March 2025

Senior Research Analyst

Reviewed By

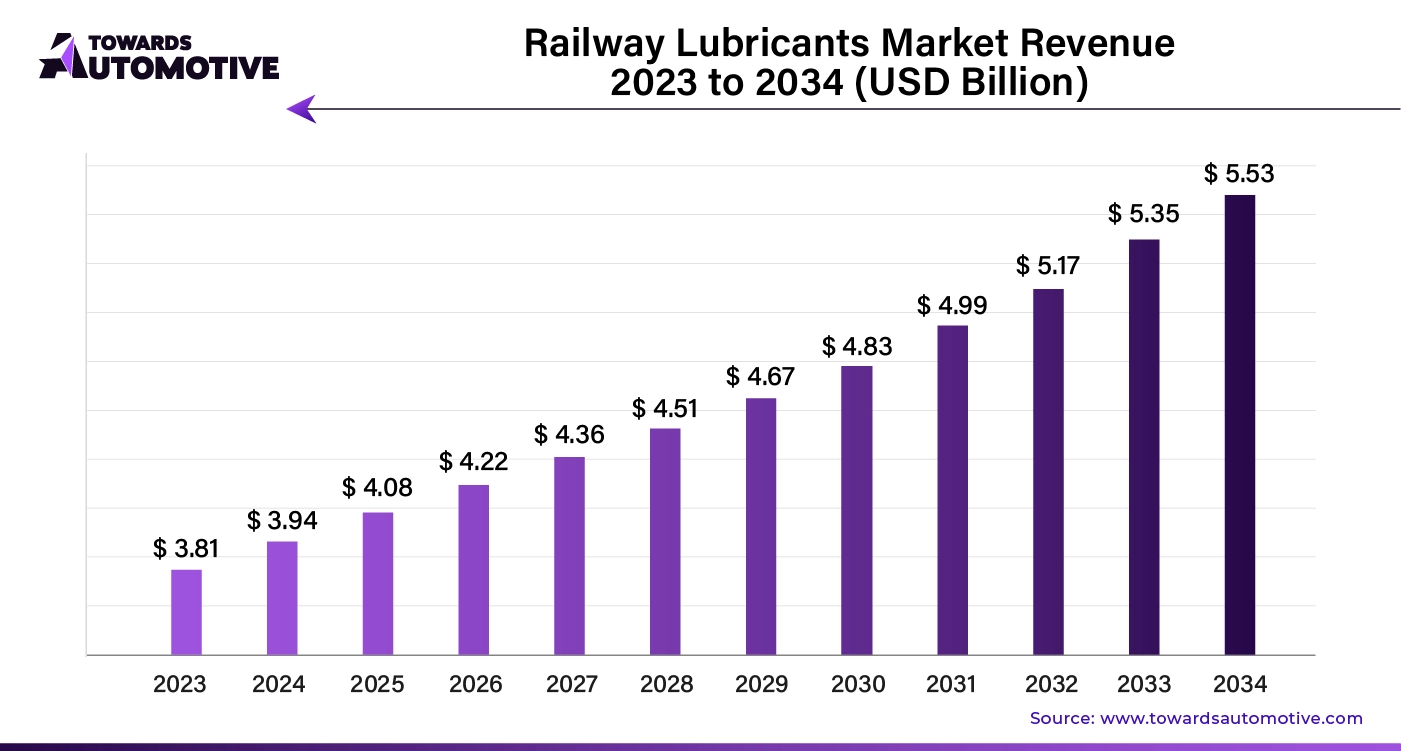

The global railway lubricants market was valued at USD 3.81 billion in 2023 and is estimated to be valued at USD 5.53 billion in 2034, expanding at a CAGR of 3.45% between 2024 and 2034.

Railway lubricants are specialized substances used to reduce friction and wear between moving parts in railway systems. They play a critical role in ensuring smooth operation, enhancing the longevity of components, and improving overall efficiency. They help manage temperatures to prevent overheating, shield metal parts from rust and degradation, and prevent dirt and debris from affecting performance. The railway lubricants market has been experiencing significant growth due to the increasing rail infrastructure investments and the need for efficient maintenance.

Increasing Rail Infrastructure Investments

With the rising urbanization, the need for efficient transportation is increasing worldwide. Thus, various countries are focusing on expanding their rail networks. Significant government and private investments in railway infrastructure, particularly in developing regions, drive the demand for reliable lubrication solutions. However, railway lubricants are essential for maintaining the safety, reliability, and efficiency of rail operations.

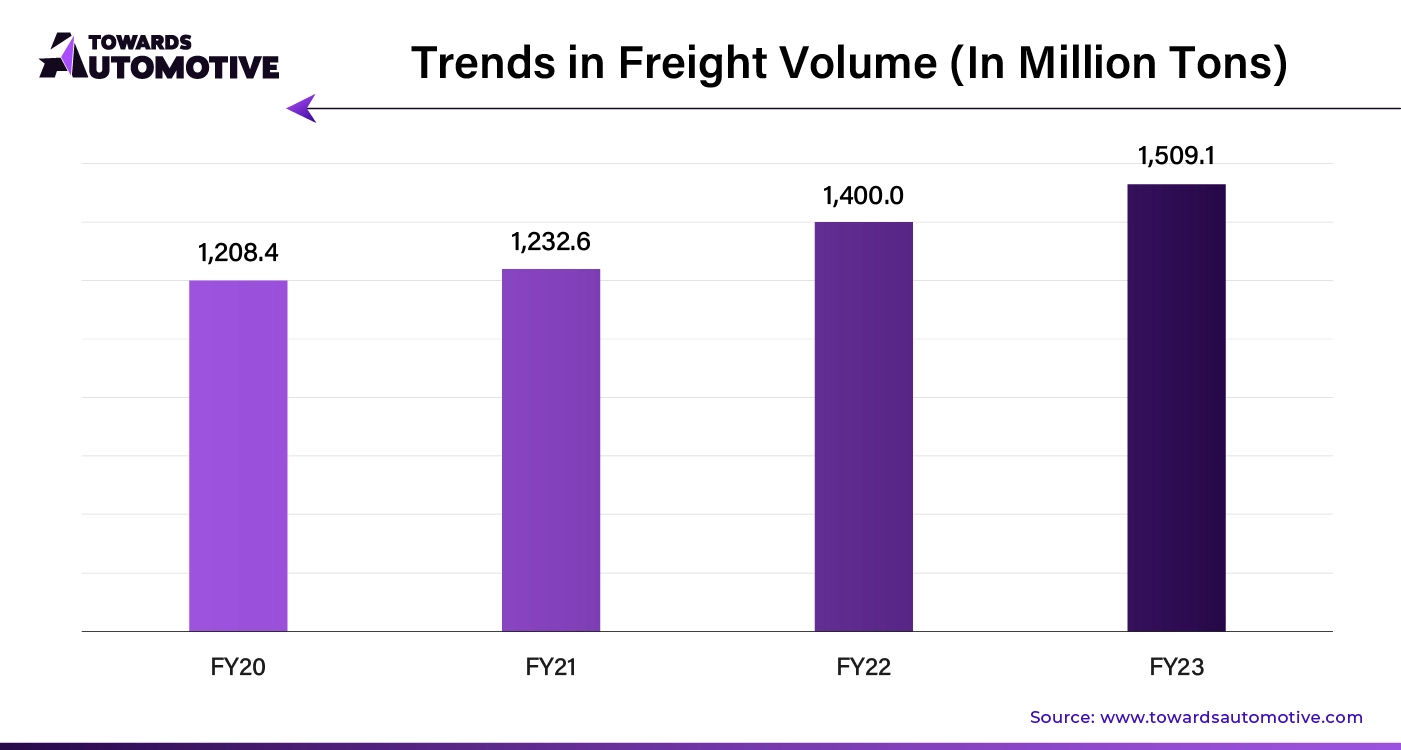

Rising Freight Transport Demand and Maintenance and Upgrades of Existing Assets

The rising need for freight transport is another major factor boosting the market. With a significant growth in global trade and logistics the need for efficient freight transport is increasing, leading to higher lubricant usage in freight trains. In addition, aging railway infrastructure requires modernization and maintenance. This leads to increased demand for lubricants for upkeep. Increased awareness of energy efficiency and the need to reduce operational costs drive the adoption of high-performance lubricants.

High Competition & Regulatory Challenges

The railway lubricants market faces several challenges that may hinder its growth. One significant challenge is the intense competition within the industry, which can lead to price wars and negatively impact profitability for manufacturers. Additionally, strict regulatory frameworks surrounding environmental compliance complicate the formulation and marketing of lubricants, forcing companies to invest in costly research and development.

Volatile Raw Material Prices and Availability of Substitutes

Fluctuating raw material prices, particularly for base oils and additives, can further disrupt pricing strategies and profit margins, significantly hampering the market. Limited awareness of advanced lubricant technologies among some railway operators may also impede adoption, particularly in regions with less technological penetration. Economic downturns can reduce investments in rail infrastructure, leading to decreased demand for lubricants. Moreover, the availability of alternative lubrication methods and technologies, such as self-lubricating components and solid lubricants, poses additional competition.

Demand for Sustainable Lubricants and Adoption of Smart Technologies

The railway lubricants market presents a range of opportunities driven by emerging trends and evolving industry needs. One significant opportunity lies in the growing demand for eco-friendly and biodegradable lubricants, as sustainability becomes a priority for many railway operators and regulatory bodies. This shift encourages manufacturers to innovate and develop greener formulations that align with environmental goals. Additionally, the increasing adoption of smart technologies in rail systems creates opportunities for integrating condition-monitoring solutions that optimize lubricant usage and enhance maintenance practices.

The rapid expansion of urban rail networks create immense opportunities in the market. The development of metro systems and light rail networks in urban areas boost the demand for lubricants to support their burgeoning transit systems. Moreover, there is a rising interest in customized lubricants tailored to specific applications, such as freight versus passenger trains, which allows manufacturers to cater to diverse customer needs. Collaborations and partnerships between lubricant producers and rail operators can lead to joint development projects, fostering innovation and improving service offerings.

Asia Pacific dominated the market in 2023. The region has experienced rapid urbanization and industrialization, leading to significant investments in rail infrastructure to support growing transportation needs. Countries like China and India are expanding their rail networks extensively, which drives the demand for high-quality lubricants. Moreover, the region is home to some of the largest rail operators, who prioritize efficient and reliable operations. This results in a higher consumption of lubricants for both freight and passenger rail systems. In addition, increasing government initiatives aimed at enhancing public transportation and reducing carbon footprints further propel the demand for railway lubricants.

The market in North America is expected to expand at the fastest growth rate in the near future. The regional market growth is mainly attributed to the extensive and well-established rail infrastructure in the U.S. and Canada. The region has a large freight rail network that is vital for transporting goods, which necessitates high-performance lubricants to ensure efficiency and minimize maintenance costs. Moreover, the presence of renowned rail operators, such as BNSF Railway, Union Pacific, and Canadian National Railway contributes to regional market growth.

The synthetic lubricants segment led the market with the largest share in 2023. This is due to the synthetic lubricants offer superior performance in extreme temperatures and conditions, providing better stability and longer service life compared to conventional oils. They provide better protection against wear, rust, and corrosion, which is crucial for railway components exposed to harsh environments. Furthermore, continuous innovation in synthetic formulations has resulted in lubricants that can meet the specific needs of various railway applications, further driving their adoption.

The bio-based lubricants segment is anticipated to grow rapidly during the forecast period. Increasing environmental regulations and policies are pushing industries toward greener alternatives, boosting the demand for bio-based options. Bio-based lubricants are derived from renewable resources, making them more environmentally friendly and appealing to operators seeking to reduce their carbon footprint. They often have lower toxicity levels, enhancing safety for workers, reducing health risks associated with traditional petroleum-based products, and minimizing environmental impact in the event of spills.

The rail mobility segment dominated the market in 22023. This is due to the critical role of lubricants in ensuring safe, efficient, and reliable train operations. With the extensive need for lubrication in locomotives and rolling stock, high-quality lubricants are essential to reduce friction, enhance performance, and prevent wear on vital components. This necessity is compounded by stringent safety regulations that mandate optimal maintenance and operational standards, pushing operators to prioritize superior lubrication solutions. Furthermore, advancements in lubricant technology specifically tailored for rail applications contribute to greater operational efficiency, ultimately improving energy consumption and reducing costs. As the demand for rail services grows, the focus on enhancing performance and reliability through specialized lubricants solidifies the rail mobility segment’s leading position in the market.

The rail infrastructure segment is likely to register a high CAGR in the coming years. This is mainly due to the essential role of lubricants in maintaining the efficiency and safety of rail systems. Lubricants are crucial for various infrastructure components, such as tracks, switches, and signaling systems, where they help reduce friction, prevent wear, and ensure smooth operation. The maintenance of these components is vital to minimize downtime and enhance the overall reliability of rail services. Additionally, the rising investments in rail infrastructure further boosts the segment.

The freight rail segment led the market in 2023 due to its significant volume of operations and the critical need for reliable performance. Freight trains, which transport large quantities of goods over vast distances, require robust lubrication solutions to ensure efficient functioning and minimize wear on components such as wheels, bearings, and couplings. The high operational demands of freight rail, including heavy loads and varying environmental conditions, necessitate lubricants that provide enhanced protection and longevity. The increasing volume of freight traffic has further boosted this segment.

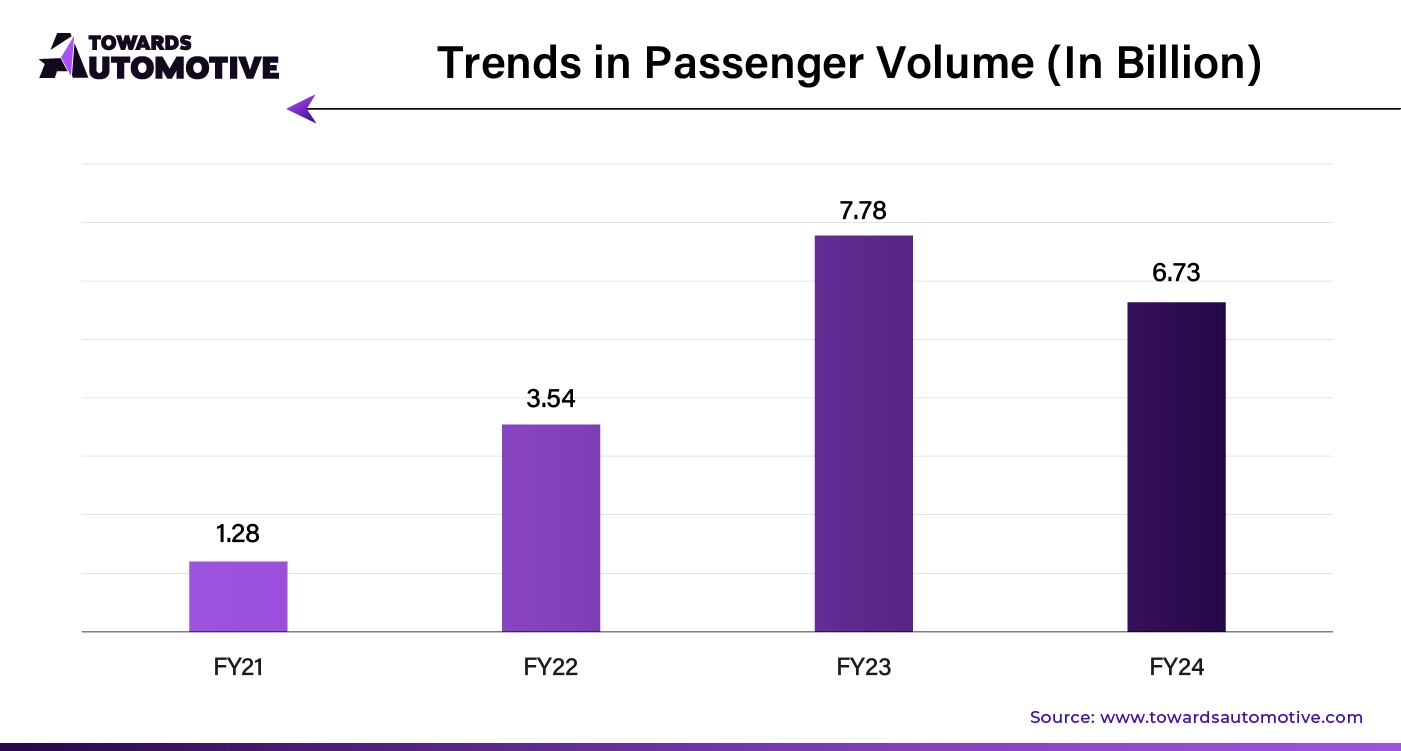

The passenger rail segment is projected to expand at a significant pace during the forecast period. With a focus on providing reliable and timely services, passenger trains require high-performance lubricants to ensure smooth operation of critical components like wheels, brakes, and motors. Effective lubrication minimizes wear and tear, reducing maintenance needs and downtime, which is crucial for maintaining service schedules. Moreover, the increasing demand for comfortable and efficient passenger travel drives the need for advanced lubricants that enhance performance and energy efficiency. As passenger rail networks expand and modernize, there is a growing focus on sustainability and compliance with environmental regulations, thus boosting the demand for bio-based lubrication solutions. Moreover, the rising passenger volume further contributes to segmental growth.

By Type

By Application

By End-user

March 2025

February 2025

February 2025

February 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us