April 2025

The automotive energy recovery system market is forecasted to expand from USD 23.95 billion in 2025 to USD 66.15 billion by 2034, growing at a CAGR of 11.95% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive industry, globally and in specific regions like the UK and Europe, is undergoing significant transformation driven by the imperative to reduce carbon emissions and embrace advanced technologies. In April 2020, the UK automotive industry received substantial investment, amounting to US$89.7 million, aimed at mitigating carbon emissions and fostering innovation in the sector. This investment not only bolsters job creation, with around 14,000 new positions expected, but also emphasizes the development of low-cost vehicles, commercial vehicles, and associated components. The overarching goal is to integrate renewable energy sources into vehicles, thereby promoting their adoption and spurring innovation within the automotive segment.

A key focus of these investments is on achieving energy recovery targets to enhance fuel efficiency and reduce emissions, aligning with broader sustainability objectives. The emphasis on low-cost vehicles and commercial vehicles underscores the industry's commitment to driving advancements in energy recovery technologies. However, challenges persist, particularly regarding cost, reliability, and performance considerations within the automotive aftermarket. Consumers and manufacturers must carefully weigh the upfront costs associated with implementing renewable energy systems against the long-term fuel savings they offer.

To address these challenges effectively, there is a pressing need for the development of affordable and reliable energy recovery systems that deliver consistent performance over time. Overcoming these obstacles is essential to realizing the full potential of renewable energy adoption in vehicles and ensuring tangible benefits in terms of cost-effectiveness and reliability. Regional initiatives, such as the $3 billion Spanish program announced by the European Commission in December 2021, underscore the commitment to fostering research, development, and innovation in electric and connected vehicles. These efforts, supported by funding mechanisms like the Recovery and Resilience Fund, are instrumental in driving mobility, sustainability, and competitiveness within the automotive industry while advancing the transition towards cleaner transportation solutions.

The COVID-19 pandemic has presented a mixed bag of challenges and opportunities for the electric vehicle (EV) recovery market. Initially, the outbreak disrupted production and supply chains, leading to slowdowns in manufacturing and distribution. However, amidst these challenges, the EV market has demonstrated resilience and adaptability.

As the world grapples with the need to address climate change and reduce emissions, there has been a notable shift towards electric vehicles and environmentally friendly technologies. Automakers are increasingly prioritizing energy efficiency and sustainability in response to evolving consumer preferences and stringent emissions standards. This strategic shift not only aligns with broader societal and regulatory trends but also presents significant opportunities for the energy recovery sector.

The emphasis on energy efficiency and sustainability creates a conducive environment for the growth of energy recovery solutions within the EV market. These solutions play a crucial role in optimizing energy usage, enhancing overall vehicle performance, and extending battery life. As automakers continue to invest in research, development, and innovation in this space, energy recovery technologies are poised to become integral components of next-generation electric vehicles.

While the initial impact of the COVID-19 pandemic posed challenges for the EV recovery market, the industry's resilience and adaptability, coupled with shifting consumer preferences and regulatory dynamics, are driving momentum towards sustainable and energy-efficient transportation solutions. As such, the long-term outlook for the energy recovery sector within the EV market remains promising, with ample opportunities for growth and innovation in the post-pandemic landscape.

The development of electric and hybrid vehicles has been a transformative phenomenon in the automotive energy recovery system industry. These vehicles leverage regenerative braking systems to capture and store kinetic energy during braking, thereby enhancing overall energy efficiency and reducing fuel consumption. As the automotive industry increasingly pivots towards electric power to meet sustainability targets, there is a growing demand for innovative energy recovery technologies that complement renewable energy systems, thus driving their adoption in the market.

Battery technology innovation plays a pivotal role in advancing automotive energy recovery systems. Breakthroughs in battery technology are instrumental in enhancing the performance and efficiency of energy recovery systems. For instance, in July 2023, Toyota unveiled its ambitious plans to develop cutting-edge electric vehicle (EV) battery technology, optimize aerodynamics, and modernize production processes. Despite external pressures to transition solely to electric vehicles, Toyota remains committed to a diversified approach, encompassing EVs, plug-in hybrid electric vehicles (PHEVs), hybrid electric vehicles (HEVs), and fuel cell electric vehicles (FCEVs).

High-performance batteries are essential for efficiently storing and utilizing recovered energy during driving, particularly during deceleration and braking phases. By effectively harnessing this stored energy, vehicles can improve fuel efficiency and optimize energy management strategies. This aligns with the automotive industry's overarching objectives of reducing emissions, enhancing range, and elevating the performance of electric and hybrid vehicles.

The convergence of electric and hybrid vehicle technologies with innovative battery advancements underscores the importance of energy recovery systems in achieving sustainability goals and driving progress within the automotive industry. As these technologies continue to evolve and mature, they are poised to play a pivotal role in shaping the future of transportation towards a greener and more energy-efficient paradigm.

The battery electric vehicle (BEV) segment is poised for significant growth in the automotive industry, particularly driven by advancements in renewable energy technologies. BEVs, which rely solely on electric power, necessitate the integration of renewable energy sources to optimize their efficiency and range. To address the inherent challenges of pure electric vehicles, such as range limitations, regenerative braking systems and other energy recovery mechanisms have been incorporated into these vehicles. These systems enable the capture and storage of energy during deceleration and braking, which can then be reused to power the vehicle, extend driving range, and reduce reliance on external charging infrastructure.

Commercial vehicles, including buses and delivery vans, are projected to represent a substantial portion of the electric vehicle market by 2022. This trend is attributed to the stop-start nature of commercial vehicle operations, which presents ample opportunities for energy recovery.

Vehicles in commercial fleets stand to benefit significantly from the implementation of energy recovery systems, as they frequently engage in stop-and-go driving patterns that facilitate the capture and reuse of kinetic energy. Moreover, companies operating commercial fleets are increasingly prioritizing initiatives aimed at improving fuel efficiency and reducing emissions. As a result, the integration of renewable energy technologies has emerged as a critical component of the automotive industry's sustainability efforts, driving adoption and fostering business growth within the commercial vehicle segment.

The growing emphasis on renewable energy solutions, coupled with advancements in energy recovery technologies, is reshaping the automotive landscape, particularly within the BEV and commercial vehicle segments. By harnessing the power of renewable energy sources and implementing innovative energy recovery systems, manufacturers and fleet operators alike can enhance the efficiency, sustainability, and overall performance of their vehicles, thereby driving progress towards a greener and more sustainable future for the automotive industry.

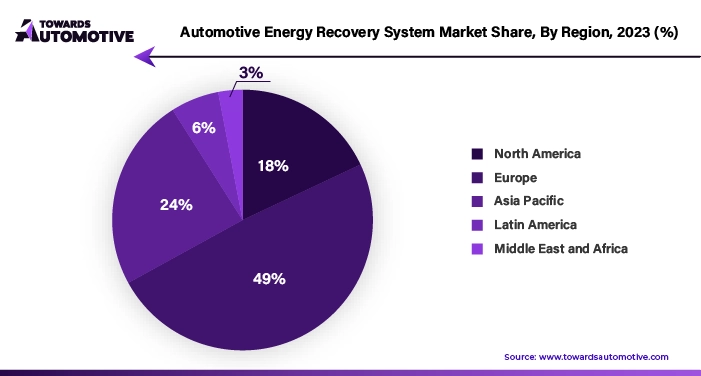

The European automotive energy recovery system market is poised for significant growth, with projections indicating that it will surpass $9.3 billion by 2022. This growth is primarily driven by stringent regulatory frameworks and increasing environmental consciousness within the region, which have prompted a greater emphasis on the adoption of renewable energy solutions to meet sustainability objectives. European automakers are increasingly integrating energy recovery systems into their vehicles as a means to enhance fuel efficiency and curb emissions.

The automotive industry in Europe is subject to strict regulations aimed at reducing carbon emissions and mitigating the environmental impact of transportation. These regulations incentivize automakers to develop and incorporate technologies that improve the environmental performance of their vehicles. As a result, energy recovery systems have become integral components of many European vehicles, enabling them to capture and reuse energy that would otherwise be lost during braking and deceleration. By harnessing this kinetic energy, vehicles can improve their overall fuel efficiency and reduce their carbon footprint, aligning with the region's sustainability goals.

Moreover, government incentives and initiatives further bolster the adoption of renewable energy technologies in the automotive sector. Various European governments offer incentives such as tax credits, subsidies, and grants to encourage consumers to choose vehicles equipped with energy-efficient and environmentally friendly technologies. These measures not only incentivize the purchase of vehicles with energy recovery systems but also drive innovation and investment in renewable energy solutions across the automotive supply chain.

The increasing awareness and concern about environmental issues among European consumers also play a crucial role in driving demand for vehicles with renewable energy technology. As consumers become more environmentally conscious, there is a growing preference for vehicles that prioritize sustainability and minimize environmental impact. This consumer demand further incentivizes automakers to invest in and prioritize the development of energy-efficient vehicles equipped with advanced energy recovery systems.

European automotive energy recovery system market is experiencing robust growth fueled by regulatory mandates, government incentives, and consumer demand for sustainable transportation solutions. As automakers continue to innovate and invest in renewable energy technologies, the adoption of energy recovery systems is expected to accelerate, contributing to a more sustainable and environmentally friendly automotive industry in Europe.

Major companies operating in the automotive energy recovery system industry are

ZF Friedrichshafen AG and Aisin Corporation are prominent players in the automotive energy recovery sector, collectively commanding a substantial market share of approximately 11%. Renowned for their extensive product portfolios and global presence, these companies cater to the diverse needs of various vehicle segments worldwide.

Both ZF Friedrichshafen AG and Aisin Corporation are at the forefront of innovation in the automotive industry, offering cutting-edge solutions such as renewable energy systems and waste-to-energy technology. These advanced technologies are widely adopted by automotive manufacturers seeking to enhance the energy efficiency and sustainability of their vehicles.

One of the key factors contributing to their market dominance is their reputation for reliability, quality, and efficiency. Automotive manufacturers rely on ZF Friedrichshafen AG and Aisin Corporation as preferred partners due to their track record of delivering high-performance solutions that meet stringent industry standards.

With their comprehensive product offerings and global reach, ZF Friedrichshafen AG and Aisin Corporation are well-positioned to capitalize on the growing demand for automotive energy recovery systems. Their continued focus on innovation and commitment to delivering superior products further solidify their leadership positions in the automotive energy recovery sector.

By Propulsion

By Vehicle

By Product

By Geography

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us