April 2025

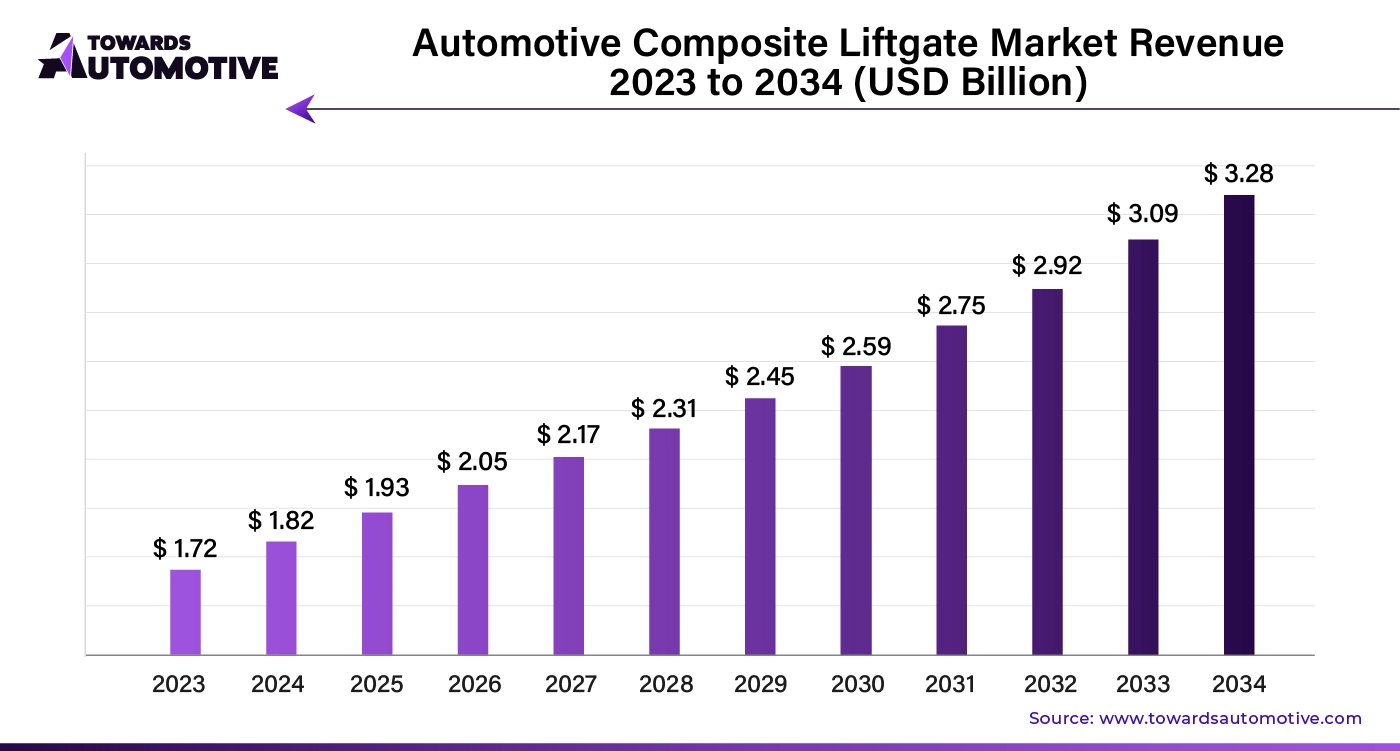

The global automotive composite liftgate market size was valued at USD 1.72 billion in 2023 and is expected to be valued at around USD 3.28 billion by 2034, growing at a CAGR of 6.04% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

An automotive composite liftgate is a rear door of vehicles that is made primarily from composite materials, such as carbon fiber, fiberglass, or reinforced plastics. Unlike traditional liftgates made of steel or aluminum, composite liftgates are designed to be lighter, more durable, and often more corrosion-resistant. Composites offer better thermal and acoustic insulation and reduce the weight of the liftgate, contributing to improved fuel efficiency and performance. Composite liftgates are commonly used in various vehicle types, including SUVs, hatchbacks, and electric vehicles, where reducing weight is particularly beneficial for improving range and efficiency. The market has been experiencing significant growth due to advancements in materials technology, increasing demand for lightweight vehicles, and stringent fuel efficiency regulations.

Demand for Lightweight Materials and Adoption of EVs

The automotive composite liftgate market is primarily driven by several key factors. First, the increasing demand for lightweight materials in vehicle manufacturing is a significant influence. As the demand for electric vehicles (EVs) continues to rise, manufacturers are seeking lightweight solutions to enhance battery efficiency and range, positioning composite liftgates as a viable option. Composites can significantly reduce weight compared to traditional metal components, leading to improved fuel efficiency and reduced emissions. Additionally, the rising acceptance of electric vehicles (EVs) and the need for sustainable materials are pushing manufacturers to adopt composites that offer both performance and environmental benefits.

Design Flexibility and Regulatory Pressure

The growing consumer demand for innovative and aesthetically pleasing vehicle designs has led manufacturers to explore composites for their versatility and design flexibility. Moreover, governments worldwide are implementing stricter emission regulations and fuel economy standards. This encourages vehicle manufacturers to adopt lighter materials, including composites, to meet fuel economy requirements, thus driving the market.

High Production Cost and Durability Issues

Despite the growth potential of the automotive composite liftgate market, several factors are hindering its growth. One significant restraint is the high cost of composite materials compared to traditional metals, which can deter manufacturers, particularly in budget-conscious segments of the automotive industry. Additionally, the complexity of manufacturing processes, such as resin transfer molding and compression molding, may require specialized equipment and expertise, resulting in increased production costs and longer lead times.

Concerns about the recyclability of composite materials also pose challenges, as environmental regulations and consumer preferences shift towards sustainable practices. Furthermore, some manufacturers may be reluctant to transition from conventional materials due to established production methods and supply chains, limiting the widespread adoption of composites. Performance concerns related to impact resistance and long-term durability in harsh conditions can also hinder the market.

Sustainability Trends and Advanced Manufacturing Techniques

The automotive composite liftgate market presents numerous opportunities for growth and innovation, driven by sustainability trends and technological advancements. The growing emphasis on sustainability is creating a huge demand for eco-friendly composite materials, which can appeal to environmentally conscious consumers. Advances in manufacturing techniques, such as automated processes and 3D printing, offer opportunities for reduced production costs and improved design capabilities, allowing for more intricate and efficient liftgate designs. Furthermore, collaboration between automotive OEMs and material suppliers can lead to the development of specialized composites tailored for specific applications, enhancing performance and durability.

The conventional liftgate segment led the market in 2023. Conventional liftgates have been widely used in vehicles for many years, leading to established manufacturing processes and supply chains that support their production. This familiarity allows automotive manufacturers to easily integrate composite materials into existing designs without extensive modifications. Conventional liftgates offer a balance of cost and functionality, making them appealing to a broad range of consumers and vehicle types. Moreover, conventional liftgates are often associated with larger vehicles, such as SUVs and crossovers, where the benefits of weight reduction are particularly impactful. As automakers strive to meet stringent fuel economy standards, the integration of composite materials into conventional liftgates provides a viable solution.

The power liftgate segment is projected to grow at the fastest rate during the forecast period. The increasing consumer demand for convenience and enhanced features in vehicles has made power liftgates a popular choice. These automated systems provide ease of use, particularly for families and individuals who regularly carry items, making them an attractive feature for many buyers. Advancements in technology have improved the integration of composite materials in power liftgates, allowing manufacturers to create lightweight yet durable components that enhance performance. The use of composites in these systems helps reduce the overall vehicle weight, which is crucial for improving fuel efficiency and electric vehicle range. Furthermore, the growing trend toward luxury and higher-end vehicles, which often come equipped with power liftgates, drives the segment.

The compression molding segment dominated the market in 2023. This manufacturing process is highly efficient and well-suited for producing large, complex parts with consistent quality. Compression molding allows for the rapid production of composite liftgates, which is essential for meeting the high demand in the automotive industry. Additionally, the process supports the use of various composite materials, which can enhance the strength and durability of the liftgates. This versatility enables manufacturers to tailor the properties of the liftgates to meet specific performance requirements.

Cost-effectiveness is another significant advantage of compression molding. The process typically requires lower capital investment and operational costs compared to other methods, such as injection molding, making it an attractive option for many manufacturers. Furthermore, compression molding generates minimal waste, contributing to sustainability efforts and reducing material costs.

The resin transfer molding (RTM) segment is expected to expand at the highest CAGR throughout the forecast period. This is due to several key advantages that align with industry demands for efficiency, quality, and design flexibility. RTM offers superior control over the composite material's properties, enabling manufacturers to achieve high strength and lightweight components essential for modern vehicles. This process involves injecting resin into a closed mold containing dry reinforcement materials, allowing for precise distribution and minimal waste, which enhances production efficiency and reduces costs.

Furthermore, RTM supports intricate designs and complex geometries, making it ideal for producing aesthetically appealing and aerodynamically efficient liftgates. The ability to create parts with excellent surface finishes also appeals to automotive manufacturers focused on quality and consumer satisfaction. As the industry shifts towards lighter materials for electric and hybrid vehicles, RTM's capability to produce large, robust components efficiently positions it as a preferred choice. Additionally, the process is compatible with a range of composite materials, further expanding its application potential within the automotive sector.

The SUVs segment dominated the market in 2023. This is due to the rising popularity of SUVs, driven by consumer preferences for spaciousness and comfort. SUVs are designed for versatility and capacity, often featuring larger liftgates that can benefit significantly from the lightweight properties of composite materials. This weight reduction enhances fuel efficiency and improves performance, which is increasingly important to consumers. Moreover, the rugged design and durability requirements of SUVs make composites an attractive option, as they provide strength while reducing weight. The rising adoption of SUVs is further likely to continue segment’s dominance in the coming years.

The hatchbacks/sedans segment is projected to generate a high revenue in the coming years. The segmental growth is attributed to the hatchbacks and sedans often feature more compact designs, allowing for creative use of space and innovative features. Composites enable the creation of complex shapes and structures, offering design flexibility that can enhance both aesthetics and functionality. This is particularly important for appealing to consumers who prioritize style and modern features in their vehicles.

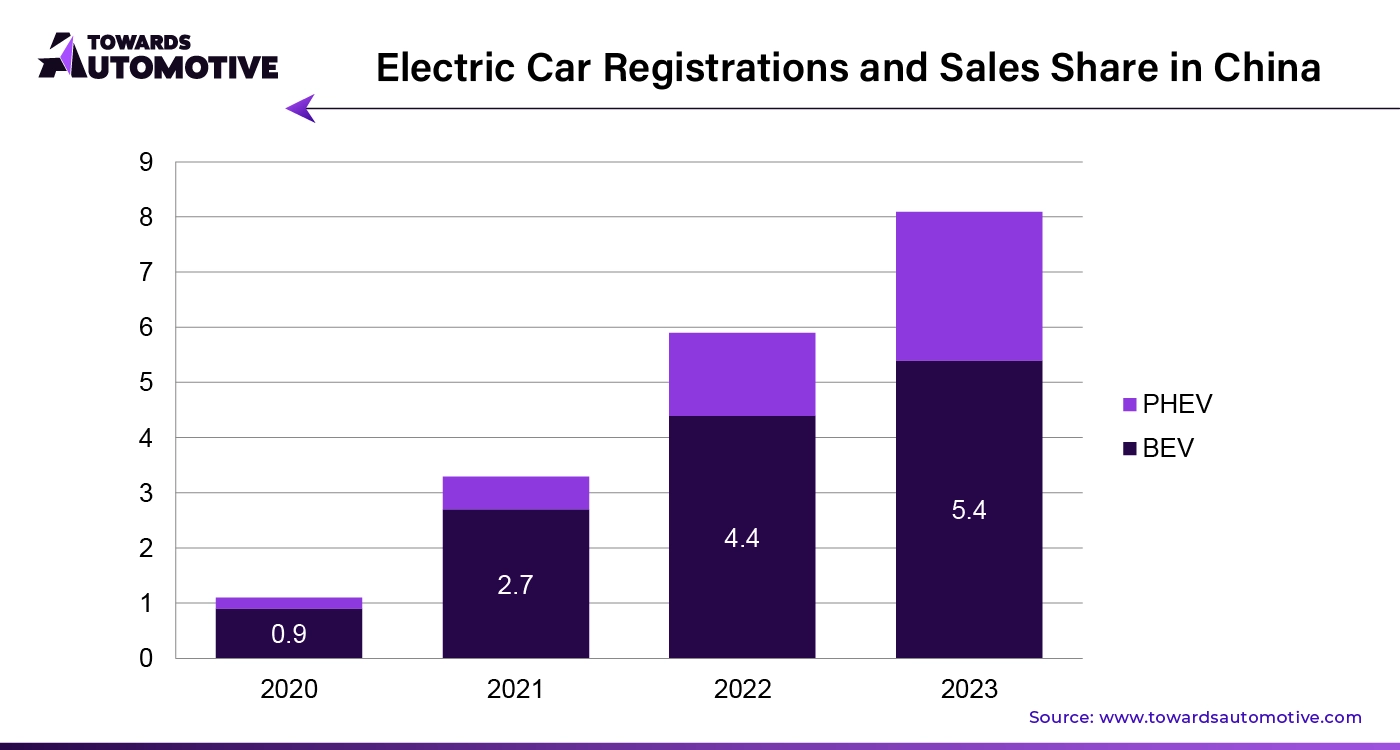

Asia Pacific dominated the market with the largest share in 2023. Asia Pacific has emerged as the dominant region in the automotive composite liftgate market due to a confluence of factors driving growth and innovation. The rapid expansion of the automotive industry in countries like China, Japan, and India has significantly increased the demand for lightweight and efficient components, particularly in the context of rising electric cars sales. As manufacturers strive to enhance vehicle range and fuel efficiency, the use of composite materials has become essential.

Furthermore, the region benefits from cost-effective manufacturing capabilities and a well-established supply chain, allowing for the economical production of composite liftgates. Government initiatives promoting sustainability and stricter emissions regulations have further incentivized the adoption of lightweight materials. Additionally, heightened consumer awareness regarding eco-friendly vehicles has led automotive companies to prioritize advanced material solutions. With substantial investments in research and development, Asia Pacific is also home to numerous leading firms innovating in composite technology. The strong presence of major original equipment manufacturers (OEMs) in the region solidifies its influence on global automotive trends, making Asia Pacific a key player in the evolution of the automotive composite liftgate market.

The market in Europe is anticipated to expand rapidly in the near future. This is mainly due to the stringent regulations, technological innovation, and a strong emphasis on sustainability. The region is known for its rigorous environmental policies, which compel automotive manufacturers to focus on reducing vehicle weight and improving fuel efficiency, particularly in light of strict emissions standards. This regulatory landscape has spurred the adoption of composite materials, which are essential for achieving the necessary weight reductions without compromising safety or performance.

Additionally, Europe boasts a robust automotive industry characterized by a high level of investment in research and development, fostering innovation in composite manufacturing processes. European consumers are increasingly seeking eco-friendly vehicles, prompting manufacturers to enhance their offerings with advanced composite liftgates that align with sustainability goals. The presence of major automotive players and suppliers in the region further supports a collaborative environment for developing cutting-edge composite technologies. As a result, Europe not only leads in market share but also sets trends that shape the future of automotive design and manufacturing.

By Type

By Manufacturing Process

By Vehicle Type

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us