March 2025

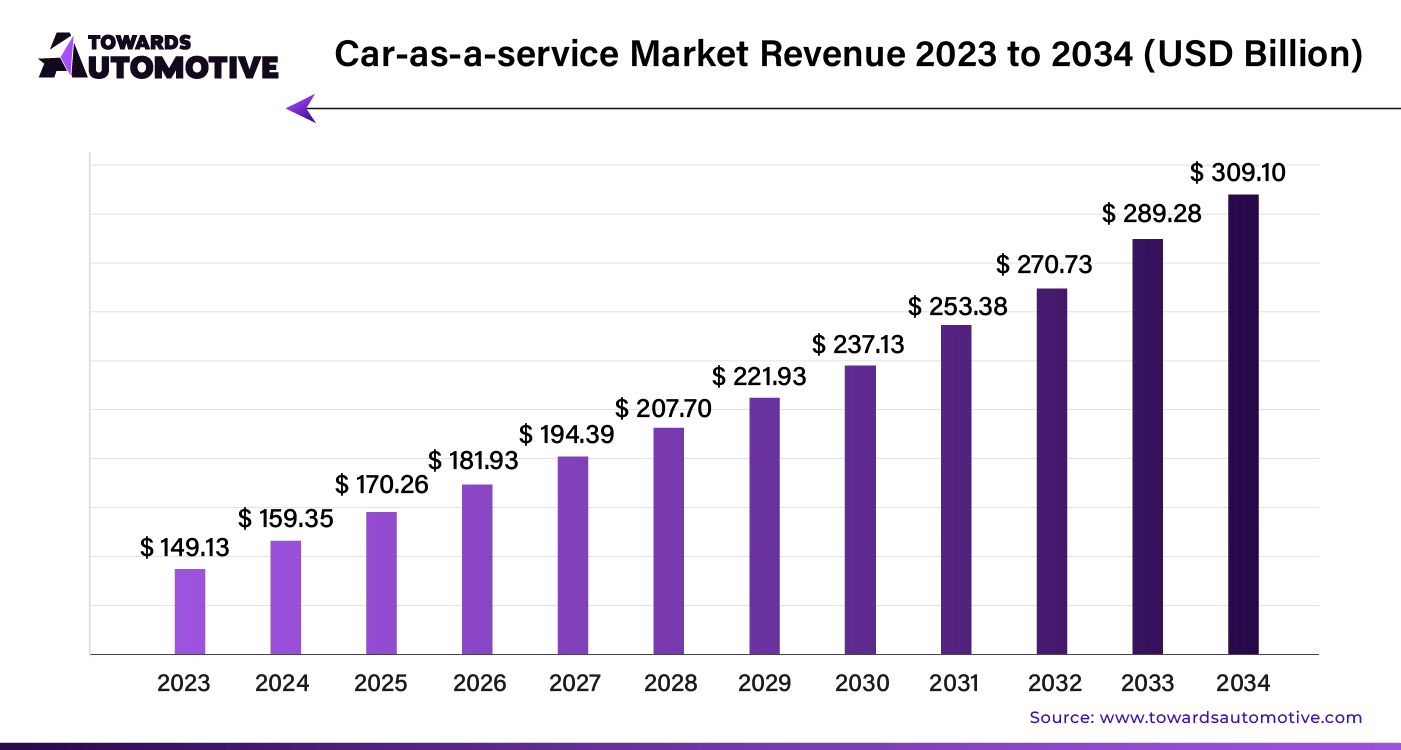

The global car-as-a-service market size is calculated at USD 159.35 billion in 2024 and is expected to be worth USD 309.10 billion by 2034, expanding at a CAGR of 6.85% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The Car-as-a-Service market is an emerging mobility solution that allows consumers and businesses to access vehicles on a flexible, subscription-based model rather than through traditional ownership. This shift is driven by the growing demand for convenience, flexibility, and cost-efficiency in transportation. CaaS services offer users access to a range of vehicles for short-term or long-term use, with all-inclusive packages covering maintenance, insurance, and often fuel or charging costs. As a result, users can avoid the financial and logistical burdens associated with owning a car, such as depreciation, repairs, and upkeep, while enjoying the benefits of mobility.

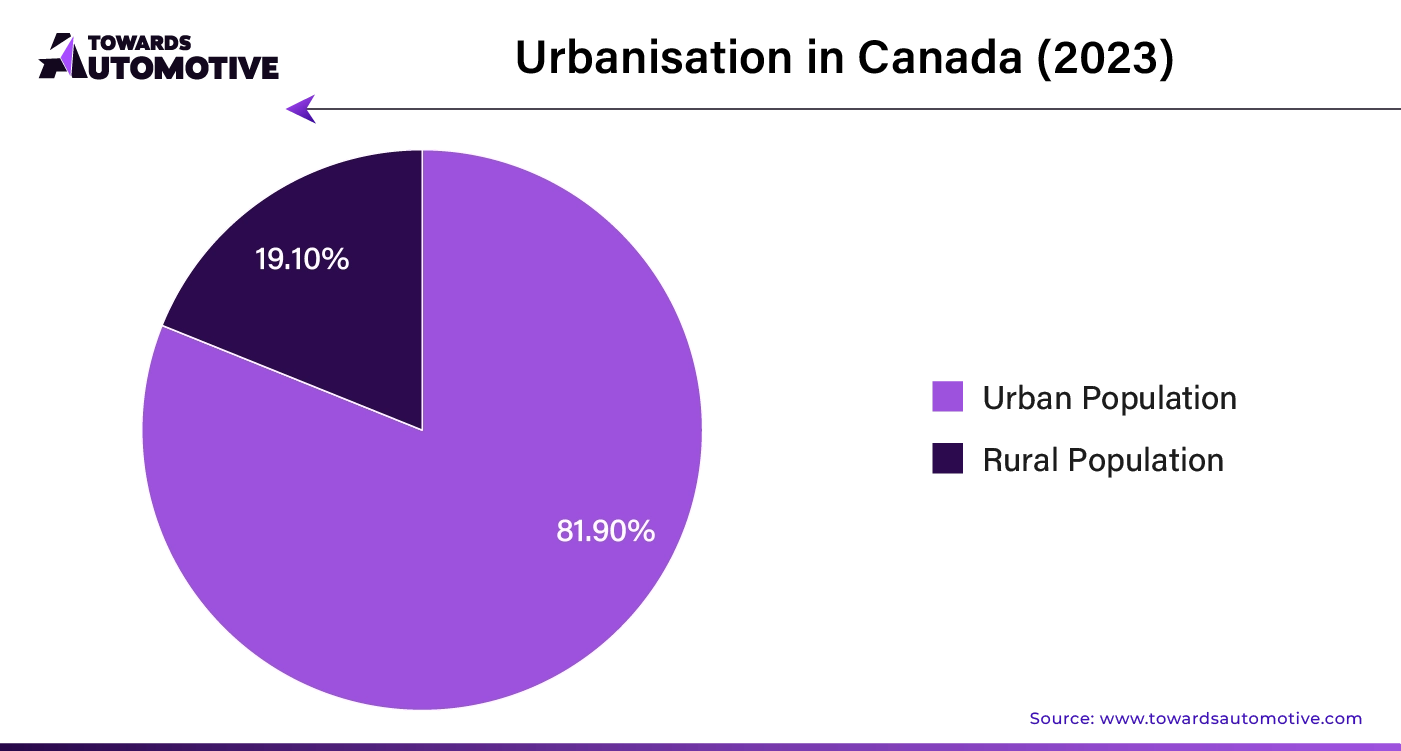

Urbanization is a key factor fueling the adoption of CaaS, as city dwellers increasingly look for ways to navigate congested areas without the hassles of parking and traffic. The rise of digital platforms and mobile applications makes it easier for consumers to access vehicles on-demand, streamlining the booking and payment processes. Moreover, CaaS aligns with the growing preference for on-demand services, particularly among younger generations who prioritize access over ownership in various sectors, including transportation.

For businesses, CaaS offers an efficient way to manage corporate fleets, enabling companies to scale their vehicle use based on operational needs. By outsourcing fleet management to CaaS providers, businesses can reduce costs related to vehicle procurement, maintenance, and insurance, improving operational flexibility.

Additionally, the integration of electric vehicles (EVs) into CaaS fleets supports environmental sustainability, aligning with increasing regulatory pressures and consumer preferences for greener transportation options. With governments incentivizing the adoption of electric and shared mobility, the CaaS market is poised for significant growth, offering both economic and environmental benefits while redefining how people and organizations access and utilize vehicles.

Artificial Intelligence (AI) plays a crucial role in shaping and advancing the Car-as-a-Service market by enhancing operational efficiency, optimizing user experience, and enabling predictive analytics. AI-powered systems enable CaaS providers to efficiently manage large fleets of vehicles by predicting demand, optimizing routes, and monitoring vehicle health in real-time. AI can analyze patterns in usage data to help providers allocate vehicles to areas with higher demand, reducing idle times and improving overall fleet utilization. Predictive maintenance powered by AI helps in identifying potential issues before they escalate, allowing vehicles to remain operational for longer, reducing downtime and repair costs.

AI enhances the user experience in the CaaS market by offering personalized recommendations and services. For instance, AI algorithms can analyze user preferences and behaviors to suggest the most suitable vehicle or service package based on individual needs. This personalization extends to optimizing routes for customers, recommending pick-up and drop-off locations, and even tailoring pricing models based on usage patterns.

AI helps CaaS providers forecast demand more accurately by analyzing historical data, weather conditions, traffic patterns, and local events. This allows companies to adjust their fleet sizes and locations dynamically, ensuring that vehicles are available when and where they are needed most. Such predictive capabilities reduce operational inefficiencies and ensure better customer satisfaction.

The growing demand for cost-efficient car subscription models is a key driver of the Car-as-a-Service market's growth. Consumers, particularly younger generations and urban dwellers, are increasingly looking for flexible, affordable alternatives to traditional car ownership, which involves high upfront costs, insurance, maintenance, and depreciation. Car subscription models offer a more financially accessible option, allowing users to pay a fixed fee that covers all essential services like insurance, maintenance, and repairs. This eliminates the unpredictable expenses tied to owning a vehicle, making mobility more manageable.

Additionally, the subscription model’s flexibility allows consumers to switch vehicles based on their needs without long-term commitments, further enhancing its appeal. As economic pressures rise and consumers prioritize convenience, the demand for cost-effective car subscription options continues to grow, fueling the expansion of the CaaS market.

The Car-as-a-Service market faces several restraints, including high initial investment costs for fleet acquisition and maintenance, especially for electric and autonomous vehicles. Limited infrastructure, such as EV charging stations, also hampers widespread adoption. Additionally, regulatory hurdles, varying by region, complicate operations for CaaS providers. Concerns over data privacy and security, as well as consumer reluctance to shift from vehicle ownership to shared mobility, further restrict market growth despite the growing demand for flexible transportation solutions.

The integration of autonomous vehicles (AVs) presents transformative opportunities in the Car-as-a-Service market by significantly reducing operational costs and enhancing service efficiency. One of the most immediate benefits of AV integration is the elimination of the need for human drivers, which accounts for a significant portion of costs in traditional ride-hailing and CaaS models. Autonomous vehicles can operate 24/7 without the limitations of driver availability, reducing downtime and increasing fleet utilization. This continuous operation enables providers to offer more rides, improve vehicle accessibility, and meet higher demand, particularly in densely populated urban areas.

AVs also create opportunities for greater scalability in the CaaS market. With fewer human resource constraints, providers can expand their fleets more easily, offering services across a wider geographic area. This scalability can lead to lower pricing for users, making CaaS more accessible and affordable to a broader audience, including those who may not have previously considered it a viable transportation option.

Moreover, autonomous vehicles can enhance safety, as they are equipped with advanced sensors and AI algorithms designed to reduce accidents caused by human error. This improved safety profile is likely to reduce insurance costs for providers, further driving down the overall cost of CaaS operations. In addition, autonomous vehicles are highly efficient in fuel usage and route optimization, especially when integrated with electric vehicles (EVs), helping to minimize environmental impacts and align with growing sustainability goals.

The data-driven nature of AVs also enables more personalized and adaptive services for users, including optimizing routes, offering tailored pricing models, and integrating with other smart city technologies. As AV technology continues to evolve, the CaaS market will benefit from greater flexibility, cost-efficiency, and the ability to deliver innovative mobility solutions that cater to a variety of user needs.

The IC powered vehicles segment held the largest share of the market. Internal combustion (IC) powered vehicles play a significant role in driving the growth of the Car-as-a-Service market by offering a familiar and widely accessible option for consumers. Despite the increasing focus on electric vehicles (EVs), IC-powered cars remain the dominant choice for CaaS providers due to their established infrastructure and widespread consumer acceptance. Many users still prefer IC vehicles because of their extended driving range, faster refueling times, and availability, especially in areas where charging infrastructure for EVs may be limited. This makes IC vehicles a practical choice for both consumers and businesses utilizing CaaS for longer trips or rural areas with limited EV support.

For CaaS providers, IC-powered vehicles offer cost-effective fleet management as they are generally less expensive to purchase upfront than EVs, making it easier to scale their offerings and meet diverse customer needs. The existing global infrastructure for refueling, maintenance, and repairs also allows CaaS operators to manage these vehicles efficiently. In regions where regulations for EV adoption are not yet stringent, IC-powered vehicles remain a viable option for providing immediate mobility solutions without requiring a transition to newer technologies.

Additionally, IC vehicles enable CaaS providers to cater to a broad customer base with varying preferences and needs. For users who are not yet comfortable with EVs or who travel longer distances, IC-powered vehicles continue to be a preferred choice. As a result, IC vehicles play a crucial role in maintaining market growth by offering flexibility, ensuring accessibility, and allowing CaaS providers to optimize their services while transitioning toward more sustainable options.

The private segment led the market. The private segment plays a pivotal role in driving the growth of the Car-as-a-Service market by catering to individual consumers seeking flexibility, convenience, and cost-efficiency in their mobility options. Increasingly, private users, especially those in urban areas, are opting for CaaS instead of traditional vehicle ownership due to the rising costs associated with owning and maintaining a car. This trend is particularly strong among younger consumers, who prefer to access vehicles on-demand through subscription or rental models, avoiding long-term financial commitments like loans, insurance, and maintenance costs. CaaS enables users to pay only for the duration of vehicle use, offering significant savings and flexibility.

Additionally, the private segment’s demand for personalized and convenient transportation solutions fuels the adoption of CaaS. With the rise of digital platforms and mobile apps, private consumers can easily book, manage, and track vehicles, enhancing the overall user experience. The ability to select specific types of vehicles based on personal preferences—whether for short-term rentals, luxury cars, or electric vehicles—gives private users the freedom to tailor their mobility needs to different occasions. This flexibility makes CaaS particularly appealing for individuals who may not need a car every day but still require access to one occasionally for errands, trips, or special events.

Moreover, the growth of the private segment is supported by urbanization and changing lifestyle patterns. As urban residents face issues like limited parking and increasing traffic congestion, CaaS provides a practical and cost-effective alternative to owning a car. By reducing the hassles associated with ownership, including maintenance and parking, the private segment’s increasing preference for CaaS is a key driver in the market’s expansion, making personal mobility more accessible and adaptable.

The executive car segment dominated the market. The private segment plays a pivotal role in driving the growth of the Car-as-a-Service market by catering to individual consumers seeking flexibility, convenience, and cost-efficiency in their mobility options. Increasingly, private users, especially those in urban areas, are opting for CaaS instead of traditional vehicle ownership due to the rising costs associated with owning and maintaining a car. This trend is particularly strong among younger consumers, who prefer to access vehicles on-demand through subscription or rental models, avoiding long-term financial commitments like loans, insurance, and maintenance costs. CaaS enables users to pay only for the duration of vehicle use, offering significant savings and flexibility.

Additionally, the private segment’s demand for personalized and convenient transportation solutions fuels the adoption of CaaS. With the rise of digital platforms and mobile apps, private consumers can easily book, manage, and track vehicles, enhancing the overall user experience. The ability to select specific types of vehicles based on personal preferences—whether for short-term rentals, luxury cars, or electric vehicles—gives private users the freedom to tailor their mobility needs to different occasions. This flexibility makes CaaS particularly appealing for individuals who may not need a car every day but still require access to one occasionally for errands, trips, or special events.

Moreover, the growth of the private segment is supported by urbanization and changing lifestyle patterns. As urban residents face issues like limited parking and increasing traffic congestion, CaaS provides a practical and cost-effective alternative to owning a car. By reducing the hassles associated with ownership, including maintenance and parking, the private segment’s increasing preference for CaaS is a key driver in the market’s expansion, making personal mobility more accessible and adaptable.

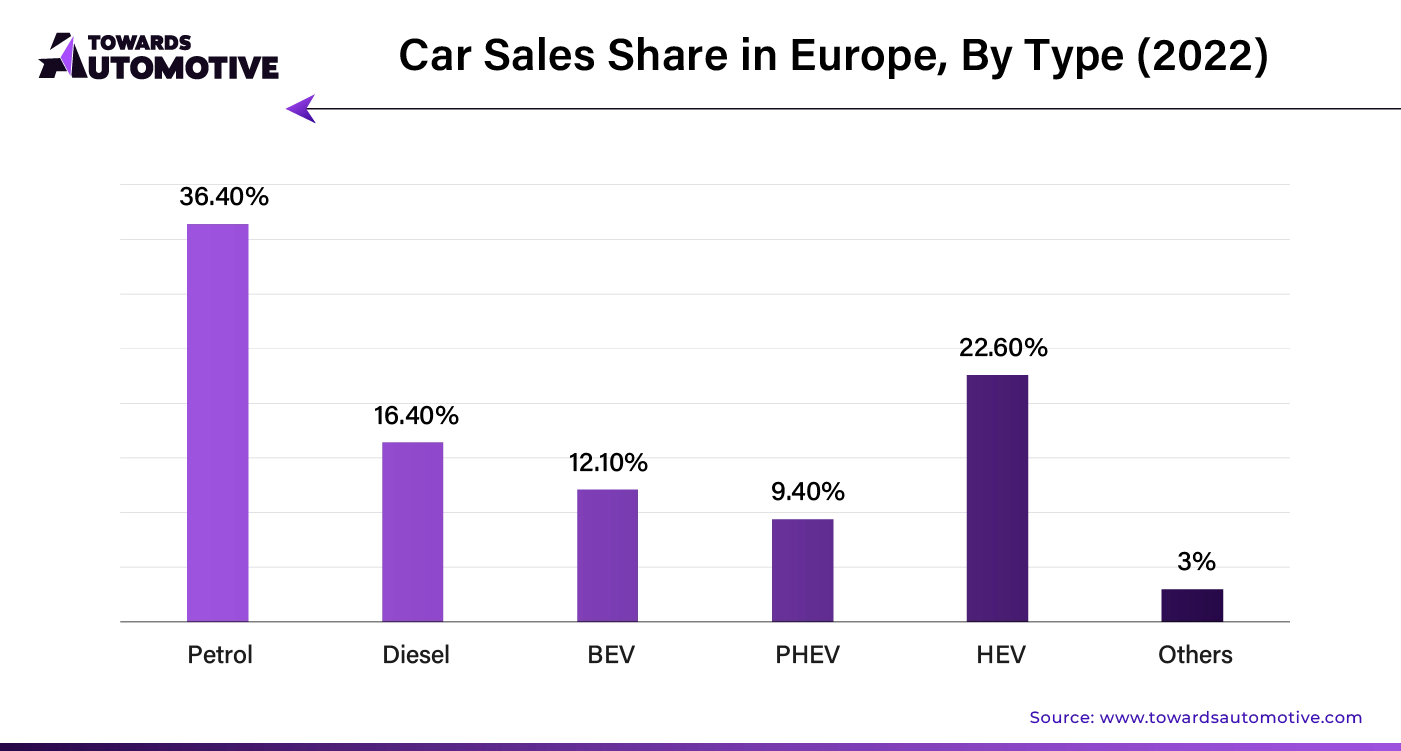

Europe dominated the car-as-a-service market. The growth of the Car-as-a-Service market in Europe is being propelled by the rising demand for flexibility and cost-efficiency, technological advancements, and regulatory support. Consumers, particularly in urban areas, are seeking more flexible mobility solutions that allow them to access vehicles when needed without the financial and long-term commitment of ownership. CaaS offers a cost-effective alternative, enabling users to pay only for the usage and avoid expenses like maintenance, insurance, and depreciation. This shift in consumer behavior aligns with a growing preference for on-demand services, especially among younger, urban populations.

Technological advancements are further driving the CaaS market by enhancing user experience and operational efficiency. Innovations in connected vehicles, telematics, and mobile applications allow users to easily book, track, and pay for services via smartphone apps. Additionally, the integration of electric vehicles (EVs) into CaaS fleets is supported by improvements in battery technology and charging infrastructure, allowing CaaS providers to offer more sustainable mobility options. These technologies also enable providers to better manage their fleets, improving both availability and reliability for users.

Regulatory support and government incentives across Europe are a key factor in accelerating CaaS adoption. Many European governments are pushing for greener transportation solutions, offering subsidies, tax breaks, and incentives for electric and hybrid vehicle usage. Strict emissions standards and urban mobility policies, such as low-emission zones, are also encouraging both consumers and businesses to turn to CaaS as a compliant and environmentally friendly option. These combined factors are fostering a strong growth environment for the CaaS market in Europe, as it aligns with both consumer preferences and regulatory goals.

North America is expected to grow with a significant CAGR during the forecast period. The growth of the Car-as-a-Service market in North America is significantly driven by a shift toward subscription-based services, rising urbanization, and increasing corporate demand for fleet management solutions. Subscription-based services appeal to consumers who prioritize flexibility and convenience, offering access to vehicles without the financial burden of ownership. This trend is particularly popular among younger generations and urban dwellers who value on-demand mobility solutions. As urbanization continues, especially in major cities, many residents face limited parking and high congestion, making CaaS an attractive alternative to car ownership. Additionally, businesses are increasingly adopting CaaS for fleet management, allowing them to scale vehicle use based on demand, reducing maintenance costs and operational burdens. This corporate demand is further amplified by the rise of remote and hybrid work models, which drive companies to seek more efficient and flexible transportation solutions for their employees. Together, these factors are pushing the adoption of CaaS, fueling the market's growth across North America.

By Propulsion Type

By End Use

By Vehicle Type

By Region

March 2025

February 2025

January 2025

January 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us