April 2025

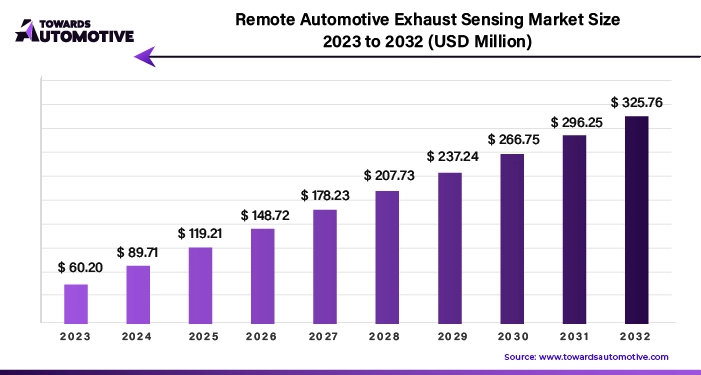

The remote automotive exhaust sensing market is set to grow from USD 80.18 million in 2025 to USD 291.26 million by 2034, with an expected CAGR of 15.41% over the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The remote automotive exhaust sensing market is poised for substantial growth, with forecasts predicting a significant increase in market size in the coming years. In recent times, there has been a growing emphasis on environmental regulations and emissions control measures, particularly in the automotive sector. This has led to an increased demand for remote automotive exhaust sensing technologies, which play a crucial role in monitoring vehicle emissions and ensuring compliance with regulatory standards.

One of the primary drivers of market growth is the tightening of environmental regulations worldwide. Governments and regulatory bodies are implementing stringent emissions standards to curb air pollution and reduce greenhouse gas emissions. This has prompted automotive manufacturers to adopt advanced exhaust sensing technologies to monitor and control vehicle emissions effectively.

Additionally, the growing awareness of environmental issues and the impact of vehicle emissions on air quality and public health have heightened the demand for remote automotive exhaust sensing solutions. Consumers are increasingly concerned about pollution levels and are seeking vehicles that are eco-friendly and comply with emission standards. This has created a strong market demand for exhaust sensing technologies that can accurately measure and analyze vehicle emissions in real-time.

Furthermore, the increasing adoption of electric and hybrid vehicles is driving the need for remote automotive exhaust sensing solutions. While electric vehicles produce zero tailpipe emissions during operation, hybrid vehicles still rely on internal combustion engines and require exhaust sensing systems to monitor emissions. As the market share of electric and hybrid vehicles continues to grow, the demand for remote automotive exhaust sensing technologies is expected to rise correspondingly.

Despite the promising growth prospects, the remote automotive exhaust sensing market faces several challenges and constraints. One of the primary challenges is the complexity of exhaust gas composition and the variability of emission sources. Vehicle emissions can vary significantly depending on factors such as engine type, fuel quality, driving conditions, and maintenance practices. Developing accurate and reliable sensing technologies that can account for these variables is a significant challenge for market players.

Moreover, the cost of implementing remote automotive exhaust sensing systems can be prohibitive for some automotive manufacturers, particularly in emerging markets. The high upfront costs associated with sensor development, integration, and calibration, as well as ongoing maintenance and support, can pose a barrier to market entry for smaller players. Additionally, the lack of standardized testing procedures and certification requirements for exhaust sensing technologies can create uncertainty and hinder market growth.

However, despite these challenges, market players are actively investing in research and development initiatives to overcome technical barriers and enhance the performance and reliability of remote automotive exhaust sensing technologies. Innovations in sensor technology, data analytics, and artificial intelligence are expected to drive advancements in the market and unlock new opportunities for growth.

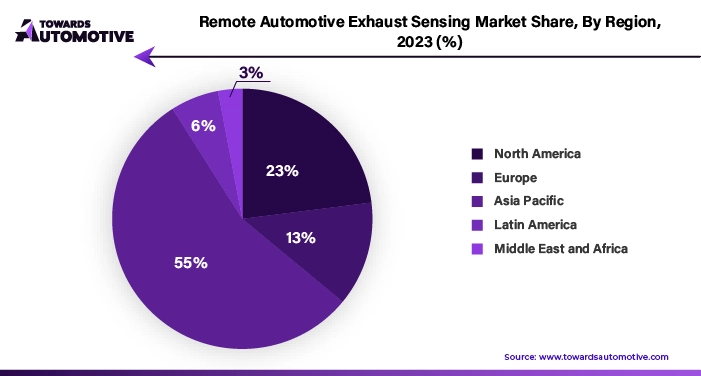

In 2022, the Asia Pacific region emerged as the dominant force in the global remote automotive exhaust sensing market, commanding a significant share of over 35%. This dominance is underscored by the region's escalating concerns regarding air quality and environmental pollution, propelling a heightened demand for advanced technologies aimed at monitoring and mitigating vehicle emissions.

One of the primary drivers of this heightened demand is the increasingly stringent emission standards and regulations being adopted by many countries across the Asia Pacific region. As governments and regulatory bodies tighten their grip on emission control measures, there arises an imperative for effective monitoring solutions to ensure compliance with these regulations. Remote sensing solutions offer a viable and efficient means of achieving this compliance, thereby experiencing a surge in adoption across various sectors.

Furthermore, the rapid pace of urbanization sweeping through the Asia Pacific region further accentuates the need for robust measures to curb vehicular emissions. With urban centers experiencing exponential population growth and expanding transportation networks, the concentration of vehicles emitting harmful pollutants has become a pressing concern. Remote exhaust sensing technology presents a compelling solution to this challenge, enabling authorities to monitor emissions levels in real-time and implement targeted interventions to mitigate pollution hotspots.

The growth of the automotive industry within the Asia Pacific region also plays a pivotal role in driving the adoption of remote automotive exhaust sensing technologies. As the automotive sector continues to flourish, fueled by factors such as rising disposable incomes, expanding middle-class population, and infrastructural developments, the sheer volume of vehicles on the roads escalates. This surge in vehicular traffic amplifies the urgency to monitor and manage exhaust emissions effectively, thereby bolstering the demand for remote sensing solutions.

In essence, the confluence of factors including stringent emission regulations, rapid urbanization, and burgeoning automotive industry growth collectively contribute to the robust expansion of the remote automotive exhaust sensing market in the Asia Pacific region. As governments, businesses, and stakeholders intensify their focus on environmental sustainability and air quality improvement initiatives, the adoption of remote sensing technologies is poised to witness continued growth, cementing its status as a pivotal component in the broader ecosystem of emission control measures.

The remote automotive exhaust sensing market can be segmented based on technology type, application, vehicle type, and geography.

By Technology Type

By Application

By Vehicle Type

By Geography

Key players in the remote automotive exhaust sensing market include

These companies are actively engaged in product development, strategic partnerships, and mergers and acquisitions to strengthen their market presence and gain a competitive edge.

These recent developments underscore the growing importance of remote automotive exhaust sensing technologies in addressing environmental challenges and achieving regulatory compliance in the automotive industry. As emissions regulations continue to evolve, market players are expected to invest further in research and development initiatives to drive innovation and address the emerging needs of automakers and consumers alike.

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us