April 2025

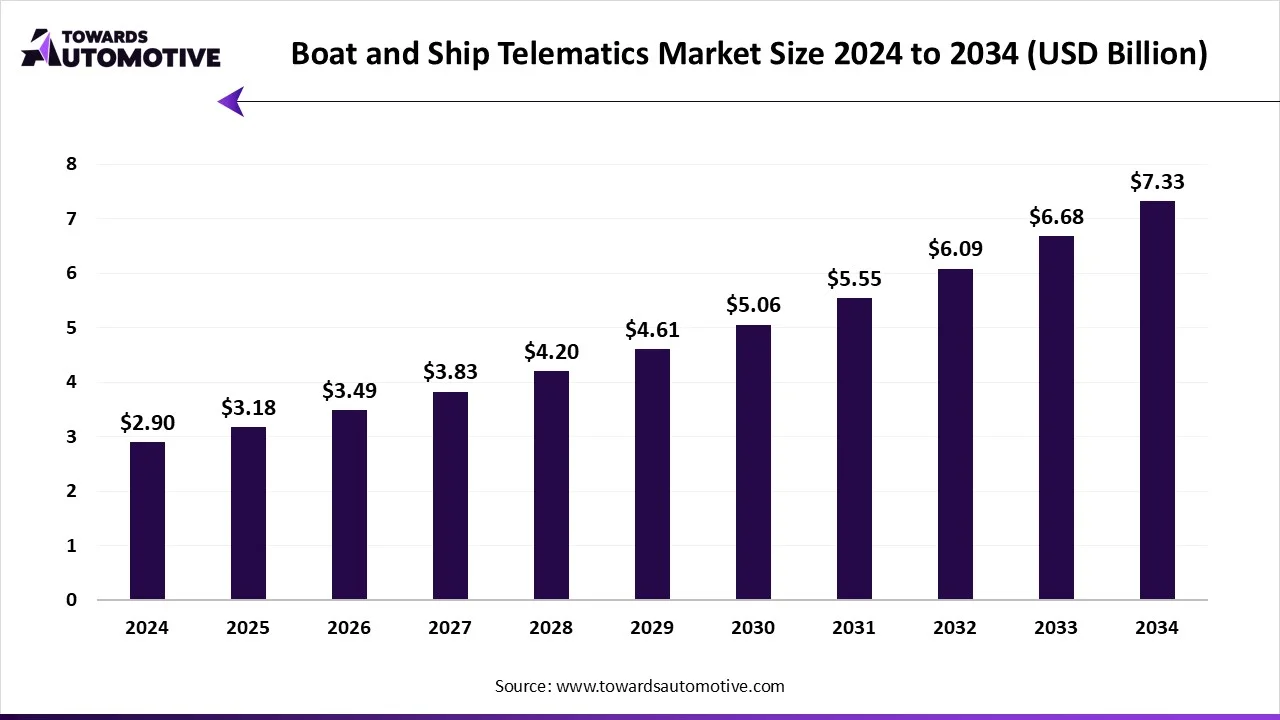

The boat and ship telematics market is projected to reach USD 7.33 billion by 2034, expanding from USD 3.18 billion in 2025, at an annual growth rate of 9.72% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

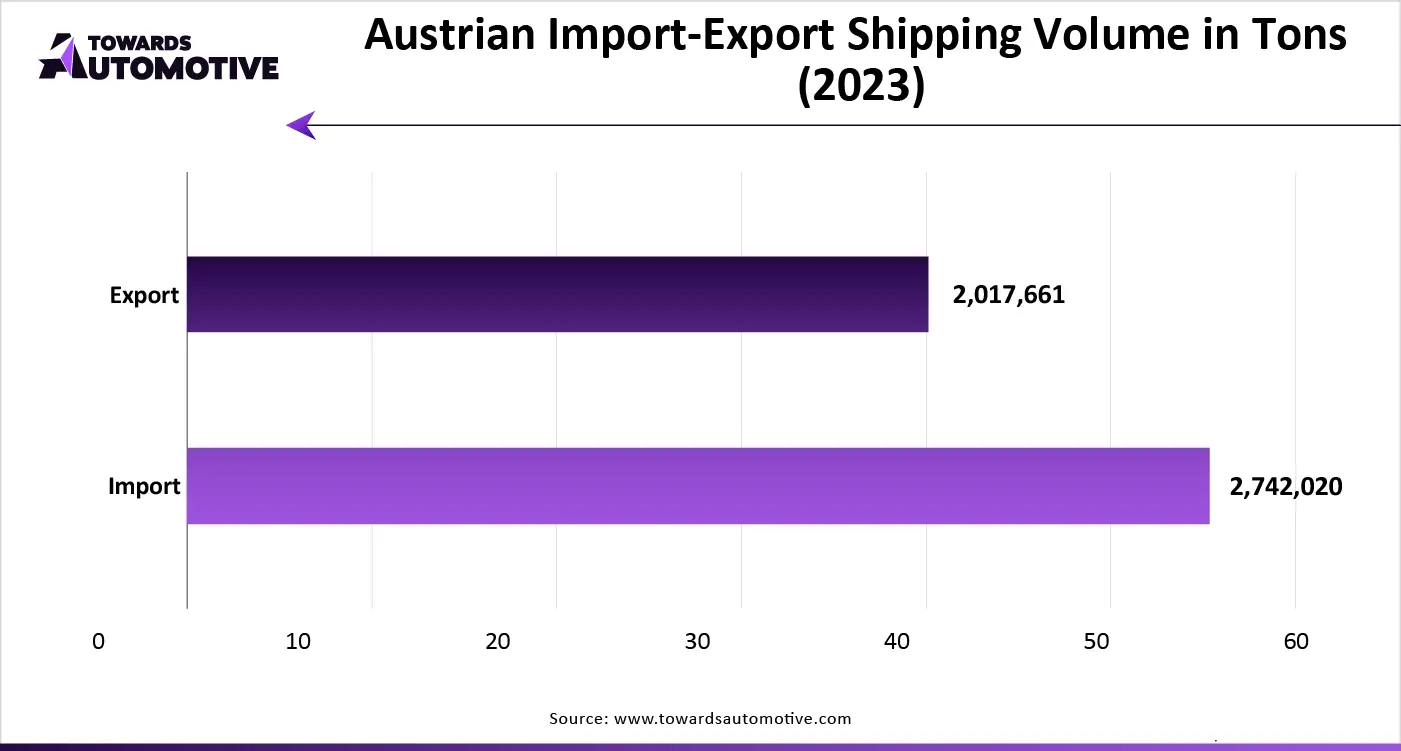

The boat and ship telematics market is a prominent branch of the marine industry. This industry deals in developing solutions for tracking boats and ships across the world. There are various components of these solutions including hardware, software and services. These solutions use different types of technologies such as GPS tracking, satellite communication, IoT enabled devices, telematics software and some others. It finds numerous applications in fleet management, navigation and safety, cargo management, performance monitoring and others. The end-users of these solutions include commercial vessels, private yachts, cargo ships, fishing boats and some others. The rising use of maritime transportation for import and export of goods in different nations has boosted the market expansion. This market is expected to rise significantly with the growth of the telematics industry around the globe.

| Metric | Details |

| Market Size in 2024 | USD 2.90 Billion |

| Projected Market Size in 2034 | USD 7.33 Billion |

| CAGR (2025 - 2034) | 9.72% |

| Leading Region | North America |

| Market Segmentation | By Application, By Technology, By End Use, By Connectivity Type and By Region |

| Top Key Players | Furuno, Tamarack Aerospace, Marlink, Sperry Marine, Cisco, Kongsberg Gruppen, AWD Technologies |

In November 2024, Richard Threlfall, the Associates Director and New Energy and Integration at Lead LRW Engineering made an announcement stating that, “We’re really excited to be launching ShieldStream to the marine market. The solution enables users to anticipate issues such as diagnostic events or high temperatures before they become a serious problem. And that is key to improve marine reliability and efficiency, we’re also anticipating significant demand for the Pro versions including the Battery Pro which will be a key piece of kit as it handles all the battery data management which the EU is mandating from 2027.”

North America held the largest share of the boat and ship telematics market. The growing trend of connected smart ship in countries such as the U.S. and Canada has boosted the market growth. Also, the rapid expansion of e-commerce industry along with rising government initiatives aimed at strengthening the marine infrastructure is crucial for the industrial expansion. Moreover, the presence of various market players such as Garmin LTD, Zebra Technologies, Flir Systems, Inc. and some others is projected to drive the growth of the boat and ship telematics market in this region.

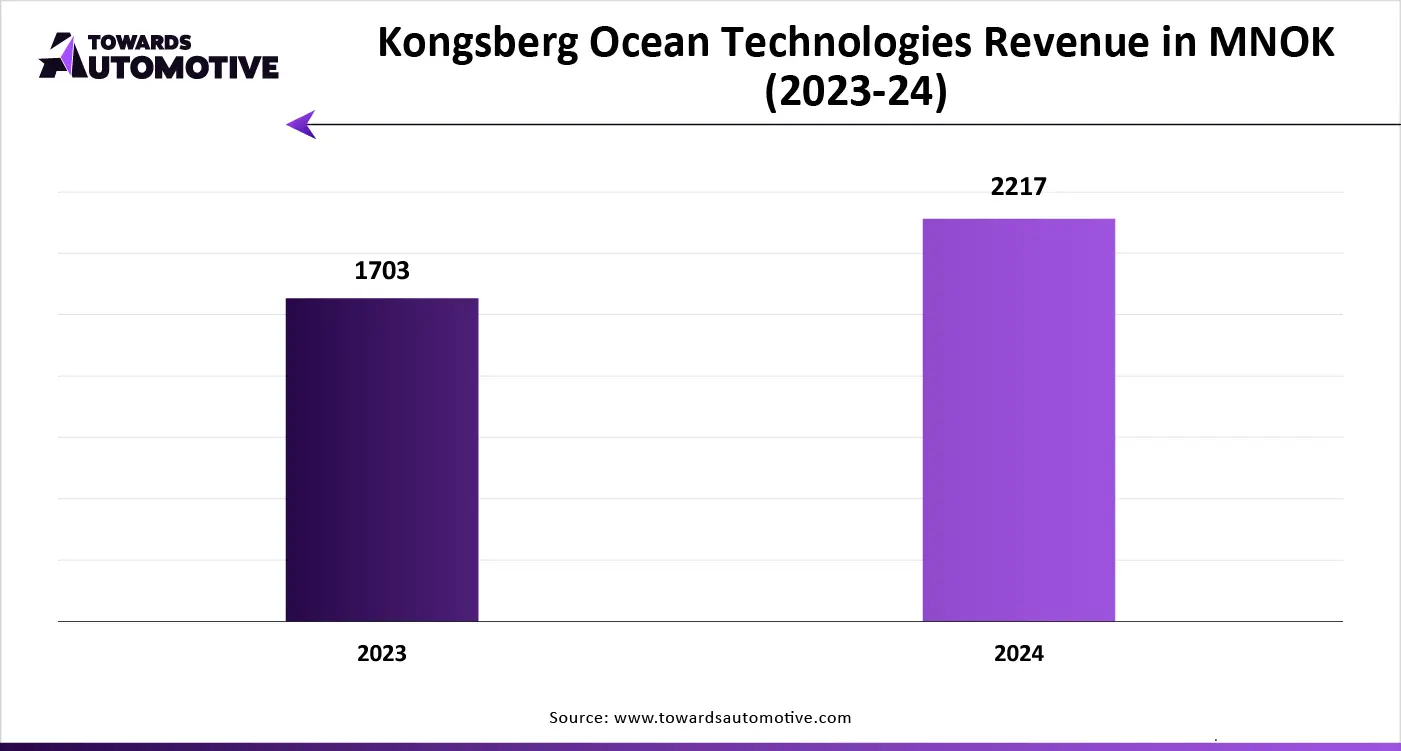

The boat and ship telematics market is developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Furuno, Tamarack Aerospace, Marlink, Sperry Marine, Cisco, Kongsberg Gruppen, AWD Technologies, MTS Systems and some others. These companies are constantly engaged in developing telematics solutions for tracking marine vehicles and adopting numerous strategies to maintain their dominant position in this industry.

By Application

By Technology

By End Use

By Connectivity Type

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us