April 2025

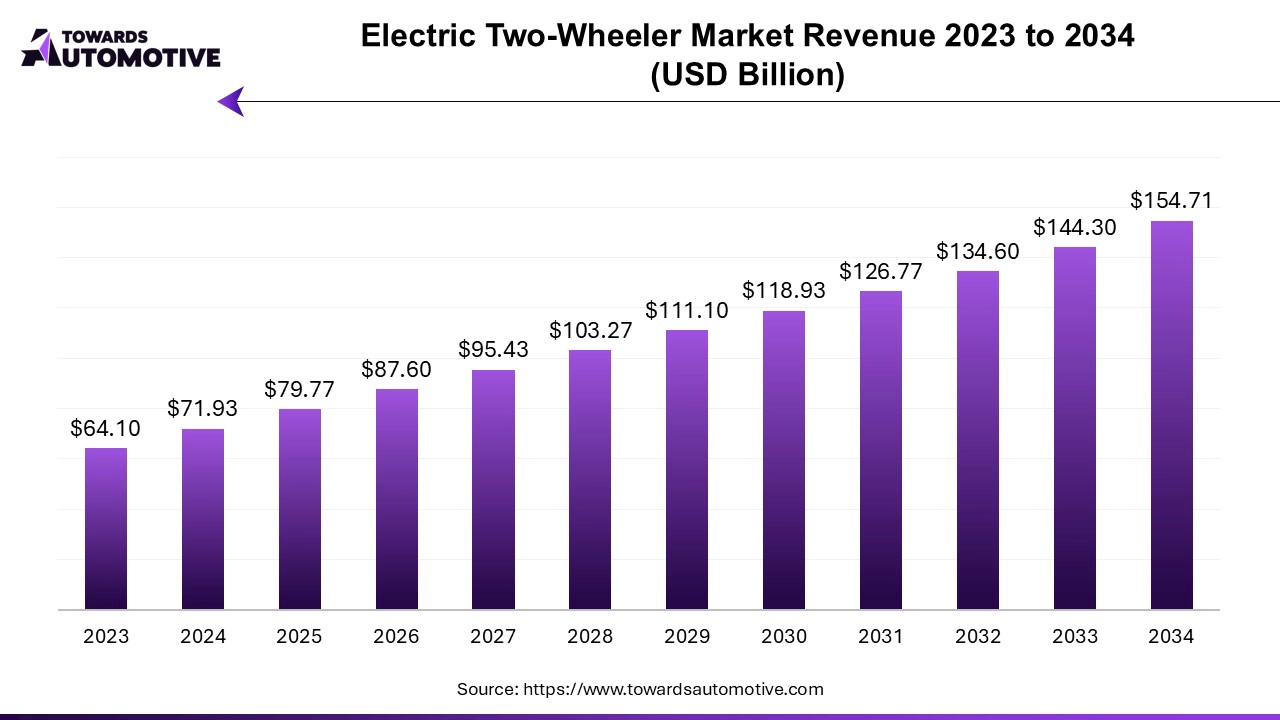

The global electric two-wheeler market is forecasted to expand from USD 79.77 billion in 2025 to USD 154.71 billion by 2034, growing at a CAGR of 7.21% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The electric two-wheeler market is experiencing rapid growth driven by the increasing demand for sustainable transportation solutions and the rising awareness of environmental issues. As urban areas grapple with traffic congestion and air pollution, electric two-wheelers offer an efficient, eco-friendly alternative to traditional gasoline-powered vehicles. These vehicles are not only more affordable to operate due to lower energy costs but also contribute significantly to reducing greenhouse gas emissions. Government incentives, such as subsidies, tax rebates, and investments in charging infrastructure, further bolster the appeal of electric two-wheelers, encouraging consumers to make the switch from conventional bikes.

Technological advancements are also playing a pivotal role in the market's expansion. Innovations in battery technology have led to improved energy density, longer ranges, and shorter charging times, addressing common consumer concerns about the practicality of electric two-wheelers. Manufacturers are continually investing in research and development to enhance the performance and safety features of electric bikes, making them more competitive with traditional options.

In addition, the growing trend of e-commerce and last-mile delivery services is propelling the demand for electric two-wheelers, particularly in urban areas where quick and efficient transport is essential. The rise of shared mobility services, including bike-sharing and ride-hailing platforms, further amplifies the market potential, as electric two-wheelers are increasingly integrated into these services.

As consumers prioritize sustainability and convenience, and as cities implement stricter emission regulations, the electric two-wheeler market is poised for significant growth. This trend is supported by a growing ecosystem of charging infrastructure, favorable policies, and consumer acceptance, solidifying electric two-wheelers as a viable and attractive mode of transportation in the modern urban landscape.

Artificial Intelligence (AI) is revolutionizing the electric two-wheeler market by enhancing various facets of design, operation, and user experience. One of the primary roles of AI lies in smart battery management, where algorithms predict usage patterns and optimize charging cycles to extend battery life and improve overall range, addressing critical consumer concerns. AI also facilitates predictive maintenance, allowing manufacturers and riders to monitor vehicle performance in real time, identifying potential issues before they escalate, thereby minimizing downtime and repair costs.

Moreover, AI enhances user experience through intelligent navigation systems that learn individual preferences, offering optimized routes and traffic updates. Features like voice recognition and AI-driven interfaces further improve interaction, making riding more intuitive. In terms of safety, AI powers advanced driver-assistance systems (ADAS), integrating collision detection, emergency braking, and stability control features that analyze sensor data to help prevent accidents.

AI is also paving the way for autonomous capabilities in electric two-wheelers, enabling vehicles to analyze real-time environmental data for safer riding decisions. Additionally, AI plays a crucial role in market analysis, helping manufacturers identify trends and consumer preferences, ultimately driving product innovation. Supply chain optimization is another area where AI contributes by predicting demand and improving production efficiency, leading to reduced costs and better availability.

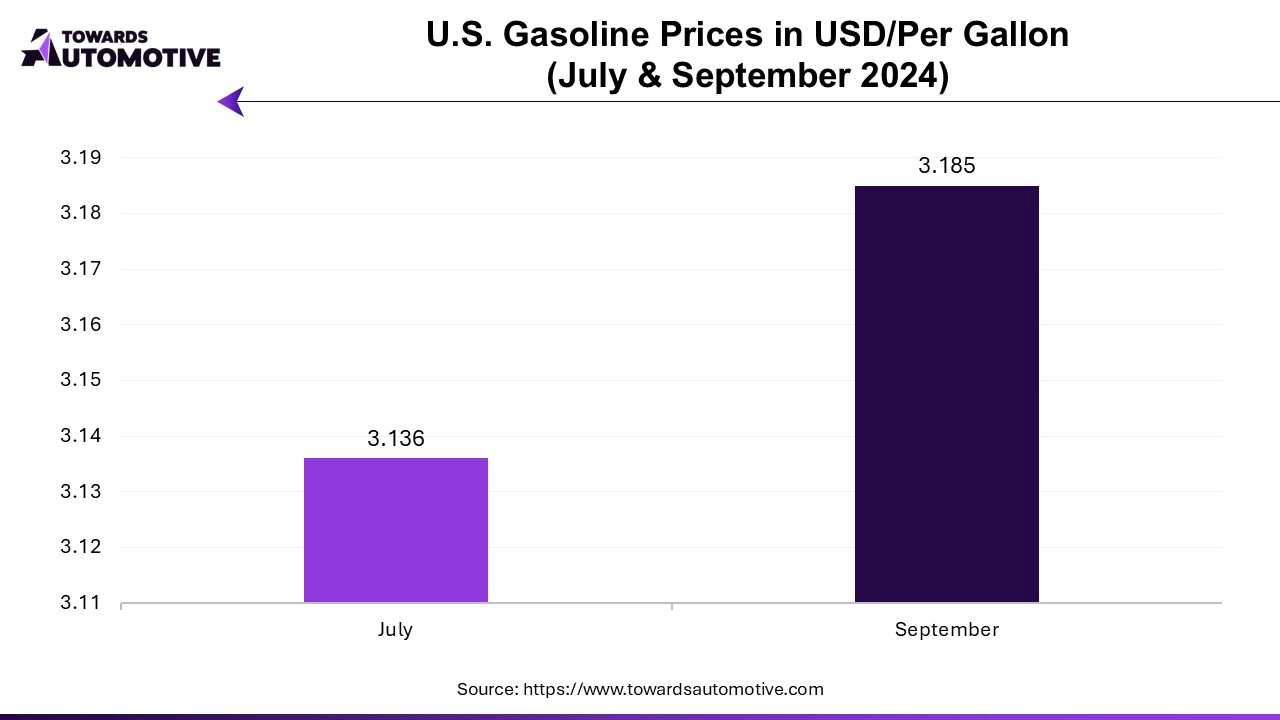

Rising fuel prices are significantly driving the growth of the electric two-wheeler market as consumers seek more economical and sustainable alternatives for their transportation needs. As gasoline and diesel costs escalate, the financial burden on riders becomes increasingly apparent, prompting many to explore cost-effective solutions. Electric two-wheelers present an attractive option, offering lower operating costs compared to traditional vehicles. The price of electricity is generally more stable and significantly less than fossil fuels, leading to substantial savings over time. Additionally, the reduced maintenance requirements associated with electric two-wheelers—such as fewer moving parts and the absence of oil changes—further enhance their cost-effectiveness.

This shift in consumer behavior is particularly evident among urban dwellers, who often face high fuel expenses due to daily commutes. Electric two-wheelers not only help mitigate these costs but also contribute to environmental sustainability, appealing to eco-conscious consumers. As more people become aware of the long-term financial benefits and the environmental impact of their transportation choices, the demand for electric two-wheelers continues to rise.

Moreover, governments across various regions are implementing policies and incentives to encourage the adoption of electric vehicles, further catalyzing the transition away from fuel-dependent transportation.

The electric two-wheeler market faces several restraints that could hinder its growth. One significant challenge is the limited charging infrastructure, which can create range anxiety among potential users and discourage them from adopting electric vehicles. Additionally, the higher upfront costs of electric two-wheelers compared to traditional gasoline-powered models can be a barrier for many consumers, despite long-term savings on fuel and maintenance. Furthermore, concerns about battery life and performance, particularly in extreme weather conditions, can deter buyers. Lastly, regulatory hurdles and varying standards across regions can complicate the market landscape, affecting manufacturers' ability to innovate and expand.

The increasing focus on shared mobility is creating significant opportunities in the electric two-wheeler market, as urbanization and congestion push cities to seek sustainable transportation solutions. With the rise of bike-sharing and scooter-sharing platforms, electric two-wheelers are becoming essential components of urban mobility ecosystems. These shared services offer a convenient and eco-friendly alternative to traditional transportation methods, catering to consumers who prefer flexible travel options without the burden of ownership. As cities invest in infrastructure to support shared mobility, including dedicated lanes and charging stations, the demand for electric two-wheelers is expected to grow.

Moreover, shared mobility solutions align with sustainability goals by reducing the number of vehicles on the road, lowering emissions, and easing traffic congestion. This trend is especially appealing to millennials and Gen Z consumers, who are increasingly prioritizing sustainability and convenience in their transportation choices. Consequently, manufacturers and service providers are likely to invest in electric two-wheelers tailored for shared mobility, incorporating smart technologies such as GPS tracking, mobile app integration, and real-time availability updates. As the market expands, partnerships between electric two-wheeler manufacturers and shared mobility platforms will further accelerate growth, solidifying electric two-wheelers as a vital part of the future of urban transportation.

The li-ion segment held the largest share of the market. The lithium-ion (Li-ion) battery segment is a key driver of growth in the electric two-wheeler market, thanks to its superior performance characteristics and technological advancements. Li-ion batteries offer a higher energy density compared to traditional lead-acid batteries, allowing electric two-wheelers to achieve longer ranges on a single charge. This enhanced range directly addresses consumers' concerns about range anxiety, making electric two-wheelers more appealing for daily commutes and longer trips.

Furthermore, Li-ion batteries have faster charging capabilities, enabling users to recharge their vehicles quickly, thereby improving convenience and usability. The declining costs of Li-ion battery production, driven by economies of scale and advancements in manufacturing processes, are also making electric two-wheelers more affordable for consumers. Additionally, the lightweight nature of Li-ion batteries contributes to better vehicle efficiency and performance, enhancing the overall riding experience.

As manufacturers increasingly focus on incorporating Li-ion technology into their electric two-wheelers, they are able to offer more powerful and efficient models, further attracting a broader customer base. With ongoing research and development aimed at increasing battery longevity and reducing environmental impact, the Li-ion segment is positioned to continue driving significant growth in the electric two-wheeler market, supporting the transition to sustainable transportation solutions.

The more than 48V segment led the industry. The more than 48V segment is significantly driving the growth of the electric two-wheeler market by enhancing vehicle performance and expanding application potential. Electric two-wheelers equipped with batteries exceeding 48V offer higher power outputs, enabling faster acceleration and better handling, which are crucial for both urban commuting and recreational riding. This increased performance attracts a wider audience, including those seeking high-speed options and robust vehicles capable of tackling diverse terrains.

Moreover, the higher voltage systems improve overall energy efficiency, allowing for longer travel ranges on a single charge. This addresses one of the major concerns among potential electric two-wheeler users: range anxiety. As a result, manufacturers are increasingly focusing on developing models with more than 48V configurations to cater to the growing demand for powerful and efficient electric vehicles.

In addition, the 48V and above segment is gaining traction in the commercial sector, where electric two-wheelers are used for delivery and logistics purposes. These vehicles require greater power and efficiency to navigate urban environments and manage heavy loads. Consequently, the growth of e-commerce and the need for sustainable delivery solutions are further propelling the adoption of electric two-wheelers in this segment, making it a critical driver for market expansion.

The electric scooters segment dominated the industry. The electric scooters segment is a significant driver of growth in the electric two-wheeler market, primarily due to their popularity among urban commuters seeking efficient and convenient transportation solutions. With their compact design and lightweight construction, electric scooters are ideal for navigating congested city streets, making them a favored choice for short-distance travel. Their ease of use, coupled with lower operational costs compared to traditional gasoline-powered scooters, appeals to a broad demographic, including students and working professionals.

Additionally, the rising trend of shared mobility services, such as electric scooter rentals and bike-sharing programs, is further fueling the growth of this segment. These services not only provide convenient and eco-friendly transportation options but also promote the adoption of electric scooters among users who may not be ready to invest in their own vehicles.

As manufacturers innovate to enhance features such as battery life, charging speed, and smart connectivity, electric scooters are becoming increasingly attractive to consumers. Governments are also supporting this growth through incentives and investments in charging infrastructure, making electric scooters more accessible.

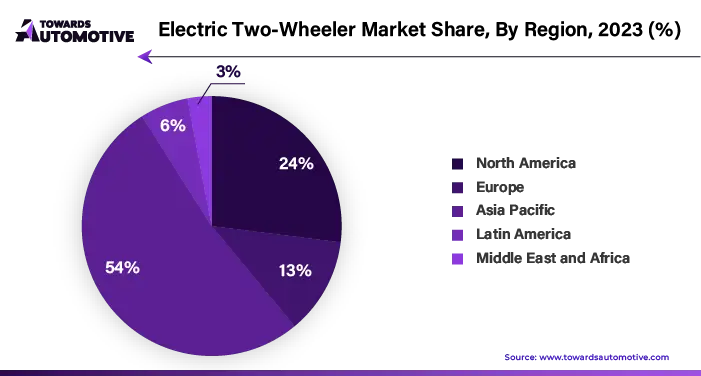

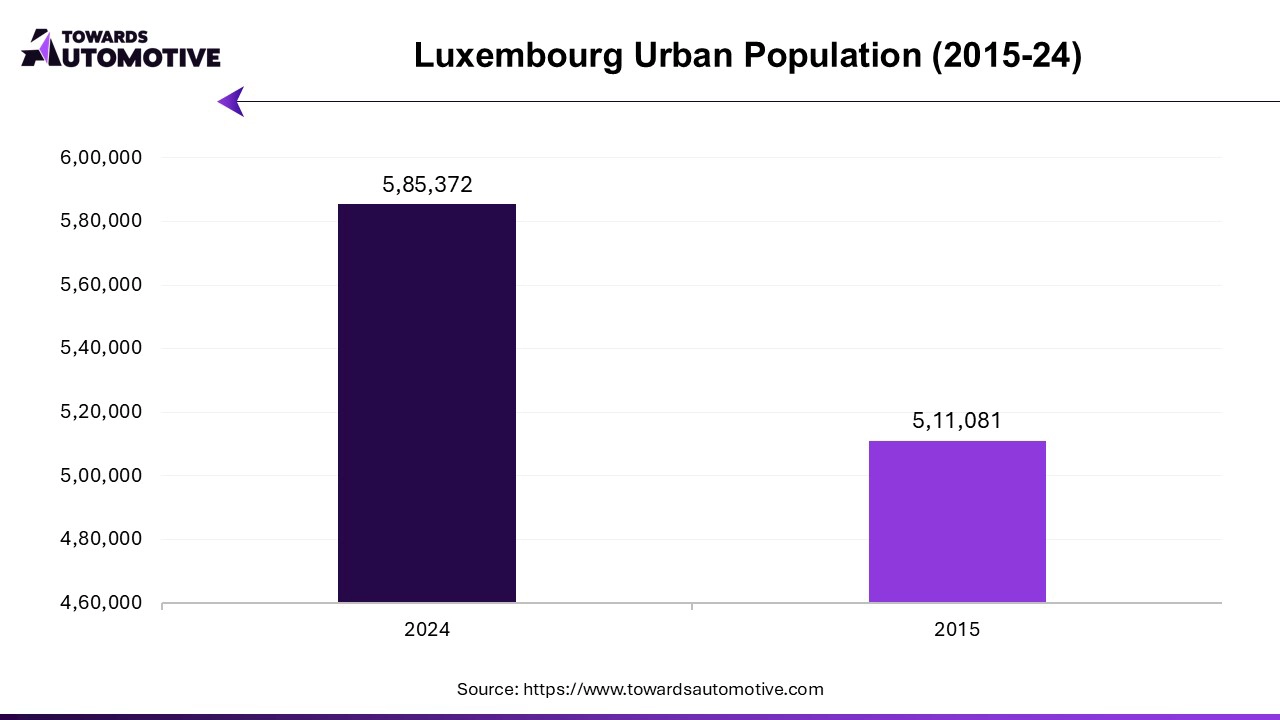

Asia Pacific dominated the electric two-wheeler market. The electric two-wheeler market in the Asia-Pacific (APAC) region is witnessing remarkable growth, driven by several interconnected factors, including the expansion of e-commerce and delivery services, increased investment from manufacturers, and rising environmental awareness. As e-commerce continues to flourish, there is an increasing demand for efficient last-mile delivery solutions, prompting businesses to adopt electric two-wheelers for their low operating costs and agility in urban settings. This surge in demand has led manufacturers to invest heavily in the development of electric two-wheeler models that cater to the needs of both consumers and businesses, enhancing the variety and availability of options in the market. Moreover, growing environmental awareness among consumers is pushing them to seek sustainable transportation solutions. With electric two-wheelers producing zero tailpipe emissions, they align with the aspirations of eco-conscious individuals and businesses aiming to reduce their carbon footprint. Collectively, these factors are not only fostering a robust electric two-wheeler market in APAC but also contributing to a broader shift towards sustainable mobility solutions in the region, positioning electric two-wheelers as a pivotal part of the future of urban transportation.

Europe is expected to grow with the highest CAGR during the forecast period. The electric two-wheeler market in Europe is experiencing significant growth, fueled by rising fuel prices, urbanization, and an increased focus on last-mile delivery solutions. As fuel prices continue to soar, consumers are actively seeking more cost-effective transportation alternatives. Electric two-wheelers present an economical solution, offering lower operating costs and reduced maintenance expenses compared to traditional gasoline-powered vehicles. This economic advantage makes them an attractive choice for commuters looking to save money while contributing to a greener environment. Additionally, rapid urbanization is leading to increased traffic congestion in major cities across Europe. Electric two-wheelers are ideally suited for navigating congested urban environments due to their agility and compact size, enabling riders to bypass traffic and reach their destinations more efficiently. This characteristic is particularly appealing to urban commuters who value time-saving transportation options. Furthermore, the growing demand for efficient last-mile delivery solutions, driven by the rise of e-commerce, has prompted businesses to adopt electric two-wheelers for deliveries. These vehicles not only reduce emissions but also enhance operational efficiency in dense urban areas.

By Type

By Battery Type

By Voltage

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us