April 2025

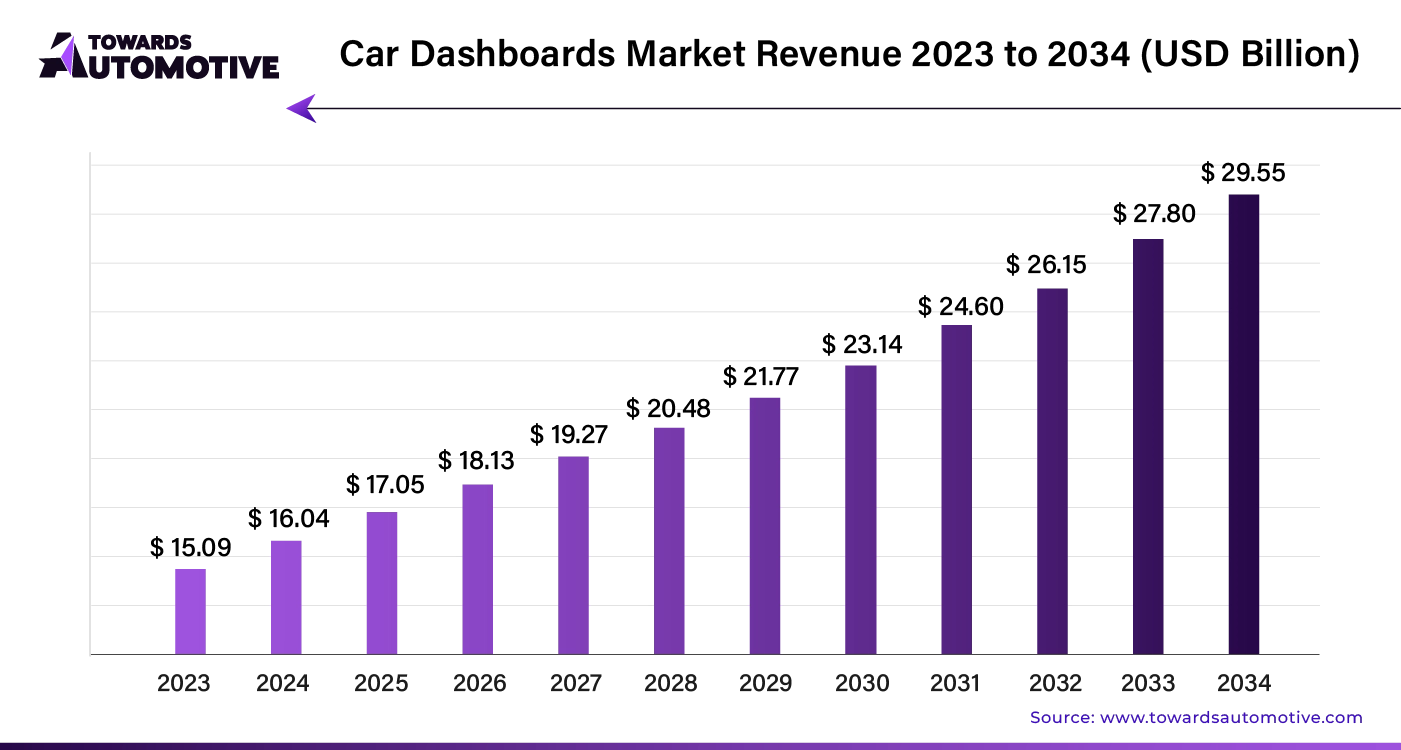

The global car dashboards market size is calculated at USD 16.04 billion in 2024 and is expected to be worth USD 29.55 billion by 2034, expanding at a CAGR of 6.3% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The car dashboards market is evolving rapidly, driven by advancements in vehicle technology and changing consumer preferences for smarter, more intuitive interfaces. Traditional dashboards, once focused primarily on displaying basic information like speed and fuel levels, are being replaced by digital, multifunctional displays that integrate a variety of systems including navigation, entertainment, and advanced driver assistance systems (ADAS). The rise of electric vehicles (EVs) and connected cars has further accelerated this transformation, with manufacturers developing dashboards that provide real-time data on battery performance, energy consumption, and connectivity options.

Consumers are increasingly expecting seamless integration of their digital lives with their vehicles, leading to the development of dashboards that offer features like voice control, touchscreen displays, and smartphone compatibility. Additionally, the push toward autonomous driving is encouraging innovations in dashboard design, with a focus on offering both enhanced safety and infotainment options.

As automakers prioritize user experience and safety, dashboards are becoming central to the driving experience. This shift is creating new opportunities for manufacturers specializing in digital displays, software integration, and in-car technologies. With growing demand for advanced features, the car dashboards market is set to see significant growth, supported by rising consumer expectations and innovations in automotive technology.

AI plays a transformative role in the car dashboards market by enhancing functionality, improving user experience, and enabling smarter, more responsive interfaces. Modern car dashboards are increasingly equipped with AI-driven systems that can learn from driver behavior, preferences, and real-time data to offer personalized experiences and predictive assistance. For instance, AI can analyze driving patterns and environmental conditions to optimize navigation, suggest the most efficient routes, or alert drivers to potential hazards. AI also powers advanced voice recognition systems, allowing drivers to control various in-car functions, such as climate control, music, and navigation, through natural language commands. This hands-free interaction enhances safety by reducing distractions, enabling drivers to keep their focus on the road. Additionally, AI integration enables dashboards to offer predictive maintenance alerts by analyzing vehicle performance and identifying potential issues before they become critical, improving vehicle longevity and reducing repair costs. As the industry moves toward autonomous driving, AI plays a crucial role in delivering real-time data through the dashboard, ensuring drivers are informed about the vehicle’s performance and environment.

Advanced Driver Assistance Systems (ADAS) are a significant driver of growth in the car dashboards market, as they enhance vehicle safety and improve the overall driving experience. ADAS technologies, such as lane departure warnings, adaptive cruise control, collision avoidance, and parking assistance, require sophisticated dashboard systems to display real-time data and alerts to drivers. These features are integrated into modern dashboards to provide crucial information that supports safe driving and enhances vehicle control.

The growing emphasis on road safety and the adoption of stricter regulatory standards have accelerated the incorporation of ADAS into vehicles. Automakers are increasingly equipping dashboards with digital displays that present data from various ADAS components, such as cameras and sensors, in a user-friendly format. This integration helps drivers respond to potential hazards, adhere to safety guidelines, and make informed decisions on the road.

Furthermore, the consumer demand for advanced safety features and a more connected driving experience is fueling the adoption of ADAS technologies. As vehicles become more sophisticated, the need for dashboards that can seamlessly integrate and present ADAS information is growing. This shift is driving innovation in dashboard design, leading to the development of high-resolution displays, customizable interfaces, and advanced controls that cater to the needs of modern drivers.

The car dashboards market faces several restraints, primarily high manufacturing costs and technological complexity. Advanced features like high-resolution displays and integrated infotainment systems significantly increase vehicle prices, which can limit adoption, especially in price-sensitive segments. Additionally, the integration of sophisticated technologies, such as Advanced Driver Assistance Systems (ADAS), poses technical challenges and increases development costs. Rapid technological advancements also necessitate frequent updates and compatibility checks, which can strain resources and complicate production. These factors collectively impact the market's growth and development.

Augmented Reality (AR) integration is creating significant opportunities in the car dashboards market by revolutionizing how information is presented to drivers. AR technology overlays digital information onto the real-world view, offering a more intuitive and interactive driving experience. By projecting navigation instructions, hazard alerts, and other critical data directly onto the windshield or dashboard displays, AR enhances driver awareness and reduces distractions. This integration allows for real-time, context-sensitive information that helps drivers make better decisions and navigate complex driving conditions with greater ease. As AR technology becomes more advanced and affordable, its adoption is expected to grow, driving demand for dashboards equipped with AR capabilities. Additionally, AR can support advanced features like lane-keeping assistance and collision warnings, further improving vehicle safety. The ability to customize and adapt AR displays to individual driver preferences also opens new opportunities for personalization and user engagement. As a result, AR integration is poised to be a transformative force in the car dashboards market, offering both enhanced functionality and a more immersive driving experience.

The LCD dashboards held the dominant share of the industry. LCD dashboards are driving the growth of the car dashboards market by offering enhanced functionality, design flexibility, and improved user experiences. Unlike traditional analog dashboards, LCD dashboards provide customizable digital displays that can be configured to show a wide range of information, from speed and fuel levels to real-time navigation and advanced vehicle diagnostics. This flexibility allows automakers to create visually appealing, high-tech interfaces that cater to the growing consumer demand for modern, connected vehicles.

One of the key advantages of LCD dashboards is their ability to integrate multiple systems into a single, user-friendly interface. This includes infotainment, climate control, and driver assistance systems, all of which can be controlled via a touchscreen or voice commands. This seamless integration reduces the need for physical buttons and knobs, making the dashboard cleaner and more streamlined.

Additionally, the rise of electric vehicles (EVs) has further boosted the adoption of LCD dashboards. EV drivers require real-time data on battery life, energy consumption, and charging status, all of which can be effectively displayed on customizable digital dashboards. Moreover, the increasing focus on safety and driver assistance features, such as adaptive cruise control and lane-keeping assistance, has led to the incorporation of more advanced displays that provide critical information in real time.

The OEM segment led the market. Original Equipment Manufacturers (OEMs) play a crucial role in driving the growth of the car dashboards market by pushing for innovative designs and advanced technologies to meet consumer demand and regulatory standards. OEMs are increasingly integrating digital and smart dashboards in their vehicle offerings to enhance user experience, safety, and connectivity. As competition intensifies in the automotive industry, OEMs are focusing on differentiating their products by incorporating high-tech dashboard solutions, such as LCD, OLED displays, and customizable digital interfaces.

OEMs are also playing a key role in the transition from analog to digital dashboards. By partnering with tech companies and investing in research and development, they are at the forefront of integrating advanced driver assistance systems (ADAS), infotainment, and vehicle diagnostic features into a single, streamlined dashboard. This shift aligns with the automotive industry’s broader trends, including the growth of electric vehicles (EVs), autonomous driving technologies, and connected car ecosystems.

Furthermore, OEMs are leveraging economies of scale to reduce production costs, making high-tech dashboards more accessible across different vehicle segments, from luxury to mass-market cars. By driving innovations and scaling up production, OEMs are fostering greater adoption of advanced dashboard systems. As vehicle technology continues to evolve, OEMs will remain key players in shaping the future of the car dashboards market, driving growth through their commitment to innovation, safety, and consumer-centric solutions.

The passenger cars segment dominated the market. Passenger cars are a significant driver of growth in the car dashboards market, fueled by the increasing demand for advanced, user-friendly interfaces and enhanced in-car experiences. As consumer expectations for vehicle technology continue to rise, car manufacturers are focusing on upgrading dashboards in passenger vehicles to offer more intuitive, digitalized displays that integrate a variety of functions such as navigation, entertainment, and vehicle performance data. The shift from traditional analog dashboards to high-tech digital displays, especially in mid-range and premium passenger cars, has become a key trend in the market.

Moreover, the growing emphasis on safety and driver assistance features in passenger cars is accelerating the adoption of advanced dashboards. Modern dashboards now include features such as real-time monitoring of ADAS systems, lane departure warnings, and collision avoidance systems, all aimed at improving safety. These advancements make dashboards a central component of the driving experience, increasing their value and demand.

The rise of electric vehicles (EVs) and hybrid models in the passenger car segment further supports the growth of the dashboard market. EVs require more detailed information displays, including battery life, charging status, and energy consumption, all of which are seamlessly integrated into digital dashboards. As passenger cars increasingly adopt these advanced technologies, the car dashboards market is set to expand rapidly, catering to consumer preferences for more connected, efficient, and safer vehicles.

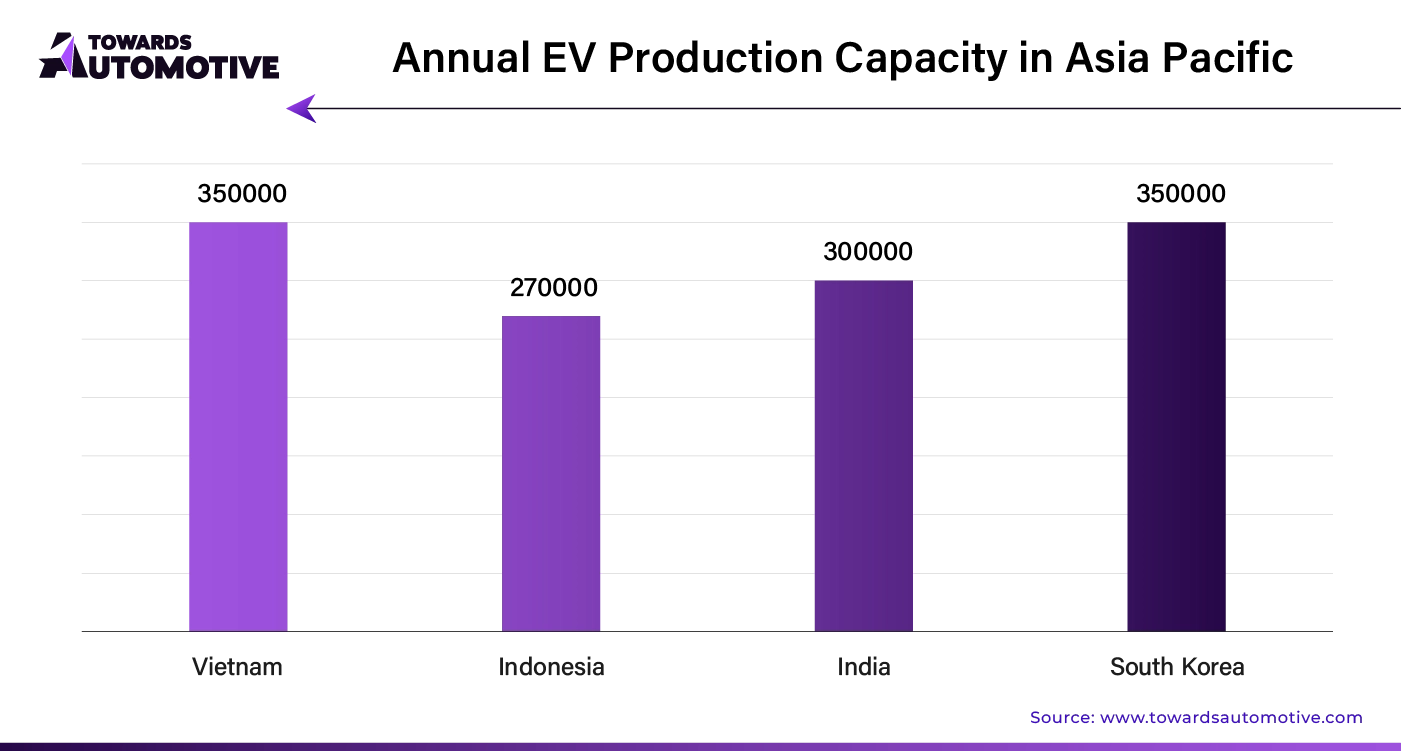

Asia Pacific dominated the car dashboards market. In Asia Pacific, the booming automotive industry, growing focus on safety with Advanced Driver Assistance Systems (ADAS), and the rapid growth of electric vehicles (EVs) are driving the expansion of the car dashboards market. The region is experiencing strong vehicle demand, particularly in emerging economies such as China, India, and Southeast Asia, where rising disposable incomes and urbanization have led to increased car ownership. This surge in vehicle production creates a significant demand for advanced, digital dashboards that offer improved functionality and user experience.

Safety has become a top priority for automakers, with increasing regulations and consumer expectations for enhanced safety features. ADAS, which includes systems like lane departure warnings, adaptive cruise control, and collision avoidance, is being integrated into car dashboards to provide real-time data and improve driver safety. The rising emphasis on these systems is fueling the demand for dashboards that support ADAS features, making them an essential part of the driving experience in modern vehicles.

Additionally, the growth of EVs in Asia Pacific, especially in China, is contributing to the adoption of advanced dashboard technologies. EVs require sophisticated dashboards to monitor battery performance, energy consumption, and charging status in real time. As governments in the region push for the adoption of EVs through incentives and environmental regulations, the demand for dashboards tailored to electric vehicles is increasing.

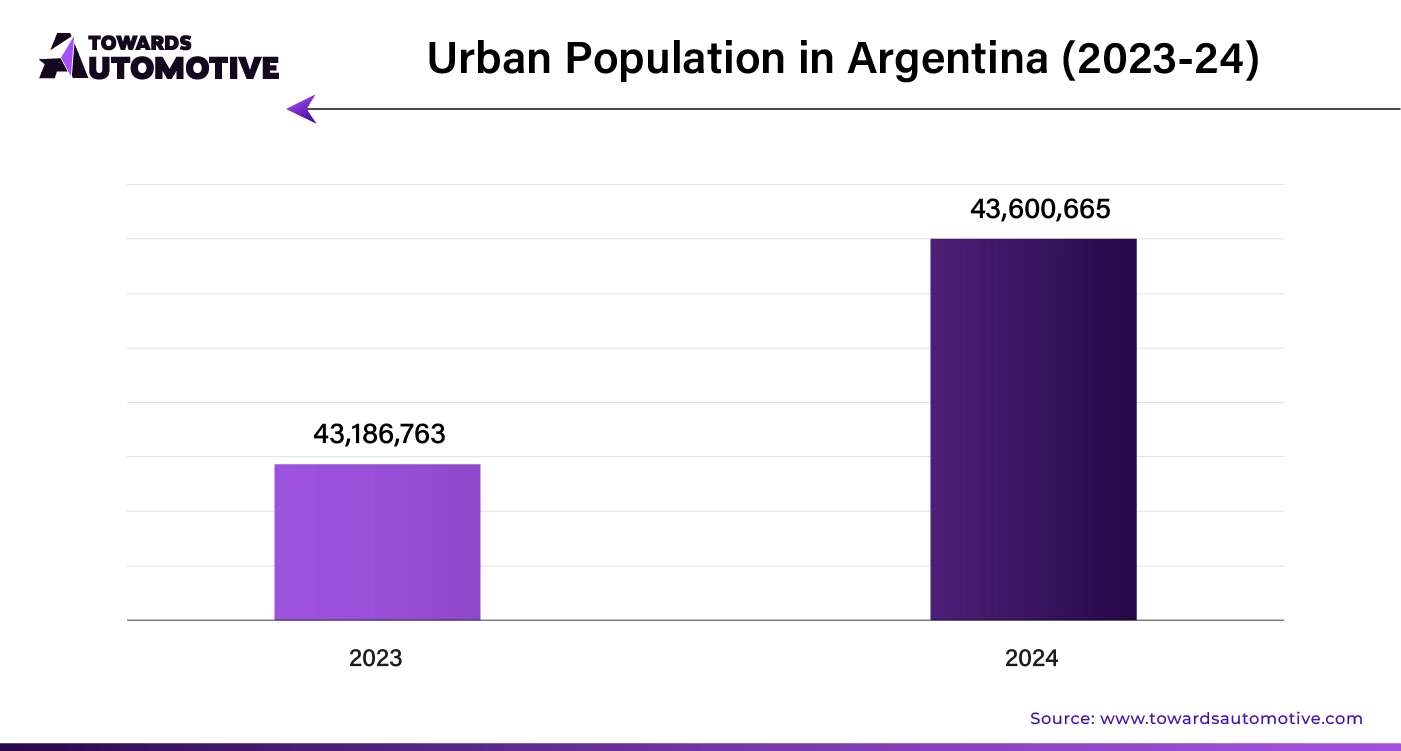

LAMEA is expected to grow with a significant CAGR during the forecast period. Technological advancements, digitalization, rising vehicle demand, and urbanization are key factors driving the growth of the car dashboards market in LAMEA (Latin America, Middle East, and Africa). As the automotive industry in the region grows, driven by increasing urbanization and a rising middle-class population, there is a significant demand for modern vehicles equipped with advanced features. Consumers are increasingly seeking cars that offer greater convenience, connectivity, and enhanced driving experiences, which has led to the adoption of digital dashboards over traditional analog systems.

Technological advancements are transforming the car dashboards market in LAMEA. Automakers are incorporating innovative features such as LCD and touchscreen displays, infotainment systems, and connected car functionalities. These digital dashboards offer a range of integrated options, from real-time navigation to entertainment and climate control, aligning with the global trend of vehicle digitalization. The ability to provide real-time data and improve the overall driving experience makes these systems highly attractive to consumers.

Moreover, the rapid urbanization in LAMEA, particularly in countries like Brazil, Argentina, South Africa, and the UAE, is fueling vehicle ownership. As urban populations grow, so does the demand for automobiles, particularly modern passenger vehicles with advanced dashboard systems. Together, these factors are contributing to the robust growth of the car dashboards market, as automakers cater to the evolving needs of urbanized consumers looking for technologically advanced and connected driving experiences.

By Type

By Vehicle Type

By Sales Channel

By Region

April 2025

March 2025

March 2025

February 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us