April 2025

Senior Research Analyst

Reviewed By

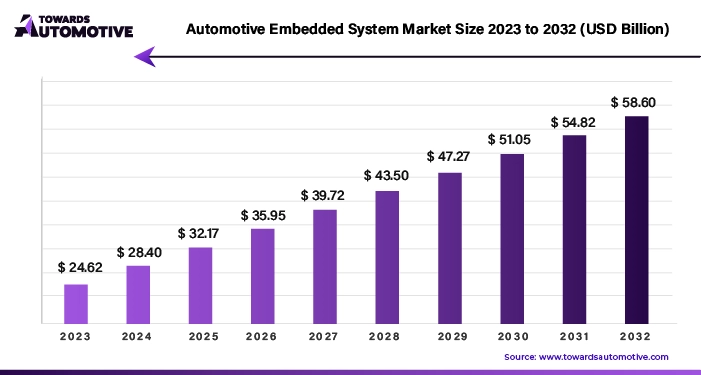

The automotive embedded system market is forecast to grow from USD 28.92 billion in 2025 to USD 59.67 billion by 2034, driven by a CAGR of 8.38% from 2025 to 2034.

In modern vehicles, integrated systems play a crucial role in processing data from a variety of sensors, including cameras, lidar, and radar. These systems analyze the incoming data in real-time to make critical decisions related to safety features such as traffic alerts, adaptive cruise control, automatic braking, and decision-making assistance. By leveraging advanced automotive embedded systems, vehicles can enhance safety, comfort, and overall driving experience by supporting features like lane-keeping assistance and blind-spot monitoring.

Moreover, the development of Level 3 Advanced Driver Assistance Systems (ADAS) enables drivers to temporarily disengage from steering under specific conditions, further augmenting vehicle safety and autonomy. This increasing sophistication in automotive technology is driving the growth of the automotive embedded systems market.

As vehicles become more connected, they offer a plethora of features such as touch screens, voice recognition, smartphone integration, navigation systems, and internet connectivity. Embedded systems serve as the backbone for these functionalities, facilitating seamless communication between the vehicle, its components, and external services. Given this trend, investments in embedded systems are on the rise to meet the evolving demands of modern vehicles.

For Instance,

The COVID-19 pandemic has wrought significant disruptions in the automotive embedded systems market, primarily due to quarantines and disruptions in global supply chains. These disruptions led to temporary interruptions in production, impacting the availability of essential components required for automotive embedded systems. As a result, automakers were compelled to suspend product shipments and implement price reductions to navigate the challenges posed by the crisis.

However, amidst the adversity brought about by the pandemic, certain trends emerged that underscored the importance of innovation and adaptation within the automotive industry. Specifically, there has been a heightened emphasis on remote diagnostics and over-the-air (OTA) updates, as automakers sought to address maintenance and software-related issues without physical interaction. This shift towards remote solutions reflects the industry's recognition of the need for flexible and efficient means of servicing vehicles, particularly in times of crisis.

Furthermore, the pandemic has underscored the significance of connectivity within automotive systems. With physical interactions constrained by social distancing measures, there has been an increased interest in contactless control mechanisms and voice assistants. These technologies offer consumers a means of interacting with vehicle features and functions without direct physical contact, aligning with evolving consumer preferences amidst the challenges posed by the pandemic.

Overall, while the COVID-19 pandemic has presented numerous challenges to the automotive embedded systems market, it has also catalyzed innovation and adaptation within the industry. By embracing remote diagnostics, OTA updates, and contactless control technologies, automakers are better positioned to navigate the complexities of the current landscape and meet the evolving needs of consumers in a post-pandemic world.

The integration of over-the-air (OTA) updates and advanced software management systems represents a pivotal development in the automotive embedded systems industry, poised to significantly influence its trajectory by 2032. These innovations offer automakers the capability to remotely update and manage software in vehicles, enhancing their functionality, performance, and security.

In March 2023, Volvo Cars made headlines by announcing its adoption of agile software development methodologies for its autonomous vehicles. By leveraging agile practices and artificial intelligence-driven testing and validation processes, Volvo aims to streamline software development, testing, and deployment cycles. This approach enables continuous improvement and modification of vehicle performance, minimizing the need for physical recalls and ensuring that vehicles remain up-to-date with the latest features and enhancements.

Central to the success of OTA updates is robust cybersecurity measures to safeguard against unauthorized access and potential cyber threats. With vehicles becoming increasingly connected and reliant on software-driven functionalities, cybersecurity emerges as a critical consideration for automakers and consumers alike. By prioritizing cybersecurity within the OTA framework, automotive embedded systems manufacturers can bolster trust in their products and mitigate the risk of cyber-attacks, thereby fostering a conducive environment for business growth and innovation.

Overall, the adoption of OTA updates and agile software development methodologies represents a paradigm shift in the automotive industry, offering manufacturers unprecedented flexibility, efficiency, and security in managing vehicle software. As automakers continue to invest in these technologies and prioritize cybersecurity, the automotive embedded systems industry is poised to thrive, driving innovation and shaping the future of mobility.

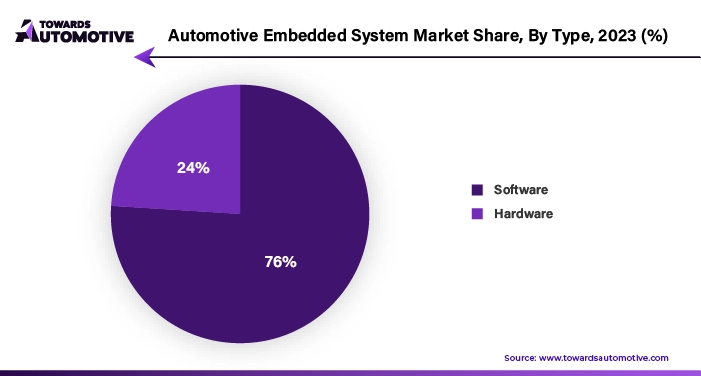

By 2022, the embedded software segment is projected to dominate the vehicle embedded system market, accounting for over 70% of the total share. A notable example illustrating this trend is Tesla's autopilot system, which relies extensively on embedded software to enable semi-autonomous driving capabilities. This highlights the critical role of embedded software in facilitating advanced functionalities within modern vehicles.

As consumer preferences evolve to prioritize safety, comfort, and entertainment features, automakers face increasing pressure to innovate and differentiate their offerings. Embedded software plays a pivotal role in meeting these evolving demands by enabling the integration of new features and functionalities into today's automobiles. Whether it's advanced driver assistance systems, in-car infotainment systems, or connectivity features, embedded software serves as the backbone that powers these innovations.

The growing emphasis on vehicle electrification, connectivity, and autonomous driving further underscores the significance of embedded software in shaping the future of the automotive industry. As automakers strive to deliver cutting-edge vehicles that meet the needs of modern consumers, the demand for embedded software solutions is expected to surge, driving growth in the vehicle embedded system market.

Overall, the dominance of the embedded software segment reflects its indispensable role in driving innovation, enhancing vehicle capabilities, and delivering superior driving experiences to consumers. As technology continues to advance and vehicles become increasingly sophisticated, embedded software will remain at the forefront of automotive innovation, driving the evolution of the industry in the years to come.

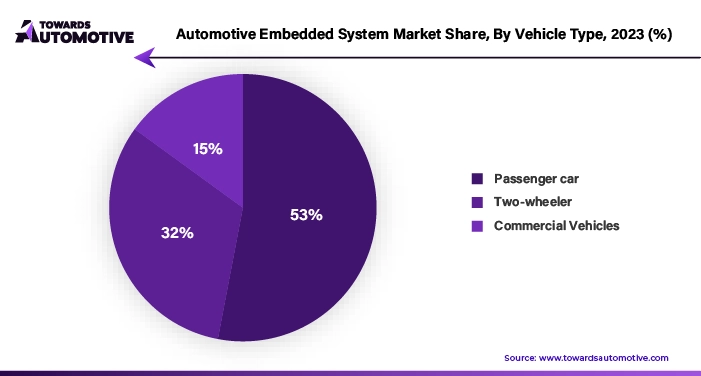

The passenger segment is poised to be a significant driver of growth in the shared car market, accounting for approximately 48% of the market share by 2022. One of the key enablers of this growth is the integration of advanced driving systems (ADAS), which play a pivotal role in enhancing safety, efficiency, and overall driving experience.

ADAS features, such as lane departure warning and emergency braking, rely heavily on embedded systems to process data and make split-second decisions. Vehicles like the Mercedes-Benz S-Class exemplify this trend, offering comprehensive ADAS packages that leverage cutting-edge technology to create a safe and comfortable driving environment for passengers.

As the automotive industry continues to evolve towards connected and autonomous driving, the importance of connected systems becomes increasingly pronounced. These systems enable seamless integration of advanced technologies, allowing vehicles to communicate with each other and with external infrastructure. This connectivity is crucial for delivering the sophisticated technology that modern customers demand, driving innovation and shaping the future of transportation.

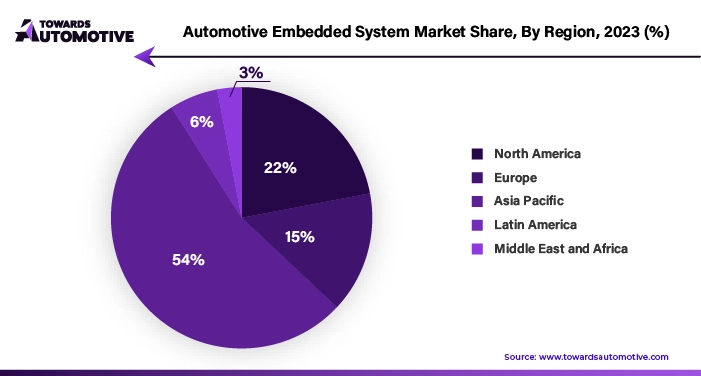

The Asia Pacific automotive embedded systems market is experiencing significant growth driven by increasing consumer demand for advanced vehicles equipped with features such as infotainment, connectivity, and driver assistance. This demand is further fueled by the rise of electric vehicles (EVs) in countries like China, where companies like NIO are leveraging advanced technologies for battery management and autonomous driving capabilities.

Moreover, the region benefits from its expanding manufacturing capacity and technological expertise, which enable the development and production of cutting-edge embedded systems for automotive applications. Government initiatives aimed at promoting the adoption of electric and connected vehicles also play a crucial role in driving growth in the Asia Pacific automotive market.

Overall, the convergence of consumer demand, technological innovation, and supportive government policies is propelling the expansion of the automotive embedded systems market in the Asia Pacific region, positioning it as a key player in the global automotive industry.

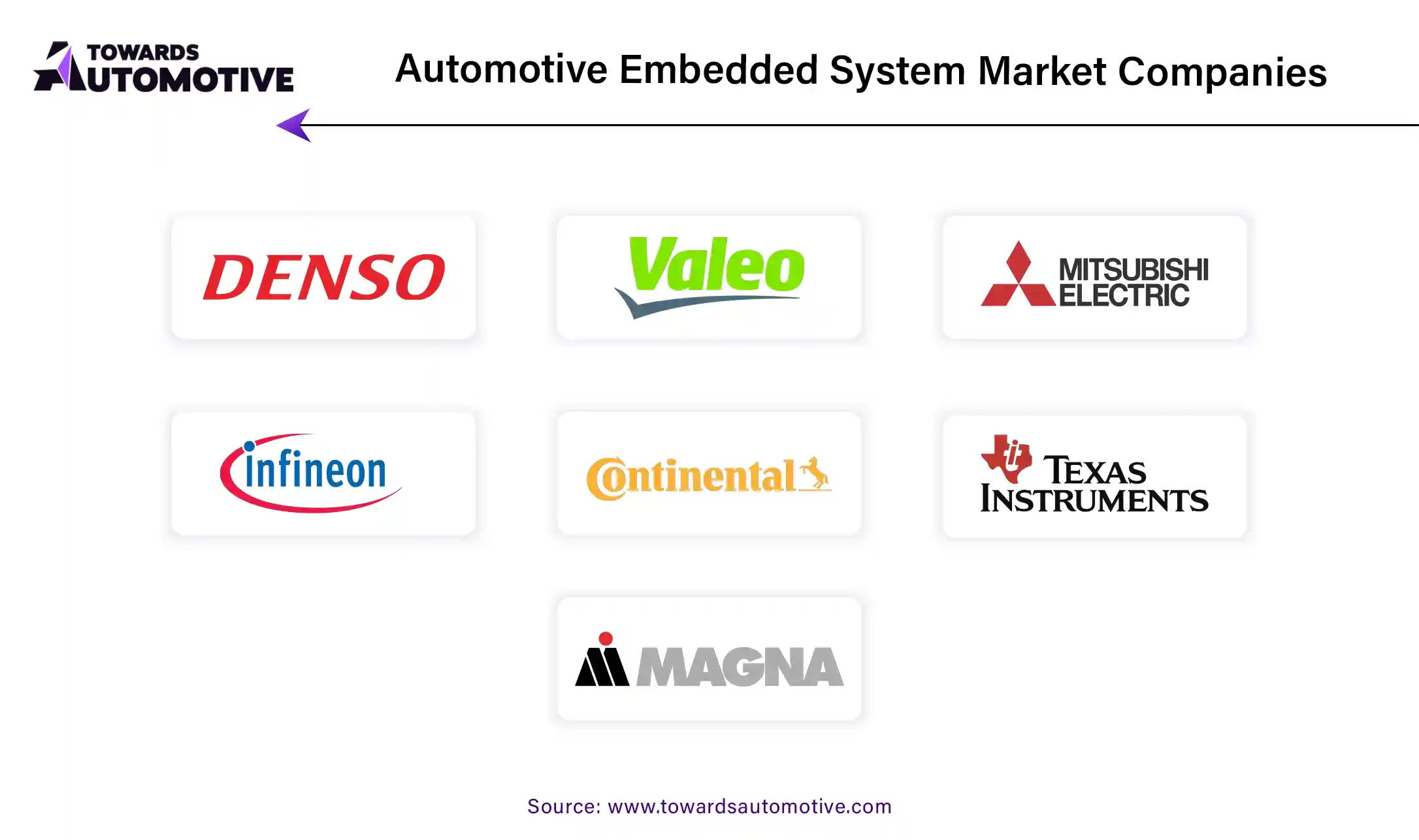

Major companies operating in the automotive embedded system market are

By Type

By Vehicle Type

By Component

By Application

By Geography

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us