April 2025

Senior Research Analyst

Reviewed By

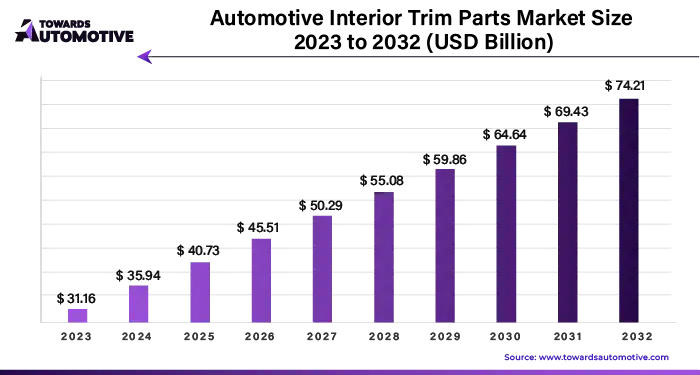

The automotive interior trim parts market is anticipated to grow from USD 36.61 billion in 2025 to USD 33.77 billion by 2034, with a compound annual growth rate (CAGR) of 8.39% during the forecast period from 2025 to 2034.

The automotive interior trim market plays a crucial role in enhancing both the aesthetic appeal and functionality of a vehicle's interior. Interior trim refers to the materials and components used to finish the inside of a vehicle, including dashboard elements, door panels, seats, headliners, flooring, and various other components. These trims are not only essential for the visual appeal of the vehicle but also contribute to comfort, durability, and overall driving experience. The automotive interior trim market has seen significant growth due to the increasing consumer demand for personalized and high-quality interiors that offer a premium experience.

Factors such as rising disposable incomes, technological advancements, and growing consumer preference for aesthetically pleasing and comfortable vehicle interiors have fueled the market’s expansion. Automakers are continuously innovating in materials and design to meet these evolving consumer expectations, leading to the use of premium materials like leather, wood, metal, and advanced synthetic options in vehicle interiors. The demand for eco-friendly and sustainable materials has also gained momentum in recent years, as consumers and manufacturers alike focus on reducing their environmental footprint.

Additionally, the increasing adoption of advanced features such as ambient lighting, multimedia systems, and smart surfaces within vehicle interiors is further driving market growth. The automotive interior trim market is evolving in line with advancements in design, materials, and consumer preferences, making it a key segment in the broader automotive industry. With the rise of electric and autonomous vehicles, the focus on enhancing interior experiences is expected to continue, further expanding opportunities in the market.

AI plays a significant role in the automotive interior trim market by enhancing design, manufacturing processes, and overall user experience. AI technologies, such as machine learning and computer vision, are used to optimize the design of vehicle interiors, ensuring better ergonomics, aesthetic appeal, and functionality. Through AI-driven simulations, manufacturers can test various interior layouts, materials, and features to identify optimal configurations, reducing time and costs associated with the physical prototyping process.

In the production process, AI-enabled automation and robotics improve the efficiency and precision of interior trim manufacturing. These systems can detect defects, ensure consistency, and enhance quality control, leading to higher product standards. AI also helps in the integration of advanced features like smart surfaces, touch-sensitive panels, and ambient lighting, all of which are becoming increasingly popular in modern vehicle interiors.

Additionally, AI-driven technologies contribute to a more personalized experience for vehicle occupants. AI can be used to create intelligent systems that adjust interior trim elements, such as seat positions, ambient lighting, and climate control, based on individual preferences or driving conditions. This level of customization enhances comfort and convenience, making the vehicle’s interior environment more adaptable and responsive to the needs of the driver and passengers.

AI also helps manufacturers meet growing consumer demands for sustainability by optimizing material selection and production methods, ensuring that eco-friendly materials are efficiently utilized, and reducing waste. In this way, AI is transforming the automotive interior trim market by driving innovation, improving production efficiency, and creating more personalized and sustainable interior experiences.

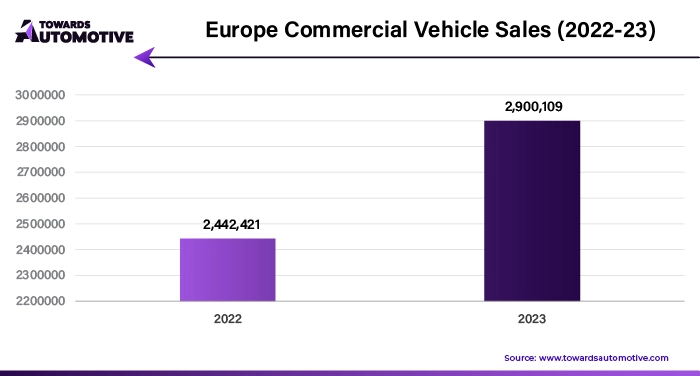

The rising sales of commercial vehicles are a key driver in the growth of the automotive interior trim market. As commercial vehicle demand increases, driven by the expansion of logistics, transportation, and e-commerce sectors, the need for enhanced interior trim solutions becomes more pronounced. Commercial vehicles, including trucks, buses, and vans, require durable and functional interior features that can withstand heavy use while providing comfort and practicality for drivers and passengers. This has led to a growing emphasis on high-quality materials, robust finishes, and customizable interior trim solutions to cater to the unique requirements of commercial vehicles.

In addition, the growing focus on improving the driver and passenger experience in commercial vehicles has prompted manufacturers to invest in advanced interior trim designs. Features such as noise reduction, ergonomic seating, and premium finishes are becoming increasingly important in the commercial vehicle sector, prompting automakers to enhance the aesthetics and comfort levels of interiors. As fleet operators and businesses recognize the value of high-quality interiors in boosting the comfort, safety, and appeal of their vehicles, demand for automotive interior trim solutions continues to rise.

Furthermore, the ongoing adoption of electric and hybrid commercial vehicles adds another layer of growth for the market. These vehicles often require innovative interior solutions that combine sustainability with advanced technology. As commercial vehicle sales grow, driven by the rise of e-commerce, logistics, and green transportation initiatives, the automotive interior trim market will continue to thrive, offering opportunities for manufacturers to provide tailored, durable, and eco-friendly interior solutions.

The automotive interior trim market faces several challenges, including the high cost of premium materials like leather and advanced composites, which can increase vehicle prices. Additionally, complex manufacturing processes and stringent regulatory standards for safety and environmental concerns add to production costs and time. Supply chain disruptions and raw material shortages further complicate production, leading to delays and potential shortages. These factors collectively hinder the growth and efficiency of the automotive interior trim market, particularly in cost-sensitive segments.

The rapid adoption of eco-friendly materials in the automotive interior trim market creates significant opportunities for growth, driven by increasing consumer demand for sustainable and environmentally conscious products. As the automotive industry seeks to reduce its carbon footprint, automakers are increasingly turning to materials like recycled plastics, bio-based composites, and natural fibers such as hemp, jute, and cotton. These materials not only contribute to a reduced environmental impact but also appeal to eco-conscious consumers who prefer vehicles with minimal ecological harm.

Furthermore, advancements in sustainable manufacturing processes and the use of alternative, low-impact materials offer a competitive edge to manufacturers. These innovations allow for a balance between aesthetics, functionality, and environmental benefits, making eco-friendly automotive interior trims more attractive to both consumers and producers. Governments worldwide are also introducing regulations and incentives to encourage the use of sustainable materials in manufacturing, further boosting this market trend.

Additionally, eco-friendly materials can result in weight reductions for vehicle interiors, contributing to better fuel efficiency and performance—key considerations in the growing electric vehicle (EV) market. As consumers and manufacturers prioritize sustainability, the demand for eco-friendly materials in automotive interior trims is expected to rise, offering ample growth opportunities for companies that can innovate in this area. This shift is reshaping the market, as automakers adopt greener solutions to meet consumer preferences, regulatory requirements, and their own sustainability goals.

The plastic segment held a dominant share of the market. The plastic segment is a key driver of growth in the automotive interior trim market, primarily due to its versatility, cost-effectiveness, and ability to meet the growing demand for lightweight materials. Plastic components are widely used in various parts of a vehicle's interior, including dashboard panels, door trims, console covers, and instrument clusters, among others. The ability to mold plastics into various shapes and sizes allows automakers to create aesthetically pleasing and functional designs, offering both flexibility in production and a broad range of customization options for consumers.

One of the key factors driving the growth of the plastic segment is the increasing demand for lightweight vehicles, which enhances fuel efficiency and reduces emissions. Plastic parts are significantly lighter than traditional materials like metal, helping manufacturers achieve the desired weight reduction while maintaining strength and durability. This aligns with the global push for more fuel-efficient and eco-friendly vehicles, especially as stricter environmental regulations are being enforced worldwide.

Furthermore, advancements in plastic technology, such as the development of high-strength composites, are enabling the creation of more durable and sophisticated components for vehicle interiors. The growing popularity of premium interiors, with high-quality plastic materials that mimic the look and feel of leather or wood, is also pushing demand. Additionally, plastic's cost-effectiveness makes it an attractive option for manufacturers, as it offers a balance between performance, aesthetics, and production costs. The combination of these factors contributes to the increasing dominance of the plastic segment in the automotive interior trim market, promoting sustained growth.

The seats segment led the industry. The seats segment plays a pivotal role in driving the growth of the automotive interior trim market, as seats are one of the most important components that influence both comfort and aesthetics in a vehicle’s interior. The increasing demand for enhanced passenger comfort and vehicle personalization is pushing automakers to focus on high-quality, innovative seat designs. The trend towards premium, ergonomic seats with features such as heating, cooling, and memory functions is driving significant growth in the segment. These advanced features not only improve comfort but also elevate the overall driving experience, which appeals to consumers seeking greater luxury and convenience.

Additionally, the rise of electric vehicles (EVs) and autonomous vehicles is contributing to growth in the seats segment, as these vehicles often require specialized seating configurations that prioritize comfort, flexibility, and space efficiency. In EVs, for example, automakers are integrating seats that maximize cabin space, offering more legroom and modular layouts due to the absence of a traditional engine. In autonomous vehicles, seats may be designed for a more relaxed position, with increased emphasis on passenger well-being and comfort during long rides.

The growing consumer preference for sustainable and eco-friendly materials is also influencing the seats segment, as manufacturers explore the use of recycled and biodegradable fabrics, leather alternatives, and other sustainable materials for upholstery. These trends are encouraging innovation within the seats segment of the automotive interior trim market, as manufacturers continuously enhance the functionality, sustainability, and comfort of vehicle seating, thus supporting market growth.

Asia Pacific dominated the automotive interior trim market. The automotive interior trim market in the Asia Pacific (APAC) region is experiencing significant growth due to several key drivers. Firstly, the growing demand for automobiles in emerging markets such as China, India, and Southeast Asia plays a major role in propelling the automotive interior trim market. The increasing disposable incomes, rising urbanization, and expanding middle class in these countries are driving the demand for vehicles, particularly passenger cars, which in turn boosts the demand for high-quality interior trim components.

Secondly, the shift toward premium and luxury vehicles in APAC is another major driver. As consumer preferences evolve toward more sophisticated, aesthetically appealing interiors, automakers are incorporating higher-quality materials such as leather, high-grade plastics, and advanced composites into vehicle designs. This trend is driving the demand for innovative interior trim solutions that provide a combination of luxury, comfort, and durability.

Thirdly, stringent government regulations regarding vehicle safety and environmental standards are pushing manufacturers to adopt more sustainable and lightweight materials in vehicle interiors. These regulations are also encouraging the use of eco-friendly materials, such as bio-based plastics and recycled composites, which are becoming increasingly popular in the region.

Additionally, technological advancements in automotive design and manufacturing processes are further fueling growth in the APAC automotive interior trim market. The adoption of advanced technologies, such as 3D printing and automation, has enabled manufacturers to create complex and customized interior components more efficiently, thus enhancing the overall consumer experience.

Europe is expected to grow with the highest CAGR during the forecast period. The automotive interior trim market in Europe is driven by several key factors that are shaping the demand for advanced, high-quality interior components. Firstly, growing consumer preference for luxury and premium vehicles plays a significant role. European consumers are increasingly opting for cars that offer higher levels of comfort, luxury, and customization, pushing automakers to incorporate premium materials like fine leather, high-grade plastics, and innovative trim designs into their interiors. The shift toward electric vehicles (EVs) and hybrid models is also influencing this trend, as consumers seek modern, environmentally conscious interiors with advanced features.

Secondly, advancements in technology and manufacturing are fueling the automotive interior trim market in Europe. Innovations such as 3D printing, advanced molding techniques, and improved material technologies are allowing manufacturers to produce more intricate and customized interior trim components. This enables automakers to meet evolving consumer demands for aesthetics, functionality, and sustainability in vehicle interiors.

Thirdly, government regulations and environmental standards are driving the adoption of sustainable and eco-friendly materials. The European Union’s stringent regulations regarding carbon emissions, fuel efficiency, and sustainability are pushing manufacturers to develop and use greener materials in interior trim. The increasing use of recyclable plastics, bio-based composites, and sustainable leather alternatives is becoming a key feature of automotive interior designs in the region.

Furthermore, rising demand for connected and smart interiors is contributing to the growth of the automotive interior trim market. As the automotive industry evolves toward more connected, high-tech vehicles, consumers are increasingly seeking interiors that incorporate advanced infotainment systems, touchscreens, and customizable lighting, leading to more innovative and functional trim solutions in European vehicles.

By Material Type

By Vehicle Type

By Component

By Level

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us