March 2025

The automotive silicone market is projected to reach USD 7 billion by 2034, growing from USD 4.06 billion in 2025, at a CAGR of 6.23% during the forecast period from 2025 to 2034.

![]()

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive silicone market is experiencing significant growth driven by the increasing demand for high-performance materials in modern vehicle manufacturing. Silicone, known for its exceptional properties such as heat resistance, durability, flexibility, and electrical insulation, has become a critical component in the automotive industry. It is widely used in applications ranging from engine components, gaskets, and seals to interior and exterior parts, as well as electrical systems. As the automotive sector advances toward lightweight, fuel-efficient, and electric vehicles, the need for silicone-based materials is growing, as they help improve vehicle performance, safety, and energy efficiency.

The shift toward electric and hybrid vehicles has further boosted the adoption of silicone in applications like battery protection, thermal management, and advanced sealing solutions, where reliability and heat resistance are crucial. Additionally, silicone’s use in automotive electronics, including sensors and wiring systems, supports the increasing integration of advanced technologies like autonomous driving and connectivity.

The market is also driven by the growing focus on sustainability and regulatory compliance, as silicone-based materials contribute to reducing emissions by enhancing fuel efficiency and extending vehicle lifespans. With advancements in silicone formulations and production processes, the automotive silicone market is poised for continued growth, playing a pivotal role in the evolving landscape of the global automotive industry.

Artificial Intelligence (AI) is playing an increasingly significant role in the automotive silicone market by enhancing production processes, optimizing material properties, and enabling advanced applications in automotive manufacturing. AI technologies, such as machine learning and predictive analytics, are being utilized to improve the efficiency and precision of silicone formulation and production, ensuring consistent quality and performance tailored to specific automotive applications.

One major area where AI contributes is in material innovation. By analyzing vast datasets, AI helps manufacturers develop new silicone compounds with enhanced properties, such as improved thermal resistance, durability, and flexibility. This enables the creation of advanced silicone solutions suited for emerging automotive trends, such as electric vehicles (EVs) and autonomous vehicles. For instance, AI-driven optimization is helping create high-performance silicones for EV battery thermal management systems, sealing solutions, and protective coatings.

AI also streamlines manufacturing processes by enabling real-time monitoring and quality control. Sensors and AI algorithms detect defects or inefficiencies in production, reducing waste and ensuring product reliability. Furthermore, AI-powered predictive maintenance minimizes downtime by identifying potential equipment failures before they occur, enhancing operational efficiency.

In addition, AI supports the integration of silicone into smart automotive applications, such as sensor technologies and advanced electronics. As the automotive industry increasingly adopts connected and autonomous systems, AI-driven innovations in silicone formulations will play a critical role in meeting the demands of next-generation vehicles.

The increasing demand for lightweight materials is a significant factor driving the growth of the automotive silicone market. With stricter environmental regulations and a growing emphasis on fuel efficiency and reduced carbon emissions, automakers are actively seeking materials that can lower vehicle weight without compromising durability or performance. Silicone, known for its lightweight yet robust properties, has emerged as a key material in achieving these objectives. Its high thermal stability, flexibility, and resistance to harsh environmental conditions make it an ideal substitute for traditional materials like metals and conventional rubbers in various automotive components.

Silicone is increasingly used in lightweight gaskets, seals, hoses, and adhesives, as well as in advanced coatings for both interior and exterior applications. By reducing the overall vehicle weight, silicone contributes to enhanced fuel efficiency in internal combustion engine (ICE) vehicles and increased range in electric vehicles (EVs). Additionally, lightweight silicone components help improve vehicle handling and performance, which aligns with the rising demand for high-performance cars.

In EVs, the need for lightweight materials is even more pronounced, as reducing vehicle weight directly impacts battery efficiency and driving range. The ongoing shift towards EVs, coupled with advancements in silicone technologies, is expected to further boost its adoption, driving the growth of the automotive silicone market as automakers prioritize innovative, lightweight solutions.

The automotive silicone market faces restraints primarily due to the high costs associated with silicone materials and their processing. Compared to traditional alternatives, silicones are more expensive, which can limit their adoption, particularly in cost-sensitive markets. Additionally, the complex manufacturing processes involved in producing automotive-grade silicone require significant investment and expertise, further driving up costs. The availability of lower-cost substitutes, such as conventional rubbers and plastics, also poses a challenge to market growth. Furthermore, the dependency on raw material supply chains, which can be affected by geopolitical and economic uncertainties, adds to the volatility and restricts the market's expansion potential.

Silicone anode batteries are creating significant opportunities in the automotive silicone market, driven by their potential to revolutionize energy storage in electric vehicles (EVs). Traditional lithium-ion batteries face limitations in energy density and charge capacity, but the incorporation of silicone anodes addresses these challenges, offering significantly higher energy storage capabilities and faster charging times. This advancement aligns perfectly with the growing demand for longer-range and high-performance EVs, thereby expanding the role of silicone in the automotive industry.

Silicone anodes can store up to ten times more lithium ions compared to traditional graphite anodes, dramatically enhancing battery capacity and energy efficiency. This innovation not only supports the development of next-generation EVs but also positions silicone as a critical material in the evolving battery technology landscape. With EV manufacturers investing heavily in research and development of high-capacity batteries, the adoption of silicone anodes is set to rise, creating new growth avenues for the automotive silicone market.

Moreover, silicone anodes improve battery durability by mitigating the effects of swelling and degradation during charge cycles, leading to longer battery lifespan. This aligns with the industry’s focus on sustainable solutions and reduced total cost of ownership. As EV adoption accelerates globally, the increasing reliance on silicone anode batteries is expected to fuel the demand for silicone materials, driving growth in the automotive silicone market in the upcoming days.

The resin segment led the industry. The resin segment plays a significant role in driving the growth of the automotive silicone market due to its versatile applications and superior performance characteristics. Silicone resins are highly valued in the automotive industry for their exceptional thermal stability, weather resistance, and durability, making them ideal for both interior and exterior vehicle components. In exterior applications, silicone resins are commonly used as coatings to protect automotive parts from harsh environmental factors such as UV radiation, extreme temperatures, and corrosion. This extends the lifespan of vehicle components, reducing maintenance costs and enhancing overall durability.

In the interior, silicone resins contribute to the production of high-performance coatings for dashboards, trims, and other surfaces, providing a smooth finish, scratch resistance, and enhanced aesthetic appeal. Additionally, silicone resins are crucial in automotive electronics, as they are used in protective coatings for circuit boards and sensors, safeguarding critical components in increasingly sophisticated vehicle systems.

The rising adoption of electric vehicles (EVs) has further boosted the demand for silicone resins. They are widely used in thermal management systems and battery pack coatings, ensuring safety and efficiency in EV operations. With growing investments in lightweight and energy-efficient vehicles, the resin segment is set to drive the automotive silicone market by catering to evolving industry demands and supporting advanced automotive designs.

The electrical segment dominated the market. The electrical segment is a major driver of growth in the automotive silicone market, fueled by the increasing integration of advanced electrical systems and electronics in modern vehicles. Silicone's exceptional electrical insulation, thermal stability, and durability make it a preferred material for various electrical applications in the automotive industry. As vehicles become more connected and electrified, the demand for silicone in wiring harnesses, connectors, and insulation systems has grown significantly, ensuring reliable performance and safety in complex electrical networks.

In electric vehicles (EVs) and hybrid electric vehicles (HEVs), silicone plays a crucial role in thermal management and insulation of battery systems, electric motors, and inverters. It ensures efficient heat dissipation, prevents overheating, and protects sensitive components from moisture, dust, and mechanical stress, enhancing the overall lifespan and reliability of these systems. Additionally, silicone adhesives and sealants are widely used in assembling electrical components, offering strong bonding and protection against vibrations and environmental factors.

The growth of autonomous driving technologies and advanced driver-assistance systems (ADAS) has further accelerated the demand for silicone in electronic sensors, control units, and radar systems. These critical systems require robust protection to ensure uninterrupted functionality. With the ongoing electrification of the automotive industry and rising adoption of smart vehicles, the electrical segment continues to drive the expansion of the automotive silicone market.

![]()

Asia Pacific dominated the automotive silicone market in 2023. The automotive silicone market in Asia Pacific is experiencing significant growth due to factors such as the rapid expansion of the automotive industry, the increasing adoption of electric vehicles (EVs), advancements in automotive manufacturing, and rising demand for lightweight and fuel-efficient vehicles. Asia Pacific is home to some of the world's largest automotive manufacturing hubs, including China, Japan, India, and South Korea, which drive the region's demand for silicone-based materials in automotive applications.

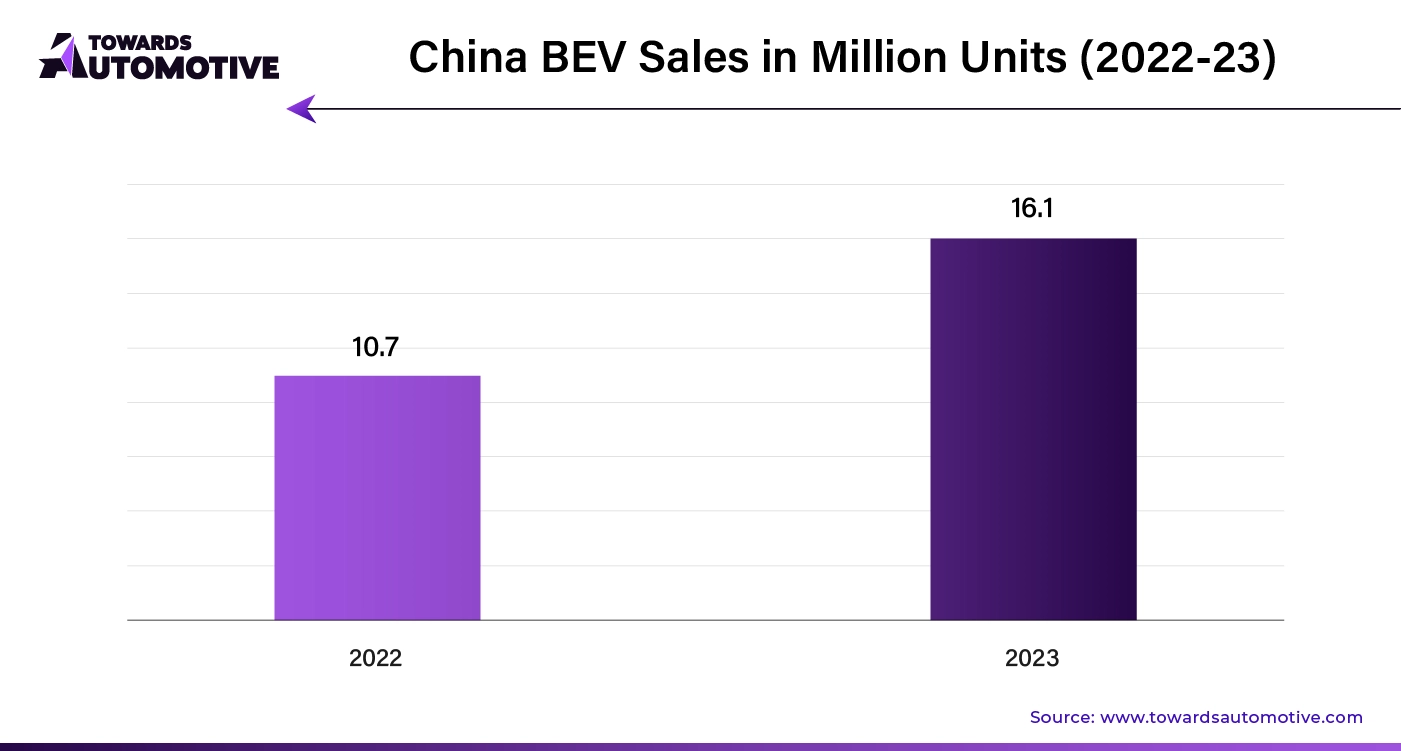

The growing shift toward EVs in countries such as China and India is a major growth driver. Silicone is extensively used in EV components such as battery systems, thermal management solutions, and sealing applications, ensuring safety, efficiency, and longevity. With governments across the region promoting EV adoption through subsidies, tax benefits, and infrastructure investments, the demand for silicone materials is on the rise.

Advancements in automotive manufacturing and the integration of advanced technologies, such as connected vehicles and autonomous driving systems, have further boosted the market. Silicone is widely used in automotive electronics for insulation, sealing, and protection of sensitive components, making it indispensable in modern vehicles. Additionally, the push for lightweight and fuel-efficient vehicles has driven the adoption of silicone-based components, which reduce vehicle weight while maintaining durability and performance.

With supportive government regulations, increasing investments in automotive R&D, and the presence of major silicone manufacturers in the region, Asia Pacific continues to be a key growth market for automotive silicone.

North America is observed to grow at the fastest rate during the forecast period. The automotive silicone market in North America is driven by several key growth factors, including the rising adoption of electric vehicles (EVs), the increasing demand for lightweight and fuel-efficient vehicles, advancements in automotive electronics, and stringent regulatory standards focused on vehicle safety and emissions.

The growing shift towards hybrid vehicles has significantly boosted the demand for silicone-based materials in the region. Silicone plays a crucial role in hybrid vehicles such as thermal management of battery systems, sealing solutions for high-voltage components, and insulation for wiring harnesses. These properties ensure safety, efficiency, and reliability, making silicone indispensable in the hybrid vehicle manufacturing process.

Another major driver is the emphasis on lightweight vehicle designs to improve fuel efficiency and reduce carbon emissions. Silicone-based materials, known for their durability, flexibility, and lightweight nature, are increasingly used in various components, including gaskets, seals, and coatings, contributing to enhanced performance and reduced vehicle weight.

Furthermore, advancements in automotive electronics, including autonomous driving systems, connected vehicle technologies, and ADAS, have increased the demand for silicone in electronic components. Its exceptional insulation, heat resistance, and protective properties make it a preferred material in these applications. Coupled with regulatory mandates for safety and emission controls, these factors continue to drive the growth of the automotive silicone market in North America.

![]()

By Type

By Application

By Region

March 2025

March 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us