October 2025

The on board chargers and stationary chargers market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2023 and 2034, powering sustainable infrastructure globally.

The on-board chargers and stationary chargers market is rapidly evolving as electric vehicle (EV) adoption accelerates globally. On-board chargers (OBCs) are integral to EVs, converting alternating current (AC) from external sources into the direct current (DC) needed to charge the vehicle’s battery. These systems allow EVs to plug into conventional outlets, making them crucial for home and public charging. Stationary chargers, on the other hand, are fixed units designed to deliver higher charging power, available in both AC and DC variants. While on-board chargers cater to the convenience of slow, overnight charging, stationary chargers—especially those offering DC fast charging—provide quicker, more powerful options at public or dedicated charging stations.

As the EV market expands, demand for both charging technologies is increasing. OBCs are seeing advancements in power efficiency and compact design, allowing for faster charging speeds without significantly impacting vehicle weight or space. Meanwhile, stationary chargers are benefiting from innovations in charging networks, with ultra-fast chargers capable of providing significant range in minutes becoming more common. Key factors driving market growth include governmental incentives for EV adoption, rising environmental awareness, and the expansion of charging infrastructure.

Both segments of the market face opportunities and challenges, such as the need for standardization in connector types, and the development of more efficient energy management systems. As the landscape of electric mobility continues to evolve, the on-board chargers and stationary chargers market plays a pivotal role in shaping the future of transportation.

AI plays a transformative role in the on-board chargers and stationary chargers market, enhancing both efficiency and user experience. In on-board chargers (OBCs), AI is being integrated to optimize the charging process by managing energy flows, predicting battery health, and adapting charging power based on real-time conditions. By using machine learning algorithms, AI can monitor battery temperature, state of charge, and overall performance ensuring that the vehicle’s battery is charged in the most efficient and safe manner. AI can also predict the optimal charging time to reduce strain on the grid during peak hours, helping to balance energy supply and demand.

In stationary chargers, AI-driven systems enable smart charging, allowing for dynamic load management, where charging power is adjusted based on the availability of electricity, user preferences, and grid capacity. AI is also crucial for the development of networked charging stations, where algorithms can predict peak usage times and allocate resources to prevent overloading the infrastructure. Additionally, AI enhances user convenience by facilitating seamless payment systems, optimizing charger placement based on user patterns, and enabling predictive maintenance of the charging equipment, thus minimizing downtime.

As the number of EVs grows, AI’s role in managing data from thousands of charging stations and millions of users becomes critical for ensuring efficient operation. The use of AI in both OBCs and stationary chargers contributes to making charging faster, safer, and more aligned with the broader goals of energy sustainability and grid integration.

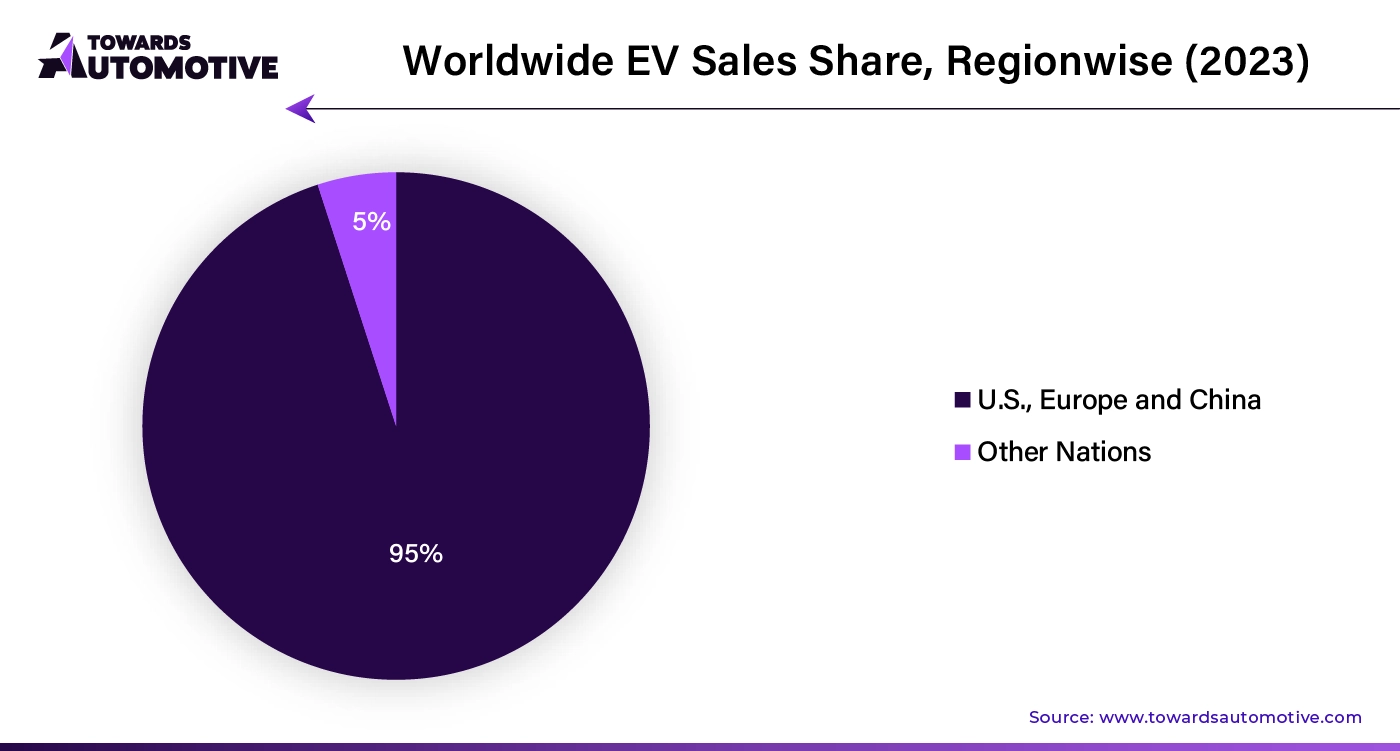

The rising sales of electric vehicles (EVs) are a key driver of growth in the on-board chargers and stationary chargers market. As more consumers and businesses transition to EVs, the demand for efficient and reliable charging solutions has surged. On-board chargers (OBCs), which enable vehicles to charge directly from standard electrical outlets, are becoming a standard feature in EVs, with manufacturers focusing on improving their power conversion efficiency and charging speed. The growing EV fleet creates an ongoing need for advanced OBC systems that can support faster charging while minimizing energy loss, boosting demand for innovations in this area.

Simultaneously, the expansion of stationary chargers is essential to meet the increasing charging infrastructure requirements. With more EVs on the road, the need for public and private charging stations—particularly fast-charging options—has skyrocketed. Stationary chargers, especially those offering high-power DC fast charging, enable drivers to recharge quickly, reducing downtime and enhancing the convenience of EV ownership. As EV sales rise, governments and private companies are investing heavily in expanding charging infrastructure, leading to rapid growth in the stationary chargers market.

Additionally, rising EV adoption has led to stronger demand for charging networks that support long-distance travel, further driving the need for an extensive and reliable network of stationary chargers. The expanding EV market also increases the necessity for smart energy management systems, ensuring that on-board and stationary chargers operate efficiently without overburdening the electrical grid. As a result, the growth of EV sales directly influences the scale, technology development, and investment in both on-board and stationary chargers, ensuring the infrastructure keeps pace with the evolving electric mobility landscape.

The on-board chargers and stationary chargers market faces several restraints, including high costs of advanced charging technologies and infrastructure deployment. Additionally, a lack of standardized charging protocols across regions creates compatibility issues, limiting widespread adoption. The need for large-scale grid upgrades to support fast-charging stations can also pose challenges, as it requires significant investment and time. Furthermore, concerns about charging speed, especially for on-board chargers, and limited availability of fast-charging stations in rural areas, hinder the seamless adoption of electric vehicles, impacting market growth.

Vehicle-to-home (V2H) systems present significant opportunities in the on-board chargers and stationary chargers market by enabling electric vehicles (EVs) to function as mobile energy storage units for residential use. V2H technology allows EVs to transfer stored energy back to a home’s electrical system, providing backup power during outages or reducing energy costs by supplying electricity during peak usage hours. This dual-purpose functionality elevates the role of on-board chargers (OBCs), making them integral to energy management systems. OBCs in V2H setups must be capable of bidirectional energy flow, creating demand for more advanced, efficient chargers that can seamlessly switch between charging the EV and powering the home.

The growing interest in V2H systems is also driving innovation in stationary chargers. These chargers, particularly those installed in residential areas, need to support bidirectional charging to enable V2H capabilities. As consumers and utility companies look for more flexible and sustainable energy solutions, V2H technology offers the potential for EVs to act as decentralized energy storage. This not only increases demand for chargers with V2H capabilities but also encourages the integration of smart charging solutions that can optimize energy distribution between the grid, the vehicle, and the home.

Moreover, V2H systems are creating new business models for energy management companies and utility providers. By allowing EV owners to feed excess energy back into their homes, V2H technology supports more efficient energy use and potentially lowers electricity costs. It also contributes to grid stability, especially in regions with high renewable energy penetration, further amplifying the need for compatible on-board and stationary chargers. As V2H adoption grows, it opens up new revenue streams and development opportunities for charger manufacturers, driving the expansion and innovation of the charging market.

Asia Pacific dominated the on-board chargers and stationary chargers market. The on-board chargers and stationary chargers market in Asia Pacific is significantly influenced by a combination of rising electric vehicle (EV) adoption, vehicle-to-grid (V2G) technology, government initiatives, and technological advancements. EV adoption is growing rapidly in major countries such as China, Japan, South Korea, and India due to heightened environmental awareness and the global shift toward cleaner energy.

This surge in EV sales directly increases demand for both on-board chargers (OBCs), which enable home charging, and stationary chargers, which power public charging networks. As more consumers and businesses invest in EVs, there is a need for efficient, reliable, and accessible charging infrastructure to meet this rising demand, creating opportunities for innovation in both OBCs and stationary charging solutions.

Vehicle-to-grid (V2G) technology, which allows EVs to supply energy back to the grid, further drives the demand for advanced on-board and stationary chargers. In a V2G system, EVs serve as mobile energy storage units, helping to stabilize the grid and reduce peak electricity loads. This bi-directional energy flow requires more sophisticated on-board chargers that can switch between charging the vehicle and supplying energy to the grid. As Asia Pacific countries increasingly adopt V2G solutions, the demand for chargers capable of handling these complex energy management systems is growing, creating new opportunities for charger manufacturers to develop smarter, more versatile products.

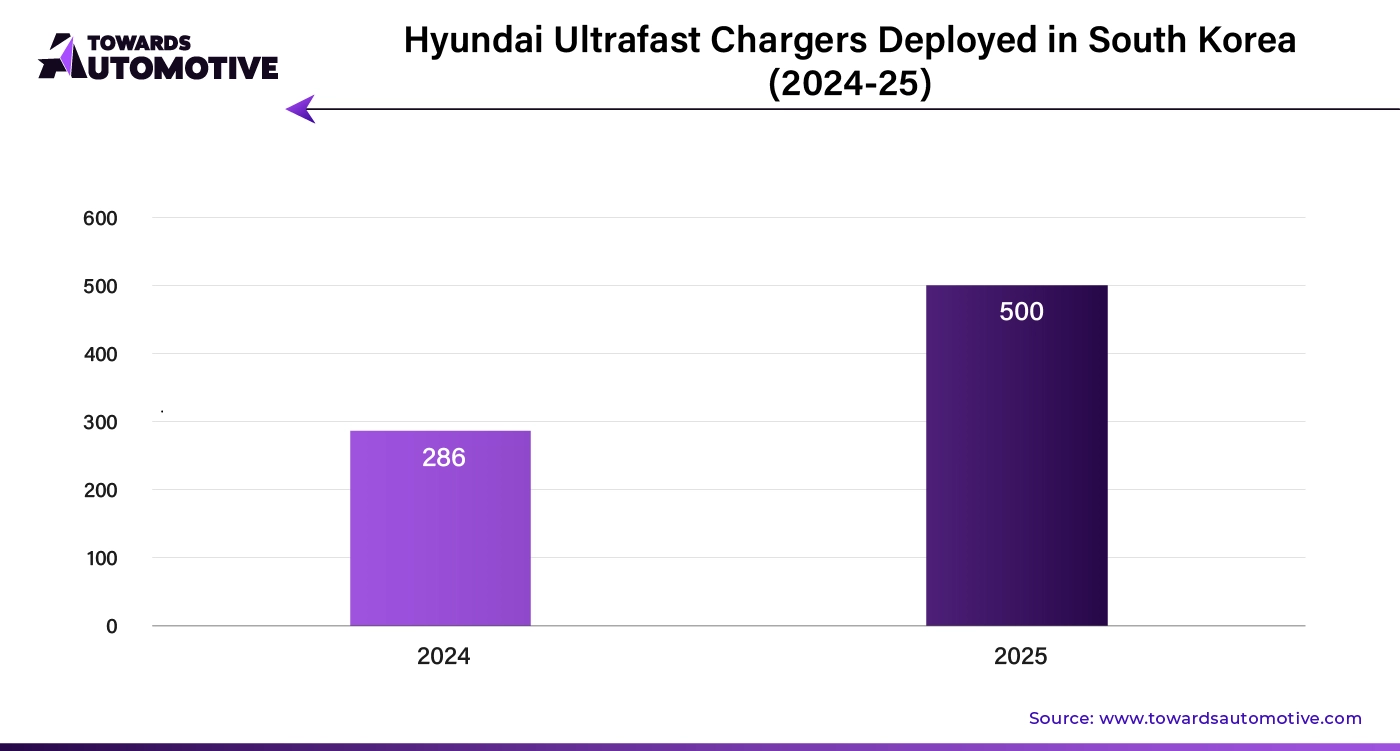

Government initiatives are also a crucial driver of market growth. Countries across Asia Pacific are offering strong policy support for EV adoption, including subsidies, tax incentives, and stringent emissions regulations aimed at phasing out internal combustion engine (ICE) vehicles. China, the world’s largest EV market, has implemented aggressive policies that mandate the installation of EV charging stations in residential and commercial spaces, while countries such as Japan and South Korea are offering incentives to build ultra-fast charging networks. These initiatives not only stimulate demand for stationary chargers but also encourage technological advancements in on-board chargers to meet the evolving needs of the EV ecosystem.

Technological advancements play a key role in driving market expansion in Asia Pacific. Innovations in power electronics and battery management systems have led to the development of more efficient and compact OBCs capable of handling higher charging power. As EV batteries become larger and more powerful, the need for fast, efficient charging becomes even more critical. Ultra-fast chargers, capable of delivering over 350 kW, are being introduced in public and commercial settings, enabling faster charging times and improving the overall EV experience. Wireless charging solutions are also gaining traction, offering a seamless charging process without the need for physical connectors, further enhancing user convenience.

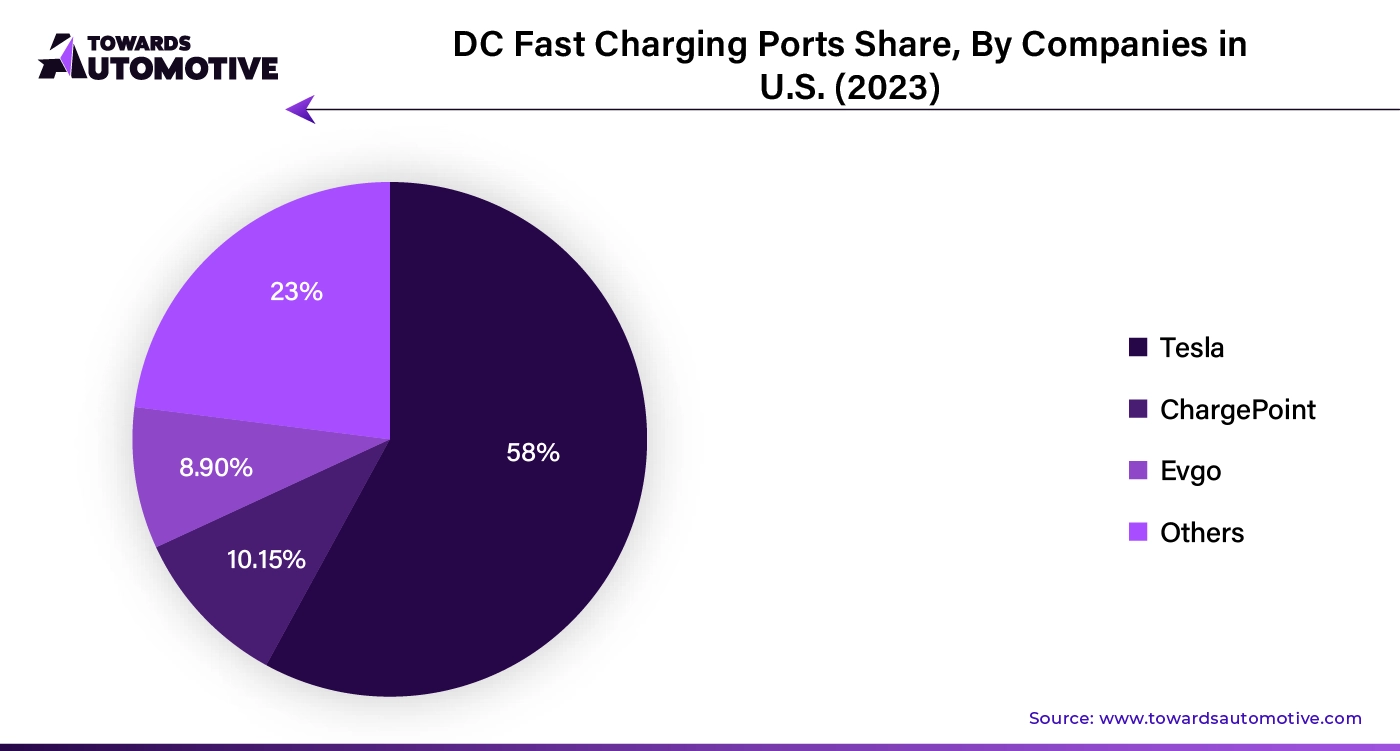

North America is expected to grow with the highest CAGR during the forecast period. The growth of the on-board chargers and stationary chargers market in North America is propelled by several key factors, including the expansion of charging infrastructure, the adoption of vehicle-to-home (V2H) systems, substantial government investment, and the burgeoning electric vehicle (EV) industry with prominent players.

The rapid expansion of charging infrastructure is a crucial driver, as the increasing number of EVs on the road necessitates a comprehensive and accessible network of charging stations. Investments in both public and private charging networks are expanding rapidly, with a focus on deploying high-power and ultra-fast stationary chargers to ensure that EV owners have convenient and reliable access to charging options. This expansion supports not only urban areas but also extends to rural and underserved regions, addressing the range anxiety often associated with EVs.

The integration of V2H technology is another significant driver, as it enables EVs to serve as energy storage units that can supply power back to homes, providing a dual benefit of enhanced grid stability and reduced energy costs. V2H systems require advanced on-board chargers capable of bidirectional energy flow, which stimulates demand for innovative charging solutions. As V2H adoption grows, the need for compatible on-board and stationary chargers that can support this technology is increasing, driving market growth.

Government investment and support play a pivotal role in accelerating the development of the charging infrastructure. In North America, federal and state-level incentives, such as tax credits, rebates, and grants for EV purchases and charging station installations, are encouraging both consumers and businesses to invest in electric mobility. These policies not only promote the adoption of EVs but also stimulate the growth of charging infrastructure, creating a positive feedback loop that drives further market expansion.

Additionally, the rising EV industry, characterized by major players such as Tesla, General Motors, Ford, and others, significantly contributes to market growth. These prominent automotive manufacturers are investing heavily in EV technology and infrastructure, including the development of more efficient on-board chargers and high-speed stationary chargers. Their commitment to expanding the EV market and enhancing charging solutions fosters a competitive environment that accelerates innovation and drives the overall growth of the on-board and stationary chargers market.

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us