March 2025

The E-scooter battery swapping market is booming, poised for a revenue surge into the hundreds of millions from 2023 to 2034, driving a revolution in sustainable transportation.

The E-scooter battery swapping market is rapidly emerging as a transformative solution in the electric mobility sector, addressing the challenges of battery charging and range anxiety. Battery swapping involves exchanging a depleted battery for a fully charged one at specialized stations, significantly reducing the time needed for recharging compared to traditional methods. This approach is particularly advantageous for electric scooters and motorcycles, which often require frequent charging due to their smaller battery capacities and high utilization rates. By providing a quick and efficient alternative to conventional charging, battery swapping enhances the convenience and accessibility of electric vehicles (EVs) and e-scooters, making them a more viable option for urban transportation.

The market for battery swapping is driven by several factors, including the growing adoption of electric scooters in densely populated cities, where efficient and swift battery replacement can alleviate the limitations of charging infrastructure. Additionally, advancements in battery technology and the development of standardized battery packs are facilitating the expansion of swapping networks. Governments and private companies are investing in battery swapping stations as part of broader initiatives to promote clean energy and reduce emissions. This innovative approach not only addresses the issue of lengthy charging times but also offers potential benefits for fleet operators and consumers by reducing the overall cost and improving the operational efficiency of electric two-wheelers. As the demand for electric mobility solutions continues to rise, the battery swapping market is poised for significant growth, shaping the future of sustainable transportation.

AI plays a crucial role in the E-scooter battery swapping market by enhancing efficiency, optimizing operations, and improving user experiences. In battery swapping stations, AI-driven systems manage inventory and predict battery demand by analyzing usage patterns and historical data. This helps ensure that fully charged batteries are readily available, reducing wait times and operational disruptions.

AI algorithms are also used for predictive maintenance, monitoring the health of battery packs to identify potential issues before they lead to failures. This proactive approach minimizes downtime and extends the lifespan of batteries, enhancing the reliability of swapping stations.

For users, AI-powered mobile apps provide real-time information on the nearest battery swapping stations, availability of batteries, and expected wait times, improving convenience and efficiency. Additionally, AI can facilitate dynamic pricing models and reward systems, incentivizing frequent users and optimizing the overall user experience.

Overall, AI enhances the operational efficiency of battery swapping stations, ensures better battery management, and delivers a smoother experience for EV and e-scooter users, supporting the growth and adoption of battery swapping as a sustainable transportation solution.

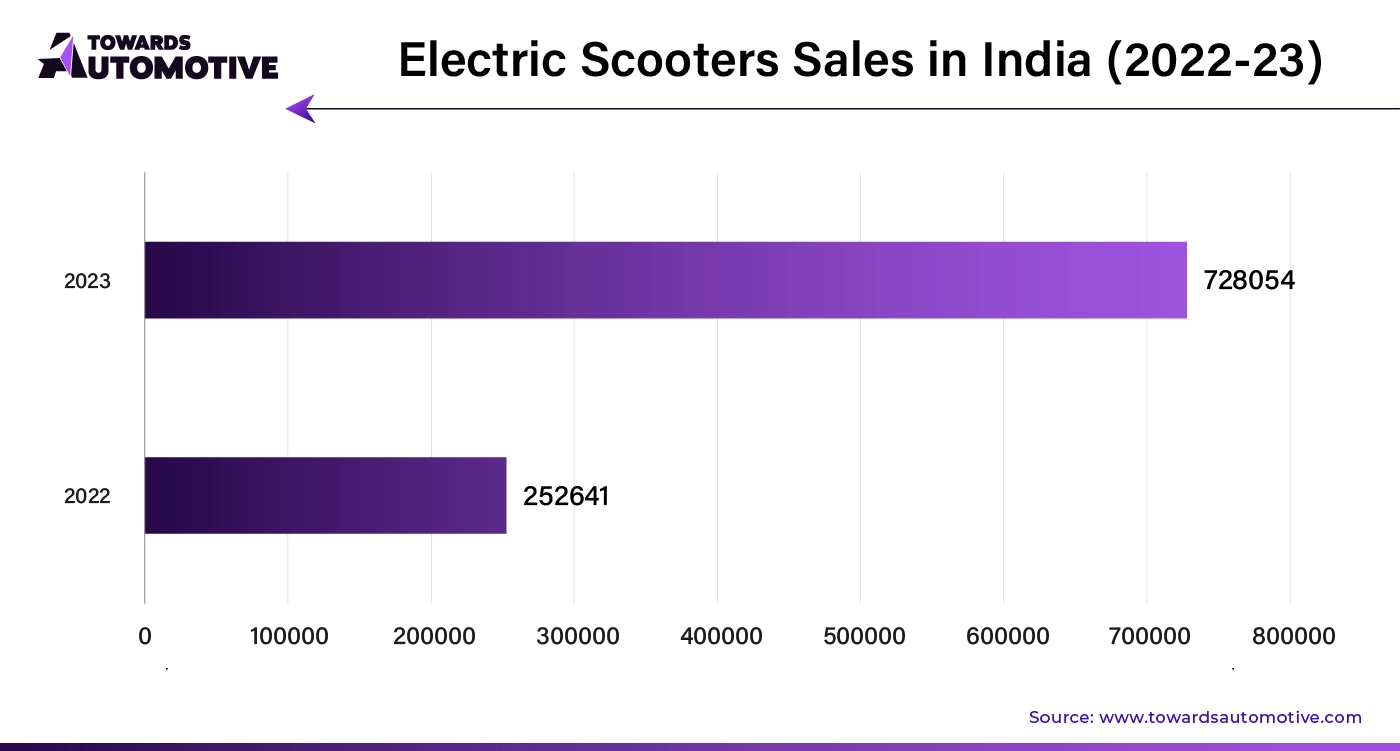

The growing demand for e-scooters is significantly driving the expansion of the E-scooter battery swapping market. E-scooters have gained immense popularity due to their convenience, affordability, and environmental benefits, particularly in densely populated urban areas where they offer a practical solution to traffic congestion and reduce carbon emissions. As the adoption of e-scooters increases, so does the need for efficient and rapid battery solutions to support their high usage rates. Traditional charging methods can be time-consuming and inconvenient, particularly for shared e-scooter fleets that require quick turnaround times to maintain service availability.

Battery swapping emerges as an attractive solution to this challenge, offering a swift and efficient alternative to charging by allowing users to exchange depleted batteries for fully charged ones at dedicated stations. This method minimizes downtime, ensuring that e-scooters remain operational and available for use throughout the day. The rise in e-scooter usage creates a higher demand for battery swapping stations and services, which in turn stimulates the market for advanced swapping technologies and infrastructure development.

Moreover, the integration of battery swapping with e-scooter rental and sharing programs amplifies this effect. Fleet operators seek to maximize the operational efficiency of their e-scooter fleets and minimize downtime, making battery swapping an appealing option. The ability to quickly swap batteries helps maintain high fleet utilization rates and enhances user satisfaction, further driving the demand for swapping infrastructure.

Additionally, as e-scooters become a more common mode of transportation, especially in urban environments, the scalability and convenience offered by battery swapping solutions are increasingly recognized. This growing acceptance and reliance on e-scooters fuel investment and innovation in the battery swapping market, paving the way for its expansion and integration into broader transportation networks. Overall, the surge in e-scooter adoption is a key driver of growth in the EV/ e-scooter battery swapping market, highlighting the need for efficient, scalable charging solutions to support the evolving landscape of electric mobility.

Unlock Infinite Advantages: Subscribe to Annual Membership

The E-scooter battery swapping market faces several constraints, including high initial infrastructure costs for setting up swapping stations and standardizing battery designs. Additionally, logistical challenges arise in managing battery inventory and ensuring consistent availability of charged batteries. Regulatory and safety concerns, such as compliance with battery disposal and recycling standards, also pose hurdles. Furthermore, consumer acceptance and the need for widespread adoption of battery swapping networks are critical barriers to market growth.

Partnerships and collaborations are creating significant opportunities in the E-scooter battery swapping market by fostering innovation, expanding infrastructure, and enhancing market reach. Collaborative efforts between vehicle manufacturers, battery providers, and swapping station operators are crucial for developing standardized battery packs and interoperable systems. These partnerships enable the creation of compatible battery solutions that streamline the swapping process and reduce costs, making the technology more accessible and appealing to a broader audience.

Strategic alliances also facilitate the rapid deployment of battery swapping infrastructure. By combining resources and expertise, partners can accelerate the establishment of swapping stations, particularly in high-density urban areas where demand is high. Shared investments in infrastructure development help distribute financial risks and leverage collective expertise, leading to more efficient and scalable solutions.

Additionally, collaborations with technology companies enhance the integration of smart technologies, such as AI and IoT, into battery swapping systems. This integration improves operational efficiency through real-time monitoring, predictive maintenance, and optimized inventory management, further driving the growth and adoption of battery swapping solutions.

Moreover, partnerships with government bodies and regulatory agencies can help navigate the complex landscape of regulations and standards, ensuring compliance and facilitating smoother market entry. Such collaborations can also secure government incentives and funding, supporting the expansion of battery swapping networks and the advancement of related technologies.

Asia Pacific dominated the E-scooter battery swapping market. In Asia Pacific, rapid urbanization, high e-scooter adoption, growing shared mobility services, and substantial infrastructure investments are pivotal drivers of the E-scooter battery swapping market. As cities across the region experience rapid urban expansion, the demand for efficient, short-distance transportation solutions increases. E-scooters have emerged as a popular choice for navigating congested urban environments due to their affordability and convenience. However, traditional charging methods can be unfavorable in densely populated areas, battery swapping addresses this challenge by offering a quick and convenient alternative to lengthy charging times, ensuring that e-scooters remain operational throughout the day.

The proliferation of shared mobility services further fuels the demand for battery swapping technology. E-scooter rental and sharing platforms, which are gaining traction in major cities, rely on the ability to rapidly swap batteries to maintain high vehicle availability and operational efficiency. For these services, minimizing downtime and ensuring a steady supply of fully charged batteries is crucial to meet user demand and enhance service reliability. Battery swapping provides an effective solution, allowing fleet operators to quickly replace depleted batteries and keep their e-scooters in circulation.

Infrastructure investments play a critical role in supporting the growth of battery swapping networks. Governments and private entities are investing heavily in the development of battery swapping stations, particularly in urban centers where e-scooter usage is high. These investments aim to create a comprehensive network of swapping stations that can cater to the increasing number of e-scooters and other electric vehicles. By expanding the availability of swapping stations, these investments not only improve the convenience of battery swapping but also encourage wider adoption of electric mobility solutions.

North America is expected to grow with the highest CAGR during the forecast period. The rising adoption of electric vehicles (EVs), technological advancements, and growing environmental and sustainability goals are driving the expansion of the E-scooter battery swapping market in North America. As electric vehicles gain popularity due to their environmental benefits and cost efficiency, there is an increasing demand for practical solutions to manage their energy needs. Traditional charging methods, which can be time-consuming, are often less suitable for high-utilization applications such as e-scooter fleets and shared mobility services. Battery swapping provides a swift and convenient alternative, allowing users to quickly exchange depleted batteries for fully charged ones, thus minimizing downtime and maintaining operational efficiency.

Technological advancements play a crucial role in enhancing the viability of battery swapping solutions. Innovations in battery design, such as improved energy density and faster charging capabilities, are complementing the development of advanced swapping systems. Automation and smart technology integration streamline the swapping process, making it more efficient and user-friendly. AI and IoT technologies facilitate real-time monitoring and management of battery inventories, ensuring that swapping stations are stocked with fully charged batteries and reducing the likelihood of service interruptions. These technological improvements are critical for increasing the attractiveness and functionality of battery swapping solutions.

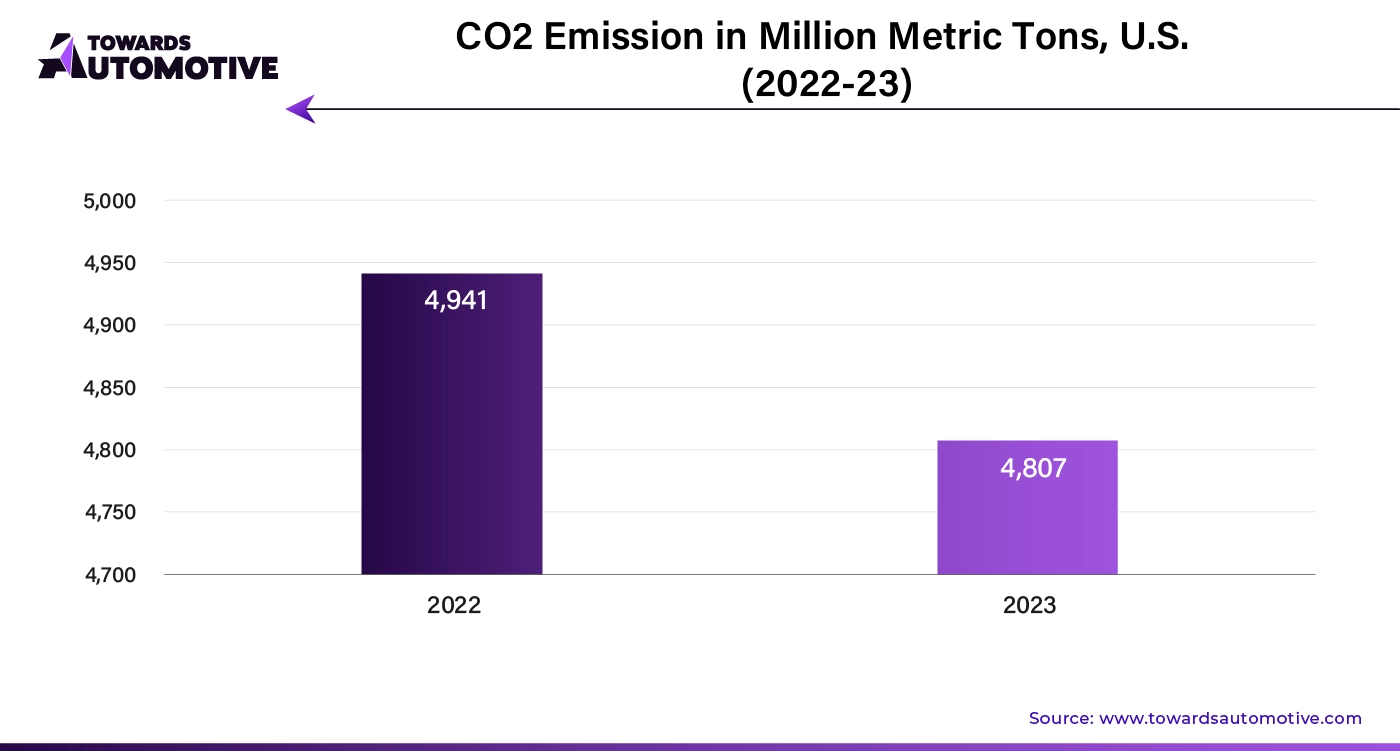

Environmental and sustainability goals are further driving the market as North America intensifies its efforts to reduce greenhouse gas emissions and promote cleaner transportation alternatives. Battery swapping supports these goals by providing a rapid and effective method for charging electric vehicles, which aligns with broader initiatives to enhance environmental sustainability. By enabling a higher turnover of e-scooters and electric vehicles with minimal environmental impact, battery swapping contributes to reducing the carbon footprint of transportation.

By Region

March 2025

March 2025

March 2025

March 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us