April 2025

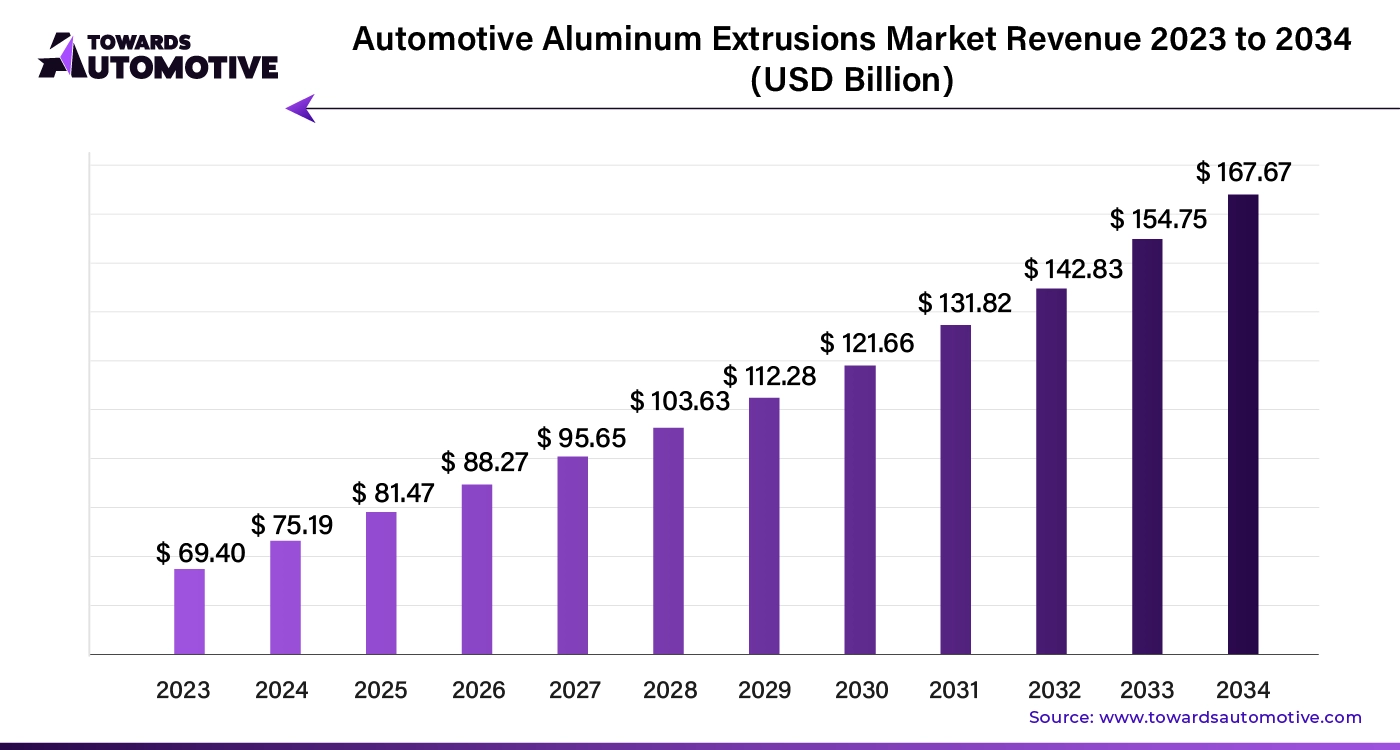

The global automotive aluminum extrusions market size is calculated at USD 75.19 billion in 2024 and is expected to be worth USD 167.67 billion by 2034, expanding at a CAGR of 8.35% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive aluminum extrusions market is gaining significant traction as automakers increasingly focus on lightweight materials to enhance vehicle performance, fuel efficiency, and reduce emissions. Aluminum extrusions, known for their high strength-to-weight ratio, durability, and flexibility, are becoming a preferred choice in the production of various automotive components, including structural frames, bumpers, and battery housings for electric vehicles. The shift toward electric vehicles (EVs) and stringent environmental regulations further accelerate the demand for aluminum extrusions, as lighter materials help improve energy efficiency and driving range.

Additionally, advancements in extrusion technology have enabled manufacturers to produce complex and precise components, offering automakers greater design flexibility. This not only enhances vehicle safety but also contributes to overall performance improvements. North America, Europe, and Asia-Pacific are witnessing growing investments in the production of aluminum extrusion parts, driven by the need to comply with government mandates on emissions and fuel efficiency. As the automotive industry moves toward sustainability and innovation, the aluminum extrusions market is set to play a crucial role in shaping the future of vehicle design and manufacturing.

AI plays an increasingly important role in the automotive aluminum extrusions market by optimizing production processes, improving material design, and enhancing quality control. In manufacturing, AI-driven systems help streamline extrusion processes by monitoring key parameters such as temperature, pressure, and extrusion speed. This real-time data analysis enables manufacturers to identify and resolve issues quickly, reducing waste and increasing efficiency. AI also enhances predictive maintenance, allowing companies to monitor equipment health and schedule timely repairs, minimizing downtime.

In material design, AI helps engineers optimize aluminum alloy compositions for specific automotive applications. By analyzing large datasets, AI algorithms can predict how different alloys will perform under various conditions, enabling the creation of lighter and stronger materials. This is particularly beneficial for electric vehicles (EVs), where reducing weight is critical for improving battery efficiency and driving range.

Multi-Utility Vehicles (MUVs) drive the growth of the automotive aluminum extrusions market by creating a strong demand for lightweight, durable components that enhance vehicle performance and efficiency. MUVs, known for their versatile functionality and spacious design, require high-strength aluminum extrusions for various applications, including structural frames, chassis components, and exterior panels. The need for robust yet lightweight materials is particularly critical in MUVs to balance payload capacity and fuel efficiency while ensuring safety and durability.

Aluminum extrusions offer several advantages for MUVs, such as reducing overall vehicle weight, which improves fuel economy and handling. This is crucial as automakers strive to meet stringent emissions regulations and enhance vehicle performance. The flexibility of aluminum extrusions also allows for innovative designs and customization, which are important for MUVs that often serve diverse purposes and markets. As the popularity of MUVs grows, driven by consumer demand for versatile and efficient vehicles, the automotive aluminum extrusions market benefits from increased orders and production volumes. Consequently, the rise in MUV production directly contributes to the expansion of the aluminum extrusions market, supporting advancements in vehicle design and manufacturing.

The automotive aluminum extrusions market faces several constraints, including high production costs and price volatility of aluminum. The specialized manufacturing processes required for aluminum extrusions contribute to these elevated costs. Additionally, achieving the desired strength and durability of extrusions can be technically challenging, impacting development times and expenses. Environmental concerns related to aluminum recycling and disposal also add to operational costs. Moreover, competition from alternative materials and advancements in other technologies may limit market growth, posing additional challenges for the automotive aluminum extrusions sector.

Lightweight alloys for wheel rims create significant opportunities in the automotive aluminum extrusions market by addressing key industry needs for enhanced performance and efficiency. As automakers strive to improve fuel economy and handling, lightweight alloys offer a crucial advantage by reducing the overall weight of vehicles. This reduction in weight enhances vehicle dynamics, accelerates acceleration, and improves fuel efficiency, which is especially important in the context of stringent emissions regulations and rising consumer demand for eco-friendly vehicles.

Aluminum extrusions used in wheel rims benefit from their high strength-to-weight ratio, providing durability and performance while maintaining a lighter profile compared to traditional materials. The adoption of these advanced alloys also supports the development of more complex and aesthetically appealing rim designs, catering to both functional and styling preferences of consumers.

Furthermore, the increased focus on electric and hybrid vehicles amplifies the demand for lightweight components, for increasing battery efficiency to provide an extended range. As a result, the automotive aluminum extrusions market sees growing opportunities for innovation and expansion, driven by the need for advanced, lightweight alloys in wheel rims. This trend supports the broader shift towards optimizing vehicle performance and sustainability, driving market growth.

The sub-structure segment dominated the market. Sub-structures drive the growth of the automotive aluminum extrusions market by creating a substantial demand for lightweight, high-strength materials in vehicle construction. Substructures, including components such as chassis frames, underbody panels, and structural reinforcements, play a crucial role in enhancing vehicle safety, rigidity, and performance. The automotive industry’s increasing focus on reducing vehicle weight to improve fuel efficiency and meet stringent emissions regulations has led to a growing reliance on aluminum extrusions for these critical parts.

Aluminum extrusions are particularly well-suited for substructures due to their excellent strength-to-weight ratio, corrosion resistance, and design flexibility. By replacing traditional steel components with aluminum extrusions, manufacturers can achieve significant weight reductions without compromising structural integrity. This weight reduction not only improves fuel economy but also enhances handling and acceleration, contributing to better overall vehicle performance.

Moreover, the shift towards electric and hybrid vehicles amplifies the demand for aluminum extrusions in substructures. These vehicles require robust yet lightweight components to support battery systems and electric drivetrains while optimizing energy efficiency. Aluminum’s recyclability also aligns with the automotive industry's sustainability goals, making it an attractive material choice for substructures.

Advancements in extrusion technology and alloy formulations further support the growth of the market by enabling the production of more complex and precise substructure components. As automakers continue to innovate and integrate advanced materials into vehicle design, the demand for aluminum extrusions in substructures is expected to rise, driving market expansion. The focus on reducing vehicle weight, improving safety, and enhancing performance ensures that aluminum extrusions will remain a key material in the development of automotive substructures.

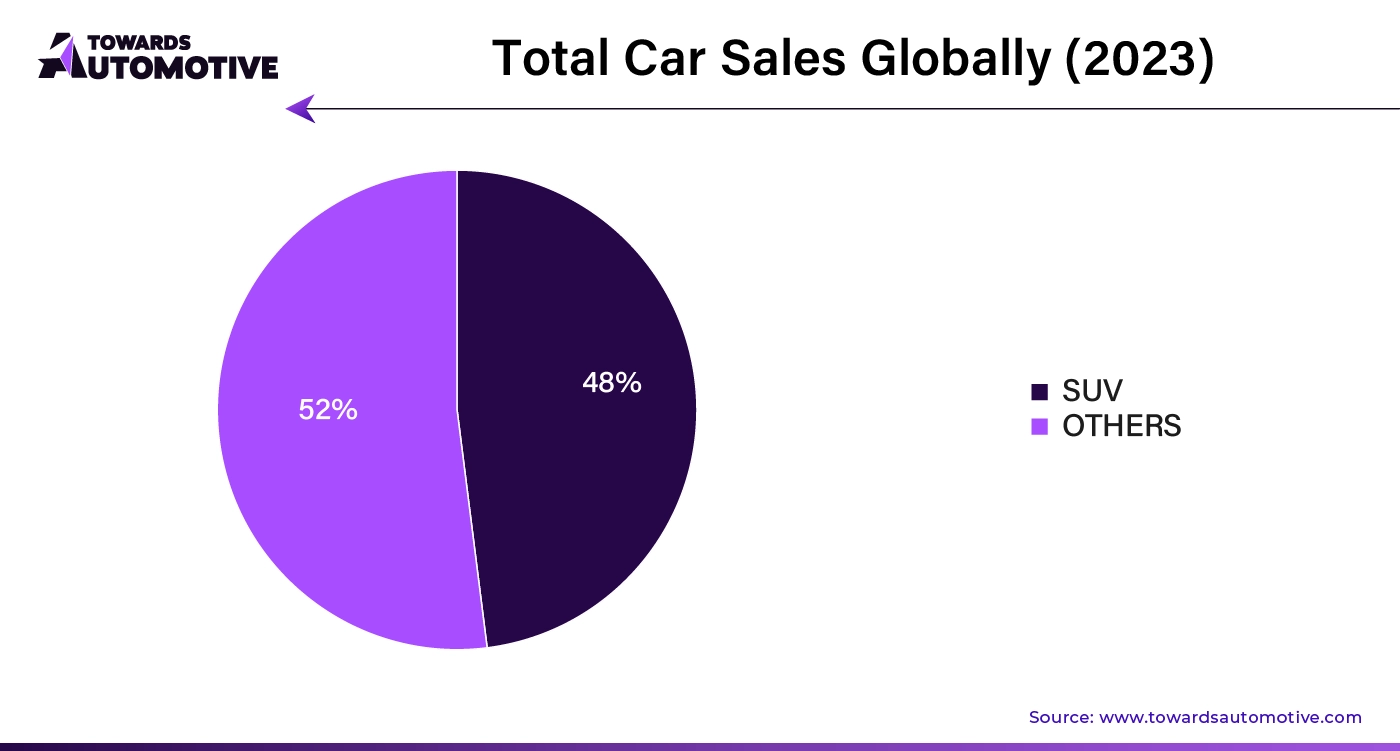

The utility vehicle segment held the largest share of the market. Utility vehicles drive the growth of the automotive aluminum extrusions market by increasing the demand for robust, lightweight, and versatile materials that enhance vehicle performance and durability. Utility vehicles, such as trucks, SUVs, and off-road vehicles, often require heavy-duty components to withstand rigorous usage and challenging conditions. Aluminum extrusions, known for their high strength-to-weight ratio and resistance to corrosion, are ideal for producing parts that can handle the stresses of utility vehicle applications while maintaining a lower weight compared to traditional materials.

In utility vehicles, aluminum extrusions are commonly used for structural components, such as chassis frames, side rails, and cargo beds. These extrusions help reduce the overall vehicle weight, which improves fuel efficiency and handling—a crucial factor for vehicles that frequently carry heavy loads or operate in demanding environments. Additionally, the flexibility of aluminum extrusions allows for innovative designs and customization, which can enhance both the functionality and aesthetics of utility vehicles.

The growing popularity of utility vehicles, driven by consumer preference for versatile and rugged transportation options, further fuels the demand for aluminum extrusions. As manufacturers seek to balance performance, safety, and efficiency, aluminum extrusions offer a solution that meets these needs while supporting the trend toward lighter and more fuel-efficient vehicles.

Moreover, advancements in extrusion technology and the development of new aluminum alloys contribute to the market's expansion. These innovations enable the production of high-strength components that meet the specific requirements of utility vehicles. As the automotive industry continues to evolve and prioritize efficiency and durability, aluminum extrusions will play a key role in driving the growth of the automotive aluminum extrusions market.

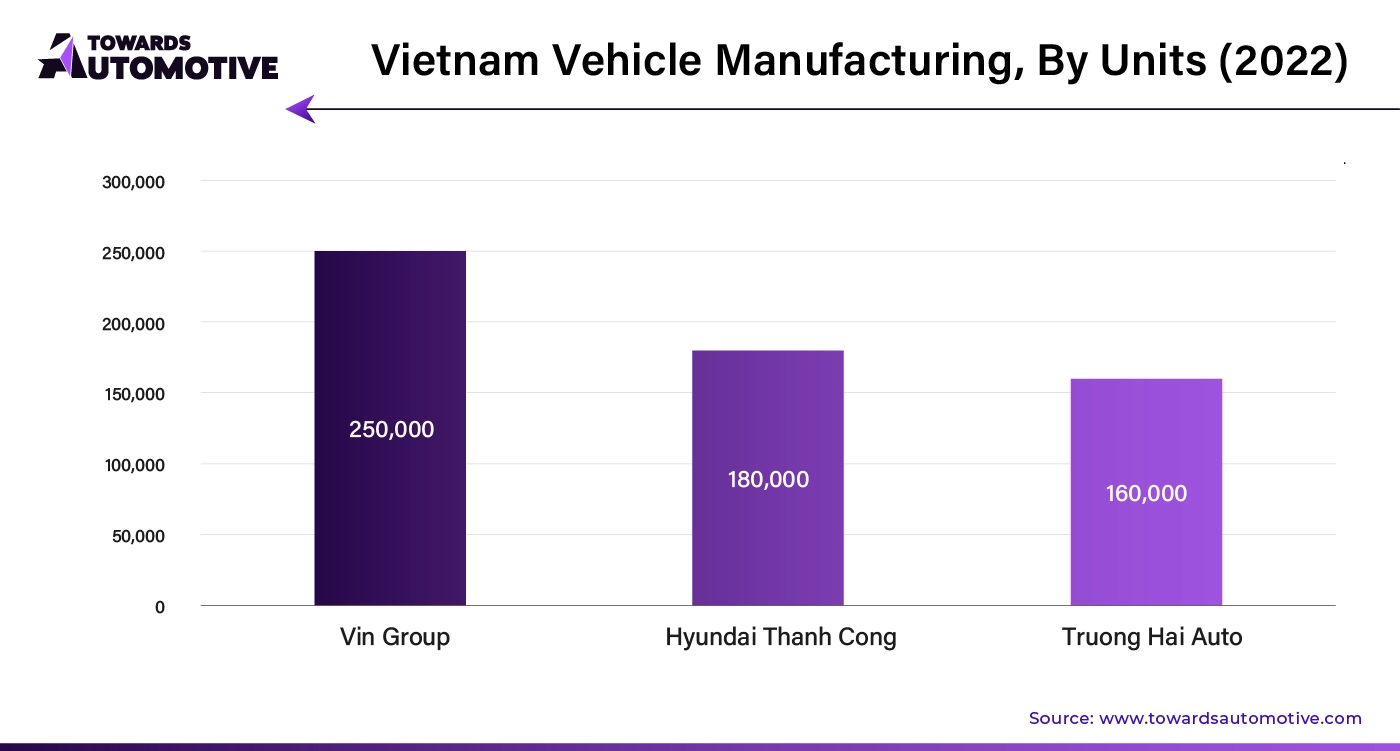

Asia Pacific dominated the automotive aluminum extrusions market. Rapid automotive industry growth, rising adoption of electric and hybrid vehicles along with government regulations and incentives drive the growth of the automotive aluminum extrusions market in Asia Pacific. The booming automotive sector in countries such as China, Vietnam and India increase the demand for advanced materials, such as aluminum extrusions, which offer lightweight, durable, and efficient solutions for vehicle components. As the adoption of electric and hybrid vehicles rises, the need for aluminum extrusions intensifies.

These vehicles use aluminum for critical components like battery enclosures and structural frames to enhance energy efficiency and extend driving range. Government regulations in the region are also pivotal; stricter emissions standards and fuel efficiency requirements push automakers to adopt lightweight materials like aluminum to meet regulatory targets. Additionally, governments offer incentives for environmentally friendly vehicles, further accelerating the use of aluminum extrusions.

North America is expected to grow with the highest CAGR during the forecast period. Increased demand for lightweight vehicles, automotive industry investments, and stringent emissions regulations drive the growth of the automotive aluminum extrusions market in North America. The push for improved fuel efficiency and reduced vehicle weight fuels the adoption of aluminum extrusions, which provide a high strength-to-weight ratio essential for enhancing vehicle performance and fuel economy. Automakers are investing heavily in research and development to innovate and integrate lightweight materials into their designs, further boosting the demand for aluminum extrusions.

These investments support advancements in extrusion technology and alloy formulations, making aluminum extrusions a more viable and attractive option. Additionally, stringent emissions regulations imposed by North American governments compel manufacturers to seek solutions that reduce vehicle weight and improve fuel efficiency to comply with environmental standards. Aluminum extrusions help automakers meet these regulatory requirements by enabling the production of lighter and more efficient vehicles.

By Type

By Vehicle

By Aluminum Grade

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us