March 2025

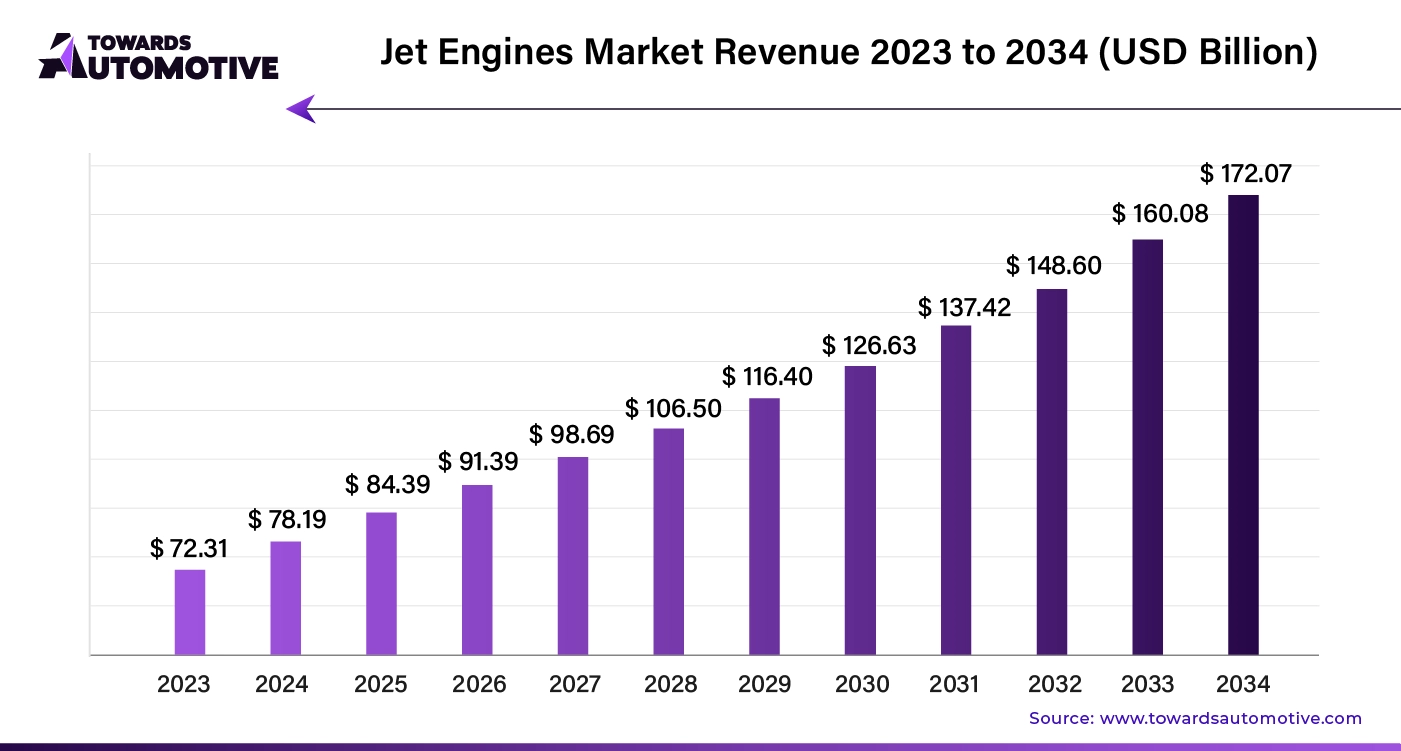

The global Jet Engines market size is calculated at USD 78.19 billion in 2024 and is expected to be worth USD 172.07 billion by 2034, expanding at a CAGR of 7.83% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The jet engines market is a dynamic sector within the aerospace industry, characterized by rapid technological advancements and evolving demand. Jet engines, critical components of both commercial and military aircraft, are essential for powering the next generation of high-performance airplanes. The market is driven by several key factors, including the increasing demand for air travel, advancements in engine technology, and the push for more fuel-efficient and environmentally friendly solutions. As airlines and defense organizations seek to enhance operational efficiency and reduce carbon footprints, there is a strong emphasis on developing engines that offer improved fuel efficiency, lower emissions, and higher performance.

Technological innovations such as the development of advanced materials, such as composite fan blades and ceramic matrix composites, are enhancing engine performance and durability. Additionally, advancements in engine design, including turbofan and turboprop technologies, are contributing to increased efficiency and reliability. The rise of electric and hybrid-electric propulsion systems is also influencing the market, as manufacturers explore alternatives to traditional jet engines to meet future environmental regulations and performance expectations.

The market is further supported by growing investments in aircraft modernization and fleet expansion, driven by increasing air passenger traffic and military procurement needs. Emerging markets in Asia-Pacific and the Middle East are becoming significant contributors to market growth, as these regions invest heavily in expanding their aviation infrastructure. Overall, the jet engines market is poised for continued growth, driven by technological progress, evolving industry needs, and the ongoing quest for more sustainable aviation solutions.

Artificial Intelligence (AI) is revolutionizing the jet engines market by enhancing design, manufacturing, and operational efficiency. In the design phase, AI algorithms analyze extensive datasets from simulations and past performance to optimize engine designs, resulting in improved fuel efficiency, performance, and reliability. These algorithms identify patterns and correlations that traditional methods might overlook, leading to more innovative and effective engine solutions.

In manufacturing, AI contributes to higher precision and quality control. Machine learning and computer vision technologies inspect engine components for defects, ensuring they meet stringent quality standards and reducing the likelihood of errors. This automation accelerates production processes and lowers manufacturing costs.

AI also plays a crucial role in predictive maintenance and performance monitoring. By analyzing real-time data from engine sensors, AI systems predict potential failures and maintenance needs before they occur, reducing downtime and enhancing engine reliability. This predictive capability allows for timely interventions and extends the operational lifespan of engines.

Additionally, AI-driven systems optimize fuel efficiency and emissions control. By continuously analyzing operational data, AI adjusts engine performance to improve fuel consumption and adhere to environmental regulations. This dynamic optimization supports sustainability goals and reduces the environmental impact of aviation.

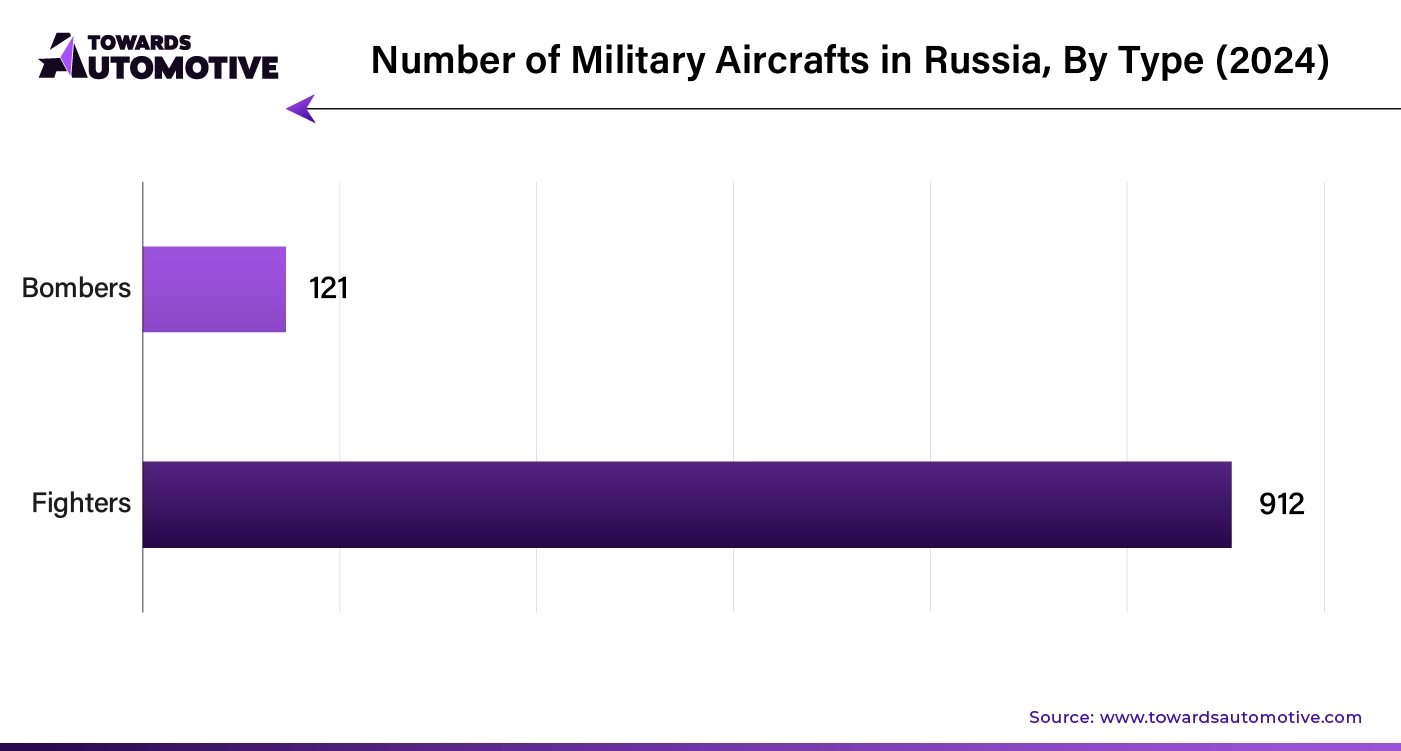

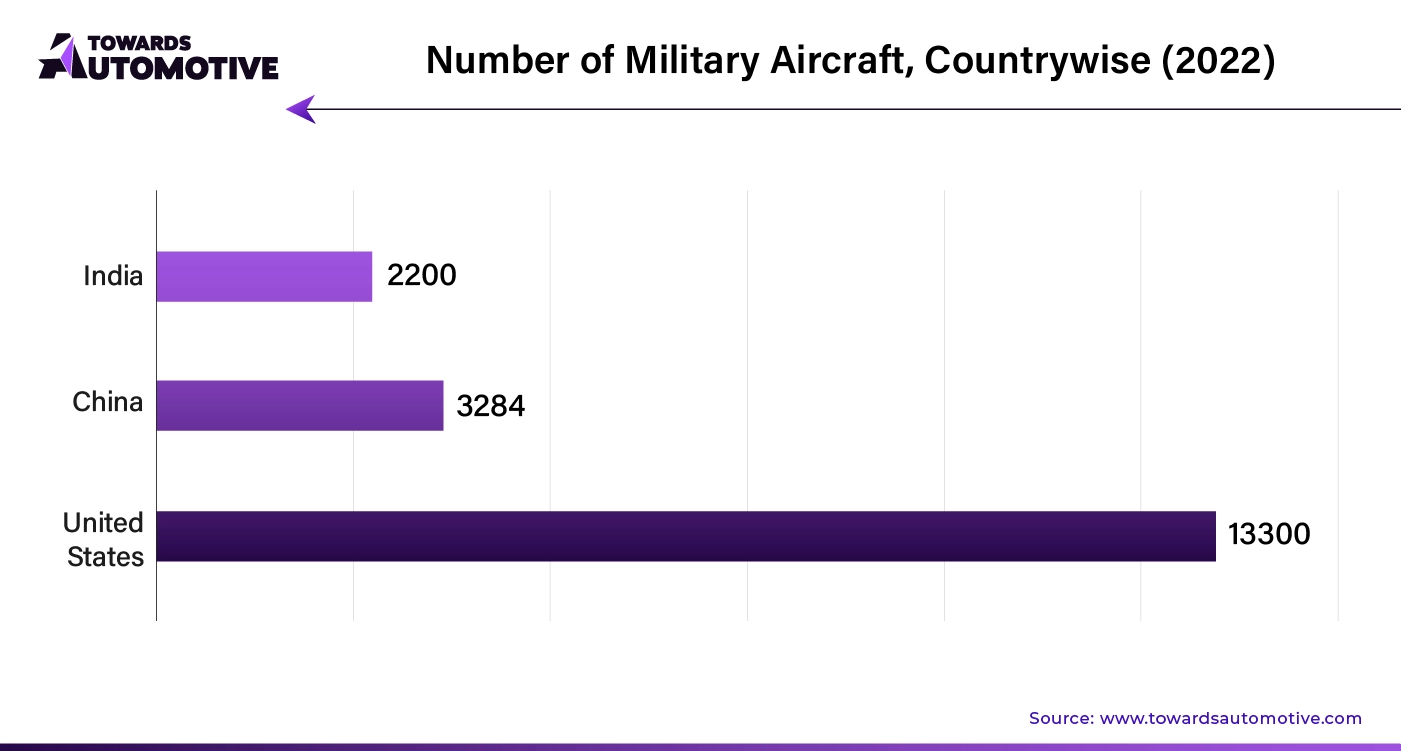

Military aircrafts are a significant driver of growth in the jet engines market, owing to their advanced requirements and ongoing modernization efforts. The demand for military aircraft, encompassing fighter jets, bombers, and transport planes, fuels the need for high-performance jet engines capable of delivering superior speed, power, and reliability. As defense budgets expand and nations seek to enhance their military capabilities, there is a heightened emphasis on developing and deploying cutting-edge jet engines that offer improved thrust, maneuverability, and efficiency.

Modern military aircraft require engines with advanced features, such as stealth capabilities, variable thrust, and enhanced fuel efficiency. The drive for technological superiority in military aviation leads to substantial investments in research and development, pushing the boundaries of jet engine technology. This investment not only advances the capabilities of military aircraft but also stimulates growth in the broader jet engine market as manufacturers develop new, more sophisticated engines to meet these demanding specifications.

Additionally, the geopolitical landscape and evolving defense strategies contribute to the continuous demand for military aircraft and their associated jet engines. As military forces around the world modernize their fleets to address emerging threats and challenges, they require state-of-the-art jet engines that integrate the latest advancements in materials, aerodynamics, and propulsion technology. This ongoing modernization effort drives innovation and growth in the jet engine market, creating opportunities for manufacturers to develop next-generation engines that meet the rigorous demands of modern military aviation.

The jet engines market faces several restraints, including high development and manufacturing costs, which limit the entry of new players and drive up the price of advanced engines. Stringent environmental regulations also pose challenges, as manufacturers must balance performance with reducing emissions and fuel consumption. Additionally, the long development cycles for new engine technologies slow market growth, while geopolitical instability and fluctuating defense budgets can impact demand for military aircraft engines. These factors collectively restrain the growth of the jet engines market.

Sustainable Aviation Fuel (SAF) compatibility is creating significant opportunities in the jet engines market by addressing the growing demand for eco-friendly aviation solutions. As environmental regulations tighten and the aviation industry commits to reducing its carbon footprint, SAF emerges as a key alternative to conventional jet fuel. Jet engines that are compatible with SAF provide airlines with the ability to reduce greenhouse gas emissions by up to 80%, depending on the fuel blend and feedstock, while maintaining similar performance levels.

The increasing adoption of SAF-compatible engines opens new avenues for manufacturers, as airlines and aircraft operators prioritize sustainability. This shift drives innovation in engine design, with manufacturers focusing on optimizing engines for SAF use, including the development of hybrid engines that can seamlessly switch between traditional fuel and SAF. Additionally, government incentives and global initiatives aimed at promoting sustainable aviation further accelerate the demand for SAF-compatible jet engines. By embracing SAF compatibility, the jet engines market can meet both regulatory requirements and the rising consumer preference for greener travel, positioning itself for long-term growth and innovation.

The turbofan jet engine segment held the largest share of the market. Turbofan jet engines are a major driver of growth in the jet engines market due to their widespread use in both commercial and military aviation. Known for their superior fuel efficiency and quieter operation compared to turbojets, turbofans are the preferred engine type for most modern aircraft, including large passenger jets and fighter aircraft. Their ability to balance high thrust with reduced noise and fuel consumption makes them ideal for long-haul flights, driving demand from airlines focused on operational efficiency and environmental compliance.

The increasing demand for air travel, coupled with airlines seeking to modernize their fleets with more fuel-efficient aircraft, further fuels the growth of the turbofan engine segment. As governments and regulatory bodies enforce stricter emissions and noise standards, turbofan engines, with their advanced design and materials, help airlines meet these requirements while maintaining performance. Additionally, ongoing advancements in turbofan technology, such as the development of geared turbofans and high-bypass designs, are pushing the boundaries of efficiency and reliability, solidifying the turbofan's role in driving the growth of the jet engines market.

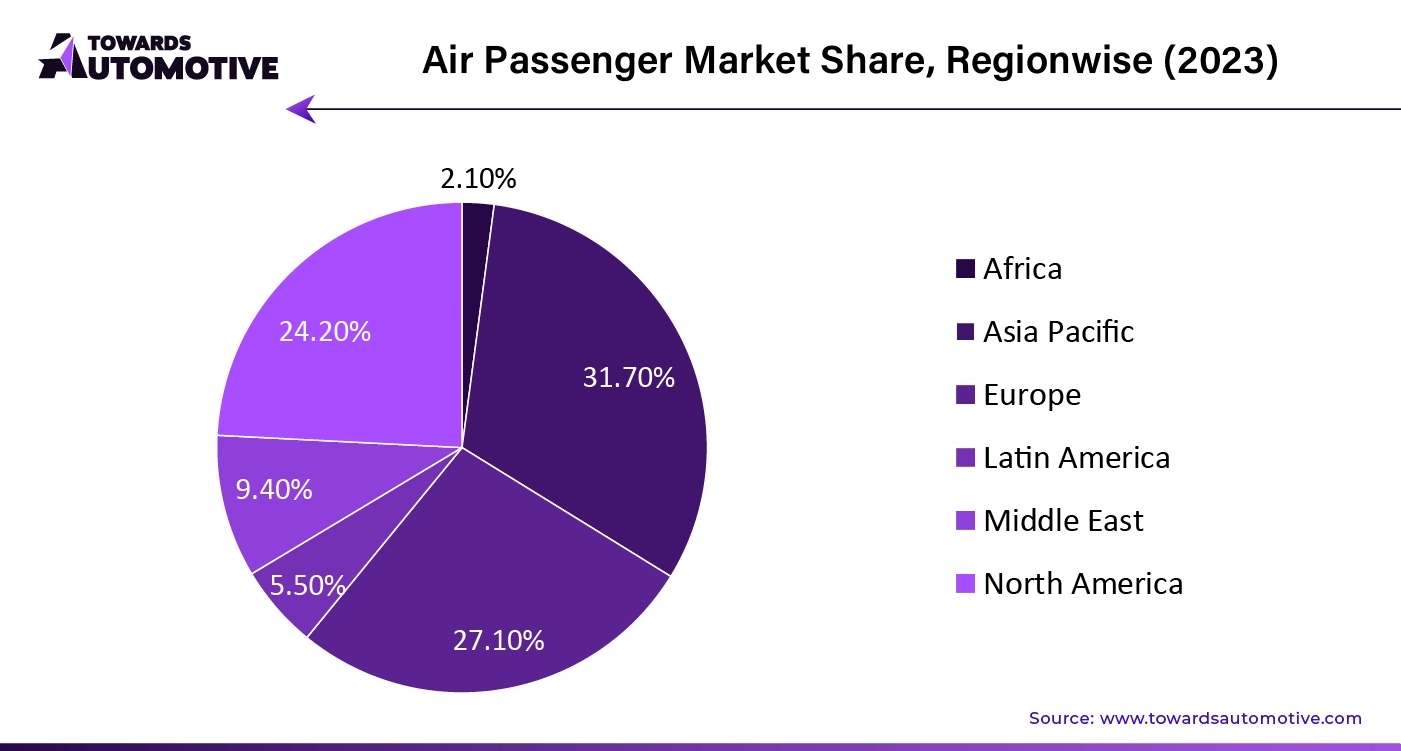

The civil aviation segment led the market. Civil aviation is a key driver of growth in the jet engines market, fueled by the rising demand for air travel and the expansion of global airline fleets. As the number of air passengers continues to increase, particularly in emerging economies, airlines are investing heavily in new aircraft to meet this growing demand. This surge in aircraft orders directly boosts the demand for advanced jet engines, particularly those designed for commercial airliners, such as turbofans, which offer high efficiency and lower emissions.

Moreover, the aviation industry’s push for sustainability and cost-efficiency is accelerating the development of next-generation jet engines. Airlines are seeking engines that not only reduce fuel consumption but also comply with stricter environmental regulations, driving innovation in engine design and materials. The replacement of aging aircraft with more fuel-efficient models also contributes to market growth, as newer engines offer better performance and lower operating costs. With civil aviation expanding and modernizing, the demand for reliable, fuel-efficient, and environmentally friendly jet engines continues to propel growth in the jet engines market.

Asia Pacific dominated the jet engines market. The growth of the jet engines market in Asia Pacific is being fueled by expanding air travel demand, growing defense budgets, and fleet modernization efforts. As economic development across the region, particularly in countries like China, India, and Southeast Asia, increases disposable incomes, the middle class is expanding, leading to a surge in both business and leisure air travel. Airlines are responding by expanding their fleets, which drives demand for more advanced, fuel-efficient jet engines.

Simultaneously, rising defense budgets across Asia Pacific are contributing to growth in the military aviation sector. Countries in the region are investing heavily in modernizing their air forces, leading to increased demand for high-performance jet engines that power fighter jets and other military aircraft.

Additionally, fleet modernization initiatives among commercial airlines are further driving market growth. Airlines are increasingly replacing older, less efficient aircraft with new-generation models that offer improved fuel efficiency and reduced emissions. These modernization efforts, driven by both economic and environmental factors, are creating strong demand for next-generation jet engines, positioning Asia Pacific as a key growth market for jet engine manufacturers.

North America is expected to grow with a significant CAGR during the forecast period. The jet engines market in North America is being driven by a combination of factors, including the growth of aftermarket services and Maintenance, Repair, and Overhaul (MRO) operations, a robust commercial aviation industry, rising military aircraft demand, and increasing emphasis on sustainability and emission regulations.

Aftermarket services and MRO play a critical role in the market, as airlines and military operators rely heavily on these services to maintain, upgrade, and extend the life of their fleets. North America is home to advanced MRO facilities, creating consistent demand for jet engine servicing, parts, and retrofitting, which boosts the overall market.

The region's commercial aviation industry is one of the largest and most advanced in the world, with airlines investing heavily in new aircraft to meet growing passenger demand. This drives the need for advanced, fuel-efficient jet engines, especially as airlines aim to reduce operating costs and improve environmental compliance.

Military aircraft demand is also a significant driver, with the U.S. leading investments in defense modernization. The increasing demand for fighter jets, drones, and transport aircraft creates strong opportunities for jet engine manufacturers, especially those providing high-performance engines tailored for military use.

Lastly, the aviation sector in North America faces growing pressure to reduce emissions and adhere to sustainability regulations. This has led to a surge in demand for new-generation jet engines that are compatible with Sustainable Aviation Fuel (SAF) and are designed to reduce carbon emissions. As both commercial and military operators focus on greener technologies, this push for sustainability is further fueling the demand for next-gen engines, driving market growth in North America.

By Type

By Application

By Region

March 2025

March 2025

February 2025

January 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us