March 2025

Senior Research Analyst

Reviewed By

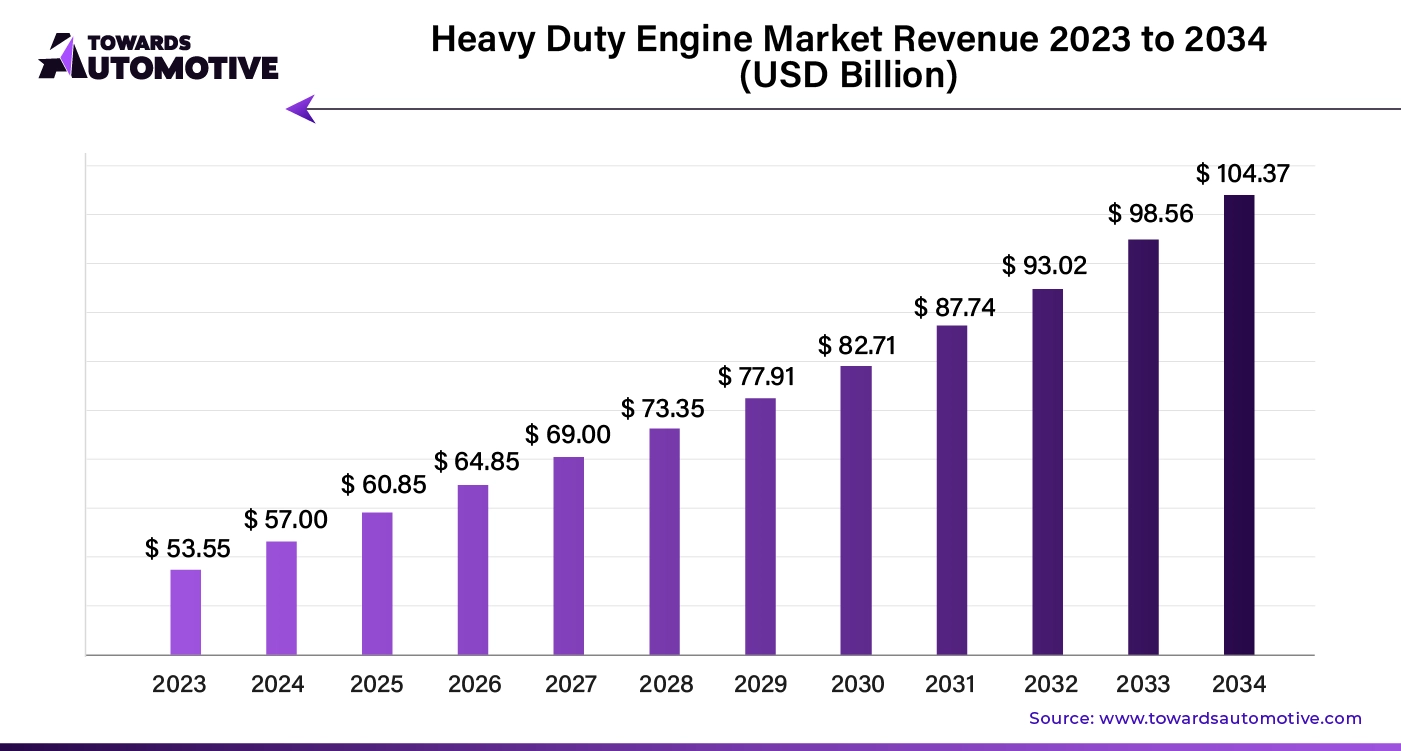

The global heavy duty engine market size is calculated at USD 57.00 billion in 2024 and is expected to be worth USD 104.37 billion by 2034, expanding at a CAGR of 6.64% from 2024 to 2034.

The heavy duty engine market is a pivotal segment within the broader automotive and industrial sectors, characterized by its focus on robust, high-performance engines designed for large-scale commercial and industrial applications. These engines power a wide range of vehicles and machinery, including trucks, buses, construction equipment, and agricultural machines. The market is driven by increasing demands for efficient and reliable engines capable of handling heavy loads, long-distance transport, and rigorous operational conditions. With the growth of global trade, urbanization, and infrastructure development, the need for heavy-duty engines has surged, leading to innovations in engine technology, fuel efficiency, and emissions control. Manufacturers are focusing on enhancing engine performance while meeting stringent environmental regulations and adapting to the evolving needs of various industries. Technological advancements, such as the integration of advanced electronics and hybrid powertrains, are also shaping the market, driving growth and improving engine capabilities. As industries continue to expand and modernize, the heavy-duty engines market remains essential to powering the machinery and vehicles that underpin economic development and infrastructure progress.

Artificial Intelligence (AI) plays a transformative role in the heavy duty engine market, enhancing both engine performance and operational efficiency through a variety of applications. AI-powered predictive maintenance systems use data analytics to monitor engine health and performance in real-time. By analyzing data from various sensors and historical maintenance records, AI can predict potential engine failures or maintenance needs before they occur. This proactive approach helps prevent unexpected breakdowns, reduce downtime, and extend the lifespan of heavy-duty engines.

AI algorithms can analyze and optimize engine performance by adjusting parameters such as fuel injection, air intake, and exhaust systems. These optimizations improve fuel efficiency, reduce emissions, and enhance overall engine performance. AI-driven systems can also adapt to different operating conditions, ensuring that engines perform optimally under varying loads and environments.

AI enhances diagnostic capabilities by quickly analyzing complex engine data and identifying issues that may be difficult for human technicians to detect. Machine learning models can classify and diagnose engine problems with high accuracy, leading to faster and more precise repairs.

AI-powered fleet management systems integrate with heavy-duty engines to provide real-time tracking, route optimization, and operational insights. These systems help fleet operators manage fuel consumption, monitor driver behavior, and improve overall fleet efficiency.

The growing agricultural activities are a key driver of expansion in the heavy duty engine market, reflecting the sector's reliance on robust and high-performance engines for various farming operations. As global demand for food increases, agricultural activities are intensifying, leading to a heightened need for advanced machinery and equipment. Heavy-duty engines are integral to powering a range of agricultural equipment, including tractors, combine harvesters, and plows, which are essential for modern farming practices. The drive towards increased productivity and efficiency in agriculture necessitates the use of powerful engines that can handle demanding tasks such as tilling, planting, and harvesting across large tracts of land.

Advancements in agricultural technology also contribute to market growth. Modern heavy-duty engines are designed to offer greater fuel efficiency, durability, and reliability, aligning with the evolving needs of the agricultural sector. Additionally, the adoption of precision farming techniques, which utilize advanced machinery for soil management and crop monitoring, further boosts the demand for high-performance engines.

Infrastructure development and investment in rural areas support this trend by facilitating better access to agricultural markets and resources. As the agricultural sector continues to expand and innovate, the demand for advanced heavy-duty engines that support efficient and sustainable farming practices is expected to grow, driving overall market expansion.

The heavy duty engine market faces several restraints that impact its growth and development. Key challenges include stringent environmental regulations and emission standards, which require continuous advancements in engine technology and may increase production costs. Additionally, fluctuating fuel prices and the high cost of raw materials can affect profitability. Supply chain disruptions and a shortage of skilled labor further complicate manufacturing and maintenance processes. These factors collectively pose significant hurdles for market growth and require ongoing innovation and adaptation from industry players.

Hybrid technologies are creating significant opportunities in the heavy duty engine market by addressing key challenges related to fuel efficiency, emissions, and operational costs. As industries seek to meet stringent environmental regulations and reduce their carbon footprint, hybrid powertrains are emerging as a viable solution. By combining traditional internal combustion engines with electric motors, hybrid systems offer enhanced fuel efficiency and lower emissions compared to conventional engines. This technology not only helps in achieving regulatory compliance but also reduces operating costs for businesses by decreasing fuel consumption.

Furthermore, hybrid engines provide improved performance and versatility, making them suitable for a wide range of heavy-duty applications, including trucks, buses, and construction equipment. The integration of regenerative braking and advanced energy management systems in hybrid vehicles further optimizes energy use and extends engine life. As technological advancements continue to evolve, hybrid systems are expected to become more sophisticated, offering greater power output and efficiency.

The adoption of hybrid technologies also aligns with the growing emphasis on sustainability and innovation within the heavy-duty engine market. By investing in hybrid solutions, manufacturers and fleet operators can enhance their competitive edge, meet market demands for greener solutions, and contribute to a more sustainable future. This shift represents a transformative opportunity for the heavy-duty engines market, driving growth and paving the way for a more eco-friendly and efficient industry.

The indirect segment held the largest share of the market. The heavy duty engine market is notably driven by the expansion and efficiency of indirect distribution channels, which play a critical role in broadening market reach and facilitating growth. Indirect distribution channels include a network of intermediaries such as distributors, dealers, and service providers who act as intermediaries between engine manufacturers and end-users. These channels significantly enhance market accessibility by connecting manufacturers with a wider array of customers, including those in remote or underserved regions.

Dealers and distributors serve as crucial touchpoints for customers, offering localized expertise and personalized service. They help potential buyers navigate the complexities of heavy-duty engine specifications, performance capabilities, and application suitability. This local presence not only aids in educating customers but also in tailoring engine solutions to specific industry needs, such as construction, mining, or agriculture. By providing detailed product knowledge and facilitating informed purchasing decisions, these intermediaries contribute to increased sales and customer satisfaction.

Additionally, indirect distribution channels enhance market flexibility and responsiveness. Distributors and dealers often possess valuable insights into regional market trends and demands, allowing manufacturers to adapt their offerings and strategies accordingly. This adaptability ensures that manufacturers can quickly introduce new engine models and technologies in response to evolving customer requirements and regulatory changes.

Furthermore, the efficiency of these channels in managing inventory and logistics plays a pivotal role in the market. By streamlining supply chain operations and ensuring timely delivery of heavy-duty engines, distributors and dealers help maintain product availability and reduce lead times. This operational efficiency is crucial for industries that depend on reliable engine performance for their machinery and equipment.

The class 8 segment dominated the industry. The Class 8 segment is a significant driver of growth in the heavy duty engine market, reflecting its vital role in powering the largest and most robust commercial vehicles. Class 8 vehicles, which include heavy-duty trucks and tractor-trailers, are crucial for long-haul transportation and heavy cargo movement across vast distances. The increasing demand for Class 8 vehicles is closely tied to the expanding logistics and transportation sectors, which rely heavily on these vehicles to facilitate efficient freight operations and support economic growth.

The growth of e-commerce and global trade has intensified the need for reliable and high-performance Class 8 trucks, driving demand for advanced heavy-duty engines. These engines must deliver superior power, durability, and fuel efficiency to handle the rigorous demands of long-distance hauling and heavy payloads. Manufacturers are continuously innovating to enhance engine performance, reduce emissions, and improve fuel efficiency, aligning with evolving regulatory standards and environmental concerns.

Additionally, the expansion of infrastructure projects and construction activities further stimulates the Class 8 segment. Heavy-duty trucks are essential for transporting construction materials, equipment, and machinery to and from job sites, supporting ongoing urban development and infrastructure improvements. As infrastructure investments increase, so does the need for robust Class 8 vehicles equipped with powerful engines capable of handling demanding tasks.

Technological advancements in engine design and fuel management also contribute to the growth of the Class 8 segment. Innovations such as advanced turbocharging, hybrid powertrains, and improved emission control systems enhance engine efficiency and performance, making Class 8 trucks more attractive to fleet operators and businesses.

Asia Pacific dominated the heavy duty engine market. The heavy-duty engines market in Asia Pacific is experiencing robust growth, propelled by several pivotal factors including growing construction and mining activities, rising demand for energy efficiency, technological advancements, and rapid industrialization. The region's ongoing infrastructure development and resource extraction projects significantly drive the need for heavy-duty vehicles. Expanding construction and mining activities necessitate powerful and durable equipment, such as bulldozers, excavators, and haul trucks, to support large-scale projects and resource extraction.

Rising demand for energy efficiency is also a crucial factor influencing the market. As environmental regulations become more stringent, there is a growing emphasis on reducing fuel consumption and emissions. This trend is encouraging the adoption of advanced technologies in heavy-duty vehicles that enhance fuel efficiency and meet regulatory standards. Innovations such as hybrid and electric powertrains, as well as advanced emission control systems, are becoming increasingly important in addressing both environmental concerns and operational costs.

Technological advancements further drive market growth by enhancing the performance, reliability, and safety of heavy-duty vehicles. New developments in engine design, vehicle telematics, and autonomous driving technologies contribute to improved operational efficiency and reduced downtime. These advancements make heavy-duty vehicles more attractive to businesses seeking to optimize their fleet operations and reduce overall costs.

Additionally, rapid industrialization across Asia Pacific fuels the demand for heavy-duty vehicles. As industries expand and new manufacturing facilities are established, the need for robust transportation solutions to move goods and materials efficiently grows. This industrial growth, combined with infrastructure investments, creates a favorable environment for the heavy-duty vehicles market, underscoring the region's significant role in the global heavy-duty vehicle industry.

North America is expected to grow with the highest CAGR during the forecast period. The heavy-duty engines market in North America is experiencing significant growth, fueled by several critical factors including infrastructure investment, economic growth, strong demand in transportation and logistics, and military activities. The region's substantial infrastructure investments are a major driver, with extensive projects such as road expansions, bridge constructions, and urban development creating a continuous demand for heavy-duty construction and transportation equipment. These vehicles are essential for executing large-scale infrastructure projects and ensuring the efficient movement of materials and machinery.

Economic growth further amplifies market expansion as it spurs increased industrial activity and consumer spending. As businesses expand and new industries emerge, there is a heightened need for heavy-duty vehicles to support various sectors, including construction, mining, and agriculture. This economic dynamism boosts demand for robust and reliable heavy-duty vehicles that can handle demanding operational requirements.

The transportation and logistics sector in North America plays a pivotal role in driving market growth. The region's extensive network of highways and railroads, coupled with its central role in global trade, necessitates a fleet of heavy-duty trucks and commercial vehicles. These vehicles are crucial for transporting goods across vast distances, supporting both domestic and international trade.

Military activities also contribute to the growth of the heavy-duty vehicles market. The defense sector requires specialized heavy-duty vehicles for various applications, including logistics, troop transport, and equipment support. Ongoing military procurement and modernization efforts drive demand for advanced heavy-duty vehicles that meet rigorous performance and durability standards.

By Class

By Horsepower

By Application

By Distribution Channel

By Region

March 2025

March 2025

September 2024

September 2024

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us