April 2025

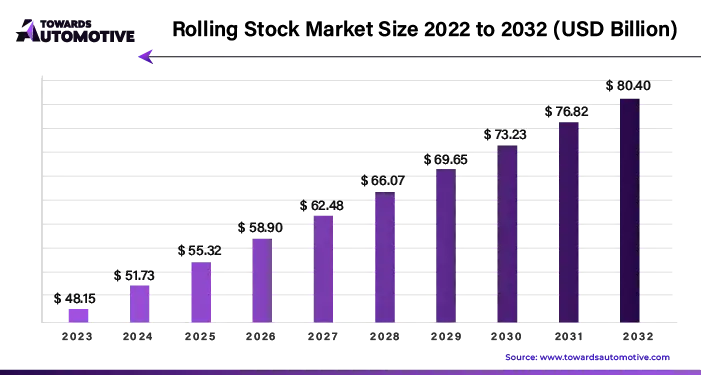

The rolling stock market is projected to reach USD 82.53 billion by 2034, growing from USD 53.11 billion in 2025, at a CAGR of 5.02% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The rolling stock market is undergoing a significant transformation driven by the urgent need to modernize existing fleets and replace aging vehicles with safer and more efficient alternatives. Many ships have reached the end of their service life, prompting the industry to seek out modern solutions that offer improved safety features, enhanced efficiency, and reduced environmental impact. This shift has opened up new opportunities for companies to bid on contracts for new trains across various routes, including popular ones like the Auto Train, California Zephyr, and Coast Starlight.

One of the key drivers of growth in the rolling stock market is the advancement of technologies such as railway remote data processing and advanced railway management systems. These innovations are revolutionizing the industry by providing real-time data insights, enabling proactive monitoring capabilities, and optimizing operations for better efficiency and performance. Railway remote data processing, in particular, allows for the continuous monitoring and analysis of railway vehicle operations, facilitating timely maintenance interventions and minimizing downtime.

The adoption of these advanced technologies comes with significant costs, which can act as a deterrent for new market entrants and smaller companies seeking to establish a presence or expand their operations in the market. Compliance with stringent safety and regulatory requirements also poses challenges for rail companies, leading to potential delays and additional expenses. Despite these obstacles, passenger preference for train travel remains strong due to the perceived safety, reliability, and time-saving benefits offered by the railway system compared to other modes of public transportation.

Investment in railway vehicles continues to be driven by passenger demand, stimulating job growth and economic development within the industry. Moving forward, ongoing innovation and investment in modern rolling stock solutions will be crucial for meeting evolving passenger expectations, enhancing safety standards, and driving sustainable growth in the global rolling stock market.

The COVID-19 pandemic has had a profound impact on the rolling stock market, causing widespread disruptions across production, supply chains, and demand. Quarantines, lockdowns, and restrictions imposed to curb the spread of the virus have led to slowdowns in manufacturing activities and delays in the delivery of critical components, affecting operations on a global scale. For instance, the Indian railway production sector experienced setbacks, resulting in delays for major projects like the Mumbai-Ahmedabad high-speed railway.

Moreover, travel restrictions and a sharp decline in passenger numbers have dealt a severe blow to the revenues of railway operators worldwide. Major transportation networks such as the London Underground have faced financial crises due to reduced ridership and lower ticket sales. However, the impact of the pandemic varied across regions, with some areas experiencing a significant drop in demand while others, like China, saw a rebound as their economies recovered at a faster pace. As administrations in certain regions eased restrictions and implemented stimulus measures, passenger demand began to recover, albeit unevenly, signaling signs of resilience in the market amidst the ongoing challenges posed by the pandemic.

The rolling stock industry is undergoing a transformation with a shift towards the adoption of electric vehicles and other energy-efficient technologies to mitigate carbon emissions and enhance overall energy efficiency. An illustrative example of this trend is the initiative undertaken by Indian Railways in October 2023, where they introduced an electric vehicle policy as part of the government's broader push towards electric mobility. This policy aims to promote the use of electric vehicles and facilitate their charging infrastructure deployment across various facilities, including major train stations, office complexes, and parking facilities. Such initiatives are crucial steps towards achieving sustainability goals and reducing the environmental footprint of the transportation sector. As these efforts continue to gain momentum, they are expected to contribute significantly to the advancement of electric mobility and the transition towards cleaner and greener transportation solutions by the target year of 2025.

The integration of digital technology and smart connectivity into rolling stock is emerging as a pivotal trend within the industry. This entails the incorporation of various features such as real-time passenger information systems, onboard Wi-Fi connectivity, predictive maintenance leveraging sensors and data analytics, and enhanced communication capabilities between trains and control centers. The overarching aim of this trend is to enhance the overall passenger experience, boost operational efficiency, ensure safety, and drive overall productivity gains. By leveraging these advanced digital capabilities, rolling stock operators can effectively meet evolving consumer expectations, optimize resource utilization, and ultimately stimulate market growth and consumption.

A prime example is the Delhi Metro in India, renowned for its role in curbing traffic congestion and reducing environmental pollution. Similarly, the Shanghai Metro boasts an extensive electric train network, significantly minimizing emissions. These instances underscore how metro systems powered by rolling stock offer a compelling solution for modern cities seeking efficient, safe, and environmentally friendly transportation solutions. Anticipated growth for the sector is estimated to surpass 3% by 2032.

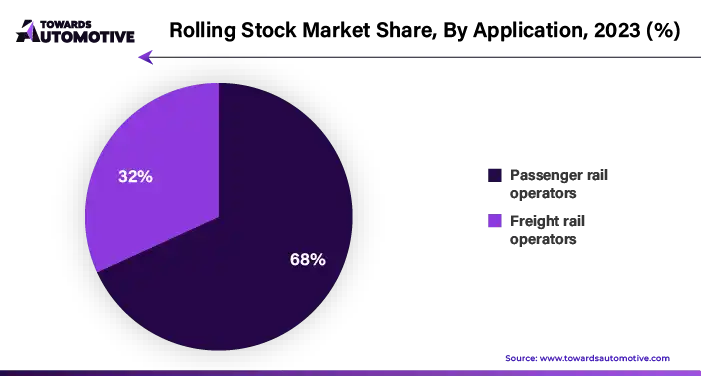

Rolling stock is increasingly favored by passenger rail operators due to its versatility, operational efficiency, and passenger-centric design. Today's rolling stock caters to travelers' preferences for comfort and quality, with safety features and luxurious interiors making trains an appealing mode of transportation. Additionally, the expansion of Eurostar's public transport services highlights how innovative products can enhance international travel, fostering efficiency and convenience for passengers.

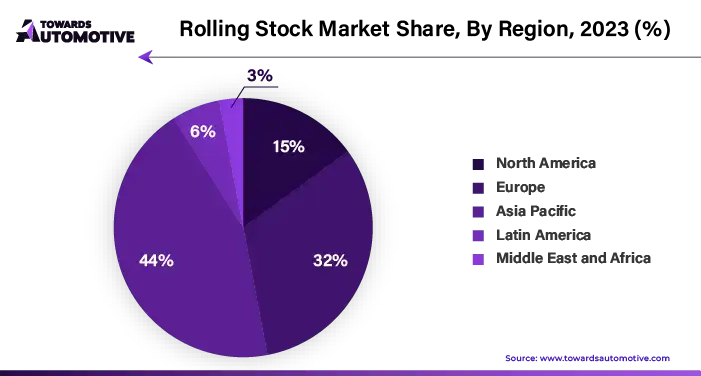

The Asia Pacific region is anticipated to exert significant dominance over the rolling stock market, accounting for over 45% of the market's revenue share in the year 2023. This prominent position is attributable to a multitude of factors, including substantial investments aimed at bolstering transportation infrastructure and addressing the complex challenges posed by urbanization across the region. As countries in Asia Pacific continue to experience rapid economic growth and urban development, the demand for efficient and reliable transportation solutions has surged.

One of the key drivers propelling the growth of the rolling stock market in the Asia Pacific region is the ongoing expansion and modernization of high-speed rail networks. Governments and transportation authorities in several countries have been investing heavily in the development of high-speed rail infrastructure, recognizing its potential to offer fast, safe, and sustainable transportation options for both passengers and freight. This expansion has led to heightened competition among train companies and operators seeking to capitalize on the burgeoning demand for high-speed rail services.

Moreover, the collaborative efforts among countries involved in the development of high-speed rail systems have contributed to the advancement of rail technology and practices across the region. Through partnerships focused on research, technology transfer, and the sharing of best practices, these countries have been able to accelerate the development and deployment of cutting-edge rail solutions. This collaborative approach has not only fostered innovation but has also enhanced the interoperability and efficiency of rail networks, further bolstering the attractiveness of rail travel for passengers and businesses alike.

The growing preference for rail travel over other modes of transportation is another factor driving the expansion of the rolling stock market in the Asia Pacific region. As travelers increasingly prioritize safety, reliability, and sustainability, rail transportation has emerged as a compelling choice. The convenience, comfort, and environmental benefits offered by rail travel have resonated with passengers, leading to a steady increase in ridership and demand for rolling stock.

Asia Pacific region's dominance in the rolling stock market underscores the region's pivotal role in shaping the future of rail transportation. With continued investments, technological advancements, and collaborative initiatives, the region is poised to remain at the forefront of the global rolling stock industry, driving innovation and sustainable development in the years to come.

Major companies in the rolling stock market are:

By Type

By Application

By Geography

April 2025

April 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us