April 2025

Senior Research Analyst

Reviewed By

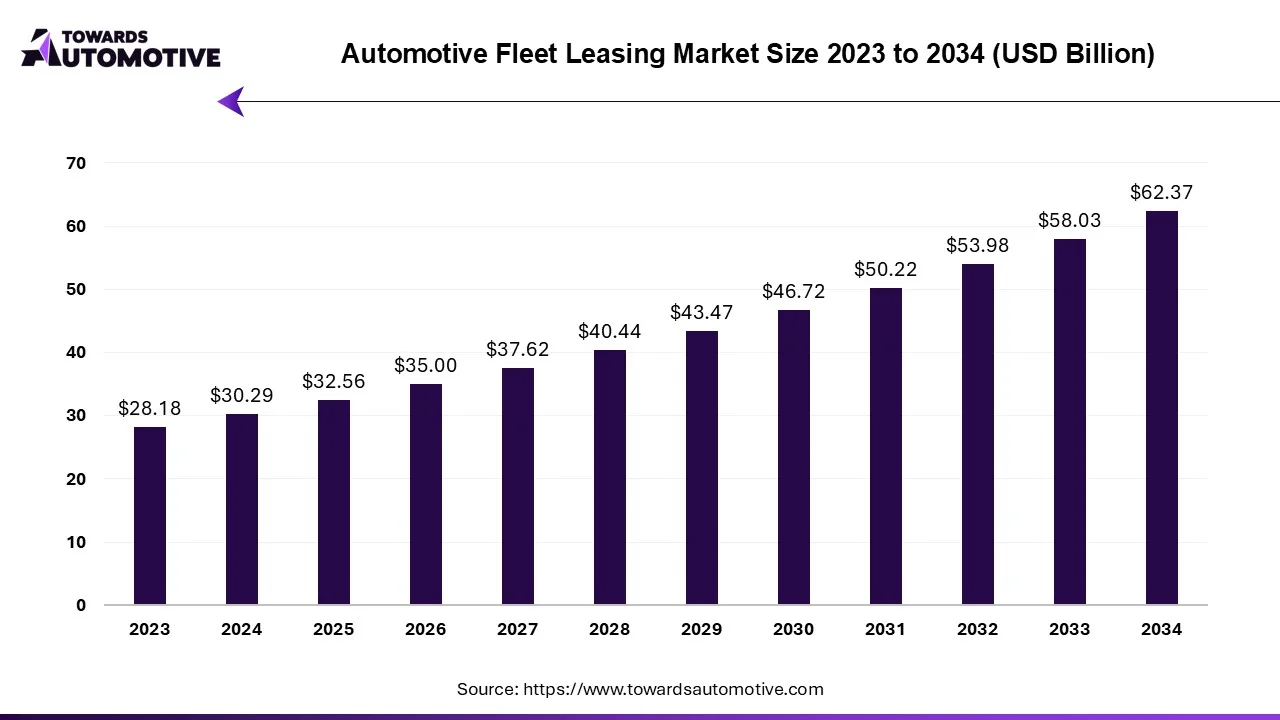

The global automotive fleet leasin market is forecasted to expand from USD 32.56 billion in 2025 to USD 62.37 billion by 2034, growing at a CAGR of 7.49% from 2025 to 2034.

The automotive fleet leasing market refers to the business of leasing vehicles to corporate clients, rather than selling them outright. In this model, companies lease vehicles for their operational needs rather than purchasing them, which can offer several benefits such as cost savings, flexibility, and access to newer vehicle models. The rise of electric vehicles (EVs), autonomous vehicles, and shared mobility are also influencing the automotive fleet leasing market. Leasing companies are adapting their offerings to meet the evolving needs of businesses in these areas.

Leasing vehicles can often be more cost-effective for businesses compared to purchasing them outright. Leasing eliminates the need for large upfront payments and provides predictable monthly expenses, including maintenance and repairs. Further, with increasing emphasis on sustainability, many businesses are opting for greener vehicle options. Leasing allows companies to easily upgrade to newer, more fuel-efficient or electric vehicles as they become available, supporting their environmental objectives.

One of the primary drivers behind the increasing adoption of EVs is the global focus on environmental sustainability. Governments, businesses, and consumers are increasingly concerned about reducing carbon emissions and mitigating climate change. EVs produce zero tailpipe emissions during operation, making them a cleaner alternative to traditional gasoline or diesel vehicles. As businesses strive to meet sustainability goals and comply with regulations aimed at reducing emissions, they are turning to EVs for their fleet operations.

Also, many governments around the world are implementing incentives and regulations to promote the adoption of EVs. These incentives may include tax credits, rebates, grants, and subsidies for purchasing or leasing EVs. Additionally, regulations such as emissions standards and zero-emission vehicle (ZEV) mandates are driving businesses to transition their fleets to electric vehicles. Fleet leasing companies can help businesses navigate these incentives and regulations, making it easier for them to adopt EVs into their fleets.

The growing urbanization with rising population rates is a significant driver of growth in the automotive fleet leasing market. As per the estimations by the World Bank Group, approximately 56% of the global population, totaling 4.4 billion individuals, resides in urban areas. Projections indicate that this trend will persist, with urban populations anticipated to surpass their current figures by 2050, reaching nearly twice the size. At that juncture, close to 7 out of every 10 individuals are forecasted to inhabit urban environments. As urban populations grow, so does the demand for transportation solutions to meet the needs of residents, businesses, and commuters. Urbanization leads to congestion, limited parking space, and challenges associated with private vehicle ownership in densely populated areas. In response, businesses and individuals increasingly turn to fleet leasing as a flexible and efficient alternative to owning vehicles outright.

Economic fluctuations, such as recessions or periods of slow economic growth, often lead to changes in business investment patterns. During economic downturns, businesses may become more cautious and conservative with their spending, including investments in new equipment or fleet expansion. As a result, demand for fleet leasing services may decline as industries prioritize cost-cutting measures and defer capital expenditures. Furthermore, economic downturns can also affect credit availability and interest rates, which are crucial factors for financing fleet leasing operations. Tighter credit markets and higher borrowing costs can make it more challenging for fleet leasing companies to secure financing for purchasing new vehicles or expanding their leasing portfolios. Additionally, companies may be less inclined to take on new lease agreements or may negotiate more favorable lease terms during periods of economic uncertainty.

The integration of connected vehicle technology presents a significant opportunity for driving growth in the automotive fleet leasing market. Connected vehicle technology involves the integration of internet connectivity and telematics systems into vehicles, enabling them to communicate with other vehicles, infrastructure, and external platforms. Connected vehicle technology enhances vehicle safety and security by providing features such as automatic crash notification, stolen vehicle tracking, and remote vehicle immobilization. Fleet leasing companies can leverage these safety and security features to offer safer and more secure fleets to their clients. Businesses value the added safety and security benefits of connected vehicles, leading to increased demand for leasing companies that offer vehicles equipped with these technologies.

As urbanization continues and populations grow, there is an increasing demand for flexible and convenient mobility solutions in urban areas. MaaS solutions offer individuals and businesses the ability to access a wide range of transportation options, including leased vehicles, ride-sharing, car-sharing, public transit, and micro-mobility services (e.g., electric scooters, bicycles), all through a single platform. This integrated approach to mobility aligns with the preferences of modern consumers and businesses, driving demand for fleet leasing companies that participate in MaaS ecosystems.

MaaS providers require diverse fleets of vehicles to support their integrated mobility services. Fleet leasing companies play a crucial role in supplying vehicles to MaaS providers, either through direct leasing agreements or partnerships. Leased vehicles are often used to support ride-sharing and car-sharing services, as well as delivery and logistics operations for MaaS providers. The diverse fleet requirements of MaaS providers create opportunities for fleet leasing companies to expand their client base and increase leasing volumes.

The open-ended segment held the largest market share of 61.94% in 2023, primarily driven by the flexibility and competitive monthly rates. Open-ended leases represent a leasing option that provides businesses with a high degree of flexibility to adapt to their evolving operational needs. These leases allow companies the freedom to extend the lease term, purchase the leased vehicles, or return them at the end of the lease period. This flexibility is particularly advantageous for companies facing uncertain market conditions or fluctuating demand, as it enables them to adjust their fleet size and composition accordingly without being locked into long-term commitments.

One of the key benefits of open-ended leases is their lower monthly payments compared to closed-ended leases. This financial advantage makes open-ended leases an attractive option for businesses looking to manage their fleet expenses more efficiently. By minimizing monthly payments, businesses can allocate their resources more effectively, allowing for greater financial flexibility and stability. Additionally, open-ended leases offer a range of customizable options to tailor the lease terms to their specific requirements.

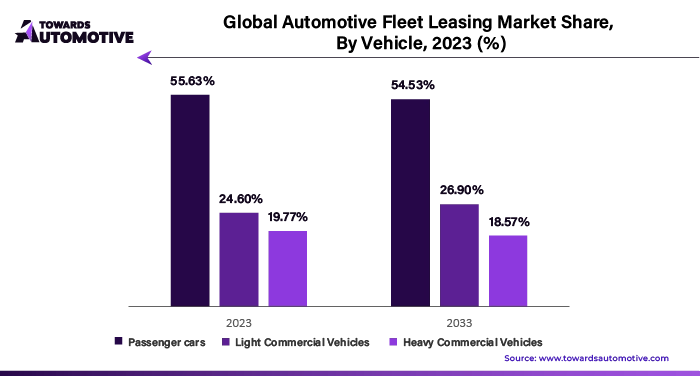

Passenger cars segment dominated the market with share of 55.63% and is expected to grow at a CAGR of 7.16% from 2024 to 2033. This is owing to the increasing consumer preferences for passenger cars. Factors such as comfort, style, performance, and brand reputation influence consumer decisions when purchasing or leasing passenger cars. Trends such as the preference for SUVs, crossovers, and electric vehicles also impact the passenger car segment. Also, features such as advanced infotainment systems, driver-assistance technologies, connectivity options, and fuel-efficient engines appeal to consumers and drive demand for newer models which in turn is expected to support the growth of the segment during the forecast period.

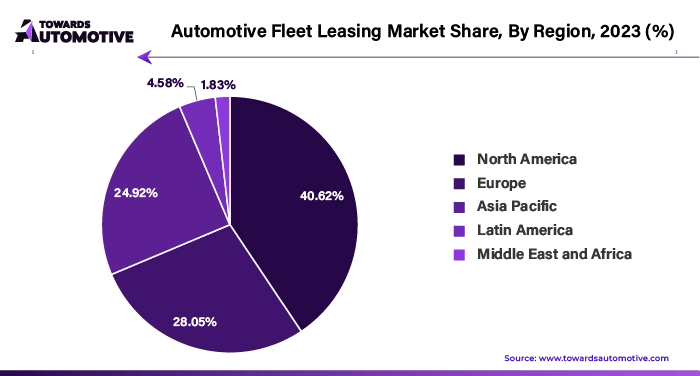

North America dominated the global automotive fleet leasing market with 40.62% of the share of the total market in 2023 and is likely to continue the same trend during the forecast period. The convenience, flexibility, and cost-effectiveness of leasing arrangements appeal to businesses seeking to optimize their fleet operations while minimizing administrative burdens and financial risks. Furthermore, the North American market offers various tax benefits and financial incentives for businesses that lease vehicles for commercial purposes. Tax deductions, depreciation allowances, and favorable lease terms contribute to the attractiveness of fleet leasing as a cost-effective option for businesses looking to manage their transportation expenses efficiently.

Asia Pacific is likely to grow at fastest CAGR of 9.16% in the automotive fleet leasing market during the forecast period. This is due to the rapid economic growth, leading to increased industrialization, urbanization, and infrastructure development. As businesses expand and industries grow, there is a growing demand for corporate transportation solutions, driving the need for fleet leasing services. Additionally, Infrastructure development initiatives in Asia Pacific, including the construction of roads, highways, and transportation networks, contribute to the demand for fleet leasing services. Improved infrastructure facilitates the movement of goods and people, driving the need for transportation solutions, including leased vehicles, to support business operations.

Some of the key players in automotive fleet leasing market are ARI, Element Fleet Management Corp., Enterprise Holdings, Emkay, Caldwell Leasing, AutoFlex AFV, Ayvens, Ewald Automotive Group, Merchants Fleet, Samsara Networks, Inc., Glesby Marks, Sixt Leasing SE and Velcor Leasing Corporation, among others.

By Lease

By Vehicle

By Application

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us