March 2025

Senior Research Analyst

Reviewed By

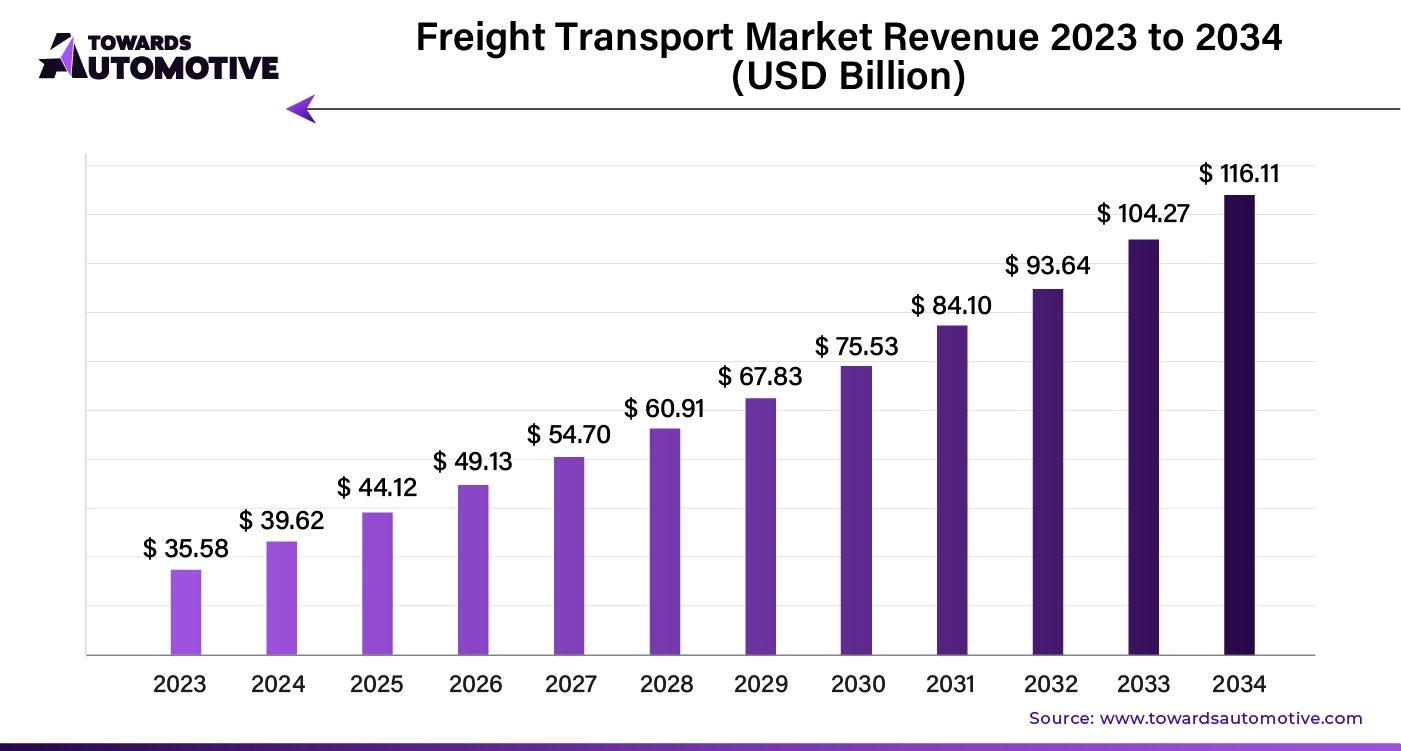

The global freight transport market size is calculated at USD 39.62 billion in 2024 and is expected to be worth USD 116.11 billion by 2034, expanding at a CAGR of 11.35% from 2024 to 2034.

The freight transport market is essential to global commerce, enabling the movement of goods through various modes such as road, rail, air, and sea. As businesses and industries increasingly rely on efficient logistics, the demand for robust freight transport services continues to grow. Key drivers include the surge in e-commerce, globalization, and the need for efficient supply chain management across diverse sectors. Technological advancements, such as automation and digital tracking, are reshaping the market by enhancing operational efficiency and reducing costs. Additionally, the push for sustainable transportation practices, including electric and hybrid vehicles, is influencing how freight transport adapts to environmental concerns. As global trade intensifies, the freight transport market is poised for significant growth, with increasing investment in infrastructure and innovative solutions to meet evolving customer needs.

Artificial Intelligence (AI) plays an increasingly transformative role in the freight transport market, enhancing efficiency, reducing costs, and improving decision-making across the entire logistics chain. AI-driven technologies, such as machine learning algorithms, predictive analytics, and automation systems, are being integrated to optimize route planning, fleet management, and warehouse operations. By analyzing vast amounts of data, AI can identify patterns and predict potential disruptions in supply chains, such as weather conditions, traffic, or equipment failure, allowing companies to adjust operations in real-time and minimize delays.

AI also facilitates the automation of key tasks, including freight scheduling, inventory management, and cargo tracking, which reduces manual labor and enhances accuracy. Autonomous vehicles and drones powered by AI are emerging innovations in freight transport, potentially revolutionizing last-mile delivery and long-haul transportation by improving fuel efficiency and safety. Additionally, AI-driven systems are enhancing sustainability efforts by enabling smarter energy use and reducing emissions through optimized fuel consumption.

The integration of AI in freight transport not only enhances operational efficiency but also improves customer service by providing real-time shipment updates and more accurate delivery time estimates. As AI technology continues to advance, its role in the freight transport market will likely expand, driving further innovation and market growth.

Free trade agreements (FTAs) play a significant role in driving the growth of the freight transport market by reducing barriers to international trade and encouraging cross-border movement of goods. By eliminating or lowering tariffs, streamlining customs procedures, and standardizing regulations, FTAs make it easier and more cost-effective for businesses to engage in global trade. This increase in trade volumes leads to greater demand for freight transport services across various modes, including road, rail, air, and sea. FTAs also facilitate the expansion of supply chains, enabling companies to source materials and distribute products more efficiently across different regions.

Additionally, the improved market access provided by FTAs stimulates competition, encouraging logistics providers to invest in infrastructure and technological advancements to meet the growing demand for efficient and timely transportation. As a result, the freight transport market benefits from increased opportunities for growth and innovation. In an increasingly globalized economy, the role of FTAs in promoting trade and driving the freight transport market is expected to become even more critical.

| Free Trade Agreements of U.S. | Countries |

| USA | Australia |

| USA | Bahrain |

| USA | Canada |

| USA | Chile |

| USA | Colombia |

| USA | Costa Rica |

| USA |

Dominican Republic |

| USA | El Salvador |

| USA | Guatemala |

| USA | Honduras |

The freight transport market faces several restraints that hinder its growth, including fluctuating fuel costs, labor shortages, and infrastructure limitations. Rising fuel prices increase operational expenses, while a shortage of skilled drivers and labor impacts the efficiency of transportation services. Additionally, aging or inadequate infrastructure in many regions creates bottlenecks and delays, reducing overall logistics efficiency. Environmental concerns and stringent regulations regarding emissions also present challenges, requiring the industry to invest in sustainable solutions, which can increase costs and slows down market expansion.

The expansion of green logistics is creating significant opportunities in the freight transport market by addressing the growing demand for sustainable and eco-friendly transportation solutions. As environmental concerns intensify and governments enforce stricter emission regulations, companies are increasingly adopting green logistics practices to reduce their carbon footprint. These practices include the use of electric and hybrid vehicles, alternative fuels like hydrogen and biofuels, and energy-efficient route optimization strategies. The integration of green logistics not only helps businesses meet regulatory requirements but also enhances their corporate social responsibility, appealing to eco-conscious consumers and investors.

Additionally, advancements in sustainable technologies, such as electric fleets and renewable energy-powered warehouses, are fostering innovation within the freight transport sector. Green logistics also promotes cost savings through fuel efficiency and improved operational practices, providing companies with a competitive edge. As businesses seek to align with global sustainability goals, the demand for green logistics services is expected to rise, creating new market opportunities for logistics providers, technology innovators, and infrastructure developers. This shift toward sustainability is reshaping the freight transport landscape, driving long-term growth and transformation in the industry.

The services segment held the largest share of the market. The services segment plays a pivotal role in driving the growth of the freight transport market by enhancing efficiency, flexibility, and customer satisfaction. This segment encompasses a wide range of value-added services, including real-time tracking, route optimization, cargo insurance, and third-party logistics (3PL). These offerings enable businesses to streamline their supply chains, ensuring timely and cost-effective deliveries. As demand for e-commerce and global trade rises, logistics service providers are leveraging advanced technologies like AI and IoT to offer tailored solutions, improving operational performance.

Additionally, service providers often offer scalable solutions that adapt to fluctuations in demand, allowing businesses to handle peak shipping seasons seamlessly. This adaptability and the focus on enhancing customer experience foster long-term partnerships, ultimately boosting market expansion. By providing customized logistics solutions, the services segment contributes to cost reduction, improved delivery speed, and a higher degree of operational transparency, further solidifying its critical role in the freight transport market’s growth trajectory.

The roadways segment dominated the industry. Roadways play a crucial role in driving the growth of the freight transport market by providing a flexible and accessible mode of transportation for goods across regions. As the backbone of the logistics network, road transport offers unparalleled reach, connecting remote areas to major trade hubs. This flexibility enables businesses to transport goods efficiently, catering to industries like retail, manufacturing, and agriculture. The growing demand for just-in-time deliveries and the expansion of e-commerce have amplified the need for road transport, particularly for short to medium-haul shipments.

Additionally, advancements in infrastructure, such as the development of highways, expressways, and bridges, have significantly improved the speed and reliability of road transport, making it a preferred choice for many companies. The integration of smart technologies, such as GPS tracking, route optimization, and automated freight management systems, has further enhanced the efficiency of roadway freight operations, reducing transit times and costs.

Moreover, roadways allow for greater flexibility in terms of load size, type of goods, and delivery schedules, making them adaptable to the diverse needs of the freight industry. This versatility, combined with continuous investments in road infrastructure and technology, ensures that roadways remain a driving force in the overall growth of the freight transport market, particularly in regions where other modes of transport may be less accessible or cost-effective.

The retail and e-commerce segment held the dominant share of the market. Retail and e-commerce are major drivers of growth in the freight transport market, as they generate significant demand for the movement of goods across regions. The rapid expansion of e-commerce has transformed consumer expectations, with a strong emphasis on fast, reliable, and flexible delivery services. This shift has increased the need for efficient logistics solutions, pushing the freight transport industry to adapt to higher volumes, shorter delivery windows, and more complex distribution networks. Retailers and e-commerce companies rely heavily on freight transport providers to ensure timely deliveries from warehouses to fulfillment centers and, ultimately, to consumers.

Moreover, the rise of omnichannel retail, where businesses sell both online and through physical stores, has amplified the demand for seamless freight transport solutions that can handle diverse shipment needs, from bulk inventory deliveries to individual package shipments. This has led to innovations in last-mile delivery services, where freight companies are investing in technology to optimize routes, reduce transit times, and enhance customer satisfaction.

In addition, as global trade continues to rise, e-commerce platforms enable cross-border transactions, increasing the need for efficient international freight transport services. The push for same-day and next-day delivery options further drives investment in transportation infrastructure and advanced tracking systems. Consequently, the booming retail and e-commerce sectors are key contributors to the continuous growth and modernization of the freight transport market.

North America dominated the freight transport market. Technological advancements, urbanization and population growth, and economic expansion are critical drivers of the freight transport market's growth in North America. Technological innovations, such as automation, AI, and data analytics, revolutionize freight logistics by enhancing operational efficiency, route optimization, and real-time tracking. These advancements streamline operations, reduce costs, and improve delivery speeds, addressing the increasing complexity of freight networks. Concurrently, rapid urbanization and population growth in major North American cities escalate the demand for goods and services, placing greater pressure on transportation systems to ensure timely and efficient distribution. As urban areas expand, the need for robust last-mile delivery solutions and infrastructure upgrades becomes more pressing, driving investments in logistics capabilities.

Economic expansion across the continent further amplifies these demands. Increased industrial production, consumer spending, and infrastructure development fuel higher freight volumes and necessitate sophisticated transport solutions to manage the flow of goods efficiently. The synergy of these factors—technology, urban growth, and economic development—creates a dynamic environment that propels the freight transport market forward. Investments in cutting-edge technology, coupled with strategic responses to demographic and economic shifts, enable the sector to adapt and thrive in a rapidly evolving landscape, ensuring that freight transport meets the growing needs of North America’s vibrant economy.

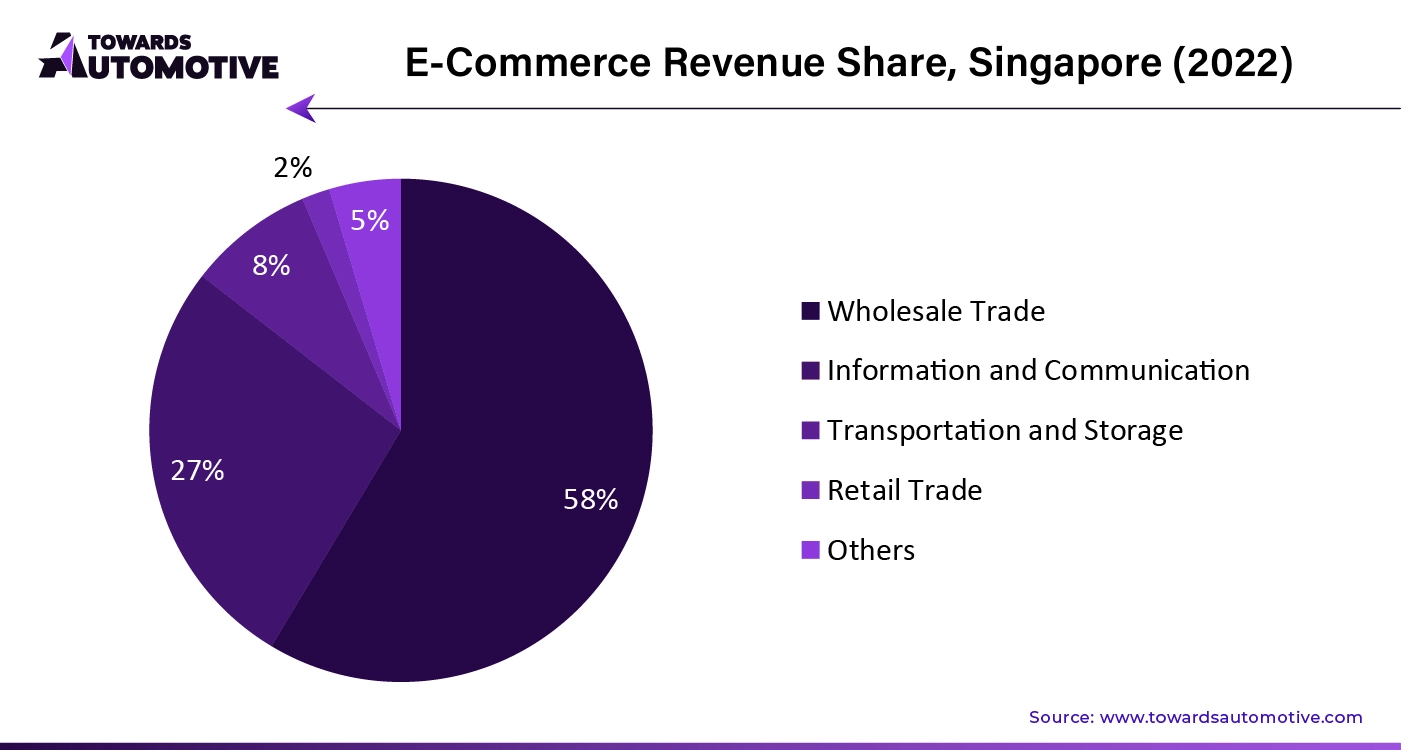

Asia Pacific is expected to grow with the highest CAGR during the forecast period. Rapid economic development, the booming e-commerce sector, and increasing trade activities are pivotal in driving the growth of the freight transport market in Asia Pacific. The region's robust economic growth, led by emerging economies such as China and India, has significantly increased the demand for efficient and reliable freight transport solutions. This economic expansion fuels industrial output and consumer consumption, thereby necessitating more complex and extensive logistics networks to handle the growing volume of goods.

Concurrently, the e-commerce boom has transformed retail dynamics, with a surge in online shopping creating a heightened need for fast, flexible delivery services. E-commerce companies require advanced logistics solutions to manage high-order volumes, quick deliveries, and efficient last-mile distribution, propelling growth in the freight transport sector. Additionally, the rise in trade activities, driven by Asia Pacific's strategic position as a global trade hub, further amplifies the demand for freight services. The region’s increasing import and export volumes necessitate robust transportation infrastructure and logistics networks to facilitate smooth cross-border trade.

These factors collectively stimulate investments in transportation infrastructure, technological advancements, and logistics services, enhancing the efficiency and capacity of the freight transport market. As economic, digital, and trade dynamics evolve, they create a synergistic effect that continually drives the expansion and modernization of the freight transport sector across Asia Pacific.

In August 2024, the government of China announced to open new freight routes in different parts of Asia. Through this announcement, China will strengthen its railway freight capabilities in Laos, Thailand, Mekong and some others.

By Offering

By Mode of Transport

By Vertical

By Region

March 2025

March 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us