April 2025

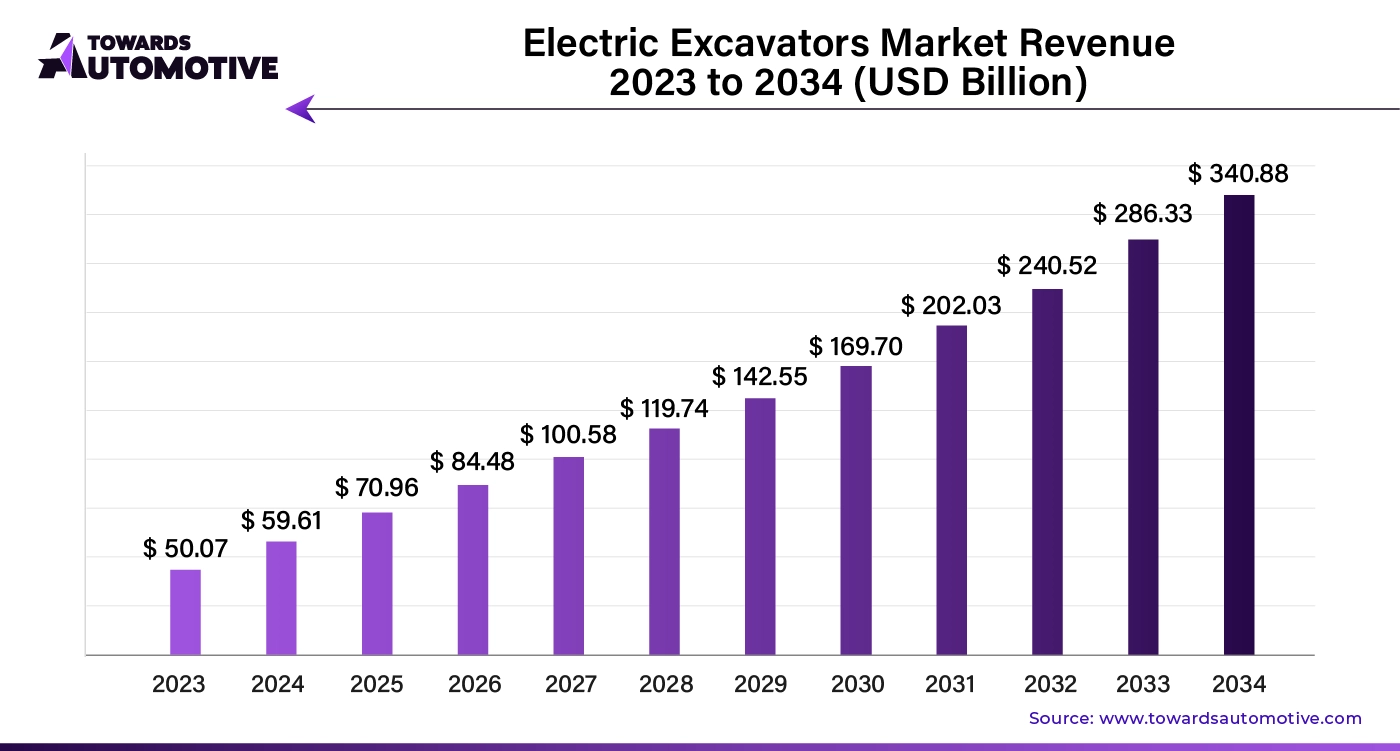

The global electric excavators market size is calculated at USD 59.61 billion in 2024 and is expected to be worth USD 340.88 billion by 2034, expanding at a CAGR of 19.05% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The electric excavators market is witnessing notable growth driven by increasing environmental concerns and advancements in battery technology. As construction and mining industries strive to reduce their carbon footprint, electric excavators present a sustainable alternative to traditional diesel-powered machinery. These electric machines offer several advantages, including lower operational costs due to reduced fuel consumption and maintenance requirements. Additionally, they contribute to quieter work environments, which is particularly beneficial for urban construction sites where noise regulations are strict. The market's expansion is further supported by government incentives and regulations aimed at promoting clean energy and reducing greenhouse gas emissions. Innovations in battery technology and electric drivetrains are enhancing the performance and efficiency of electric excavators, making them a viable option for heavy-duty applications.

Companies are investing in research and development to improve battery life, charging infrastructure, and overall machine durability, which are critical factors for widespread adoption. Moreover, the rising demand for electric excavators is being fueled by the need for energy-efficient and eco-friendly equipment in various construction projects. As technology continues to advance and the initial costs of electric excavators decrease, their adoption is expected to accelerate, driving further growth in the market. The shift towards electrification in the construction sector aligns with broader sustainability goals, positioning electric excavators as a key player in the future of green construction practices.

AI is playing a transformative role in the electric excavators market by enhancing operational efficiency, safety, and productivity. AI technologies enable advanced automation of excavation tasks. Machine learning algorithms can optimize excavation patterns, load handling, and even predict maintenance needs. Automated controls reduce the need for manual intervention, allowing for more precise and efficient operations.

AI-driven predictive maintenance systems analyze data from various sensors embedded in the excavators. By monitoring wear and tear, AI can predict potential failures before they occur, reducing downtime and extending the lifespan of the machinery. This predictive approach helps avoid costly repairs and enhances overall equipment reliability.

AI enhances safety on construction sites by enabling advanced collision avoidance systems and real-time hazard detection. AI algorithms can process data from cameras and sensors to identify potential obstacles and prevent accidents, thereby improving safety for operators and nearby personnel.

AI algorithms analyze operational data to optimize performance and fuel efficiency. For electric excavators, this includes optimizing battery usage, reducing energy consumption, and enhancing overall machine performance. AI can adjust operational parameters in real-time based on changing site conditions. AI provides valuable insights through data analytics.

By collecting and analyzing data from various sources, including the excavator's sensors and external environmental factors, AI can offer recommendations for improving work processes and site management. AI facilitates remote monitoring and control of electric excavators. Operators can manage and oversee equipment performance from a distance, enabling better management of multiple machines and improving operational efficiency.

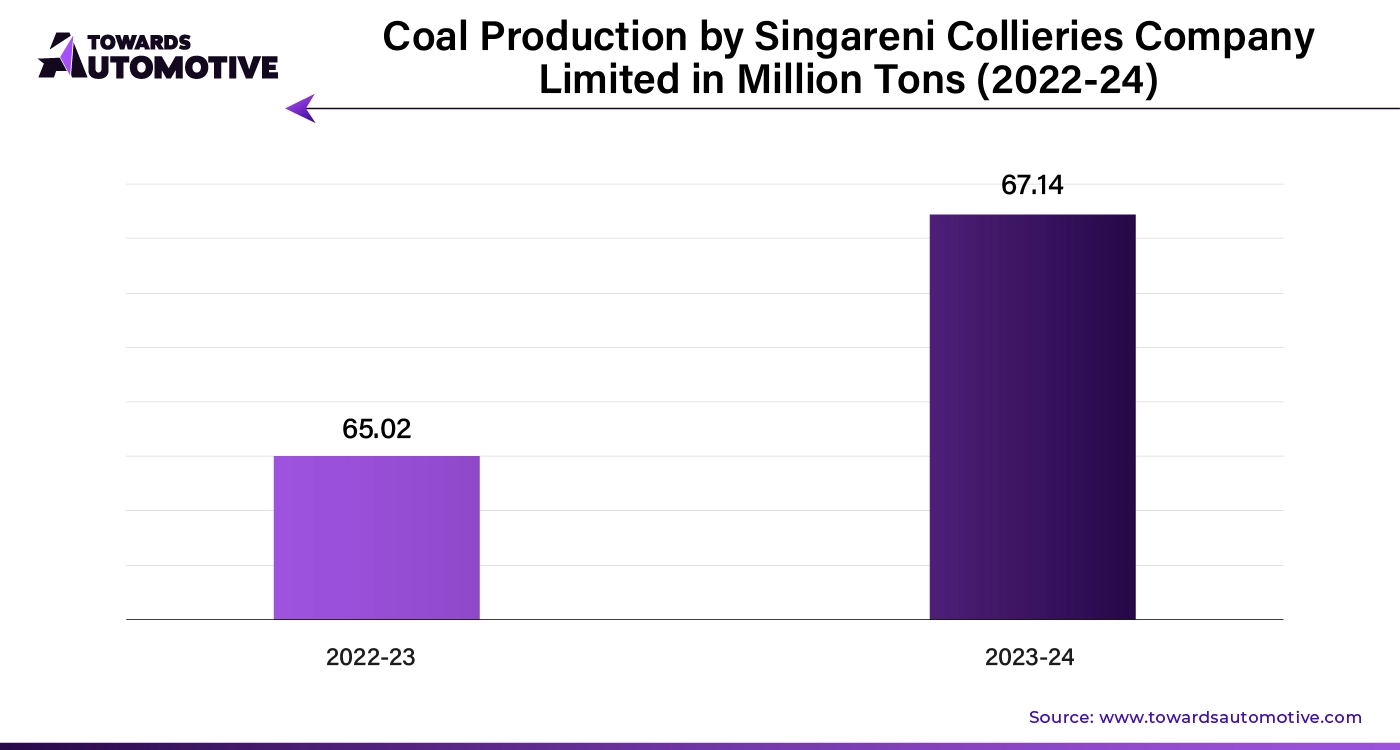

Mining activities are a significant driver of growth in the electric excavators market, primarily due to the industry's shift towards sustainable and environmentally friendly practices. As mining operations increasingly face regulatory pressures and community demands for reduced environmental impact, electric excavators offer a compelling alternative to traditional diesel-powered equipment. These electric machines produce zero emissions during operation, aligning with global efforts to minimize carbon footprints and comply with stringent environmental regulations. Additionally, electric excavators contribute to quieter mining operations, which is beneficial in minimizing noise pollution and enhancing safety in sensitive areas. The mining sector's focus on energy efficiency further fuels the adoption of electric excavators, as these machines can significantly lower operational costs by reducing fuel consumption and maintenance needs. Innovations in battery technology are also expanding the capabilities of electric excavators, making them suitable for heavy-duty mining applications.

Enhanced battery life and faster charging solutions are addressing previous limitations, allowing electric excavators to meet the demanding requirements of mining operations. Furthermore, as mining companies invest in modernizing their fleets, electric excavators represent a forward-thinking choice that aligns with broader sustainability goals. The integration of electric excavators into mining operations not only supports environmental stewardship but also offers long-term economic benefits through reduced operational expenses and improved efficiency. Consequently, the growth of mining activities, driven by the need for sustainable solutions, is accelerating the adoption of electric excavators in the industry.

The electric excavators market faces several constraints, notably the high initial cost of these machines ompared to traditional diesel models. Advanced technology and specialized components contribute to their elevated price, which can be a significant barrier for many operators. Additionally, limitations in battery technology, such as restricted battery life and longer charging times, hinder operational efficiency. The insufficient charging infrastructure in remote areas further complicates adoption, while the need for specialized operator training adds to the overall costs and complexity of transitioning to electric excavators.

Enhanced charging infrastructure is creating substantial opportunities in the electric excavators market by addressing key limitations that have previously hindered adoption. The development of advanced charging solutions, including fast-charging stations and portable charging units, is crucial for overcoming the challenges associated with battery life and charging time. Fast-charging technology reduces downtime, allowing electric excavators to remain operational for longer periods and improve overall productivity on job sites. Additionally, the expansion of charging networks into remote and underserved areas makes it more feasible to deploy electric excavators in diverse locations, including challenging environments where traditional diesel equipment was previously the only option.

This increased accessibility to reliable charging infrastructure mitigates one of the primary concerns for operators and facilitates a smoother transition to electric equipment. Furthermore, the growth of charging infrastructure is supported by investments and incentives from governments and private entities, which are actively working to expand and upgrade charging facilities. As charging solutions become more widespread and efficient, they will play a pivotal role in driving the adoption of electric excavators, enhancing their practicality, and making them a more attractive choice for the construction and mining industries focused on sustainability and operational efficiency.

The mini/compact segment held the largest share of the market. The mini and compact segment is driving significant growth in the electric excavators market due to its suitability for urban and small-scale construction projects. Mini and compact electric excavators offer a range of advantages, including their ability to operate in tight spaces and navigate confined areas, which are common in urban environments and smaller job sites. These machines are particularly valuable for tasks such as landscaping, utility work, and residential construction, where traditional larger excavators might be impractical or over-sized. The growing demand for sustainable and eco-friendly equipment in these sectors is further boosting the adoption of electric mini and compact excavators. Their lower noise levels and zero emissions align with the increasing emphasis on reducing environmental impact and adhering to strict urban noise regulations.

Additionally, advancements in battery technology are making these compact electric excavators more powerful and efficient, extending their operational capabilities and reducing the limitations associated with earlier models. As urbanization continues and the need for smaller, more versatile machinery increases, the mini and compact segment of electric excavators is expected to expand rapidly, driving overall market growth and contributing to a broader shift towards electrification in the construction industry.

The construction segment dominated the industry. The construction segment is a major driver of growth in the electric excavators market, propelled by the industry's increasing focus on sustainability and efficiency. Electric excavators offer numerous benefits for construction projects, including zero emissions, reduced noise pollution, and lower operating costs, which align with the growing emphasis on green building practices and compliance with stringent environmental regulations. As construction sites become more conscious of their environmental footprint, the demand for electric excavators rises, particularly in urban areas where noise and air quality are critical concerns.

The advancements in battery technology and electric drivetrains have also enhanced the performance of electric excavators, making them suitable for a variety of construction tasks, from site preparation to excavation and material handling. Additionally, the construction sector's ongoing trend towards modernization and technological integration supports the adoption of electric machinery, as companies seek to improve operational efficiency and reduce long-term costs. Government incentives and regulations favoring clean energy solutions further accelerate the shift towards electric excavators, providing financial and regulatory support for their adoption. As the construction industry continues to prioritize sustainability and innovation, the electric excavators market is poised for substantial growth, driven by the sector's evolving needs and commitments to environmentally responsible practices.

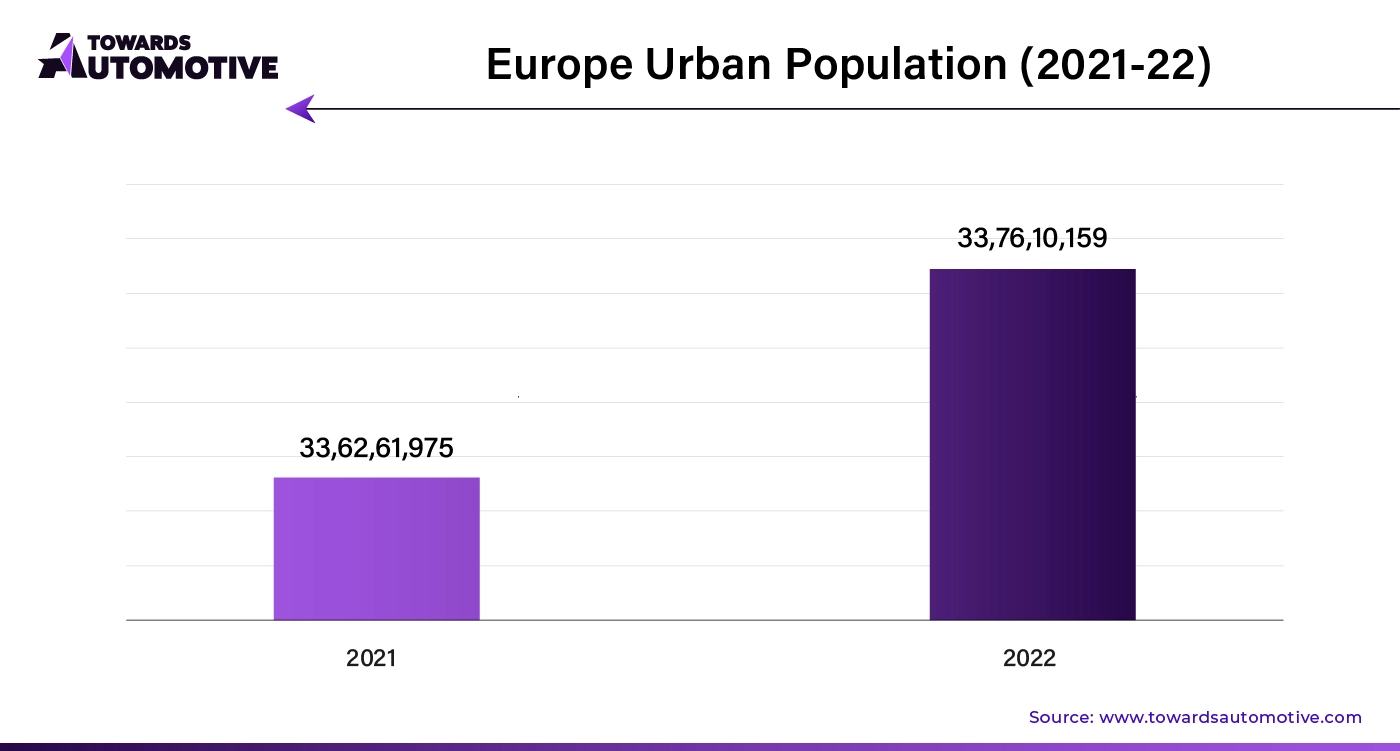

Europe dominated the electric excavators market. In Europe, the growth of the electric excavators market is significantly driven by growing urbanization, a strong focus on sustainability, and the availability of incentives and subsidies. As urban areas expand, there is a heightened demand for construction equipment that can operate efficiently in dense, noise-sensitive environments. Electric excavators, with their quiet operation and zero emissions, are ideal for such urban settings, meeting stringent environmental regulations and improving air quality. Additionally, Europe's commitment to sustainability is pushing construction firms to adopt greener practices, making electric excavators a preferred choice for projects aiming to reduce their carbon footprint. Government incentives and subsidies further accelerate this transition by offsetting the higher initial costs of electric machinery. These financial supports make electric excavators more accessible to construction companies, fostering greater adoption across the industry.

Latin America is expected to grow with a significant CAGR during the forecast period. Increasing infrastructure development, technological advancements, and rising environmental awareness are key drivers of growth in the electric excavators market in Latin America. Rapid urbanization and large-scale infrastructure projects across the region are creating a strong demand for efficient and sustainable construction equipment. Electric excavators, with their lower environmental impact and suitability for urban environments, are becoming increasingly popular as they align with the growing emphasis on sustainability. Technological advancements are also playing a crucial role, as improvements in battery technology and electric drivetrains enhance the performance, reliability, and range of electric excavators. These innovations make electric machinery more feasible for a variety of construction tasks, addressing previous limitations and expanding their applications. Additionally, rising environmental awareness among stakeholders, including governments and the public, is driving a shift towards greener construction practices. As concerns about pollution and climate change grow, there is a greater push for zero-emission equipment, making electric excavators an attractive choice for meeting regulatory standards and corporate sustainability goals.

By Propulsion

By Product

By End-User

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us