April 2025

Senior Research Analyst

Reviewed By

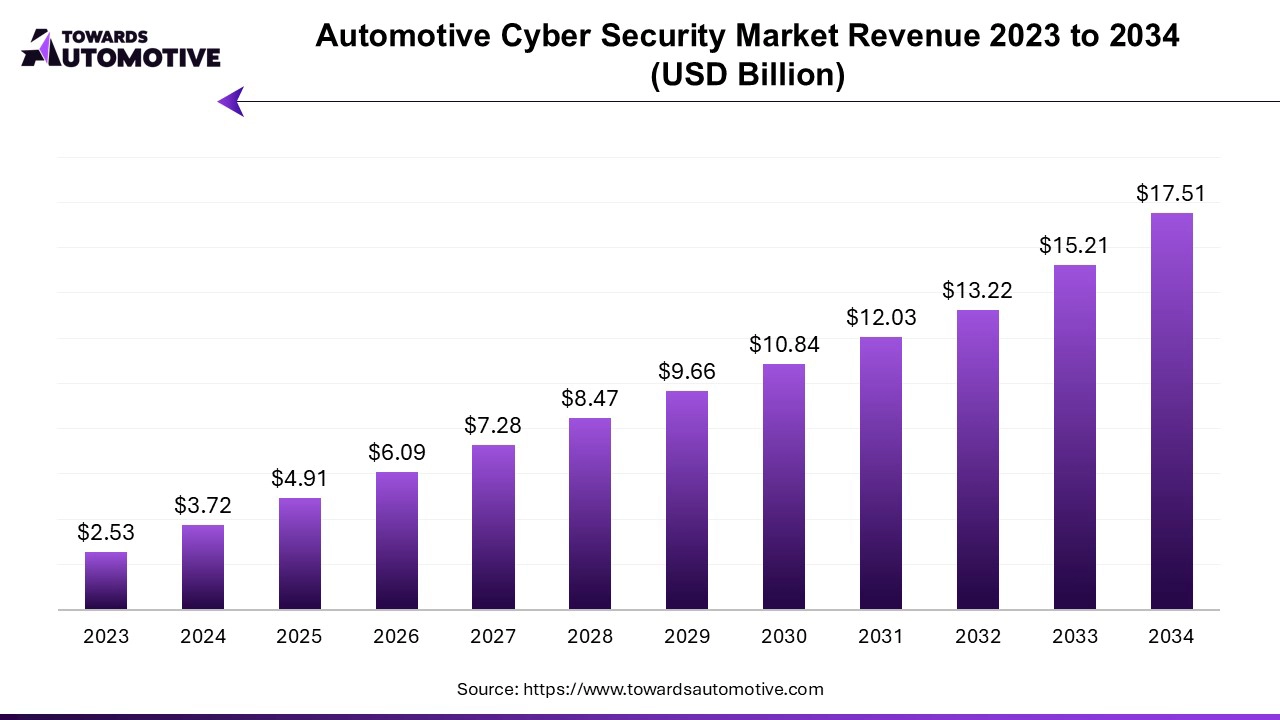

The automotive cybersecurity market is forecasted to expand from USD 4.91 billion in 2025 to USD 17.51 billion by 2034, growing at a CAGR of 15.14% from 2025 to 2034.

The Automotive Cyber Security market is rapidly evolving in response to the increasing connectivity of vehicles and the rising threat of cyberattacks. As vehicles become more integrated with advanced technologies, including IoT devices, autonomous driving systems, and connected infotainment features, the potential vulnerabilities also escalate. This has led to a growing demand for robust cyber security solutions that protect critical automotive systems from malicious threats. Key players in this market are focusing on developing advanced security frameworks, encryption technologies, and real-time monitoring systems to safeguard vehicles from potential breaches.

Regulatory pressures and industry standards are also driving the adoption of comprehensive security measures to ensure consumer safety and maintain public trust in automotive innovations. Moreover, the growing awareness of data privacy and the importance of protecting sensitive user information further amplify the need for strong cyber security measures in the automotive sector. As a result, investments in research and development are increasing, with a focus on integrating AI and machine learning technologies for proactive threat detection and response. This dynamic landscape underscores the vital importance of automotive cyber security, as manufacturers and suppliers work collaboratively to create a secure ecosystem that supports the future of connected and autonomous vehicles.

AI plays a pivotal role in the Automotive Cyber Security market by enhancing the ability to detect, prevent, and respond to cyber threats in real time. With the increasing complexity and connectivity of modern vehicles, traditional security measures are often insufficient to address sophisticated cyberattacks. AI algorithms analyze vast amounts of data generated by vehicle systems, identifying patterns and anomalies that may indicate potential security breaches. By employing machine learning techniques, these systems can continuously improve their threat detection capabilities, adapting to new attack vectors as they emerge.

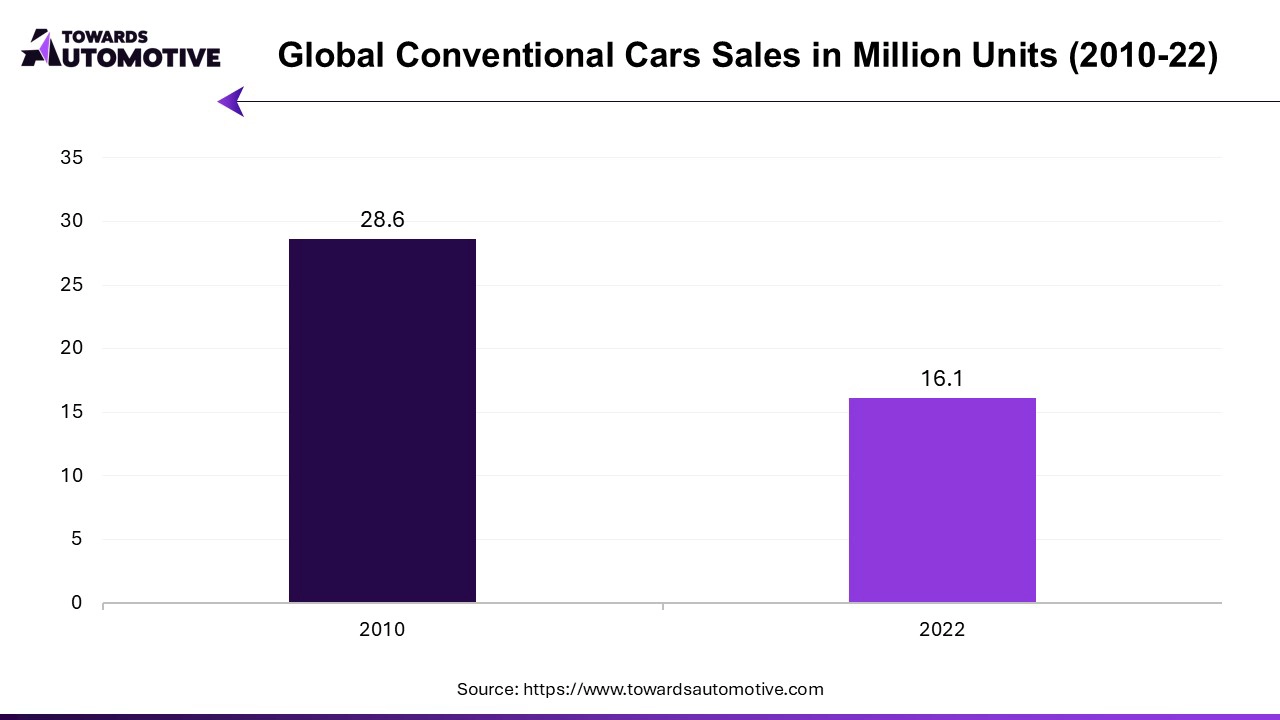

The growing sales of passenger vehicles significantly drive the growth of the Automotive Cyber Security Market, primarily due to the increasing integration of advanced technologies and connectivity features in modern automobiles. As passenger vehicles evolve to include sophisticated infotainment systems, advanced driver-assistance systems (ADAS), and connectivity options like Wi-Fi and Bluetooth, they also become more vulnerable to cyber threats. The rise in the number of connected passenger vehicles has created an expanded attack surface for hackers, prompting both manufacturers and consumers to prioritize cyber security measures.

With consumers increasingly aware of the potential risks associated with connected technologies, there is a rising demand for robust security solutions to safeguard personal data and ensure the safe operation of vehicles. Additionally, regulatory agencies are implementing stricter cyber security standards for passenger vehicles, compelling manufacturers to invest heavily in advanced security protocols and technologies. This includes measures such as encryption, intrusion detection systems, and secure software updates to protect against unauthorized access and data breaches.

As the sales of passenger vehicles continue to rise, so does the necessity for enhanced automotive cyber security, making it a vital component of vehicle design and manufacturing. Consequently, the growing sales of passenger vehicles serve as a significant catalyst for the expansion of the Automotive Cyber Security Market, emphasizing the need for comprehensive security solutions in today’s increasingly connected automotive landscape.

The Automotive Cyber Security Market faces several restraints that may hinder its growth. One major challenge is the high costs associated with implementing advanced security measures, which can be a significant financial burden for manufacturers, especially smaller companies. Additionally, the rapid pace of technological advancements makes it difficult for security solutions to keep up, leading to potential vulnerabilities. There is also a lack of standardization in cyber security protocols across the industry, which complicates the development and implementation of effective security measures. Furthermore, the shortage of skilled cyber security professionals poses a challenge, limiting the industry's ability to address emerging threats adequately.

Intrusion Detection Systems (IDS) are becoming increasingly vital in the Automotive Cyber Security Market, presenting significant opportunities for growth and innovation. As vehicles evolve into complex, connected platforms with extensive data exchange capabilities, the potential for cyber threats increases. IDS technologies are designed to monitor network traffic for suspicious activities and potential intrusions, providing a proactive defense mechanism. By implementing IDS, automotive manufacturers can detect unauthorized access or anomalies in real-time, enabling swift responses to potential security breaches.

The integration of IDS enhances the overall security posture of connected vehicles, making them more resilient against cyber-attacks. This proactive approach not only safeguards sensitive data but also ensures the safe operation of critical vehicle systems, such as advanced driver-assistance systems (ADAS) and infotainment features. As regulatory bodies increasingly emphasize the need for robust cyber security measures in automotive design, the demand for IDS solutions is expected to rise.

Moreover, the development of advanced IDS solutions incorporating artificial intelligence and machine learning can further enhance threat detection capabilities, creating a competitive edge for manufacturers. As a result, investments in IDS technologies will not only contribute to compliance with emerging regulatory standards but also foster consumer confidence, driving the growth of the Automotive Cyber Security Market.

The infotainment segment held the largest share of the market. The infotainment segment is a key driver of growth in the Automotive Cyber Security Market, primarily due to the increasing integration of advanced technologies in modern vehicles. As infotainment systems become more sophisticated, featuring connectivity options such as smartphone integration, internet browsing, and streaming services, they simultaneously expand the attack surface for cyber threats. These systems often collect and store sensitive user data, including personal information and location data, making them attractive targets for cybercriminals. Consequently, automotive manufacturers are compelled to invest in robust cyber security measures to protect these systems from unauthorized access and data breaches. Additionally, the rise in consumer demand for enhanced in-car experiences drives automakers to continuously innovate and improve their infotainment offerings, further emphasizing the need for stringent security protocols.

The wireless network security segment led the industry. The wireless network security segment plays a pivotal role in driving the growth of the Automotive Cyber Security Market, largely due to the increasing reliance on wireless communication technologies in modern vehicles. With the advent of connected vehicles, automotive manufacturers are integrating various wireless networks—such as Wi-Fi, Bluetooth, and cellular communication—to enable features like real-time navigation, infotainment, and vehicle-to-everything (V2X) communication. While these advancements enhance the driving experience and improve vehicle functionality, they also introduce significant cyber security risks. The exposure of vehicle systems to external networks increases vulnerability to hacking, data breaches, and unauthorized access. Consequently, there is a growing demand for comprehensive cyber security solutions tailored to protect these wireless communications. Manufacturers are investing in advanced security protocols, including encryption and authentication measures, to safeguard against potential attacks targeting wireless networks.

Moreover, regulatory bodies are emphasizing the need for stringent security standards, further propelling investment in protective technologies. As the automotive industry continues to embrace wireless connectivity, the demand for robust cyber security measures to protect these networks will only intensify, making the wireless network segment a critical driver of growth in the Automotive Cyber Security Market. This focus on securing wireless communications not only enhances vehicle safety but also boosts consumer confidence in connected technologies.

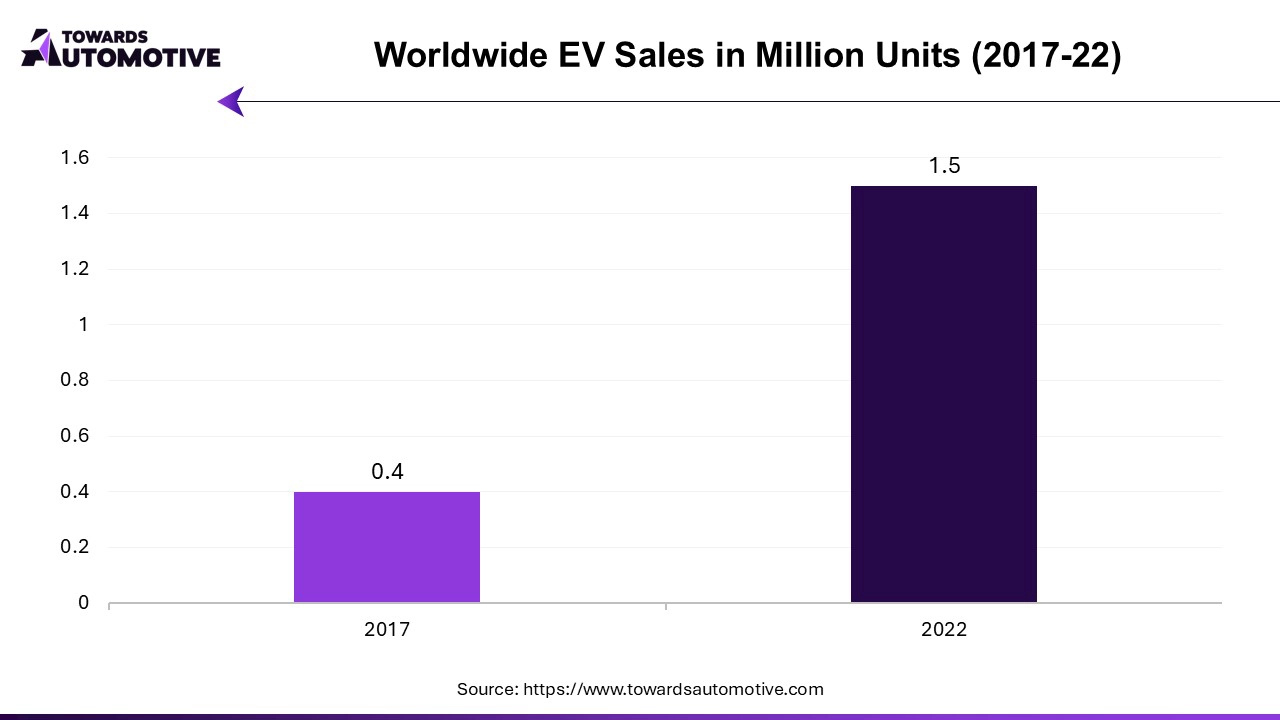

The electric vehicle segment dominated the industry. The rise of electric vehicles (EVs) significantly propels the growth of the Automotive Cyber Security Market due to their reliance on advanced technology and connectivity. As EVs integrate complex software systems for battery management, energy optimization, and regenerative braking, they become increasingly dependent on secure digital infrastructure. The connectivity features of EVs, including remote diagnostics, over-the-air updates, and charging station integration, create potential entry points for cyber threats, necessitating robust security measures. As consumers become more aware of the cyber risks associated with connected vehicles, they demand enhanced security features to protect their data and privacy.

Moreover, regulatory bodies are implementing stricter guidelines and standards for cyber security in automotive systems, prompting manufacturers to prioritize the development and implementation of comprehensive security protocols. The growing ecosystem of EVs also includes interactions with smart grids and charging infrastructure, further expanding the attack surface that needs protection. Consequently, automotive companies are investing in advanced technologies such as encryption, intrusion detection systems, and real-time monitoring to safeguard their electric vehicles from potential cyber threats. As the EV market continues to expand, the demand for effective cyber security solutions will grow, driving significant advancements in the Automotive Cyber Security Market. This focus on securing electric vehicles not only enhances safety but also fosters consumer trust in the future of sustainable transportation.

The in-vehicle segment held the highest share of the market. The in-vehicle segment is a crucial driver of growth in the Automotive Cyber Security Market, primarily due to the increasing complexity and connectivity of vehicle systems. Modern vehicles are equipped with a multitude of interconnected components, such as infotainment systems, advanced driver-assistance systems (ADAS), and communication networks that manage everything from engine performance to passenger comfort. This interconnectedness creates multiple access points for cyber threats, making the security of in-vehicle systems paramount.

As manufacturers incorporate more software and connectivity features into their vehicles, the risk of unauthorized access and data breaches escalates. Consumers are becoming more aware of these vulnerabilities and are demanding enhanced security measures to protect their personal information and ensure the integrity of their vehicles. Additionally, regulatory bodies are imposing stricter cyber security requirements, pushing manufacturers to prioritize the implementation of advanced security protocols within their in-vehicle systems.

This includes measures such as intrusion detection systems, encryption, and secure communication channels. As the automotive industry continues to innovate with technologies like V2X communication and autonomous driving features, the need for robust cyber security solutions for in-vehicle systems will become even more critical. Consequently, the in-vehicle segment significantly contributes to the overall growth of the Automotive Cyber Security Market, highlighting the importance of securing the vehicle's digital ecosystem for ensuring safety and consumer trust.

Asia Pacific dominated the automotive cyber security market. The Automotive Cyber Security Market in the Asia-Pacific (APAC) region is experiencing robust growth, driven by several key factors. Firstly, the increasing vehicle connectivity, marked by the rise of connected and autonomous vehicles, has amplified the complexity and number of potential cyber threats. As vehicles become more integrated with advanced technologies, such as IoT and V2X communication, the attack surface for cybercriminals expands, necessitating the implementation of comprehensive security measures to protect sensitive data and vehicle systems.

Secondly, the region has witnessed a notable rise in cyber threats targeting the automotive sector, with incidents highlighting vulnerabilities in vehicle software and networks. This escalation in attacks has heightened awareness among manufacturers and consumers alike, prompting significant investments in cyber security solutions. Lastly, investment in research and development (R&D) by automotive manufacturers and technology companies is driving innovation in cyber security technologies. These investments focus on developing advanced threat detection systems, secure software architectures, and robust encryption protocols, all aimed at safeguarding vehicles from cyber risks.

North America is expected to grow with a significant CAGR during the forecast period. The Automotive Cyber Security Market in North America is rapidly expanding, fueled by several critical factors. The growing adoption of autonomous vehicles is at the forefront of this trend, as these vehicles rely heavily on advanced software and connectivity to operate safely and efficiently. This reliance creates a pressing need for robust cyber security measures to protect against potential hacking and data breaches. Additionally, consumer demand for safety and security has intensified, as buyers increasingly recognize the importance of safeguarding their vehicles from cyber threats.

This heightened awareness drives automotive manufacturers to prioritize cyber security features, ultimately enhancing vehicle resilience. Furthermore, collaboration between industry players, including automakers, technology firms, and cyber security experts, is fostering a comprehensive approach to addressing cyber risks. By pooling resources and expertise, these stakeholders are developing innovative solutions that address vulnerabilities in connected vehicle systems. This cooperative effort accelerates the creation of industry-wide standards and best practices, ensuring that all vehicles meet stringent security requirements.

By Application

By Security Type

By Service

By Vehicle Type

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us