April 2025

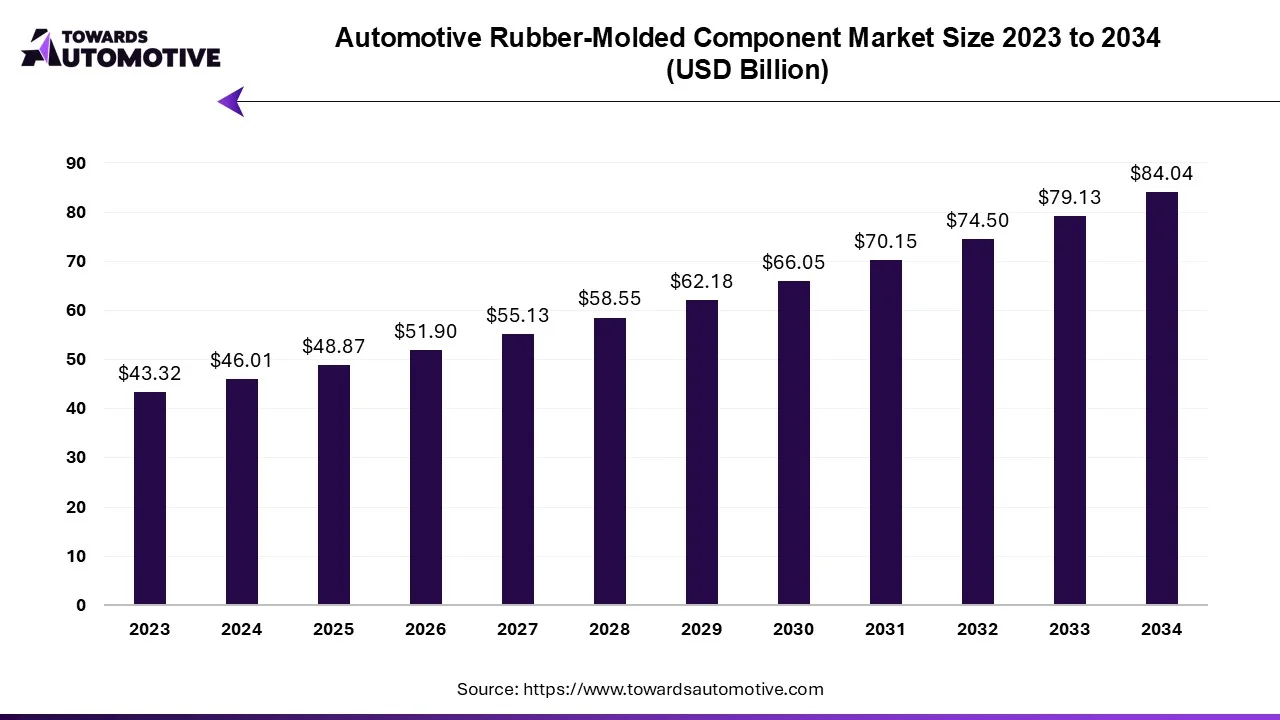

The automotive rubber-molded component market is forecasted to expand from USD 48.87 billion in 2025 to USD 84.04 billion by 2034, growing at a CAGR of 6.21% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Major players in the automotive market are actively seeking ways to reduce the overall weight of vehicles. This reduction not only enhances fuel efficiency but also lowers emissions, aligning with stringent government regulations and attracting greater demand. To address the specific requirements of OEMs, manufacturers of automotive components are assessing existing technologies and materials to develop new components that are lighter, more durable, safer, and more efficient than traditional ones.

Advancements in molding technology have significantly improved the properties of rubber and its products, making them more favorable for manufacturers. Rubber has been a staple material in the automotive sector for centuries. With factors like weight, environmental impact, cost, and durability in mind, molded rubber products, once derived from natural sources, are now produced from inexpensive synthetic materials. This molded rubber can be manufactured in various shapes, sizes, and colors to serve diverse purposes in the automotive market, presenting a significant growth opportunity for businesses.

Ford, for instance, has managed to double the stretchability of rubber by replacing 25% of the gasoline content with renewable soybean oil. This innovation not only enhances the material's performance but also reduces its carbon footprint. The new rubber formulation can be utilized in automotive components such as gaskets, seals, hoses, radiators, and floor mats. With the automotive sector consuming over 50% of global rubber production, which stood at over 22 million tons in 2008 according to the International Rubber Research Organization, the demand for rubber in the automotive market is anticipated to grow further during the forecast period due to its versatility and widespread application across various manufacturing processes.

EPDM, or Ethylene Propylene Diene Monomer, offers numerous advantages that make it ideal for automotive applications. It boasts weather resistance, vibration resistance, heat resistance, color stability, excellent sealing properties, tear resistance, durability, and high tensile strength ranging from 500 to 2500 PSI. With a density exceeding 2.00g/cm3, EPDM is a cost-effective choice for various automotive needs.

The global rubber molded parts market is largely driven by the demand for low-emission and lightweight materials like EPDM. Being a synthetic rubber, EPDM finds extensive usage in the automotive sector, where the imperative to reduce vehicle weight to curb emissions fuels its adoption. The increasing popularity of electric vehicles and new energy vehicles further bolsters the demand for EPDM rubber molded parts.

EPDM exhibits outstanding electrical properties and demonstrates excellent resistance to weathering, as well as resistance to ketones, dilute acids, and dilute alkalis. With a temperature resistance ranging from -60°F/-51°C to 350°F/177°C, it is widely employed in various automotive applications such as weather sealing, stripping, window seals, hydraulic brakes, and door, window, and gate components. Its strong adhesion to metal, rubber, and cable ropes makes it particularly suitable for sealing applications.

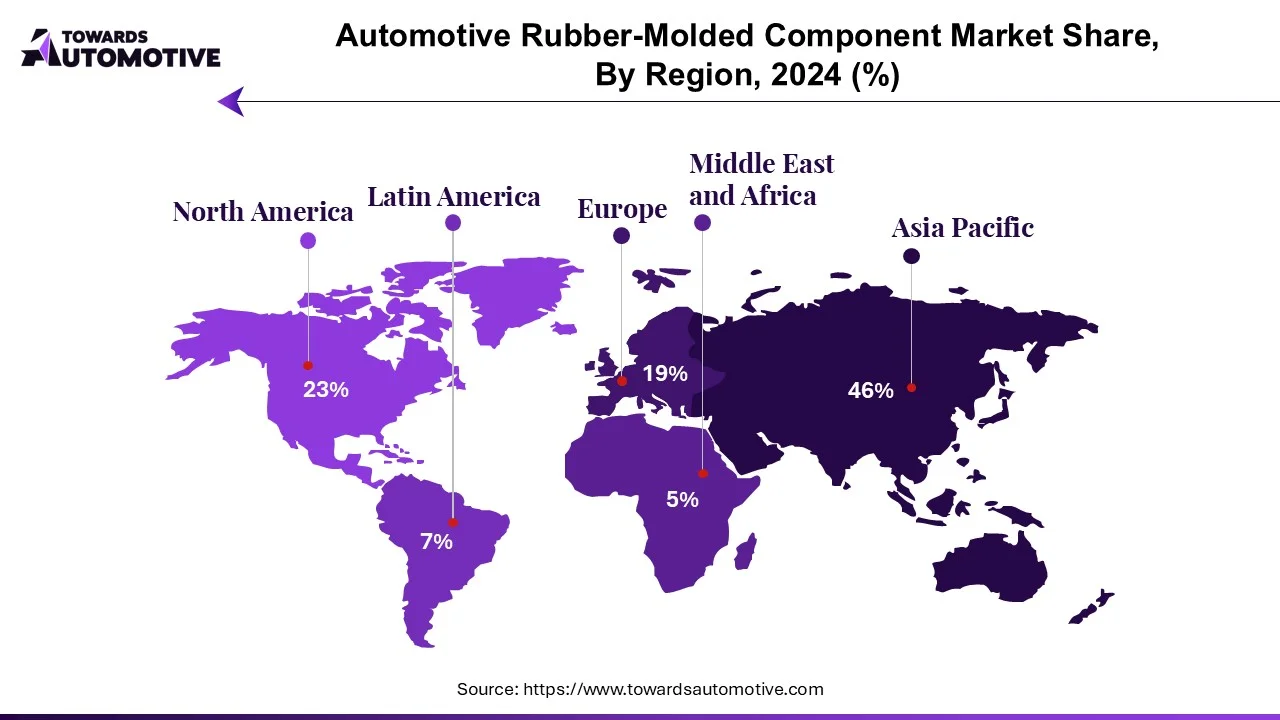

In the Asia Pacific region, the EPDM market is poised to sustain healthy growth due to factors like increasing electrification, stringent emission regulations, rising demand from the automotive and light industries, and competitive pricing, particularly in tire manufacturing.

China stands as one of the world's largest automobile manufacturers, with its production accounting for approximately 28% of the global total in 2019. While most cars produced in China are currently internal combustion engine vehicles, the country has accelerated the development of hybrid and electric cars following the government's 2012 plan addressing the demand for new energy vehicles (NEVs) such as electric, hybrid, and fuel cell vehicles. The Chinese government has set ambitious targets, aiming to ban all gasoline and diesel vehicles and have at least one in every five cars on the road be electric or plug-in hybrid by 2025. This shift towards electric vehicles will inevitably impact the market, leading to the discontinuation of rubber molded parts in applications for internal combustion engine vehicles.

In Japan, the electric car market is also experiencing growth, driven by increasing demand for zero-emission vehicles. The Japanese government has made substantial investments in the electric vehicle market and aims to transition all new cars sold in the country to electric or hybrid vehicles by 2050. Additionally, targets have been set to reduce carbon dioxide emissions from vehicles and other sources by around 80% by 2050. This transition to electric and hybrid vehicles in Japan will impact the market dynamics as molded rubber products are less utilized in electric cars compared to vehicles with internal combustion engines.

The rubber molded parts market, which encompasses various components used in automotive, industrial, and other applications, is characterized by the presence of several major players. These companies, including Continental AG, Dana Holdings, Hutchinson AG, Trelleborg AG, Federal-Mogul AG, and Freudenberg AG, dominate a significant portion of the market share.

Despite the dominance of these key players, the market remains fragmented, with numerous smaller manufacturers and suppliers catering to niche segments and specific customer requirements. This fragmentation reflects the diverse nature of the rubber molded parts market, where products range from seals and gaskets to vibration mounts and automotive components.

The automotive rubber molded parts market encompasses the latest trends and technological advancements in rubber molded components used in automobiles. It also addresses the requirements of top automotive rubber molded parts manufacturers, categorized by equipment, brand, vehicle type, region, and market share.

By Material Type

By Component Type

By Vehicle Type

By Geography

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us