April 2025

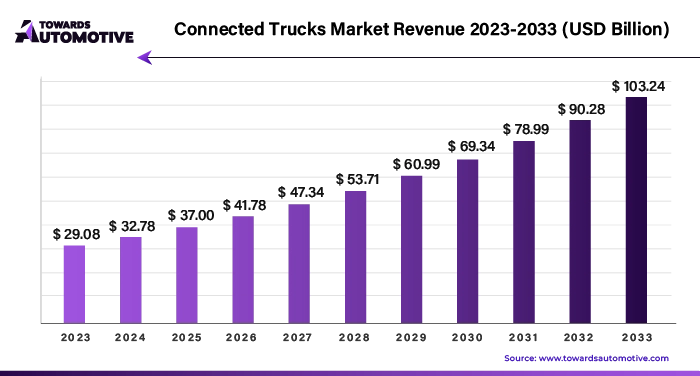

The global connected trucks market size is estimated to reach USD 103.24 billion by 2033, up from USD 29.08 billion in 2023, at a compound annual growth rate (CAGR) of 13.59%.

Unlock Infinite Advantages: Subscribe to Annual Membership

Connected trucks, also known as smart trucks or intelligent trucks, leverage these technologies to enable real-time monitoring, diagnostics, and management of various aspects of truck operations. The connected trucks market involves a diverse array of technologies and solutions aimed at enhancing the efficiency, safety, and sustainability of commercial trucking operations. At its core, connected trucks use telematics, Internet of Things (IoT), and artificial intelligence (AI) to enable real-time data transmission, remote monitoring, predictive maintenance, and intelligent fleet management. This merging of digital innovations has led to transformative changes in the way fleets are managed, optimized, and controlled.

The connected trucks market is propelled by several key drivers that highlight its rapid growth and transformative potential. Fleet operators, driven by efficiency imperatives, are increasingly turning to connected truck solutions to optimize their operations and enhance profitability.

Connected trucks revolutionize fleet operations through a suite of efficiency-enhancing features. Real-time monitoring enables fleet managers to track vehicle performance, identify inefficiencies, and respond promptly to issues. Predictive maintenance utilizes data analytics to forecast potential equipment failures, allowing proactive maintenance scheduling and minimizing downtime. Route optimization optimizes travel routes based on factors like traffic conditions, weather, and delivery schedules, reducing fuel consumption and delivery times. These features collectively streamline operations, maximize resource utilization, and enhance overall efficiency in fleet management.

Connected trucks prioritize driver safety with advanced safety features that mitigate risks and ensure compliance with regulatory standards. Collision detection systems use sensors and cameras to detect potential collisions and alert drivers, providing crucial reaction time to prevent accidents. Lane departure warnings notify drivers when they unintentionally drift out of their lane, reducing the likelihood of lane departure accidents. These safety enhancements not only protect drivers and passengers but also safeguard other road users and valuable cargo. By promoting safer driving behaviours and reducing accident rates, connected trucks contribute to lower insurance costs, improved regulatory compliance, and enhanced brand reputation for fleet operators.

The initial investment costs of deploying connected truck solutions constitute a significant restraint for fleet operators. These costs encompass a range of expenses, including the procurement of hardware components such as telematics devices and on-board sensors, acquisition of software licenses, and investment in infrastructure upgrades to support data transmission and storage. For many fleet operators, particularly small and medium-sized enterprises (SMEs), the financial burden associated with these upfront costs can be prohibitive, hindering their ability to adopt connected truck technologies. Moreover, uncertainties surrounding the return on investment (ROI) and the long-term benefits of these solutions may further deter investment.

The proliferation of connected trucks has raised significant data security concerns within the transportation industry. These concerns stem from the large volumes of sensitive data generated and transmitted by connected trucks, including vehicle diagnostics, location information, and driver behavior metrics. Fleet operators and technology providers must contend with the risk of data breaches, unauthorized access, and cyberattacks that could compromise the confidentiality, integrity, and availability of data. Moreover, compliance with data privacy regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) adds another layer of complexity to data security management. Failure to adequately address data security concerns can erode customer trust, expose organizations to legal liabilities, and damage their reputation.

Rapid advancements in telematics, IoT, and AI technologies are propelling the evolution of connected trucks, unlocking new opportunities for enhanced efficiency and innovation. Telematics systems provide real-time monitoring and data collection capabilities, enabling fleet managers to track vehicle performance and optimize operations.

Integration with IoT devices facilitates seamless communication between various components of the truck ecosystem, enabling predictive maintenance and proactive decision-making. Additionally, AI-driven analytics algorithms analyze vast amounts of data to identify patterns, optimize routes, and improve fuel efficiency. These technological advancements also enable integration with autonomous driving systems, paving the way for safer and more efficient transportation solutions.

The increasing demand for efficient, safe, and sustainable transportation solutions presents significant growth opportunities for the connected trucks market. As businesses worldwide prioritize efficiency and environmental responsibility, there is a growing recognition of the benefits offered by connected truck technologies. Emerging economies, in particular, represent fertile ground for market expansion, as they seek to modernize their transportation infrastructure and improve logistics efficiency. Additionally, the shift towards sustainability and regulatory compliance drives further market expansion, as companies seek solutions that reduce emissions, optimize fuel consumption, and enhance overall operational efficiency.

The dedicated short-range communication segment captured a substantial market share of 61.36%%, primarily driven by the rising interest in sustainable transportation. DSRC has been a well-established technology in the automotive industry for facilitating vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication. Its reliability and effectiveness in enabling direct communication between vehicles and infrastructure make it a preferred choice for connected truck systems. It further offers interoperability between different vehicle manufacturers and infrastructure providers, ensuring seamless communication and compatibility across diverse systems.

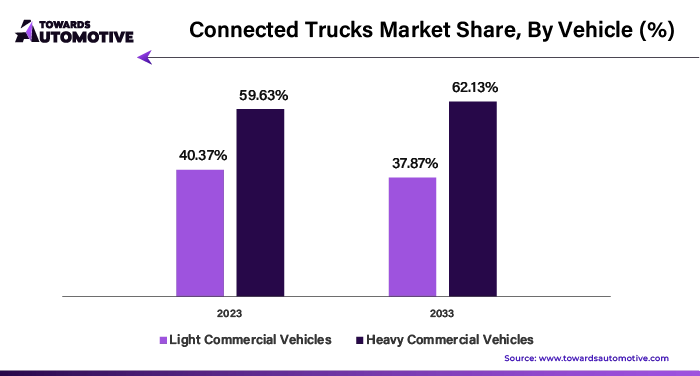

The heavy commercial vehicle segment dominated the market with share of 59.63%. This is owing to the emphasis on fleet management efficiency has propelled the adoption of connected technologies in the HCV sector. Furthermore, the HCV segment's substantial market share can be attributed to the significant role these vehicles play in long-haul transportation, logistics, and heavy-duty applications, where the benefits of connected technologies in improving efficiency and reducing operational costs are particularly prominent.

The vehicle-to-cloud (V2C) communication segment dominated the market in 2023. V2C communication enables seamless and efficient data transmission between vehicles and cloud-based platforms, facilitating real-time monitoring, analytics, and decision-making. Furthermore, the scalability and flexibility offered by cloud-based communication solutions make them well-suited for addressing the diverse needs and requirements of the connected trucks market.

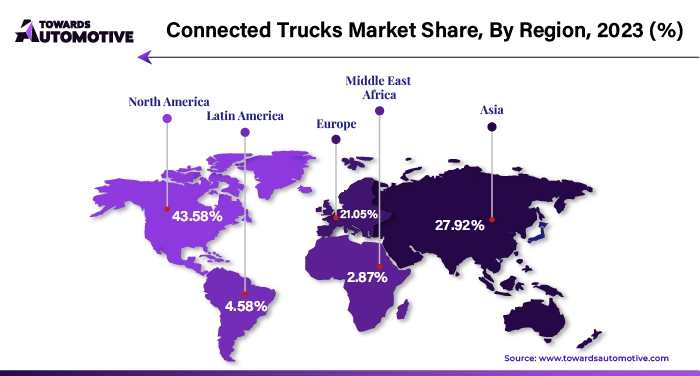

North America dominated the global connected trucks market with 43.58% of the share of the total market in 2023. This is owing to its technological advancement and widespread adoption of connected technologies in the transportation industry. The region has a well-developed internet infrastructure, characterized by high-speed connectivity and extensive network coverage, providing a robust foundation for the deployment of connected truck solutions.

Europe is likely to grow at a substantial CAGR of 12.75% in the connected trucks market during the forecast period. This is due to the widespread adoption of Internet of Things (IoT) and telematics technologies for remote fleet monitoring by fleet owners. The region's transportation industry has witnessed a significant shift towards digitization and connectivity, fueled by the imperative to enhance operational efficiency, improve fleet management practices, and comply with stringent regulatory requirements.

Some of the key players in connected trucks market are CalAmp, Daimler AG, Navistar International Corporation, PACCAR Inc., Fleet Complete, Geotab, MiX Telematics, Continental AG, Verizon Connect, Omnitracs, Volvo Group, Samsara Networks Inc., Scania AB, Teletrac Navman, Trimble Inc., WABCO Holdings Inc., TomTom Telematics, and ZF Friedrichshafen AG, among others.

By Component

By Range

By Connectivity

By Vehicle

By Application

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us