March 2025

Senior Research Analyst

Reviewed By

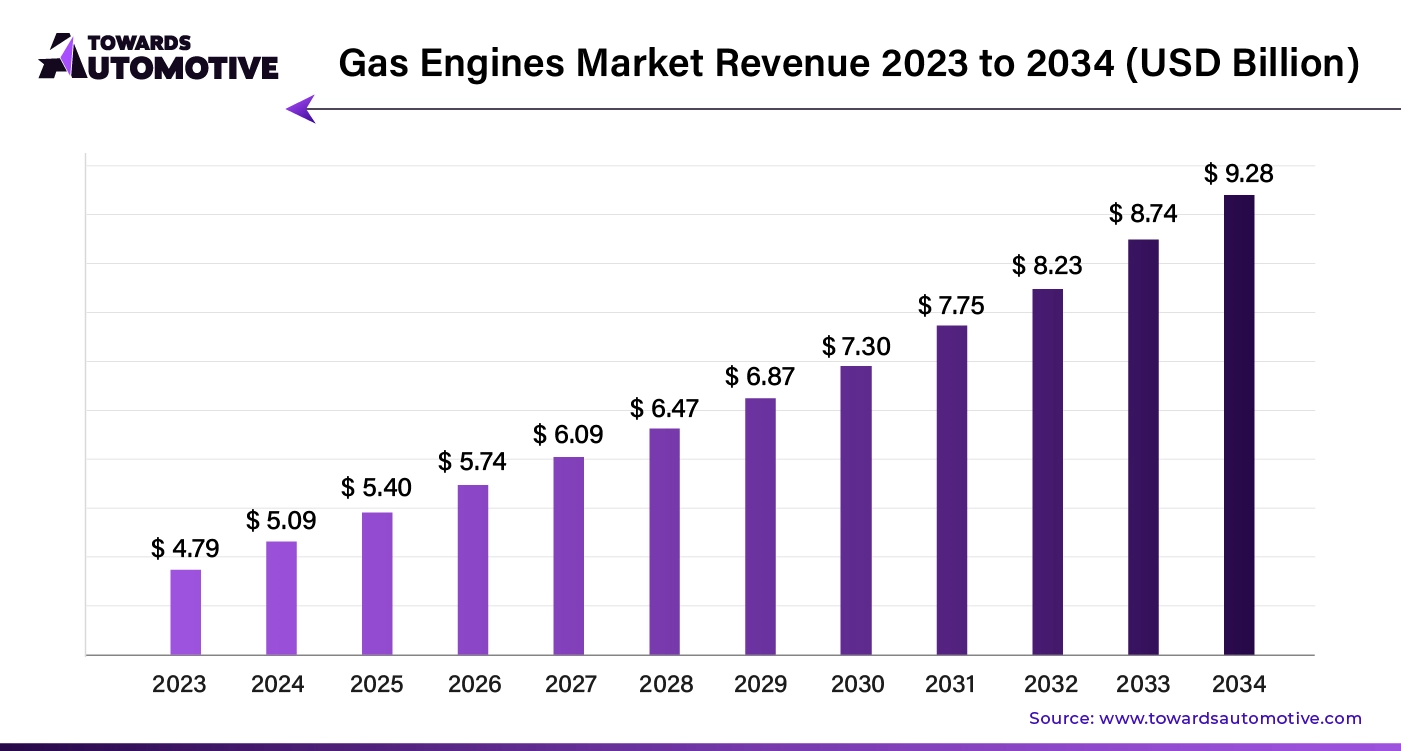

The global gas engines market size is calculated at USD 5.09 billion in 2024 and is expected to be worth USD 9.28 billion by 2034, expanding at a CAGR of 6.20% from 2024 to 2034.

The gas engines market is characterized by its significant role in diverse applications, ranging from power generation to transportation and industrial machinery. Gas engines, known for their efficiency and lower emissions compared to traditional diesel engines, are increasingly being adopted due to their environmental benefits and operational advantages. In the power generation sector, gas engines are favored for their ability to provide reliable and flexible energy solutions, particularly in combined heat and power (CHP) systems, where they deliver both electricity and thermal energy.

This dual capability supports energy efficiency and reduces operational costs. In transportation, gas engines are gaining traction in various vehicle segments, including buses, trucks, and passenger cars, driven by the demand for cleaner alternatives to diesel and gasoline engines. Technological advancements, such as improved engine designs and the development of biogas and synthetic gas fuels, enhance the performance and sustainability of gas engines.

Additionally, increasing regulatory pressures and environmental standards are pushing industries toward more eco-friendly options, further driving the market for gas engines. The market is also supported by growing investments in infrastructure to support gas fuel supply and distribution. Overall, the gas engines market is experiencing steady growth, driven by technological innovation, environmental concerns, and the need for efficient, reliable, and cleaner energy solutions across various sectors.

AI plays a pivotal role in the gas engines market by revolutionizing performance optimization, predictive maintenance, and design innovation. Through advanced data analytics and machine learning, AI enhances engine efficiency by continuously monitoring operational parameters and adjusting settings for optimal performance. Predictive maintenance algorithms analyze data from engine sensors to foresee potential issues before they lead to failures, thus minimizing downtime and repair costs.

Additionally, AI accelerates the development of new engine technologies by simulating various design scenarios and operational conditions, leading to more efficient and innovative solutions. AI-driven analytics also improve fuel efficiency and emission control by fine-tuning combustion processes and reducing environmental impact. Overall, AI's integration into the gas engines market enables more precise control, better resource management, and advancement in cleaner, high-performance engine technologies.

The reliability and efficiency of gas engines compared to traditional fuel engines significantly drive the growth of the gas engines market. Gas engines are renowned for their consistent performance and reduced operational costs, largely due to their ability to run on cleaner fuels such as natural gas, which leads to lower emissions and better environmental compliance. Their inherent efficiency, including improved fuel utilization and lower maintenance needs, makes them a cost-effective alternative to diesel and gasoline engines. This operational reliability translates into fewer breakdowns and extended engine life, enhancing overall system performance. Moreover, gas engines offer greater flexibility in various applications, from power generation to transportation, by providing stable and efficient energy solutions. As industries and consumers increasingly prioritize sustainability and cost savings, the superior reliability and efficiency of gas engines continue to drive their adoption and expansion in the market.

The gas engines market faces several restraints, including fluctuating natural gas prices, which impact operational costs and profitability. Additionally, the limited availability of natural gas infrastructure in certain regions hinders market expansion, particularly in developing economies. Environmental concerns related to methane leakage during gas extraction and transport also pose challenges, as stricter regulations on emissions are enforced. Furthermore, competition from renewable energy sources, such as solar and wind power, adds pressure to the market by offering cleaner alternatives.

Hybrid gas engines are creating significant opportunities in the gas engines market by combining the benefits of traditional gas-powered systems with electric or renewable energy technologies. These engines enhance fuel efficiency, reduce emissions, and offer greater operational flexibility, making them attractive across various sectors, including power generation and transportation. By integrating electric components or utilizing renewable fuels such as hydrogen or biogas, hybrid gas engines help industries meet increasingly stringent environmental regulations while maintaining high performance and reliability.

In power generation, hybrid gas engines are well-suited for decentralized energy systems, where they can operate efficiently alongside renewable energy sources like solar and wind. This allows for more stable and reliable energy output, even when renewable sources fluctuate. Additionally, the ability to switch between gas and electric power or alternative fuels ensures cost savings and operational versatility. As industries prioritize sustainability and energy efficiency, hybrid gas engines present a lucrative opportunity for manufacturers and operators looking to adopt cleaner, more adaptable energy solutions in the gas engines market.

The natural gas segment held the largest share of the market. The natural gas segment plays a crucial role in driving the growth of the gas engines market due to its abundance, cost-effectiveness, and lower environmental impact compared to traditional fossil fuels. Natural gas engines are highly efficient and produce fewer emissions, making them an attractive option for industries aiming to reduce their carbon footprint and meet stricter environmental regulations. In power generation, natural gas engines are widely used in combined heat and power (CHP) systems, where they offer both electricity and thermal energy, improving overall energy efficiency and reducing operational costs.

The increasing global focus on cleaner energy sources has led to a rising demand for natural gas-powered engines in various applications, from industrial machinery to transportation. The transportation sector, in particular, benefits from the lower fuel costs and reduced emissions of natural gas engines, especially in heavy-duty vehicles like buses and trucks. As more industries transition to natural gas as a primary fuel source, the segment continues to drive the growth of the gas engines market, contributing to cleaner, more sustainable energy solutions across multiple sectors.

The 1-2 MW segment dominated the industry. The 1-2 MW segment significantly drives the growth of the gas engines market due to its versatility and ideal power output for a wide range of applications. These mid-range gas engines are particularly popular in industries such as commercial power generation, small-scale industrial facilities, and decentralized energy systems, where they provide a reliable and efficient source of electricity. Their capacity makes them well-suited for combined heat and power (CHP) systems, delivering both electricity and thermal energy, thereby increasing overall energy efficiency and reducing operational costs.

Additionally, the 1-2 MW gas engines are favored for use in remote areas or industrial settings where larger power plants may not be feasible. The segment’s ability to offer stable, cost-effective energy solutions also makes it highly attractive for backup power in critical infrastructures, such as hospitals and data centers. As demand for distributed power generation and flexible energy solutions grows, the 1-2 MW segment continues to expand, contributing to the overall development of the gas engines market by offering reliable and scalable power generation solutions.

The cogeneration segment held the dominant share of the market. The cogeneration segment, also known as combined heat and power (CHP), is a key driver of growth in the gas engines market due to its superior energy efficiency and cost savings. Cogeneration systems use gas engines to simultaneously generate electricity and capture the resulting heat for use in heating, cooling, or industrial processes. This dual function significantly improves energy efficiency, as it reduces fuel consumption by utilizing waste heat that would otherwise be lost in conventional power generation.

Industries such as manufacturing, utilities, and commercial buildings are increasingly adopting cogeneration systems to lower energy costs and reduce emissions. The demand for cleaner, more efficient energy solutions, especially in regions with stringent environmental regulations, is pushing the adoption of gas engine-based cogeneration systems. These systems are also favored in decentralized power setups, providing reliable energy for both industrial and residential applications. As energy efficiency becomes a top priority across sectors, the cogeneration segment continues to drive the gas engines market by offering sustainable, cost-effective, and energy-efficient power solutions for a broad range of industries.

North America dominated the gas engines market. The groswth of the natural gas industry, the transition to cleaner energy, and the increased demand for decentralized power generation are key drivers of the gas engines market in North America. The region's abundant natural gas reserves, particularly from shale gas extraction, provide a reliable and cost-effective fuel source. This availability of natural gas fuels the widespread adoption of gas engines across various sectors, including power generation, transportation, and industrial applications. As natural gas is cleaner than traditional fossil fuels like coal and diesel, its use aligns with the growing emphasis on reducing greenhouse gas emissions and meeting stricter environmental regulations.

Additionally, North America's ongoing transition toward cleaner energy is further driving the demand for gas engines. As industries and governments focus on sustainability and energy efficiency, gas engines are being adopted for their lower emissions and operational efficiency. They are particularly well-suited for combined heat and power (CHP) systems, where they can generate both electricity and heat, further improving energy efficiency.

The rise in decentralized power generation is also a major contributor to the market's growth. Gas engines are ideal for providing reliable, flexible energy in microgrids and off-grid applications, especially in remote areas and industrial sites. This decentralized model ensures energy stability and reduces reliance on centralized power grids, making gas engines an attractive solution. Together, these factors are propelling the growth of the gas engines market in North America, as industries increasingly seek efficient, clean, and reliable energy alternatives.

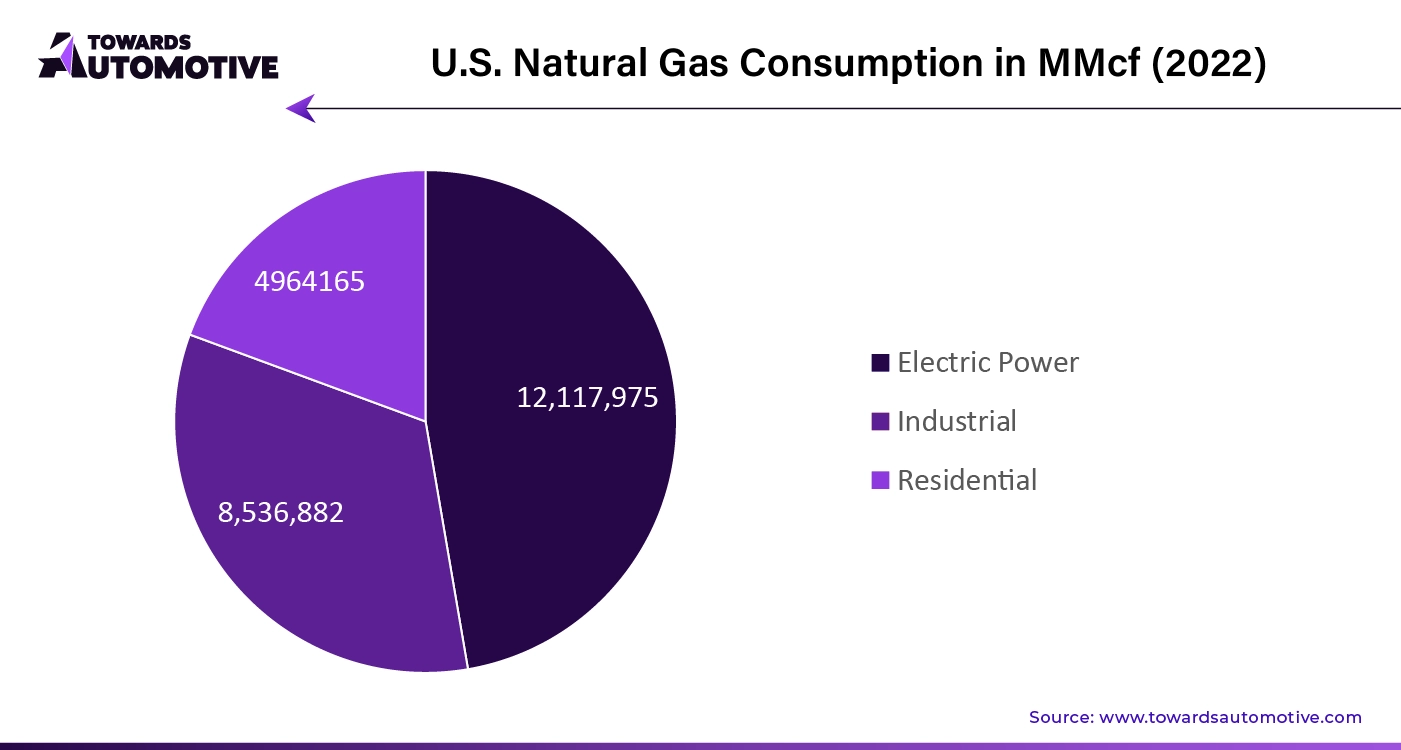

According to the U.S. Energy Information Administration, the electric power segment utilized the maximum natural gas in the U.S. with 12,117,975 MMcf followed by Industrial and Residential segments.

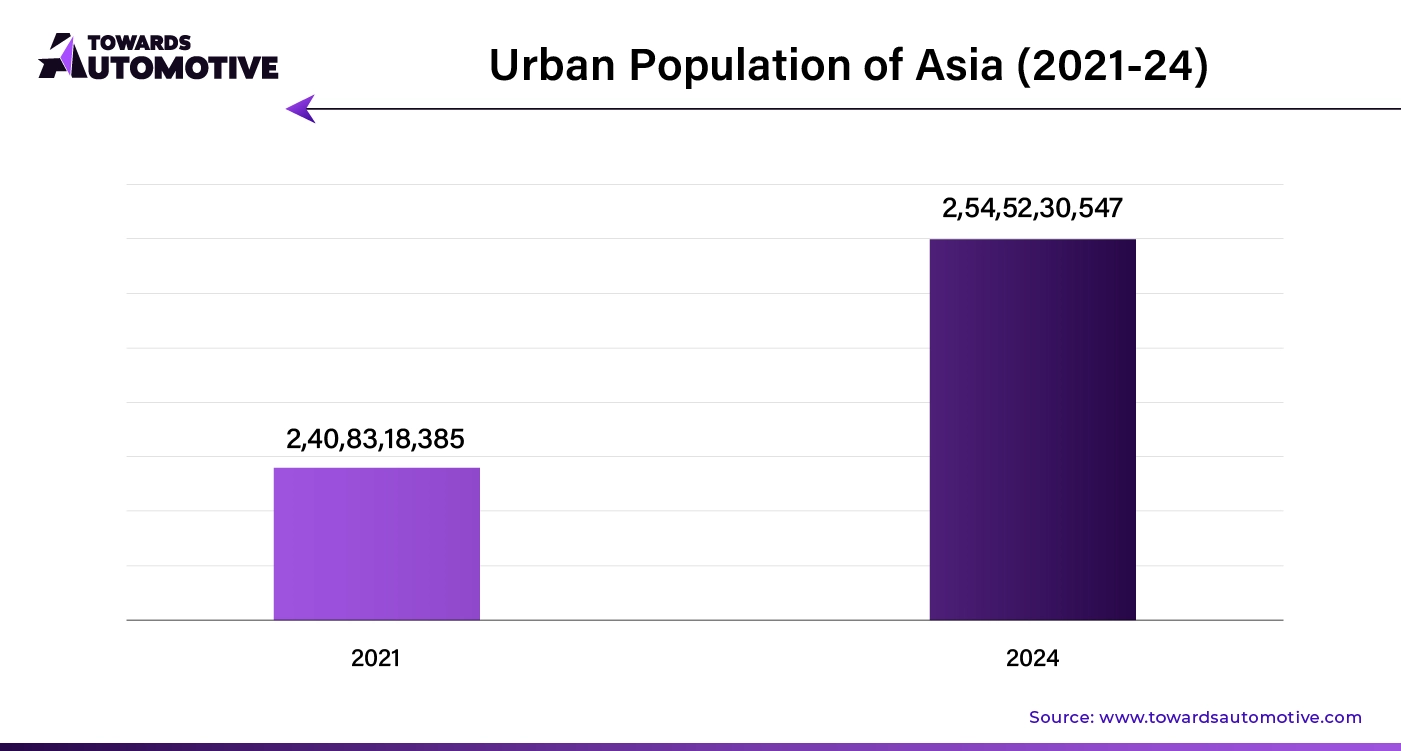

Asia Pacific is expected to grow with a significant CAGR during the forecast period. Rapid industrialization and urbanization, growing demand for combined heat and power (CHP) systems, and technological advancements are key drivers of the gas engines market growth in Asia Pacific. The region is witnessing rapid industrialization, particularly in emerging economies like China, India, and Southeast Asia, where expanding industries and infrastructure require reliable, efficient, and sustainable power solutions. Gas engines, known for their operational efficiency and lower emissions compared to traditional diesel and coal-based engines, are increasingly being adopted to meet these energy needs, particularly in decentralized power generation systems.

Urbanization is also fueling the need for cleaner and more reliable energy, with gas engines playing a crucial role in supporting power generation for growing urban centers. In densely populated areas, CHP systems, which generate both electricity and heat from a single fuel source, are gaining popularity for their energy efficiency and cost savings. The demand for gas engines in CHP systems is growing, as these systems are widely used in industrial, commercial, and residential sectors across the region.

Additionally, technological advancements in gas engine design, fuel flexibility, and emissions reduction are driving market growth. Innovations such as biogas and hydrogen-compatible engines, along with improved combustion technologies, are making gas engines more efficient, reliable, and environmentally friendly. These technological improvements not only enhance engine performance but also ensure compliance with increasingly stringent environmental regulations in the region.

By Application

By Product Type

By Power Output

By Region

March 2025

March 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us