April 2025

Senior Research Analyst

Reviewed By

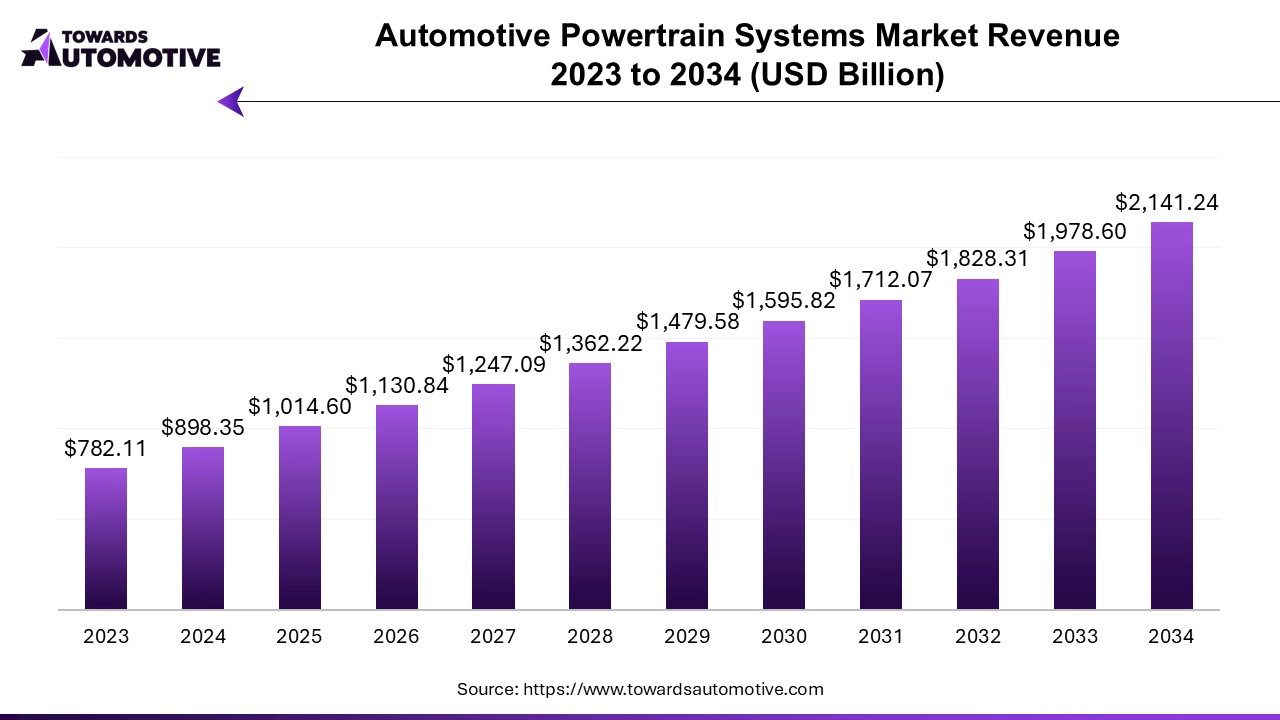

The global automotive powertrain systems market is expected to increase from USD 1,014.60 billion in 2025 to USD 2,141.24 billion by 2034, growing at a CAGR of 8.22% throughout the forecast period from 2025 to 2034.

The automotive powertrain systems market is experiencing significant growth due to the increasing demand for fuel-efficient and high-performance vehicles. The powertrain, which comprises the engine, transmission, driveshafts, and differential, plays a crucial role in delivering power to the vehicle’s wheels. With the global shift towards reducing emissions and improving energy efficiency, automakers are focusing on developing advanced powertrain technologies, including hybrid and electric powertrains. The rise in electric vehicle (EV) adoption is particularly driving innovation, as electric powertrains offer a cleaner alternative to traditional internal combustion engines (ICE), supporting sustainability goals.

Moreover, advancements in hybrid technology have resulted in powertrains that combine both electric and ICE components, offering a balance between performance and energy efficiency. Governments worldwide are implementing stringent emission regulations, pushing manufacturers to invest in lightweight materials, turbocharged engines, and more efficient transmission systems. Additionally, consumer demand for vehicles that offer better fuel economy and lower operational costs is boosting the market. In regions like Asia-Pacific and Europe, where environmental regulations are more aggressive, the demand for advanced automotive powertrains is even higher. As the industry transitions towards electrification and hybridization, the automotive powertrain market is poised for robust growth in the coming years.

AI plays a transformative role in the automotive powertrain systems market by enhancing efficiency, performance, and sustainability. One of the key applications of AI is in optimizing powertrain systems for better fuel efficiency and reduced emissions. AI algorithms analyze vast amounts of data in real-time, allowing engines and transmissions to adapt to driving conditions, terrain, and driver behavior. This leads to smarter energy management, minimizing fuel consumption and improving vehicle performance.

AI also aids in predictive maintenance, where sensors integrated into the powertrain continuously monitor the health of components. Using machine learning models, the system can predict potential failures before they occur, ensuring timely maintenance and reducing downtime. This not only enhances the reliability of vehicles but also extends the lifespan of powertrain components, resulting in cost savings for manufacturers and vehicle owners.

Additionally, AI is crucial in the development of hybrid and electric powertrains. It helps in optimizing energy distribution between the engine and battery in hybrid vehicles, ensuring seamless transitions and efficient power usage. In electric vehicles (EVs), AI-driven systems manage battery performance, cooling, and regenerative braking to maximize range and longevity.

Furthermore, AI contributes to advancements in autonomous vehicles, where the powertrain must respond to inputs from AI-driven driving systems, adapting to various driving scenarios and environmental conditions. Overall, AI’s integration into the automotive powertrain market drives innovation, leading to cleaner, more efficient, and intelligent powertrain solutions.

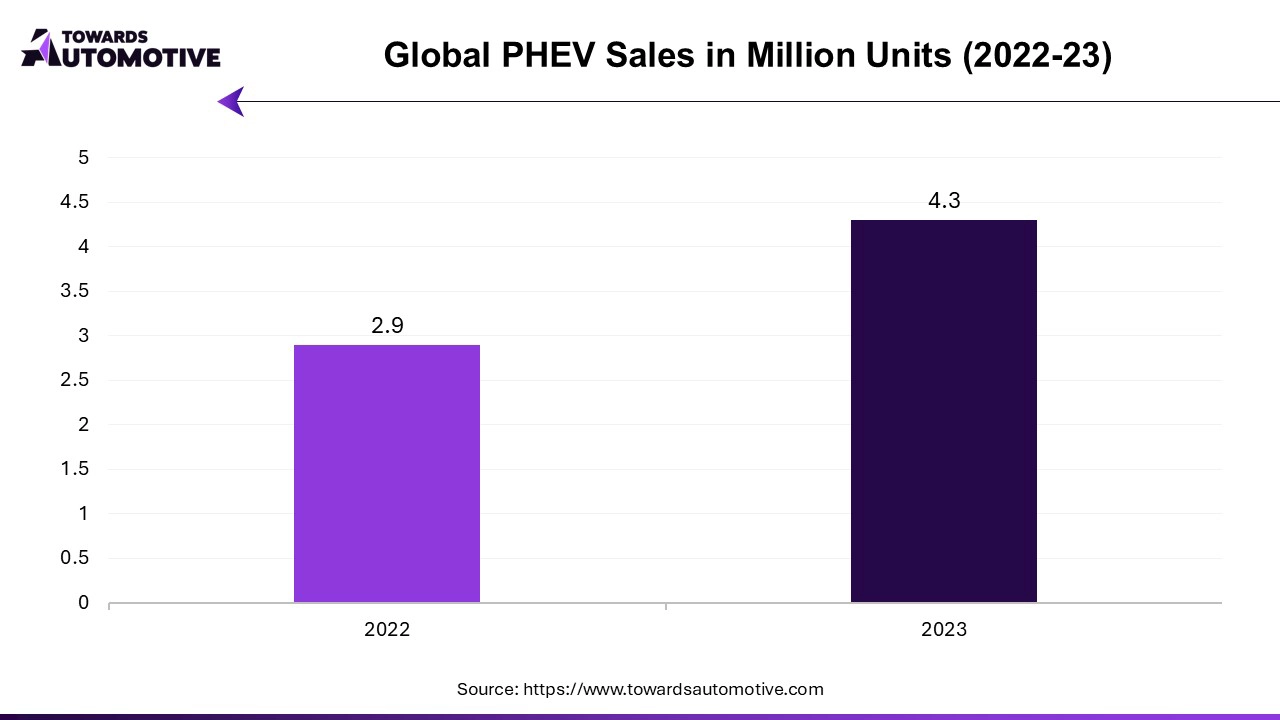

The growing demand for hybrid vehicles is a significant driver of the automotive powertrain systems market, reflecting a broader trend towards sustainable and efficient transportation solutions. As consumers become increasingly aware of the environmental impact of traditional internal combustion engine (ICE) vehicles, they are seeking alternatives that offer improved fuel efficiency and reduced emissions. Hybrid vehicles, which combine an ICE with an electric motor, provide an appealing solution, striking a balance between performance and sustainability.

One of the primary factors fueling this demand is the rising fuel prices, which have made consumers more conscious of their fuel expenditures. Hybrid vehicles typically offer better mileage than their conventional counterparts, resulting in lower fuel costs and decreased frequency of refueling. This economic benefit has led to increased consumer interest and adoption of hybrid models, prompting automakers to expand their hybrid offerings.

Additionally, government regulations aimed at reducing greenhouse gas emissions and promoting clean energy technologies are further propelling the hybrid vehicle market. Many countries are implementing stringent emissions standards and providing incentives for the purchase of hybrid vehicles, making them more attractive to consumers. This regulatory environment encourages manufacturers to invest in hybrid powertrain technologies, resulting in innovative designs that enhance efficiency and performance.

Moreover, advancements in battery technology are enhancing the appeal of hybrid vehicles. Improved battery efficiency and decreased costs are enabling longer electric-only ranges and faster charging times, making hybrids more convenient for everyday use. As a result, automakers are increasingly integrating sophisticated hybrid powertrains into their vehicles, fostering competition in the market.

The automotive powertrain systems market faces several restraints that may hinder its growth. One significant challenge is the high cost of advanced powertrain technologies, including electric and hybrid systems, which can deter consumers from making the switch from traditional internal combustion engines. Additionally, the lack of charging infrastructure for electric and hybrid vehicles, especially in developing regions, poses a significant barrier to widespread adoption. Regulatory complexities and varying standards across different markets can also impede manufacturers' ability to innovate and introduce new powertrain solutions efficiently. Furthermore, the global supply chain disruptions and component shortages can adversely affect production timelines and costs.

Hydrogen fuel cells are emerging as a significant opportunity in the automotive powertrain systems market, driven by their potential to provide clean and efficient energy solutions. As the automotive industry increasingly focuses on reducing carbon emissions, hydrogen fuel cells offer an attractive alternative to traditional internal combustion engines and even battery electric vehicles. These fuel cells generate electricity through a chemical reaction between hydrogen and oxygen, producing only water as a byproduct, which aligns perfectly with global sustainability goals.

Additionally, hydrogen fuel cells can be refueled quickly, similar to conventional gasoline vehicles, addressing one of the major challenges of battery electric vehicles—long charging times. This quick refueling capability makes them particularly appealing for commercial applications, such as buses and heavy-duty trucks, where downtime needs to be minimized. The expanding hydrogen infrastructure, driven by investments from governments and private sectors, further enhances the feasibility of hydrogen fuel cells as a mainstream powertrain solution.

As research and development continue to advance the efficiency and reduce the costs of hydrogen production and storage, the automotive powertrain market is likely to witness increased adoption of fuel cell technology, opening new avenues for manufacturers and creating a competitive edge in a rapidly evolving market landscape.

The Internal Combustion Engine (ICE) segment held the largest share of the market. The Internal Combustion Engine (ICE) segment plays a crucial role in driving the growth of the automotive powertrain systems market, primarily due to its established presence and widespread acceptance among consumers. Despite the increasing shift towards electrification, ICE vehicles remain dominant in global automotive sales, especially in regions with underdeveloped electric vehicle (EV) infrastructure. As a result, manufacturers continue to innovate and enhance ICE technologies to meet evolving consumer demands and stringent emissions regulations. These advancements focus on improving fuel efficiency, reducing emissions, and enhancing performance, which contribute to the attractiveness of ICE vehicles in the market.

One significant driver for the ICE segment is the ongoing demand for fuel-efficient vehicles. Consumers often prioritize fuel economy and affordability, particularly in markets where gasoline and diesel prices fluctuate. Automakers are responding to this demand by investing in technologies such as turbocharging, variable valve timing, and direct fuel injection, which enhance engine performance while minimizing fuel consumption. Additionally, many consumers in emerging markets still prefer ICE vehicles due to their lower upfront costs compared to EVs, making them an attractive option for budget-conscious buyers.

Furthermore, the ICE segment is adapting to comply with increasingly stringent environmental regulations. Manufacturers are investing in cleaner technologies, including hybrid systems and improved emission control measures, to ensure compliance with local regulations while maintaining the appeal of traditional vehicles. The continued development of alternative fuels, such as biofuels and synthetic fuels, also provides avenues for growth within the ICE segment, as these solutions help reduce the overall carbon footprint of conventional vehicles.

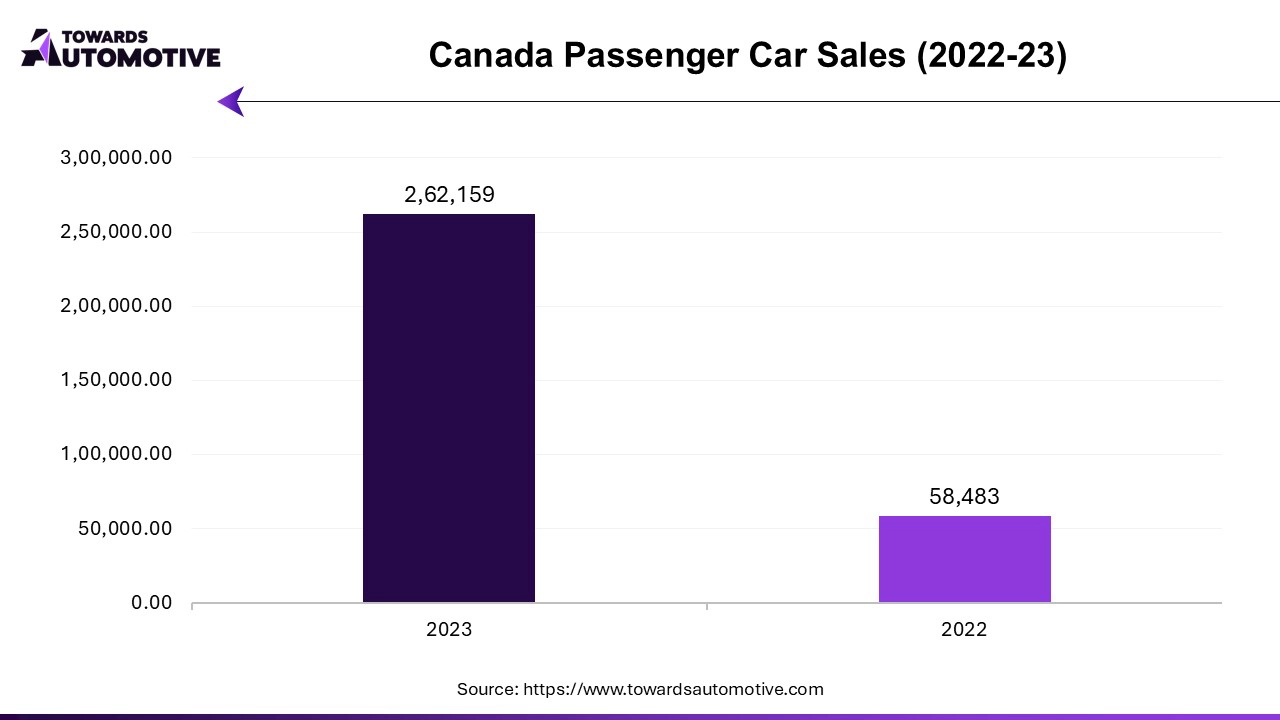

The passenger vehicle segment led the industry. The passenger vehicle segment significantly drives the growth of the automotive powertrain systems market, primarily due to its substantial contribution to overall vehicle sales and the increasing consumer preference for advanced powertrain technologies. As one of the largest segments within the automotive industry, passenger vehicles account for a considerable share of global vehicle production and sales. This demand creates a robust market for various powertrain systems, including internal combustion engines (ICE), hybrid, and electric powertrains.

One of the key factors propelling this growth is the rising consumer demand for fuel-efficient and environmentally friendly vehicles. With growing awareness of environmental issues and rising fuel costs, consumers are increasingly seeking vehicles that offer better fuel economy and lower emissions. Automakers are responding by investing heavily in advanced powertrain technologies that enhance fuel efficiency and reduce the carbon footprint of their passenger vehicles. Innovations such as turbocharging, hybrid systems, and fully electric drivetrains are becoming more prevalent, catering to the preferences of environmentally conscious consumers.

Moreover, government regulations and incentives aimed at promoting sustainable transportation are further driving the growth of the automotive powertrain market within the passenger vehicle segment. Many countries are implementing stringent emissions standards and providing incentives for electric and hybrid vehicles, encouraging manufacturers to develop and introduce cleaner powertrain options. This regulatory push not only fosters innovation but also stimulates competition among automakers, leading to more efficient and advanced powertrain solutions.

Additionally, the increasing adoption of smart technologies in passenger vehicles, such as connected car features and automated driving systems, requires advanced powertrains that can integrate with these technologies. As the automotive landscape continues to evolve with the advent of electrification and automation, the passenger vehicle segment will remain a critical driver for the growth of the automotive powertrain market, ensuring a dynamic and competitive industry.

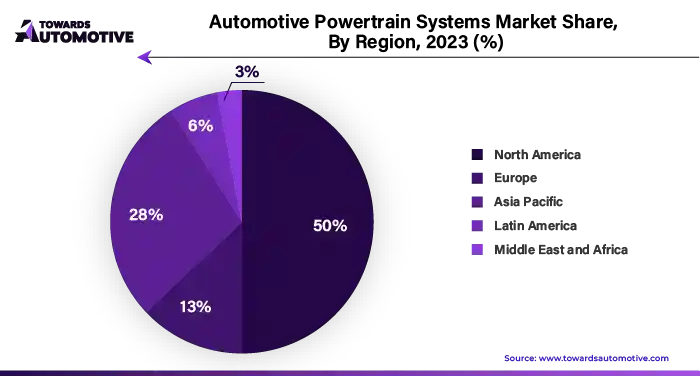

Asia Pacific dominated automotive powertrain market. The automotive powertrain systems market in the Asia-Pacific (APAC) region is experiencing significant growth driven by several interrelated factors. A key driver is the rising demand for fuel-efficient and environmentally friendly vehicles as consumers become increasingly aware of the impact of emissions and fuel consumption on the environment. This heightened awareness is prompting a shift towards cleaner technologies, leading to a surge in demand for hybrid and electric powertrains that offer improved fuel economy and reduced carbon footprints. Additionally, advancements in technology, including the development of high-performance batteries, lightweight materials, and sophisticated powertrain control systems, are enhancing the efficiency and performance of modern vehicles. These innovations not only cater to consumer expectations but also align with the automotive industry’s goal of meeting stringent emission regulations. Furthermore, government initiatives across various APAC countries, such as subsidies for electric vehicle purchases, investments in charging infrastructure, and stricter emissions standards, are further promoting the adoption of electric mobility. These initiatives create a conducive environment for manufacturers to invest in research and development, leading to the introduction of advanced powertrain technologies.

Europe is expected to grow with a significant CAGR during the forecast period. The automotive powertrain systems market in Europe is experiencing robust growth, primarily fueled by stringent environmental regulations and climate policies aimed at reducing greenhouse gas emissions. Governments across the region are implementing rigorous standards that compel automakers to adopt cleaner technologies, significantly boosting the demand for electric and hybrid powertrains. As these regulations become more stringent, manufacturers are investing heavily in innovative powertrain solutions to comply with the legal requirements while maintaining vehicle performance. Additionally, the growing consumer preference for electric vehicles (EVs) reflects an increasing awareness of environmental sustainability, further accelerating the shift towards electric powertrains. Consumers are now actively seeking vehicles that align with their values regarding sustainability and fuel efficiency, pushing automakers to prioritize the development of EV technologies. Furthermore, collaborations and partnerships among automakers, technology firms, and energy providers are fostering advancements in powertrain technology. These alliances enable companies to share resources, knowledge, and expertise, leading to accelerated innovation and enhanced product offerings.

By Propulsion Type

By Vehicle Type

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us