April 2025

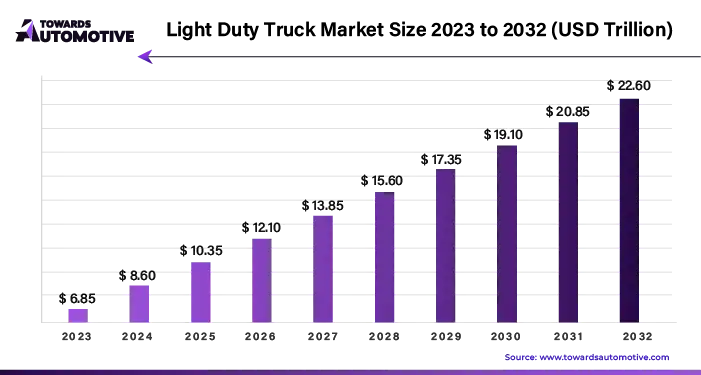

The light duty truck market is forecasted to expand from USD 8.49 trillion in 2025 to USD 22.31 trillion by 2034, growing at a CAGR of 11.33% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Light trucks, also known as light-duty trucks, play a crucial role in transportation and distribution, particularly for short-distance operations within urban environments. These vehicles offer versatility, compactness, and maneuverability, making them well-suited for navigating tight spaces and congested city streets while providing ample cargo capacity. As businesses increasingly focus on last-mile delivery and urban transportation solutions, the demand for light trucks has surged, driving growth in the market.

The rise of e-commerce and the growing need for fast and efficient delivery services have further fueled the demand for light trucks. These vehicles are essential for transporting packages in urban traffic and navigating narrow roads, facilitating the timely delivery of goods to customers. With the continuous expansion of the e-commerce sector, the demand for high-quality transportation solutions, including light trucks, is expected to continue growing.

Moreover, as consumers become more conscious of fuel consumption and environmental impact, there is a growing preference for smaller, more fuel-efficient vehicles. This shift in consumer preferences could influence the demand for larger vehicles, including light trucks, in the market. Additionally, higher fuel prices may increase the operating costs for transportation and delivery businesses, impacting their profitability and investment decisions.

Light trucks play a vital role in modern transportation and logistics, particularly in urban environments where efficiency and maneuverability are essential. The increasing demand for last-mile delivery services and the rise of e-commerce are driving growth in the light truck market, while factors such as fuel efficiency and operating costs may influence future trends in the industry.

The COVID-19 pandemic has indeed left a significant mark on the automotive industry, with disruptions in production, supply chains, and consumer demand. Initially, widespread lockdowns and restrictions imposed to curb the spread of the virus led to significant disruptions in manufacturing operations and distribution channels. As economic activity slowed and uncertainty gripped global markets, consumer confidence waned, resulting in a decline in vehicle purchases.

However, amid the challenges, the pandemic also catalyzed certain shifts in consumer behavior, particularly in the realm of e-commerce. With more people turning to online shopping for their essential and non-essential needs, there was a corresponding surge in demand for last-mile delivery services. This surge in e-commerce activity has created new opportunities for the automotive industry, particularly for light trucks and vehicles used in urban logistics and delivery operations.

Looking ahead, the recovery of the automotive industry from the impacts of the pandemic will depend on various factors. Government policies and stimulus measures aimed at reviving economic activity and supporting industries will play a crucial role. Changes in consumer behavior, including preferences for online shopping and delivery services, will continue to shape the demand for vehicles, especially in the urban transportation and logistics sectors. Additionally, broader economic trends and shifts in global markets will influence the pace and trajectory of the industry's recovery. Overall, navigating the post-pandemic landscape will require adaptability, innovation, and strategic planning from stakeholders across the automotive ecosystem.

The trucking industry is experiencing a notable shift towards sustainability and efficiency, driven by a growing focus on improving fuel efficiency and reducing emissions. Heightened environmental awareness and increasingly stringent regulations have compelled both consumers and businesses to prioritize vehicles that offer better fuel economy and lower emissions.

This emphasis on sustainability has sparked competition within the trucking market, prompting manufacturers to innovate and develop greener and more efficient models. As a result, there has been a surge in the adoption of new technologies such as hybrid and electric power systems, which not only reduce environmental impact but also offer economic benefits through lower operating costs.

Moreover, this shift towards greener trucking solutions aligns with the evolving preferences of consumers who are increasingly seeking vehicles that prioritize safety, efficiency, and environmental sustainability. As a result, manufacturers are investing in research and development to meet these demands, leading to the introduction of innovative and eco-friendly trucking solutions.

Overall, the convergence of stricter regulations, environmental consciousness, and consumer preferences is driving significant growth and innovation in the trucking industry. By embracing sustainable technologies and practices, companies are not only meeting regulatory requirements but also capitalizing on emerging market trends to stay competitive and meet the evolving needs of customers.

The forecasted dominance of electric vehicles in the transportation market by 2023 underscores a significant shift towards sustainable and efficient mobility solutions. An illustrative example of this trend is the introduction of Eicher Trucks and Buses' Pro 2000 series light trucks in the UAE and the Middle East in February 2023. These trucks boast industry-leading fuel efficiency and superior uptime, offering economic benefits to vehicle owners while reducing environmental impact.

This transition towards electric vehicles is driven by a growing demand for more economical and environmentally friendly transportation options. As consumers and businesses increasingly prioritize sustainability, there is a notable interest in diesel as a fuel, particularly in the light vehicle segment. By improving range and efficiency, electric trucks have garnered attention from various industries, including e-commerce, pharmaceuticals, food, and local services, all of which rely on efficient last-mile delivery solutions.

Light trucks, in particular, have emerged as vital assets in meeting the demand for timely and efficient delivery to customers' doorsteps. Their urban flexibility and efficiency make them well-suited for navigating congested city streets and fulfilling the evolving needs of modern businesses. To capitalize on the growing demand for light trucks, companies must focus on optimizing their delivery processes, thereby increasing market adoption and expanding the overall market for these vehicles.

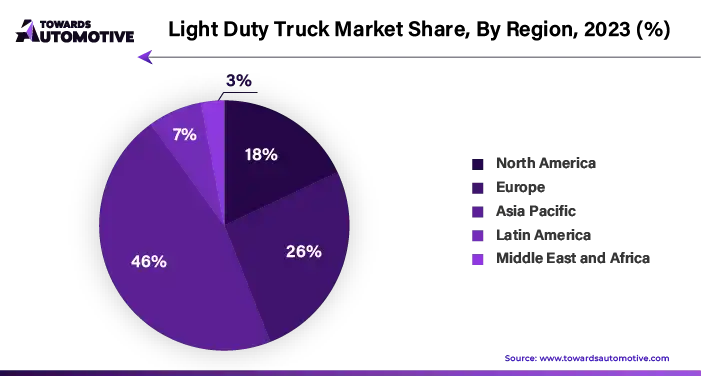

The projection of the Asia Pacific light truck market capturing 65% of revenue by 2023 underscores the region's significant role in driving growth and innovation in the commercial vehicle sector. A notable example of this trend is Mahindra Truck and Bus Division's (MTB) announcement in September 2023 regarding the introduction of the Mahindra FURIO 7, which represents the latest addition to its commercial vehicle range.

The Mahindra FURIO 7 encompasses three distinct product platforms catering to various needs within the light commercial vehicle (LCV) segment, including 4-tire cargo, 6-tire cargo HD, and 6-tire dump truck variants. These vehicles are engineered to deliver optimal performance, reliability, and fuel efficiency, addressing the evolving demands of trucking companies and fleet operators across the Asia Pacific region.

In response to the growing demand for efficient and versatile light trucks, manufacturers like Mahindra have embarked on initiatives to expand their product lines and introduce innovative solutions. By offering a diverse range of options tailored to different applications and business requirements, these companies are well-positioned to capitalize on the burgeoning opportunities in the Asia Pacific light truck market.

Major companies operating in the light duty truck market are:

By Fuel Type

By Application

By Drive Configuration

By Geography

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us