April 2025

The automotive torque converter market is projected to reach USD 6.75 billion by 2034, growing from USD 4.15 billion in 2025, at a CAGR of 5.56% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The recent COVID-19 pandemic has had a notable impact on business development, particularly within the automotive sector, where a decrease in demand for cars has been observed due to quarantines and travel restrictions. Consequently, the growth of automotive products has slowed down over the past two years, a trend evident across all segments of the automotive industry.

In the medium term, the increasing adoption of torque converters in the automotive industry is anticipated to drive market demand during the forecast period. The expansion of business activities and growth in the transportation and logistics sector are driving the uptake of automatic transmission systems in vehicles. Furthermore, ongoing technological advancements and rising demand for hybrid electric vehicles are expected to further stimulate market growth.

The function of a torque converter in an automatic transmission system is akin to that of a clutch in a manual transmission. The growing prevalence of automatic transmissions in modern vehicles directly influences the need for torque converters.

In addition to these factors, the escalating number of vehicles on the road, advancements in transportation and logistics infrastructure, and the imperative for companies to enhance driving experiences are poised to propel the on-road growth of the global automotive torque converter market throughout the forecast period. However, challenges such as high maintenance costs and the risk of torque converter failure may impede market growth during this period.

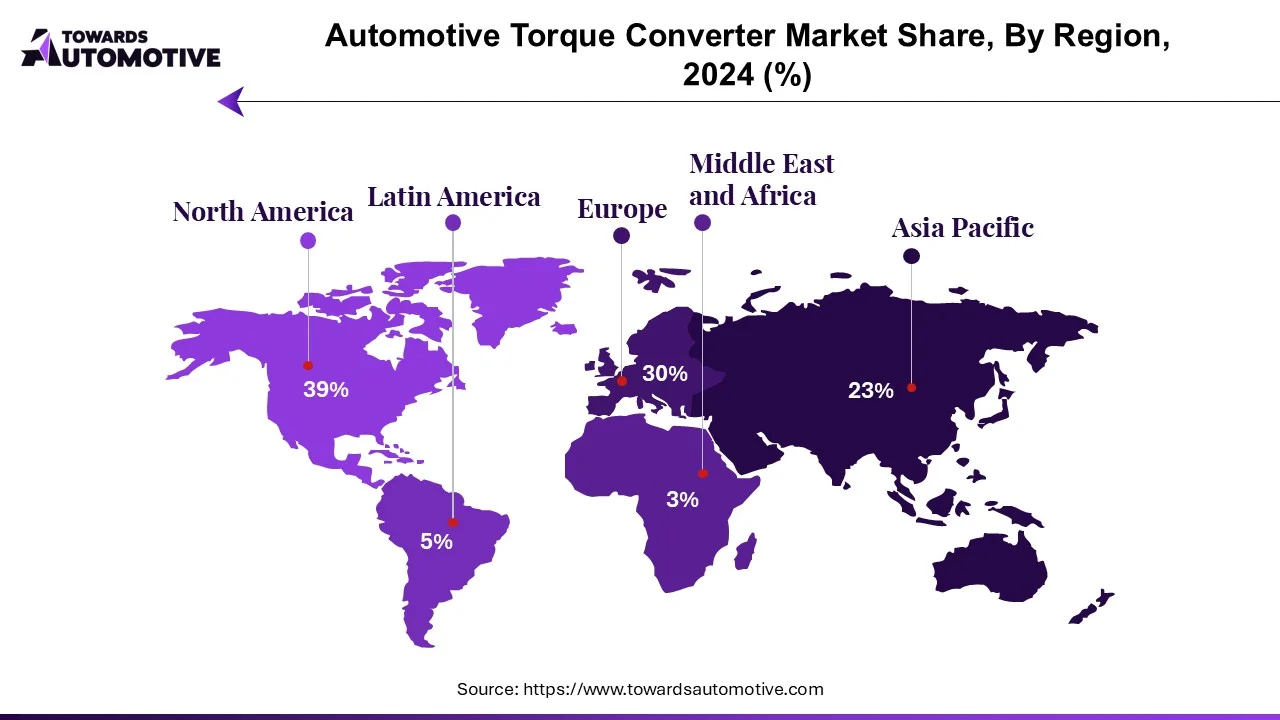

North America is anticipated to lead the market growth, followed by Europe and Asia Pacific, primarily due to the early adoption of these changes in these regions. Notably, the premium car segment warrants attention in these areas. Moreover, market expansion is expected to be bolstered by the increasing integration of automatic transmission systems in medium and heavy trucks over the forecast period.

In terms of technology, commercial vehicles are becoming increasingly fuel-efficient, with automatic transmission systems offering users a fatigue-free driving experience by eliminating the need for frequent gear shifting. This ease of driving, particularly in challenging conditions, has led to growing demand for automatic transmission.

In response to this demand, major automakers have dedicated significant efforts to developing advanced technology for automatic transmissions in the automotive industry. For instance, in January 2022, Schaeffler introduced the iTC torque converter, representing a new generation of lightweight and vibration-reducing components. A key feature of the iTC (Integrated Torque Converter) is the inclusion of a close clutch integrated into the torque converter turbine. This design not only reduces weight but also allows for improved torsional shock absorption through features like centrifugal pendulum shock absorbers.

As automobile sales continue to rise and automatic transmission systems become more prevalent, major players in the industry have devised various new strategies to capitalize on this trend. For example, ZF's TraXon offers enhanced torque, a wide ratio range, and top-notch performance, setting a new standard for transmissions tailored for cranes, commercial vehicles, and other special applications. The TraXon Torque model incorporates a torque converter and dry clutch as part of its design, further enhancing its capabilities.

These advancements and developments are expected to fuel positive prospects for the market during the forecast period, driving further growth and innovation in the automotive industry.

North America is poised to play a significant role in the construction industry in the coming years. The projected growth in the US transmission market will be heavily influenced by the increasing adoption of automatic transmissions in both passenger and heavy-duty vehicles, as well as medium-duty commercial vehicles.

For instance, car sales in the US are expected to reach 12 million units in 2021, up from an estimated 11.5 million units in 2020. This growth is driven by factors such as increased demand for freight transportation and passenger services. Moreover, the US economy has shown promising signs in 2021, with first-quarter sales rising by 13.2% annually to 3.97 million units, and second-quarter sales reaching 4.35 million units, marking a 46.9% annual increase.

The rapid growth in this sector can be largely attributed to the success and widespread adoption of advanced technologies, particularly in countries like the United States and Canada.

In addition to North America, Europe and Asia Pacific have also witnessed significant growth in the automotive industry. Major players and automotive OEMs are actively introducing new models equipped with torque converter technology to attract customers' attention.

For example,

These developments underscore the progress made in these regions, signaling promising prospects for economic growth during the forecast period.

The automatic transmission market is characterized by the dominance of major players such as Exedy, BorgWarner, Aisin Seiki, and Valeo. These industry leaders employ a variety of strategies to maintain and expand their market share, including initiatives focused on expansion, collaboration, and productivity enhancement.

For instance,

Partnerships within the gearbox sector are commonplace, particularly between original equipment manufacturers (OEMs) such as Ford and General Motors, and industry players including OEM suppliers like BMW and CAE Ford, Land Rover and ZF, Chrysler and ZF, and Allison and Sinotruk. These collaborations are often geared towards the development of efficient 8, 9, and even 10-speed transmissions that can be seamlessly integrated across various vehicle types.

By leveraging these strategic partnerships and focusing on innovation and efficiency improvements, major players in the automatic transmission market aim to maintain their competitive edge and meet the evolving demands of consumers and the automotive industry as a whole.

A torque converter functions as a type of fluid coupling, facilitating the transfer of rotational power from a primary mover, such as an internal combustion engine, to a rotating driven load. In vehicles equipped with automatic transmissions, the torque converter serves as the intermediary component that links the power source to the load. Typically positioned between the engine's flex plate and the transmission, the torque converter occupies a critical role in the transmission system. In contrast, in vehicles with manual transmissions, the mechanical clutch fulfills a similar function to the torque converter, serving as the linkage between the engine and the transmission.

By Transmission Type

By Vehicle Type

By Geography

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us