March 2025

Senior Research Analyst

Reviewed By

The global vehicle tracking systems market size is calculated at USD 28.13 billion in 2024 and is expected to be worth USD 93.39 billion by 2034, expanding at a CAGR of 14.15% from 2024 to 2034.

![]()

The vehicle tracking systems market is experiencing rapid growth, driven by advancements in technology, increasing demand for fleet management solutions, and a heightened focus on safety and security. Vehicle tracking systems utilize GPS, RFID, and other technologies to monitor the real-time location and movement of vehicles, providing valuable insights for businesses and individuals alike. As companies seek to optimize their operations and improve efficiency, the demand for tracking solutions has surged, particularly in industries such as logistics, transportation, and delivery services.

Additionally, the rising concern for vehicle theft and the need for improved fleet visibility have prompted many organizations to adopt tracking systems as a proactive measure. These systems not only enhance operational efficiency but also enable better resource management, route optimization, and improved customer service. Moreover, the integration of advanced features such as geofencing, analytics, and mobile access is further enhancing the capabilities of vehicle tracking systems.

As urbanization increases and traffic congestion becomes more prevalent, the need for effective vehicle management solutions is expected to rise, positioning the vehicle tracking systems market for continued expansion. Overall, the combination of technological advancements, evolving consumer demands, and a growing emphasis on safety is driving significant growth in the vehicle tracking systems market.

Artificial Intelligence (AI) plays a transformative role in the vehicle tracking systems market, enhancing the capabilities and effectiveness of these systems. AI algorithms analyze vast amounts of data collected from vehicle tracking systems to identify patterns and predict potential issues before they occur. This includes forecasting maintenance needs, predicting vehicle breakdowns, and optimizing route planning based on historical data and real-time conditions.

AI-powered systems can analyze traffic conditions, weather patterns, and historical data to optimize routes in real time. This leads to more efficient route planning, reduced travel times, and fuel savings. AI-driven route optimization also allows for dynamic adjustments based on changing conditions, further enhancing the accuracy and effectiveness of vehicle tracking systems.

AI enhances real-time monitoring by detecting anomalies and sending instant alerts for various conditions, such as unauthorized vehicle use, abnormal driving behavior, or deviations from planned routes. This improves security and allows fleet managers to respond quickly to potential issues.

AI systems can analyze driver behavior by assessing metrics such as speed, acceleration, and braking patterns. This data helps identify unsafe driving practices and provides insights for training and improving driver performance. Enhanced driver behavior monitoring contributes to safer driving and reduces the risk of accidents.

AI automates routine tasks, such as generating reports, managing schedules, and analyzing data. This reduces manual effort, minimizes errors, and allows fleet managers to focus on strategic decision-making.

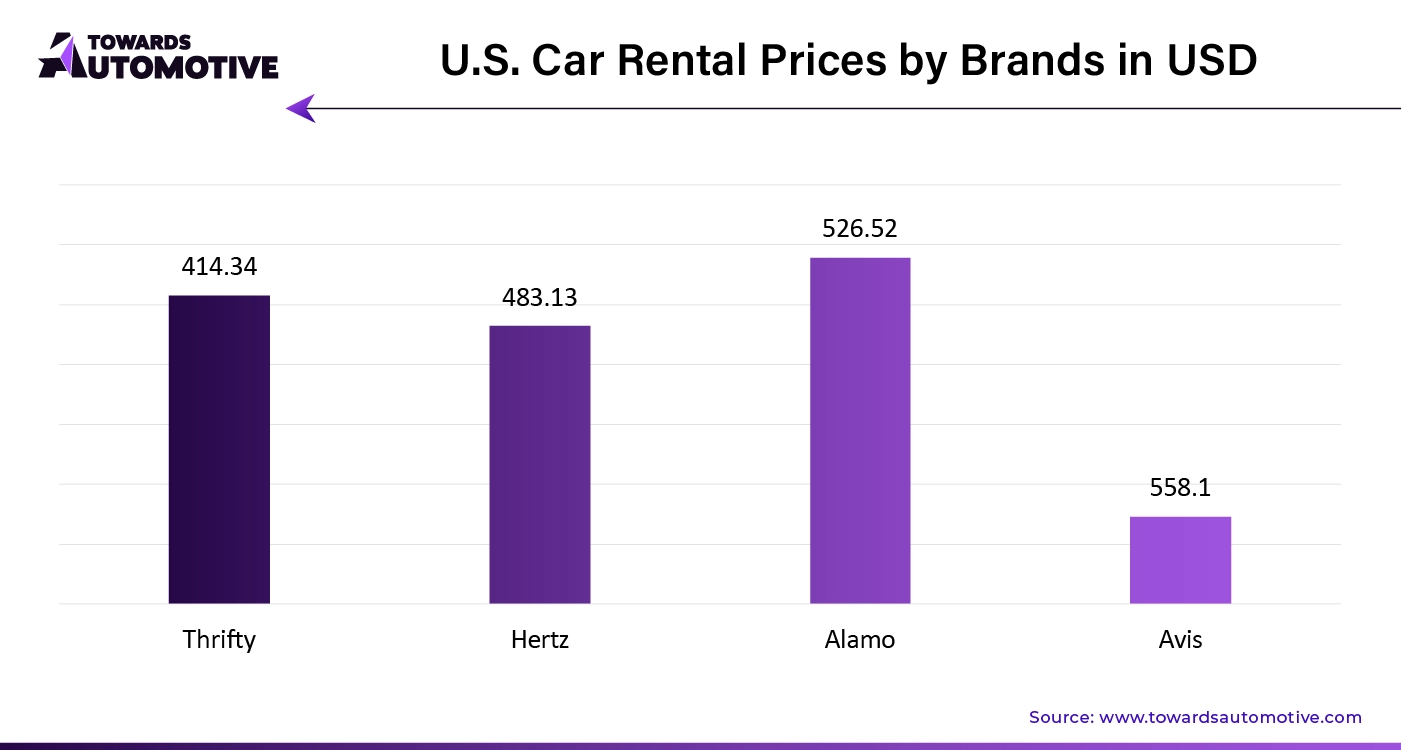

The rising demand for car rental and leasing activities is significantly driving the growth of the vehicle tracking systems market. As the car rental and leasing sectors expand to meet increasing consumer preferences for flexible mobility solutions, the need for effective fleet management and tracking becomes more critical. Vehicle tracking systems offer car rental and leasing companies enhanced visibility over their fleets, enabling real-time monitoring of vehicle locations, usage patterns, and operational efficiency. This capability is essential for managing large numbers of vehicles, optimizing routes, and ensuring timely maintenance. Additionally, tracking systems help mitigate risks associated with vehicle theft, unauthorized use, and accidents by providing robust security features and alerts. The growing popularity of car sharing and subscription services further amplifies the demand for advanced tracking solutions to manage and streamline these increasingly complex fleets. By integrating vehicle tracking technology, rental and leasing companies can enhance customer satisfaction through improved service delivery, accurate billing, and efficient vehicle allocation. Overall, the rise in car rental and leasing activities underscores the need for sophisticated vehicle tracking systems to support operational efficiency, security, and customer service, driving substantial growth in the market.

The vehicle tracking systems market faces several restraints that could impact its growth. High initial costs associated with advanced tracking technology can be a barrier for small to medium-sized enterprises. Privacy concerns related to data security and the potential misuse of tracking information also pose challenges. Additionally, the integration of tracking systems with existing infrastructure and technology can be complex and costly. These factors may hinder broader adoption and slowdown market expansion.

The expansion of fleet management capabilities is creating significant opportunities in the vehicle tracking systems market. As businesses increasingly seek to optimize their operations and enhance efficiency, advanced fleet management features are becoming essential. Modern vehicle tracking systems now offer comprehensive capabilities beyond basic location tracking, including real-time monitoring of vehicle performance, route optimization, and predictive maintenance. These advanced features enable fleet operators to manage their assets more effectively, reduce operational costs, and improve service delivery. Enhanced capabilities such as automated scheduling, driver behavior analysis, and integrated reporting tools are transforming how fleets are managed, providing deeper insights and greater control. This evolution in fleet management not only helps in streamlining operations but also contributes to improved safety, reduced downtime, and increased customer satisfaction. As a result, the growing demand for sophisticated fleet management solutions is driving innovation and growth in the vehicle tracking systems market, presenting new opportunities for both technology providers and end-users seeking to enhance their fleet operations.

The passenger vehicles segment held the largest share of the market. The increasing adoption of passenger vehicles is a significant driver of growth in the vehicle tracking systems market. As vehicle ownership rises globally, particularly in urban areas, there is growing demand for real-time monitoring solutions to enhance safety, security, and convenience. Vehicle tracking systems provide features such as GPS navigation, real-time location tracking, and theft prevention, which are increasingly sought after by both individual vehicle owners and fleet operators. Additionally, as ridesharing services and rental car businesses expand, they rely heavily on tracking technology to monitor vehicle usage, ensure safety, and optimize operational efficiency. The integration of vehicle tracking systems in passenger cars also allows for better traffic management and road safety, addressing concerns of congestion and accidents in densely populated areas. Moreover, technological advancements, including IoT and connected car systems, have made tracking systems more accessible and appealing to everyday consumers. This growing demand for enhanced security and efficiency in passenger vehicles is fueling the expansion of the vehicle tracking systems market globally.

The active segment dominated the industry. The active segment plays a crucial role in driving the growth of the vehicle tracking systems market. Active tracking systems provide real-time data transmission, allowing users to monitor vehicle location, speed, and other critical metrics instantly. This immediate access to information is particularly valuable for fleet management, where operational efficiency, driver safety, and route optimization are paramount. The active segment's ability to deliver live updates offers significant advantages over passive tracking, making it a preferred choice for businesses in logistics, transportation, and rental services. Moreover, the rise of connected vehicles and advancements in telematics have further enhanced the functionality of active vehicle tracking systems, enabling more precise tracking and predictive maintenance. As industries increasingly prioritize data-driven decision-making and operational efficiency, the demand for active tracking solutions continues to grow. These systems also support enhanced security features such as geofencing and instant alerts, providing a robust solution for theft prevention and driver safety. The growing preference for real-time data monitoring is driving the adoption of active vehicle tracking systems across various sectors, contributing to the overall market expansion.

The software segment led the market. The software segment is a major driver of growth in the vehicle tracking systems market, as it provides the essential tools for managing and analyzing the vast amounts of data generated by tracking devices. Advanced vehicle tracking software enables fleet managers and individual users to monitor real-time vehicle location, optimize routes, track driver behavior, and ensure timely maintenance. With features such as geofencing, automated alerts, and predictive analytics, these software solutions enhance efficiency, security, and safety across various industries, including logistics, transportation, and rental services. The increasing integration of cloud-based platforms and IoT technologies in vehicle tracking software allows for seamless data sharing and remote access, enabling businesses to manage fleets from anywhere. Additionally, the rise of data analytics and AI-powered software has further expanded the capabilities of tracking systems, providing deeper insights into operational performance and enabling proactive decision-making. As companies seek to improve operational efficiency and reduce costs, the demand for sophisticated software solutions in vehicle tracking is rising, making the software segment a key contributor to the overall growth of the market.

The GPS/Satellite segment held the dominant share of the market. The GPS/satellite segment is a critical driver of growth in the vehicle tracking systems market, providing the foundation for real-time tracking and location-based services. GPS technology enables precise vehicle positioning and navigation, making it indispensable for fleet management, logistics, and transportation industries. Through satellite connectivity, GPS systems allow businesses to monitor vehicle movements in real-time, optimize routes, and enhance operational efficiency by reducing fuel consumption and travel times. The global coverage offered by satellite-based tracking is particularly beneficial for long-distance transportation and cross-border logistics, ensuring vehicles remain connected even in remote areas.

Additionally, the GPS/satellite segment enhances security by enabling features such as geofencing and theft prevention, providing real-time alerts in case of unauthorized vehicle movements. The rise of connected vehicles, smart city initiatives, and advancements in satellite technology have further improved the accuracy and reliability of GPS systems. As businesses increasingly rely on data-driven solutions to streamline operations and improve fleet performance, the demand for GPS-based vehicle tracking continues to grow, positioning this segment as a vital contributor to the expansion of the vehicle tracking systems market.

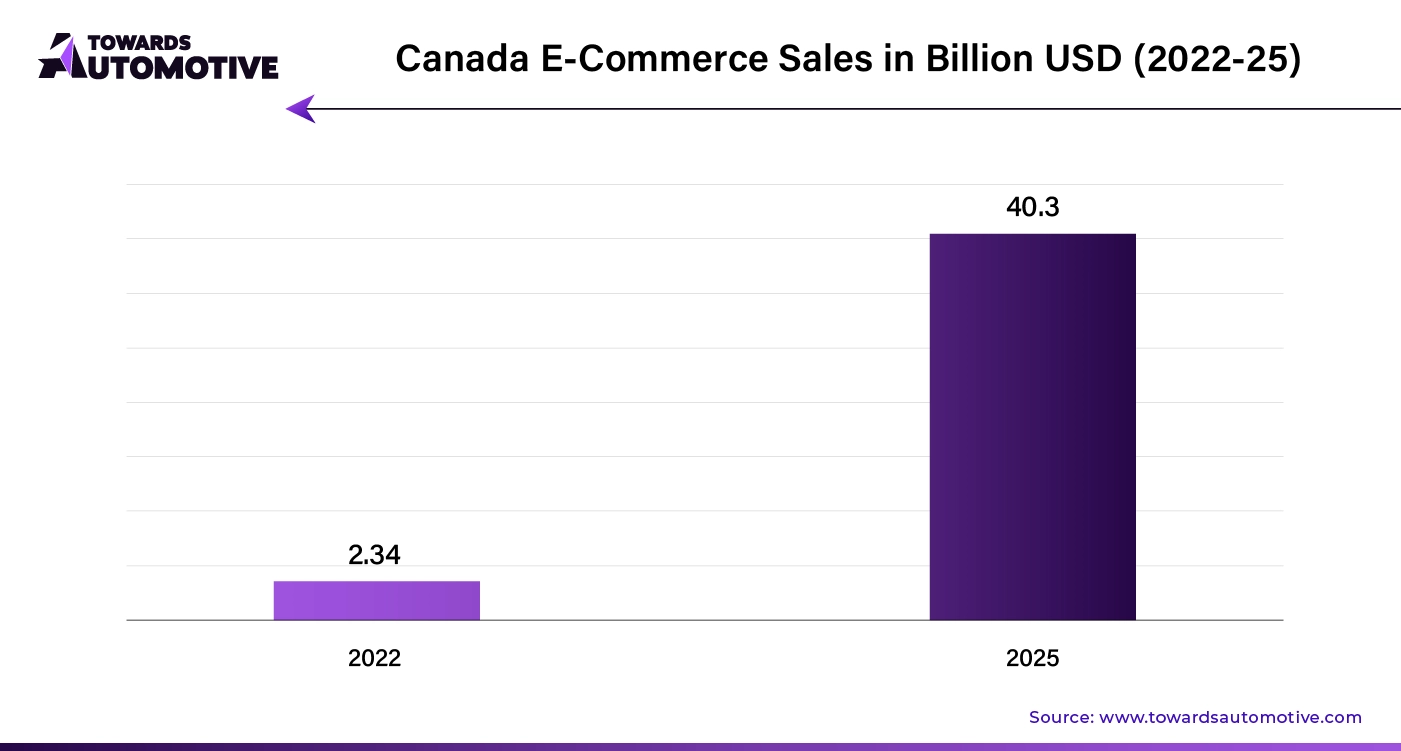

The transportation and logistics segment led the market with highest share. The transportation and logistics segment are a major driver of growth in the vehicle tracking systems market, as it relies heavily on real-time monitoring and fleet management solutions to optimize operations. With the rapid expansion of e-commerce and global supply chains, logistics companies are under increasing pressure to ensure timely deliveries, reduce operational costs, and enhance overall efficiency. Vehicle tracking systems provide these companies with real-time data on vehicle location, route optimization, and driver behavior, enabling more efficient fleet management and reducing fuel consumption.

Additionally, vehicle tracking systems enhance security by providing features such as geofencing and instant alerts, helping to prevent theft and unauthorized vehicle use. In a highly competitive and fast-paced market, the ability to monitor and manage large fleets effectively is crucial for maintaining operational efficiency and customer satisfaction. As a result, transportation and logistics companies are increasingly adopting vehicle tracking technologies to streamline their operations, meet growing delivery demands, and stay ahead in the competitive landscape. This strong demand is fueling the growth of the vehicle tracking systems market across the globe.

North America dominated the vehicle tracking systems market. Regulatory compliance, growing e-commerce, and rising fuel prices are key drivers of growth in the vehicle tracking systems market in North America. Stricter regulations on fleet management, driver safety, and vehicle maintenance require businesses to adopt tracking systems to ensure compliance. These systems provide real-time data, helping companies monitor driver hours, vehicle conditions, and route adherence, thereby reducing risks of penalties and improving safety. Simultaneously, the surge in e-commerce has created a pressing need for efficient last-mile delivery solutions. Vehicle tracking systems enable businesses to optimize routes, manage large fleets, and provide real-time updates, enhancing operational efficiency and customer satisfaction. Additionally, fluctuating fuel prices are prompting companies to seek ways to reduce fuel consumption. Vehicle tracking systems assist by optimizing routes, monitoring fuel usage, and identifying cost-saving opportunities. These combined factors are pushing the adoption of advanced vehicle tracking technologies in North America, positioning the market for sustained growth as companies prioritize regulatory compliance, cost efficiency, and enhanced fleet management in a competitive and evolving landscape.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The rollout of 5G, rising urbanization, and the growing logistics and transportation sector are key factors driving the growth of the vehicle tracking systems market in Asia Pacific. With the advent of 5G technology, vehicle tracking systems can offer faster, more reliable data transmission, enhancing real-time tracking, route optimization, and predictive maintenance. This improved connectivity is crucial as cities across the region experience rapid urbanization, leading to increased traffic and the need for smarter transportation solutions. Governments are investing heavily in smart city projects, where vehicle tracking plays a vital role in managing traffic and improving public transportation efficiency. Additionally, the booming logistics and transportation sector, fueled by the e-commerce surge, is driving demand for advanced tracking systems to optimize fleet management, reduce delivery times, and improve customer satisfaction. These combined factors are creating a dynamic environment for the vehicle tracking systems market, positioning it for substantial growth as the region continues to modernize its transportation infrastructure and leverage cutting-edge technology.

By Component

By Vehicle Type

By Technology

By Type

By End Use

By Region

March 2025

March 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us