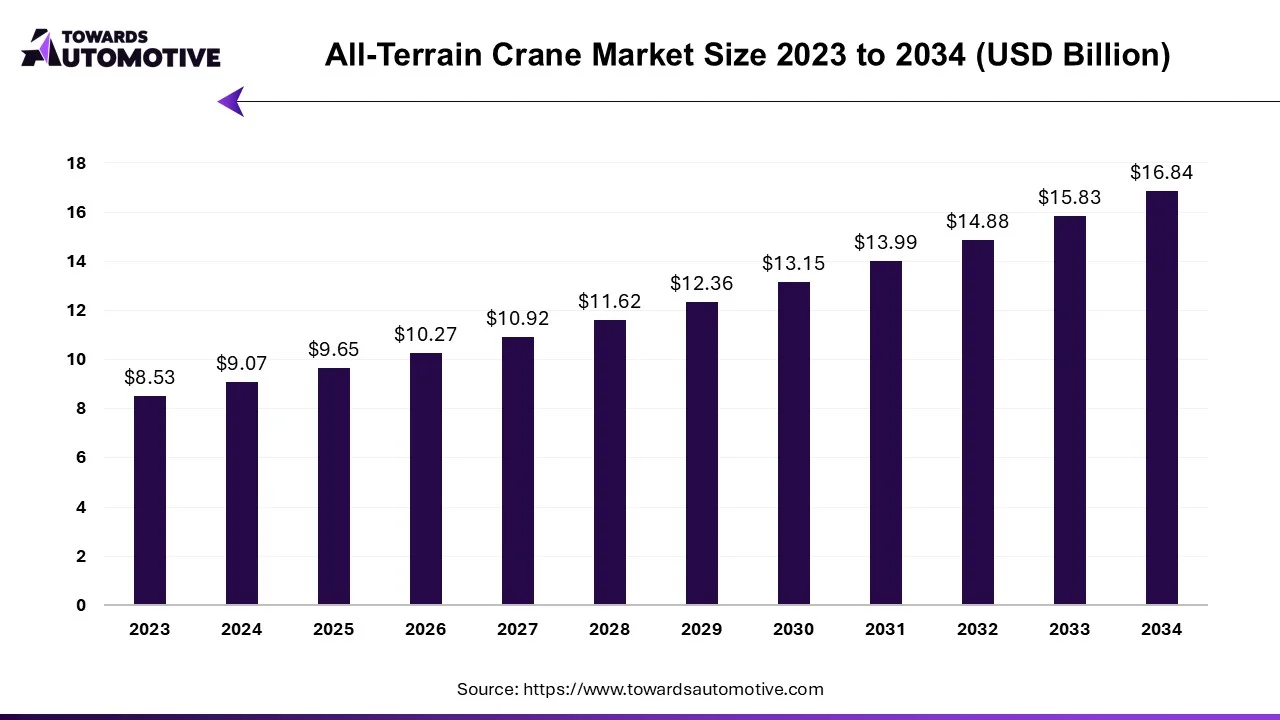

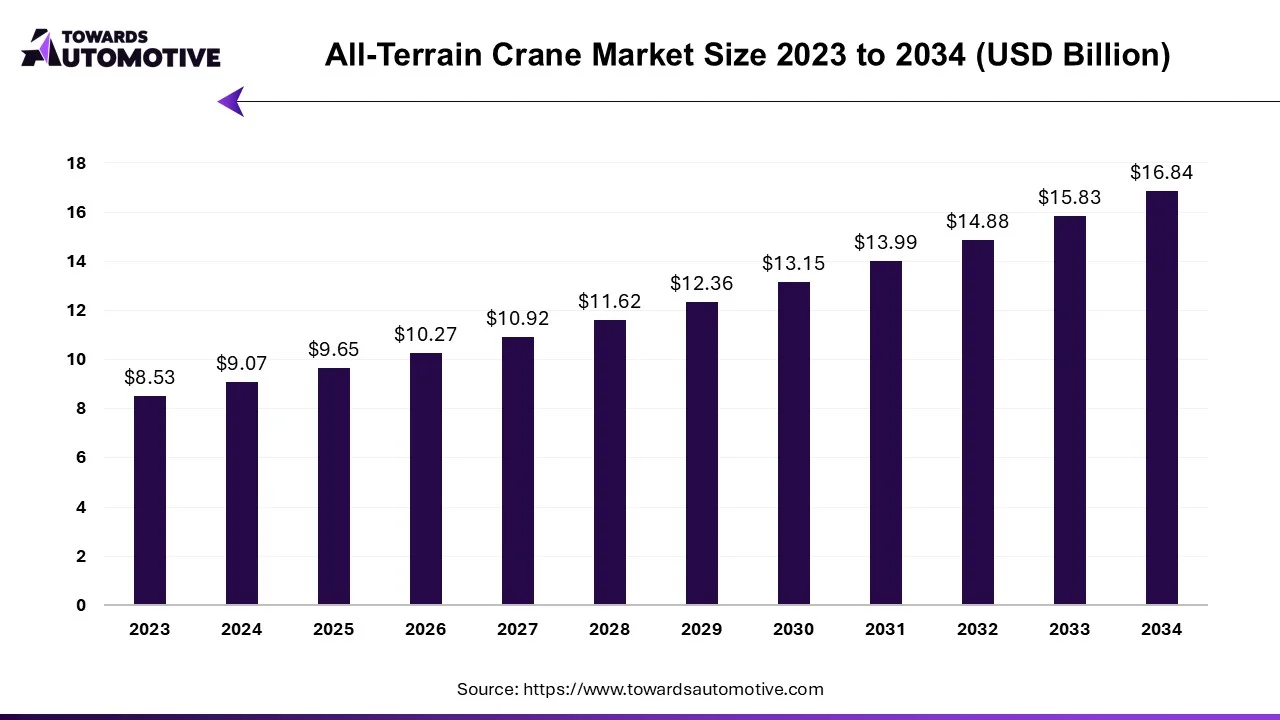

All-Terrain Crane Market Size and Growth Analysis

The all-terrain crane market is forecasted to expand from USD 9.65 billion in 2025 to USD 16.84 billion by 2034, growing at a CAGR of 6.38% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

However, the business landscape has been significantly impacted by the COVID-19 pandemic, leading to widespread disruptions across major markets worldwide. The pandemic-induced economic slowdown and supply chain disruptions forced the closure of many manufacturing facilities and Original Equipment Manufacturers (OEMs), halting production activities to comply with local regulations and curb the spread of the virus.

During this period, the demand for all-terrain cranes experienced a notable decline. Nevertheless, as economies gradually reopen and demand rebounds, there is a resurgence in the market, particularly in regions such as China and India. The revival of the construction and transportation sectors, coupled with various infrastructure projects, is expected to have a positive ripple effect on the entire crane industry. While developed markets witness robust growth in construction and renovation activities, emerging markets are also expected to witness notable demand for all-terrain cranes during the forecast period.

Despite the promising growth prospects, certain factors may act as impediments to the growth of the crane market. High medical costs and substantial initial investment requirements could pose challenges for market expansion. Additionally, the increasing trend towards equipment rental worldwide may impact sales in the new all-terrain crane market segment.

For Instance,

- The downturn in the non-financial market, sluggish sales of new housing projects globally, and the lingering impact of the COVID-19 pandemic have collectively dampened the growth momentum of the crane industry, thereby affecting the demand for new cranes.

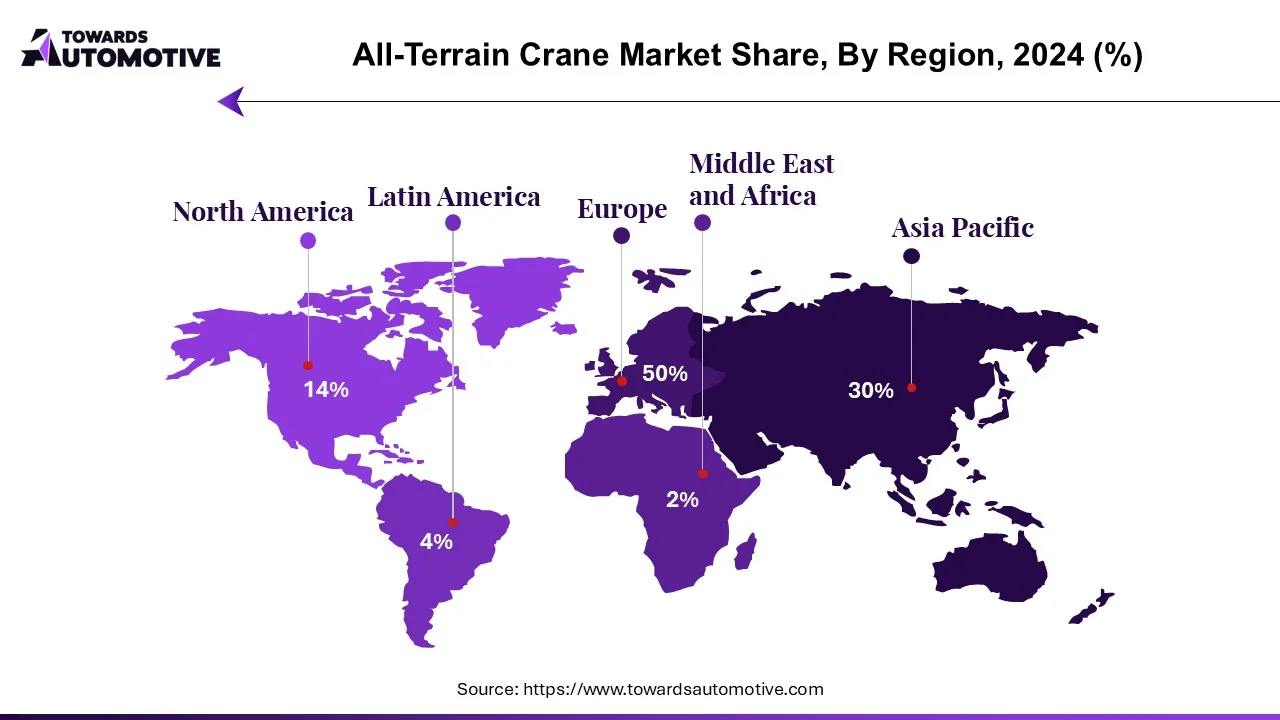

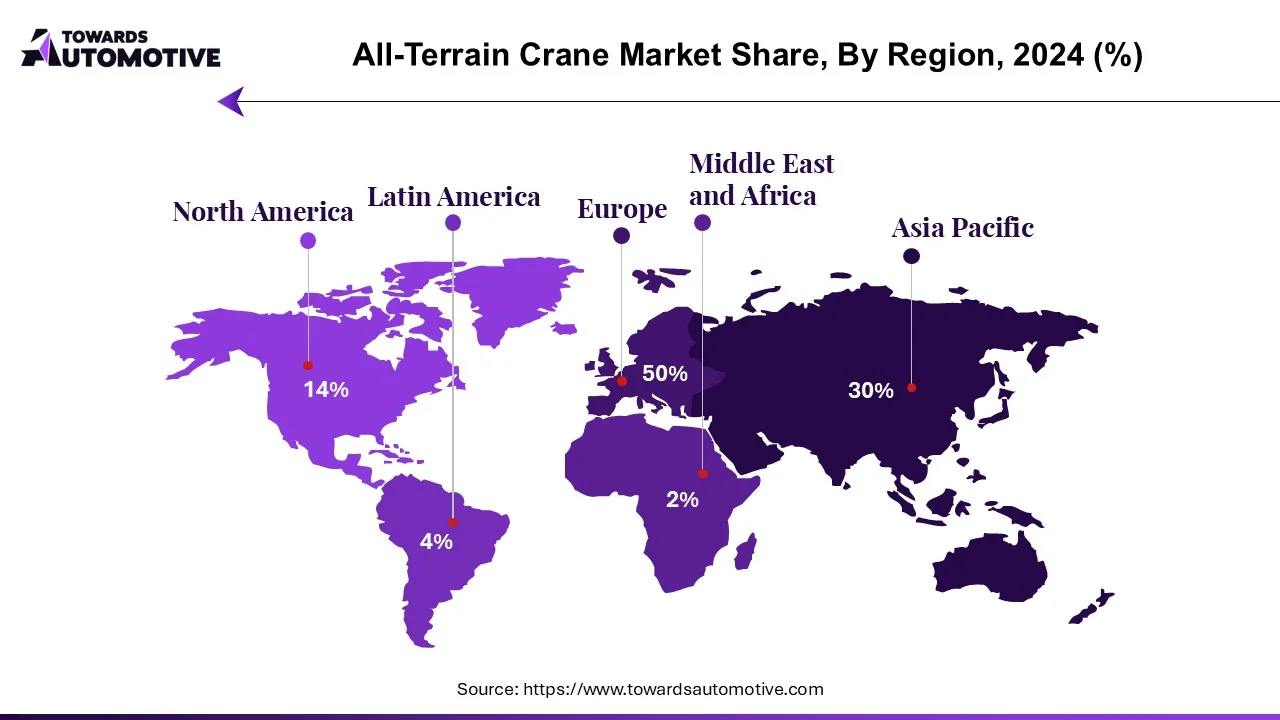

Europe stands out as the largest market globally for all-terrain cranes, driven by robust infrastructure development and construction activities. Although the Chinese market has experienced relatively slower growth, the Asia-Pacific region remains the largest market for various types of cranes, underscoring the region's significance in the global crane industry landscape.

All-Terrain Crane Market Trends

Construction is Driving the All-Terrain Crane Market

According to the American Society of Civil Engineers, the projected cost of repairing the current state of infrastructure in the United States stands at nearly $4 trillion by 2025. Furthermore, the global construction industry's growth trajectory and investments in infrastructure are anticipated to drive economic expansion. The accelerated adoption of all-terrain cranes is expected, propelled by the expansion of cement plants and the increased capacity in shipbuilding and repair projects.

Major players in the crane market are actively engaged in developing new cranes equipped with cutting-edge technologies. For instance, in May 2022, Tadano has launched a new line of all-terrain cranes, using the manufacturing experience of its Zweibrücken and Lauf plants in Germany.

Moreover, intensified competition within the construction industry is projected to drive up crane rental prices, thereby boosting overall crane revenue. Demand for all-terrain cranes and crane rentals is on the rise. Given the high costs associated with purchasing new equipment, as well as maintenance and storage concerns, leasing has emerged as a viable alternative for businesses, especially newcomers in the industry. In fact, for short-term utilization, renting machinery proves to be a more cost-effective option for construction professionals, enabling efficient use of resources.

Europe is the Leading the All-Terrain Crane Market

According to the EU Cohesion Policy, approximately 4 billion euros of EU funds are slated to be invested in 25 major projects spanning 10 states. These investments are earmarked for Bulgaria, Czech Republic, Germany, Greece, Hungary, Italy, Malta, Poland, Portugal, and Romania. The projects encompass a wide array of sectors including health, transportation, science, environment, and energy, reflecting the EU's commitment to regional development and infrastructure enhancement.

- In 2021, the European equipment market experienced significant growth, with overall sales surpassing a 4% increase compared to the previous year. This uptrend indicates a robust recovery and renewed confidence in the region's economic prospects.

Despite the challenges posed by the COVID-19 pandemic in 2020, which resulted in subdued sales across the crane industry, the adoption of digitalization and connectivity has ushered in a new era of innovation and efficiency in the construction sector. Many European countries have embarked on ambitious infrastructure projects, revitalizing the road and construction industries across the continent.

Recent Instances Further Underscore this Trend

- January 2023: The European Commission announces a new round of funding under the EU Cohesion Policy, allocating an additional 2 billion euros for infrastructure development projects in Eastern European countries such as Hungary, Poland, and Romania.

- March 2023: Germany unveils plans to invest heavily in renewable energy infrastructure, with a focus on wind and solar projects. This initiative is part of the country's broader strategy to transition to clean energy sources and reduce carbon emissions.

- July 2023: Italy launches the "Green Cities Initiative," a comprehensive program aimed at modernizing urban infrastructure to enhance sustainability and resilience to climate change. The initiative includes investments in green transportation, renewable energy, and eco-friendly building practices.

All-Terrain Crane Industry Overview

The off-road crane market is predominantly controlled by both international giants and regional players, with key contenders including Liebherr International AG, Terex AG, and XCMG. These major players continuously expand their product portfolios by introducing new crane models to stay competitive within the industry.

Recent instances of product launches by major players in the off-road crane market include:

- In May 2022, Manitowoc bolstered its Grove mobile crane lineup with the introduction of the innovative four-axle TTS9000-2. This new model features full steps and long stay jibs, catering to the evolving needs of customers. Manitowoc's commitment to enhancing its offerings is evident through its incorporation of customer feedback, utilizing the Voice of the Customer approach to drive engineering improvements and boost productivity.

- Sany Heavy Industry made waves in May 2021 with the unveiling of the STC250HBEV, the world's first licensed electric crane. Equipped with a seven-section 92-meter main boom and a heavy-duty hydraulically mounted wind turbine extension, this crane is specifically designed for wind turbine repair and maintenance tasks. Sany's foray into electric crane technology reflects its dedication to innovation and sustainability within the off-road crane market.

- Liebherr made headlines at CON EXPO 2020 with the announcement of its most powerful four-axle off-road crane, the LTM 1120-4.1. This groundbreaking model boasts impressive capabilities and performance, setting a new standard in the industry. The company commenced shipments of the LTM 1120-4.1 in January 2021, signaling its commitment to delivering cutting-edge solutions to meet evolving market demands.

All-Terrain Crane Market Leaders

- Sany Heavy Industry Co., Ltd

- Manitowoc

- Terex Corporation

- Liebherr-International AG

- Tadano Limited

- Zoomlion Heavy Industry Science and Technology Co. Ltd.

- Kobelco Cranes Co. Ltd

- Manitex International Inc

- Hitachi Sumitomo Heavy Industries Construction Cranes Co. Ltd.

- XCMG Group

All-Terrain Crane Market News

- In April 2022, Terex made a significant move by announcing the acquisition of Steelweld, a heavy-duty manufacturer based in Northern Ireland. This strategic acquisition aligns with Terex's growth strategy for its Work Equipment division, leveraging the manufacturing capabilities in Northern Ireland to enhance its product offerings.

- In February 2022, NORWALK demonstrated its commitment to innovation by initiating a Series B investment in Viatec, Inc., a plug-and-play manufacturer based in South Carolina. This investment aims to capitalize on the growing demand for electronic power take-off (PTO) systems, which enable the efficient transfer of power to electrical equipment. By partnering with Viatec, NORWALK seeks to strengthen its position in the market for power transmission solutions.

- In October 2021, Manitowoc, a leading crane manufacturer, introduced two new models to its portfolio: the Grove GMK5120L and Grove GMK5150XL. These state-of-the-art cranes were unveiled at Manitowoc's Wilhelmshaven plant in northern Germany, showcasing the company's commitment to innovation and product development. The launch of these new models further solidifies Manitowoc's position as a frontrunner in the crane industry.

- In January 2022, Liebherr launched the LR 1800-1.0 crawler crane, featuring a lifting capacity of 800 tonnes and a maximum boom length of 180 meters. This new addition to Liebherr's crane lineup showcases the company's commitment to providing high-performance solutions for heavy lifting applications.

- In March 2022, Tadano introduced the GR-1300XL rough terrain crane, designed for versatility and efficiency in challenging job sites. With a maximum lifting capacity of 130 tonnes and advanced safety features, the GR-1300XL represents Tadano's dedication to meeting the diverse needs of its customers.

- XCMG unveiled the XCA220U all-terrain crane in February 2022, featuring innovative design elements for improved stability and maneuverability. With a lifting capacity of 220 tonnes and intelligent control systems, the XCA220U exemplifies XCMG's commitment to technological advancement in crane manufacturing.

- Terex announced the release of the RT 100US rough terrain crane in April 2022, offering enhanced performance and reliability for demanding construction projects. Equipped with advanced telematics and safety features, the RT 100US reflects Terex's ongoing efforts to deliver industry-leading solutions to its customers.

All-Terrain Crane Industry Segmentation

All-terrain cranes are versatile machines known for their ability to navigate various terrains and work environments with ease. Equipped with four-wheel drive capabilities, these cranes offer high speed and maneuverability, making them indispensable for construction, infrastructure development, and industrial applications.

Market Segmentation

By Capacity Type

- < 200 Tons

- 200 - 500 Tons

- > 500 Tons

By Application

- Construction

- Industries

- Utilities

- Others

By Geography

- North America

- United States

- Canada

- Rest of North America

- Europe

- Germany

- United Kingdom

- France

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle-East and Africa

- South Africa

- Rest of Middle East and Africa