December 2025

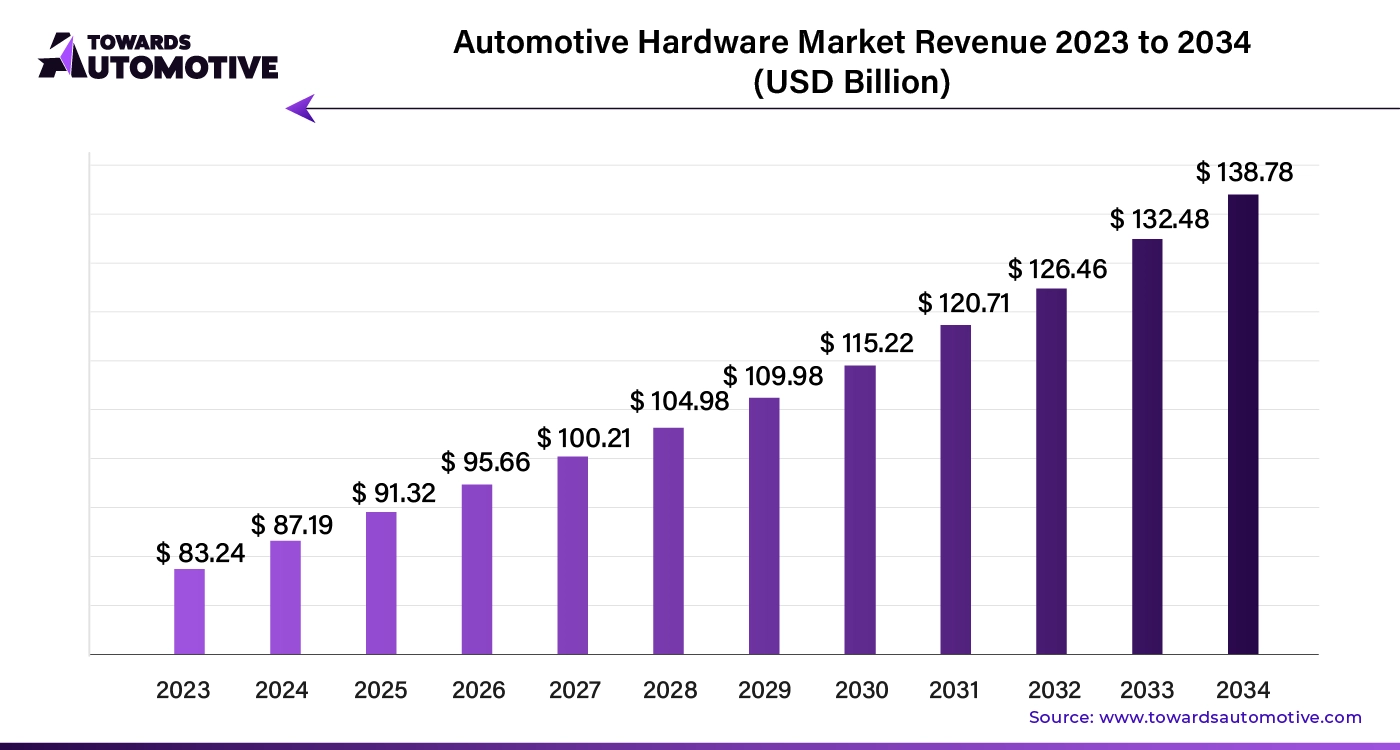

The automotive hardware market is set to grow from USD 91.32 billion in 2025 to USD 138.78 billion by 2034, with an expected CAGR of 4.8% over the forecast period from 2025 to 2034. The increasing sales of passenger vehicles in different parts of the world coupled with technological advancements in the automotive sector has driven the market expansion.

Additionally, numerous government initiatives aimed at adopting EVs along with growing use of high-quality hardware components in commercial vehicles is playing a crucial role in shaping the industrial landscape. The rapid adoption of robotic manufacturing technology in the automotive industry is expected to create ample growth opportunities for the market players in the upcoming days.

The automotive hardware market is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of hardware components for the automotive sector. There are various types of products developed in this sector comprising of fasteners, locks & latches, hinges, brackets, door handles, interior trim components and some others. These products are designed for several types of vehicles including passenger cars, commercial vehicles and electric/hybrid vehicles. It is available in a well-established distribution channel consisting of OEMs and aftermarket. This market is expected to rise significantly with the growth of the EV sector in different parts of the world.

The major trends in this market consists of partnerships, business expansions and growing sales of commercial vehicles.

The fasteners segment dominated the automotive hardware market. The increasing use of threaded fasteners in EVs has boosted the market expansion. Additionally, the growing demand for stainless-steel based fasteners from the automotive sector due to high durability and low maintenance is playing a crucial role in shaping the industrial landscape. Moreover, the rising application of fasteners to mechanically join components for providing structural support, ensure safety, resist vibration, and enable serviceability in the automotive sector is expected to proliferate the growth of the automotive hardware market.

The interior trim components segment is expected to rise with a notable CAGR during the forecast period. The rising demand for decorative and aesthetic cabins from luxury car owners has driven the market expansion. Also, the surging popularity of climate-controlled seats in developed nations coupled with the increasing use of armrests in SUVs to enhance driving experience is playing a prominent role in shaping the industry in a positive direction. Moreover, rapid investment by market players for constructing new production facilities to enhance the manufacturing of interior trim components is expected to drive the growth of the automotive hardware market.

The passenger cars segment held the largest share the automotive hardware market. The growing sales and production of passenger vehicles in several countries including India, Germany, the U.S., Canada and some others has boosted the market expansion. Additionally, the increasing adoption of high-quality hardware components by luxury car manufacturers is playing a vital role in shaping the industrial landscape. Moreover, the rising use of li-ion batteries in electric vehicles to provide superior driving range is expected to boost the growth of the automotive hardware market.

The commercial vehicles segment is expected to expand with a robust CAGR during the forecast period. The rising demand for heavy duty trucks from several industries such as mining, logistics, e-commerce and some others has driven the market expansion. Additionally, growing investment by automotive brands for developing LCEVs coupled with rapid emphasis of automotive component manufacturers to open new production facilities is contributing to the industry in a positive manner. Moreover, partnerships among market players and commercial vehicles manufacturers is expected to drive the growth of the automotive hardware market.

The OEMs segment led the automotive hardware market. The increasing consumer preference to purchase automotive components from automotive OEMs has boosted the market expansion. Additionally, numerous offers and assured guarantee provided by OEMs for buying automotive parts is contributing to the industry in a positive manner. Moreover, rapid investment by automotive OEMs for opening up new outlets to enhance their brand presence is expected to drive the growth of the automotive hardware market.

The aftermarket segment is expected to grow with a considerable CAGR during the forecast period. The growing demand for cost-effective automotive hardware components from several low-income countries including Thailand, Vietnam, Indonesia, Somalia and some others has driven the market expansion. Also, the increasing trend of aftermarket modification along with numerous subscription-based services offered by aftermarket platforms is contributing to the industrial growth. Moreover, the availability of various automotive hardware components in several online platforms such as Amazon, Alibaba, Walmart and some others is expected to accelerate the growth of the automotive hardware market.

Asia Pacific dominated the automotive hardware market. The growing sales and production of commercial vehicles in several nations such as India, China, Japan, South Korea and some others has increased the demand for high-quality hardware components, thereby driving the market expansion. Additionally, rapid investment by market players for opening up new automotive hardware production facilities coupled with rise in number of garages and workshops is playing a vital role in shaping the industrial landscape. Moreover, the presence of local automotive hardware manufacturers such as Aisin Seiki Co., Ltd., Denso, Panasonic Automotive, Uno Minda and some others is expected to propel the growth of the automotive hardware market in this region.

North America is expected to grow with a significant CAGR during the forecast period. The increasing adoption of electric vehicles in the U.S. and Canada for lowering emission has driven the market expansion. Additionally, rapid investment by government for developing the automotive component industry coupled with technological advancements in the automotive sector is contributing to the industry in a positive manner. Moreover, the presence of several market players such as Harman International Industries, Inc, Phinia Inc, Magna International and some others is expected to boost the growth of the automotive hardware market in this region.

The production of automotive hardware components consists of several types of raw materials such as steel, aluminum, plastics, and rubber.

Automotive hardware components are fabricated using a combination of techniques such as metal fabrication (stamping, bending, cutting), casting, and forging for complex or high-stress parts, with 3D printing offering customization and rapid prototyping.

Quality control on a vehicle is a systematic process aimed at ensuring the vehicle meets predefined standards of performance, safety, and reliability. It involves thorough checks at every stage of manufacturing, including the inspection of raw materials, components, assembly processes, and final product tests.

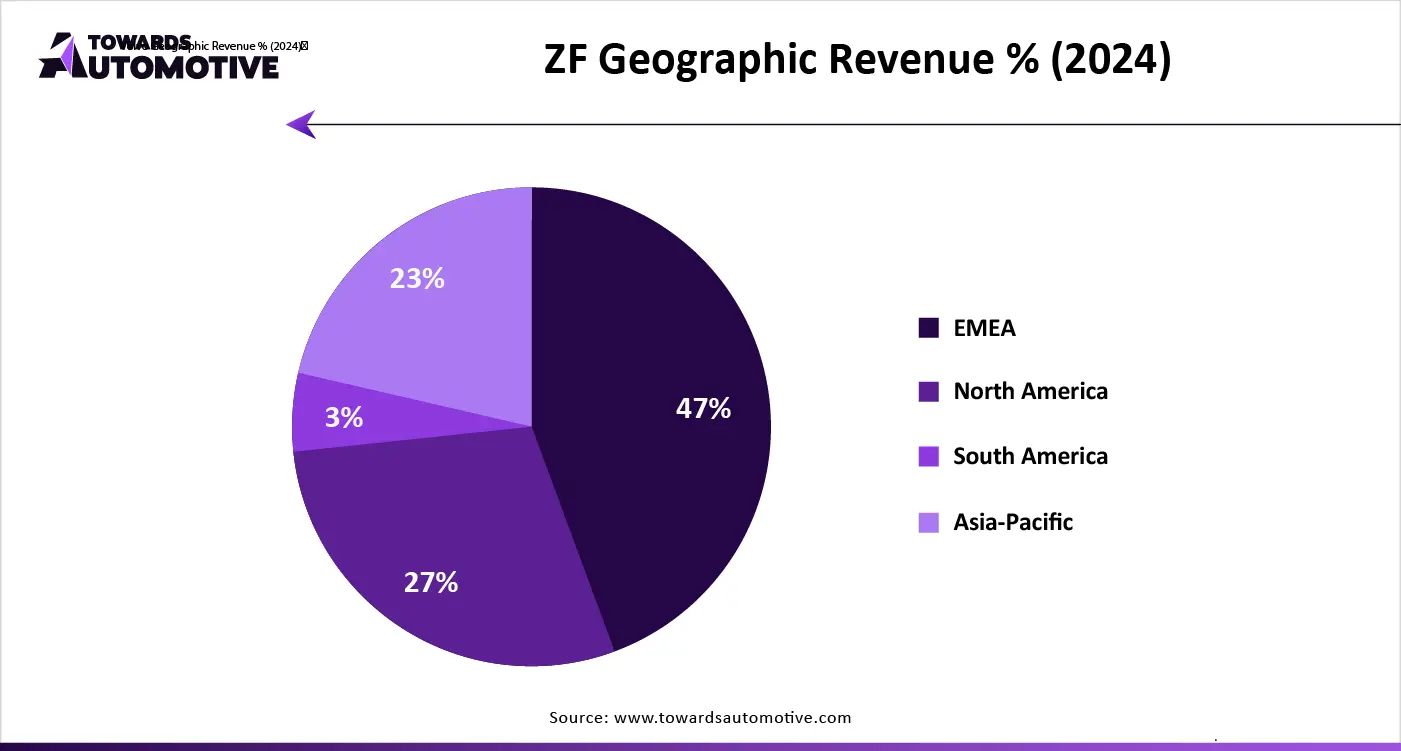

The automotive hardware market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of ZF Friedrichshafen, Autoliv, Panasonic Automotive, Bosch, Continental, Denso, Valeo, Magna International, Infineon Technologies, NXP Semiconductors, Aptiv, Alpine Electronics, Aisin Seiki Co., Ltd., Harman International and some others. These companies are constantly engaged in manufacturing hardware components for the automotive sector and adopting numerous strategies such as partnerships, collaborations, launches, joint ventures, business expansions, acquisitions, and some others to maintain their dominance in this industry.

By Product

By Vehicle

By Sales Channel

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us