March 2025

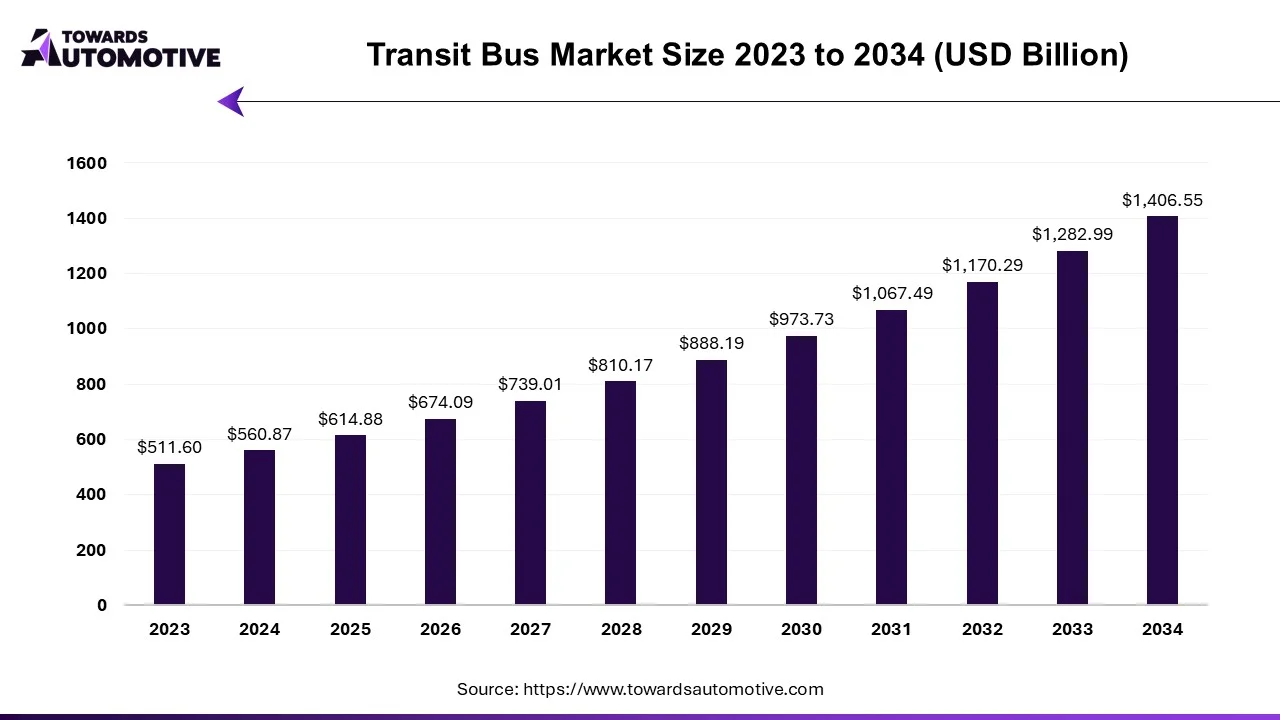

The transit bus market is forecasted to expand from USD 614.88 billion in 2025 to USD 1.406.55 billion by 2034, growing at a CAGR of 9.63% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Urbanization, characterized by the influx of people into cities, stands as the primary driving force behind the growth of the bus sector. With burgeoning urban populations and increasing traffic congestion in major cities, there arises a pressing need for efficient public transportation solutions. Public buses emerge as the preferred mode of transport for urban dwellers, offering a practical solution to mobility challenges in densely populated areas. As cities expand and urbanization continues unabated, the demand for public buses steadily rises, contributing to economic expansion and fostering technological advancements to adapt to evolving urban traffic dynamics.

The bus market, projected to reach $431.3 billion in 2022, is poised for robust growth, with a compound annual growth rate (CAGR) of 8.1% forecasted between 2023 and 2032. The surge in bus travel, particularly among tourists, serves as a catalyst for economic development. As an increasing number of individuals opt for bus travel, the demand for buses surges accordingly. For instance, according to Northern Ireland Public Transport Statistics, bus passenger numbers are anticipated to reach 60.6 million in 2022-23, reflecting a notable 19.9% increase from the previous year. This upward trend not only fuels innovation but also intensifies competition among manufacturing companies, driving advancements in technology, design, and operational efficiency within the industry.

However, the high initial cost poses a significant hurdle to business demand for public buses. Procuring modern buses, especially environmentally friendly electric or hybrid models, entails substantial investment, straining transportation budgets. Limited financial resources impede the adoption of transportation solutions, constraining the capacity of operators to expand or upgrade their fleets. The exorbitant prices deter potential buyers, resulting in the gradual phase-out of older and less efficient buses. Consequently, this curtails overall market growth and constrains the emergence of new business opportunities within the sector.

The COVID-19 pandemic has dealt a severe blow to the public bus industry, precipitating a cascade of challenges and disruptions. Government-imposed lockdowns, stringent social distancing measures, and heightened public apprehensions regarding the use of public transportation have significantly curtailed travel demand. Transportation agencies find themselves grappling with diminished revenues, curtailed services, and escalated operating costs incurred in implementing stringent safety protocols to safeguard passengers.

Manufacturers operating in the public bus sector have also borne the brunt of the pandemic-induced upheaval. Supply chain disruptions, production halts, and order backlogs have plagued manufacturing operations, exacerbating the challenges faced by transportation agencies. The confluence of these adversities, compounded by pervasive economic uncertainty, has stymied investments in transportation infrastructure and hindered initiatives aimed at modernizing public transit systems.

The adverse repercussions of the pandemic have reverberated beyond the confines of the public bus industry, casting a pall over the broader economy. With transportation networks hamstrung by operational constraints and financial exigencies, economic activity has been curtailed, impeding the pace of recovery and exacerbating socio-economic disparities.

COVID-19 pandemic has inflicted significant hardships on the public bus industry, precipitating a confluence of operational, financial, and economic challenges. The path to recovery entails concerted efforts to restore passenger confidence, fortify operational resilience, and revitalize investment in public transportation infrastructure to catalyze economic resurgence.

The proliferation of electric buses represents a significant stride toward enhancing the efficiency and sustainability of the public bus sector. With a burgeoning emphasis on environmental consciousness and concerted government initiatives aimed at promoting eco-friendly transportation alternatives, the demand for electric buses has witnessed a notable uptick. A noteworthy example of such collaboration is evidenced by the partnership forged between the United States and India in September 2023, with a shared objective of augmenting the deployment of electric buses across India. Through this collaborative endeavor, an ambitious target of introducing approximately 10,000 electric buses onto Indian roads has been set, underscoring the transformative potential of such initiatives in catalyzing market growth and fostering technological innovation.

This collaborative push toward electric buses not only augurs well for environmental sustainability but also engenders a competitive landscape within the industry. By fostering a climate conducive to technological advancement and innovation among manufacturers, this intensified competition propels the market forward, driving further enhancements in product offerings and operational efficiency. As an increasing number of cities transition toward embracing electric buses as a cornerstone of their public transportation infrastructure, the market stands poised for expansion, with substantial revenue-generation potential on the horizon.

Government interventions aimed at incentivizing public transportation adoption play a pivotal role in bolstering bus revenues and fostering market growth. Through a gamut of subsidies, incentives, and policy frameworks designed to bolster the proliferation of public transportation, governments worldwide are instrumental in creating an enabling environment conducive to the widespread adoption of public buses.

Strategic investments in infrastructure and concerted efforts to promote environmentally sustainable transport alternatives, such as electric buses, further galvanize demand, laying the groundwork for the flourishing of the public bus sector. These multifaceted government interventions not only spur the emergence of new players and the diversification of product offerings but also serve to elevate the intrinsic value proposition of the public transportation ecosystem at large.

The dominance of the diesel segment in the public bus market is expected to persist, accounting for over 65% of the market share by 2022. Diesel buses remain a preferred choice for transportation organizations worldwide, owing to their robust construction, cost-effectiveness, and operational efficiency. Moreover, the widespread availability and familiarity with diesel engines within the industry further bolster their prominence as the go-to option for bus fleets.

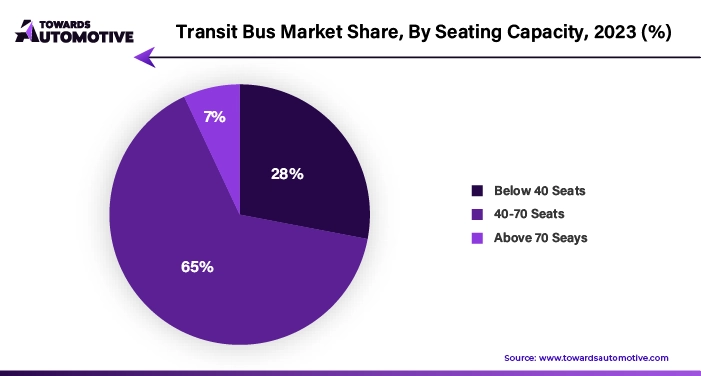

In terms of seating capacity, buses accommodating 40 to 70 passengers are poised to command a significant share of the market, constituting approximately 55% of the public bus segment by 2022. Positioned to meet medium-level transportation needs, these buses strike a balance between passenger capacity and operational flexibility, making them a popular choice for diverse transit applications.

A pertinent illustration of this trend is evidenced by the proactive initiatives undertaken by the Transport Minister of the Indian State of Karnataka in October 2023. Through the procurement of 40 non-air-conditioned buses and hundreds of additional buses equipped with point-to-point services, the Karnataka Road Transport Corporation has embarked on a strategic endeavor to bolster its public transportation infrastructure.

This initiative forms an integral component of the Corporation's overarching strategy to introduce a total of 798 new buses by 2023, thereby augmenting the accessibility and efficiency of public transit services across the state. Such concerted efforts underscore the pivotal role of medium-capacity buses in meeting evolving transportation demands and fostering enhanced connectivity within urban and peri-urban areas.

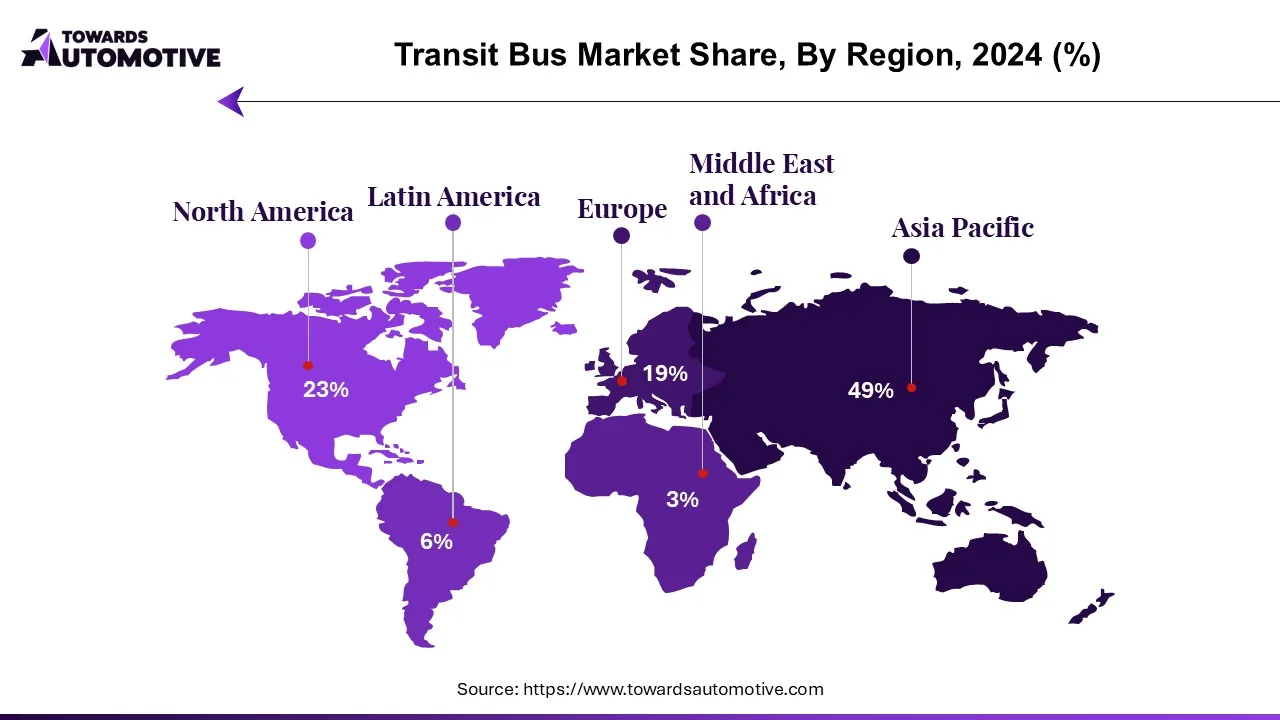

The Asia Pacific public bus market is poised to dominate with over 65% of the revenue share in 2022, propelled by a concerted emphasis on environmental sustainability and pollution mitigation endeavors. Against the backdrop of escalating environmental awareness and concerted efforts to curb pollution, there has been a notable surge in demand for electric and hybrid buses across the region. Government incentives and policy frameworks further amplify this trend, as they incentivize the adoption of clean technologies within the public transportation sector.

With a steadfast commitment to fostering sustainable transportation solutions, transportation organizations and operators across the Asia Pacific region are increasingly pivoting toward environmentally friendly vehicles. Notably, China has emerged as a trailblazer in this regard, spearheading initiatives aimed at expanding the adoption of electric and hybrid buses. By fostering a conducive regulatory environment and offering robust financial incentives, the Chinese government has catalyzed significant investments in clean transportation technologies, thereby propelling the growth trajectory of the public transportation market.

This paradigm shift toward eco-friendly public transportation solutions not only underscores the region's commitment to mitigating environmental degradation but also augurs well for the long-term sustainability and resilience of its transportation infrastructure. By embracing clean technologies and incentivizing their adoption, the Asia Pacific region is not only fostering a greener and more sustainable mode of transit but also laying the groundwork for enhanced societal well-being and economic prosperity in the years to come.

The major companies operating in the transit bus industry are:

AB Volvo and NFI Group are pivotal players in the public bus market, leveraging a diverse array of unconventional growth strategies to solidify their market positions. Through strategic mergers, acquisitions, partnerships, and collaborations, these industry behemoths effectively navigate the competitive landscape and capitalize on emerging opportunities within the sector. By forging synergistic alliances with governments and regulatory bodies, they not only secure lucrative contracts but also ensure compliance with evolving industry regulations and standards.

A key focal point of their growth strategy lies in the development and deployment of electric buses, underscoring their commitment to environmental sustainability and technological innovation. Through substantial investments in research and development, AB Volvo and NFI Group spearhead the advancement of electric vehicle technologies, driving the transition toward greener and more eco-friendly public transportation solutions. Moreover, strategic partnerships aimed at establishing robust charging infrastructure further bolster their efforts to accelerate the adoption of electric buses, ensuring seamless integration and compatibility with environmentally friendly technologies.

By proactively addressing the burgeoning demand for sustainable transportation options and aligning their business strategies with evolving market trends, AB Volvo and NFI Group reinforce their positions as industry leaders while driving positive transformation within the public bus market. Through their multifaceted approach to growth and innovation, these companies not only anticipate and adapt to changing consumer preferences but also actively shape the future trajectory of the transportation industry.

By Fuel Type

By Application

By Seating Capacity

By Geography

March 2025

March 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us