September 2024

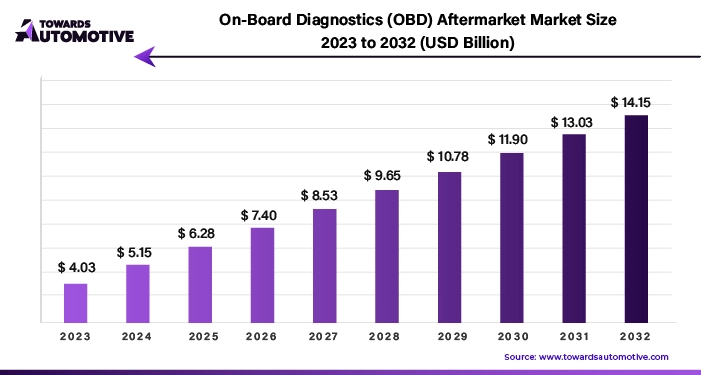

The on-board diagnostics aftermarket size was valued at USD 4.03 billion in 2023 and is expected to increase by USD 14.15 billion in 2032 with is projected CAGR of 14.99% during the forecast period.

Unlock Infinite Advantages: Subscribe to Annual Membership

The widespread adoption of remote vehicle diagnostics, facilitated by data-driven technology, has emerged as a pivotal driver for business expansion within the automotive aftermarket. Remote diagnostic systems offer a layer of security by enabling operators to monitor and control vehicles remotely, facilitating temporary servicing and minimizing vehicle downtime and damage.

The persistent issue of traffic congestion on long-distance routes has intensified the demand for aftermarket solutions. As vehicles age, their performance may degrade, leading to various operational issues. OBD products and associated aftermarket services present cost-effective solutions for diagnosing and addressing these issues, thereby prolonging the lifespan of vehicles and ensuring optimal performance, efficiency, and safety over time.

The proliferation of counterfeit OBD aftermarket products poses significant challenges to the market. While there is a growing demand for affordable solutions, counterfeit products lack proper testing and fail to meet safety standards, potentially causing harm to vehicles and dissatisfaction among consumers. To mitigate this issue, businesses must implement stringent control and management measures to ensure the authenticity and quality of their products.

COVID-19 pandemic has left a profound impact on the aftermarket diagnostics sector. Initially, lockdown measures and economic uncertainty led to a downturn in vehicle usage and associated spending, affecting demand for aftermarket solutions. However, the emphasis on personal transportation, coupled with the rise of remote diagnostics and online sales channels for OBD products, has fueled business growth. The market has witnessed a notable shift towards digitalization and e-commerce, with continued interest in after-sales solutions as consumers seek remote vehicle management capabilities and access to diagnostics. This trend underscores the resilience of the aftermarket sector and its ability to adapt to evolving consumer preferences and market dynamics in the face of adversity.

The integration of Internet of Things (IoT) technology is fueling significant growth within the on-board diagnostics (OBD) market, particularly in the aftermarket segment. IoT-enabled OBD systems enable swift data collection and transmission, revolutionizing remote diagnostics, vehicle tracking, and predictive maintenance capabilities. By harnessing connectivity, these systems facilitate seamless monitoring and analysis, thereby enhancing vehicle performance, ensuring quality maintenance, and empowering users with self-service capabilities.

As IoT-driven OBD solutions continue to gain momentum, the market is poised to showcase its capacity to revolutionize diagnostics and vehicle management practices. With real-time access to comprehensive vehicle data, stakeholders can proactively address maintenance needs, identify potential issues before they escalate, and optimize vehicle performance. This proactive approach not only enhances operational efficiency but also minimizes downtime and maintenance costs, ultimately translating into improved customer satisfaction and loyalty.

Moreover, the integration of IoT technology opens up avenues for innovative service offerings and business models within the aftermarket sector. By leveraging advanced analytics and machine learning algorithms, service providers can offer personalized maintenance recommendations, tailored to each vehicle's unique usage patterns and operating conditions. This personalized approach enhances the value proposition for consumers, driving adoption and fostering long-term customer relationships.

IoT-enabled OBD systems play a crucial role in advancing the concept of connected vehicles and smart transportation ecosystems. As vehicles become increasingly connected and autonomous, the ability to gather and analyze real-time data becomes paramount for ensuring safety, efficiency, and sustainability on the roads. By harnessing the power of IoT, OBD systems serve as a cornerstone of the intelligent transportation infrastructure, enabling seamless communication between vehicles, infrastructure, and other connected devices.

Integration of IoT technology into OBD systems represents a transformative shift in the automotive aftermarket landscape. With its ability to deliver actionable insights, enhance operational efficiency, and drive innovation, IoT-driven OBD solutions are poised to redefine the future of vehicle diagnostics and management. As the market continues to evolve, stakeholders must embrace this technological revolution and capitalize on the opportunities it presents to stay ahead of the curve and deliver unparalleled value to customers.

The hardware segment is poised to emerge as the leading revenue generator in the aftermarket sector for 2022, driven by the introduction of cutting-edge diagnostic tablets. These innovative tablets are revolutionizing the automotive diagnostics landscape by enhancing the reading and interpretation of vehicle data, expediting diagnostics processes, and delivering rapid insights. An illustrative example of this trend is the launch of Innova Electronics Corporation's Smart Diagnostic System (SDS) tablet and RepairSolutionsPRO app in July 2023. As part of Innova's portfolio of innovative automotive solutions, these smart tools and applications have the potential to elevate diagnostic capabilities, streamline workflows for mechanics, and facilitate seamless communication between repair shops and customers.

Meanwhile, fleet management is set to dominate the realm of aftermarket fault detection, starting from 2022. Fleet management solutions heavily rely on OBD technology to furnish comprehensive fleet tracking and monitoring functionalities. Vehicles equipped with OBD systems can be precisely tracked on digital maps, empowering fleet managers to monitor their locations, routes, and parking activities in real-time. This wealth of information holds immense promise for enhancing road quality, enabling drivers to adhere to designated routes, and curbing unauthorized vehicle usage. Moreover, the accurate monitoring afforded by OBD solutions facilitates operational efficiency, enables timely adjustments, and provides invaluable insights into driver behavior, thereby optimizing resource allocation and enhancing overall fleet performance.

Insights reveal that the convergence of advanced hardware and fleet management solutions represents a significant leap forward in the automotive aftermarket domain. By leveraging cutting-edge diagnostic tablets and OBD-enabled fleet management systems, businesses can unlock new avenues for operational efficiency, cost optimization, and customer satisfaction. Furthermore, these technological advancements underscore the growing importance of data-driven decision-making in the automotive industry, paving the way for smarter, more agile aftermarket solutions. As the market continues to evolve, stakeholders must embrace these innovations to stay competitive and capitalize on the myriad opportunities they present for driving business growth and delivering superior customer experiences.

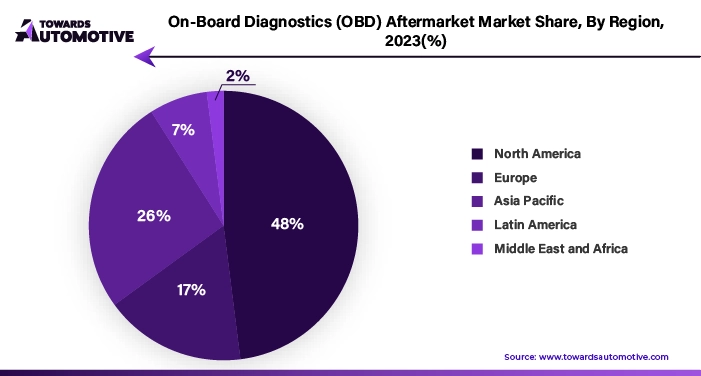

The North America on-board diagnostics (OBD) aftermarket is a significant player in the global automotive diagnostics landscape, commanding a substantial 48% share of revenue in 2023. This market dominance can be attributed to several key factors that collectively contribute to its robust performance and leadership position.

Firstly, North America boasts a thriving automotive industry characterized by a robust manufacturing sector, a diverse range of vehicle offerings, and a strong emphasis on technological innovation. This vibrant automotive landscape provides a fertile ground for the proliferation of aftermarket OBD solutions, as vehicle owners and fleet operators seek advanced diagnostic tools to ensure optimal performance, efficiency, and safety.

Technological advancements play a pivotal role in driving the adoption of aftermarket OBD solutions in North America. The region is at the forefront of innovation in automotive technology, with ongoing developments in areas such as connected vehicles, telematics, and data analytics. As such, there is a growing demand for sophisticated OBD systems that leverage cutting-edge technology to deliver accurate diagnostics, real-time monitoring, and predictive maintenance capabilities.

Furthermore, North America's extensive fleet operations, encompassing commercial fleets, logistics companies, and transportation services, contribute significantly to the demand for aftermarket OBD solutions. Fleet operators rely on OBD technology to monitor vehicle health, track fuel consumption, and ensure regulatory compliance, thereby driving the adoption of advanced diagnostic systems.

Regulatory compliance requirements also play a crucial role in shaping the North American OBD aftermarket. Stringent emissions regulations, safety standards, and vehicle maintenance mandates necessitate the use of OBD systems to conduct comprehensive diagnostics and ensure regulatory compliance. This regulatory-driven demand further propels the growth of the aftermarket segment in the region.

Moreover, North America benefits from a high level of awareness and acceptance of automotive technology among consumers and businesses alike. The region's tech-savvy population, coupled with a mature aftermarket ecosystem comprising service providers, distributors, and retailers, creates a conducive environment for the adoption and integration of OBD solutions.

North America's robust automotive industry, technical breakthroughs, regulatory compliance, and mature aftermarket ecosystem all contribute to the region's dominating position in the global on-board diagnostics aftermarket, which drives diagnostic solution growth and innovation.

Major companies operating in the on-board diagnostics aftermarket are:

By Vehicle Type

By Component

By Application

By Geography

September 2024

September 2024

September 2024

September 2024

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us