April 2025

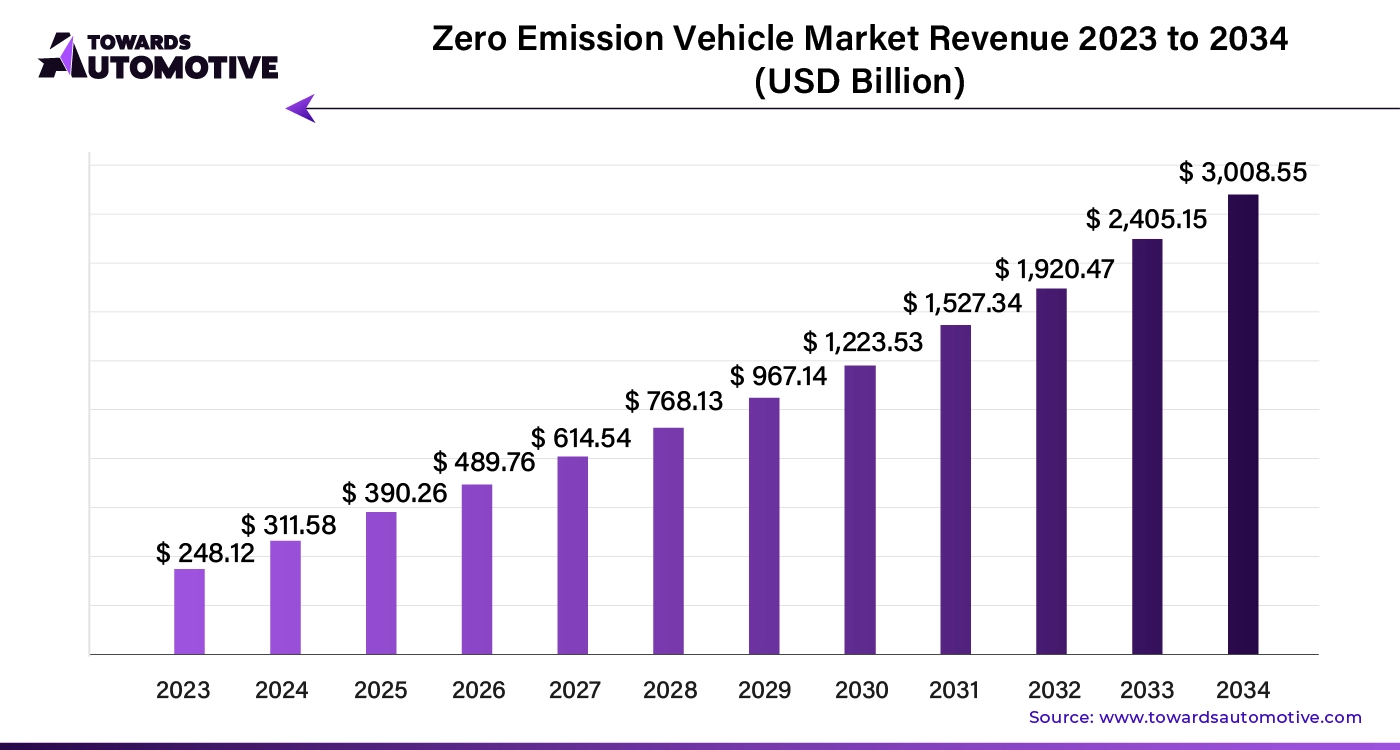

The global zero emission vehicle market was valued at US$ 248.12 billion in 2023 and is estimated to be valued at US$ 3,008.55 billion in 2034, expanding at a CAGR of 25.4% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

A zero emission vehicle (ZEV) is a type of vehicle that does not produce any harmful emissions from its tailpipe. Unlike traditional vehicles that emit pollutants such as carbon dioxide (COâ‚‚), nitrogen oxides (NOx), and particulate matter, ZEVs do not emit these substances during operation. These vehicles help reduce air pollution and control climate change. The ZEV market witnessed significant growth in the past few years and is expected to continue its rapid growth in the coming future due to ongoing advancements in technology, supportive government policies, and increasing consumer demand.

Government policies and regulations are likely to propel the market during the forecast period. Many governments offer financial incentives, such as tax credits, rebates, and grants, to reduce the purchase cost of ZEVs. These incentives make ZEVs more attractive to consumers and fleets. Moreover, stricter emissions standards and regulations are pushing manufacturers to develop cleaner vehicles. Various countries are setting ambitious targets to reduce greenhouse gas emissions and phase out internal combustion engines (ICEs). Some regions have implemented regulations that require a certain percentage of new vehicle sales to be zero-emission, driving manufacturers to prioritize ZEV production.

For instance,

Consumer Preferences and Awareness

Growing concern about climate change and air pollution is encouraging consumers to seek out eco-friendly transportation options. The desire to reduce personal carbon footprints is leading more people to choose ZEVs. Major automakers are committing to electrify their fleets and invest in ZEV technology. This includes both developing new models and transitioning existing models to electric power.

Moreover, the increasing awareness about the benefits and the availability of cleaner transportation options are driving the sales of electric vehicles. ZEVs are generally more efficient than internal combustion engine (ICE) vehicles. Electric motors convert a higher percentage of energy into movement compared to ICEs. By eliminating tailpipe emissions, ZEVs contribute to improved air quality and reduced greenhouse gas emissions. They can reduce dependence on fossil fuels and promote the use of renewable energy sources.

High Cost and Charging Infrastructure

The initial purchase price of ZEVs is higher than traditional vehicles. This may deters potential buyers from adopting ZEVs. Moreover, inadequate charging infrastructure can limit the practicality of BEVs, particularly in rural or less-developed areas. For FCVs, the lack of widespread hydrogen refueling stations is a significant barrier to adoption. The production of batteries requires materials like lithium, cobalt, and nickel, which can be subject to supply chain constraints and price volatility, thus hindering the market.

Technological Advancements

Improvements in battery technology, such as increased energy density, reduced costs, faster charging times, and longer lifespans, make electric vehicles (EVs) more practical and appealing. Advances in hydrogen production and fuel cell technology are also making hydrogen fuel cell vehicles more viable and attractive. Moreover, the expansion of charging networks, including fast-charging and ultra-fast charging stations, reduces range anxiety and improves the convenience of owning BEVs. Companies and organizations are increasingly committing to electrify their fleets as part of their sustainability goals. This bulk purchasing drives demand and encourages manufacturers to produce more ZEVs.

The passenger cars segment dominated the market with the largest market share in 2023. This is due to the increasing demand for personal transportation. Passenger cars are primarily used for personal transportation, and consumers are increasingly seeking eco-friendly options for their daily commutes and travel. However, ZEVs fit well with this demand for cleaner and more sustainable personal transportation.

The commercial vehicle segment is expected to expand at the fastest growth rate in the coming years due to several factors that make it a promising area for ZEV adoption. Commercial vehicles, such as trucks and buses, often operate on a high-mileage basis. The cost savings from reduced fuel consumption and lower maintenance needs of ZEVs can be substantial for fleet operators. BEVs and hydrogen fuel cell vehicles (FCVs) offer lower energy and maintenance costs compared to diesel engines.

The mid-priced segment held a major share of the market in 2023. This is due to the mid-priced ZEVs offer a balance between cost and features, making them more accessible to a wider consumers compared to high-end or luxury models. As prices for ZEVs have been falling, mid-priced models provide a compelling option for those looking to adopt zero-emission technology without the high cost associated with premium models. Government incentives and subsidies often make mid-priced ZEVs more affordable, bringing them closer to the average consumer’s budget. These financial supports help reduce the upfront cost of mid-priced ZEVs, making them an attractive choice for consumers.

The battery electric vehicle (BEV) led the market in 2023 and is likely to continue its dominance throughout the forecast period. This is mainly due to BEVs have a more mature and well-developed technology compared to other zero-emission options, like hydrogen fuel cell vehicles (FCVs). The technology behind BEVs, including electric drivetrains and battery systems, has been refined over the years, leading to improved performance, reliability, and efficiency. Additionally, BEVs were among the first zero-emission vehicle types to gain widespread attention and market adoption, giving them a head start in technology development and market presence.

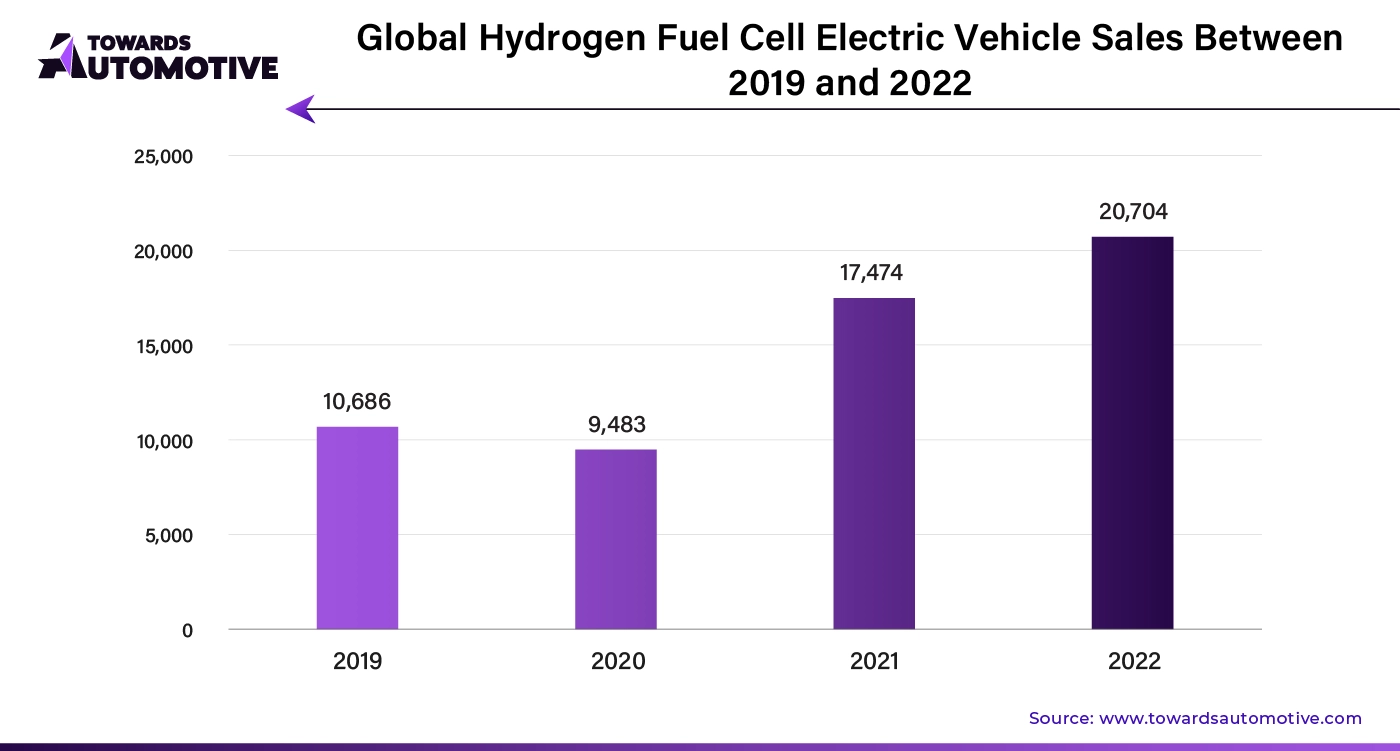

The fuel cell electric vehicle (FCEV) segment is anticipated to grow at the highest CAGR in the coming years. FCEVs typically offer longer driving ranges compared to BEVs. This is due to the higher energy density of hydrogen fuel compared to current battery technology. This makes FCEVs attractive for applications requiring long-distance travel without frequent refueling. The rising demand for FCEV is expected to contribute to segmental growth.

The rear wheel drive segment dominated the market in 2023 owing to its popularity among performance-oriented vehicles. Rear-wheel drive vehicles are known for their dynamic handling and driving experience, especially in sport cars and luxury vehicles. They offer better weight distribution, which can enhance acceleration and cornering performance. RWD vehicles often offer better performance and handling characteristics compared to front-wheel drive (FWD) or all-wheel drive (AWD) vehicles. This is particularly appealing in the electric vehicles (EVs), where high performance is a significant selling point.

For electric vehicles, having the drive wheels at the rear can simplify the design of the vehicle. The absence of a traditional internal combustion engine in the front allows for a more flexible and spacious cabin layout, and the rear placement of the motor can lead to better weight distribution. Many high-end, performance-focused EVs have been developed with rear-wheel drive configurations.

The more than 125 MPH segment is projected to expand at a significant pace during the forecast period. This is mainly due to the increasing demand for high-performance electric vehicles. Many consumers and enthusiasts expect new EVs to deliver performance comparable to or exceeding that of high-end internal combustion engine vehicles. Achieving speeds over 125 MPH is often associated with high performance, which appeals to these buyers. Additionally, high-speed capabilities are often associated with luxury and prestige.

North America dominated the market in 2023, accounting for the largest market share. This is due to the presence of major automakers in the region, such as Tesla, Rivian, and Lucid Motors. Furthermore, both federal and state governments in the U.S. have implemented various incentives to promote EV adoption. Programs such as tax credits for EV purchases and rebates for home charging installations have made zero-emission vehicles more attractive to consumers. Additionally, policies like California’s stricter emissions standards have pushed other states to follow suit.

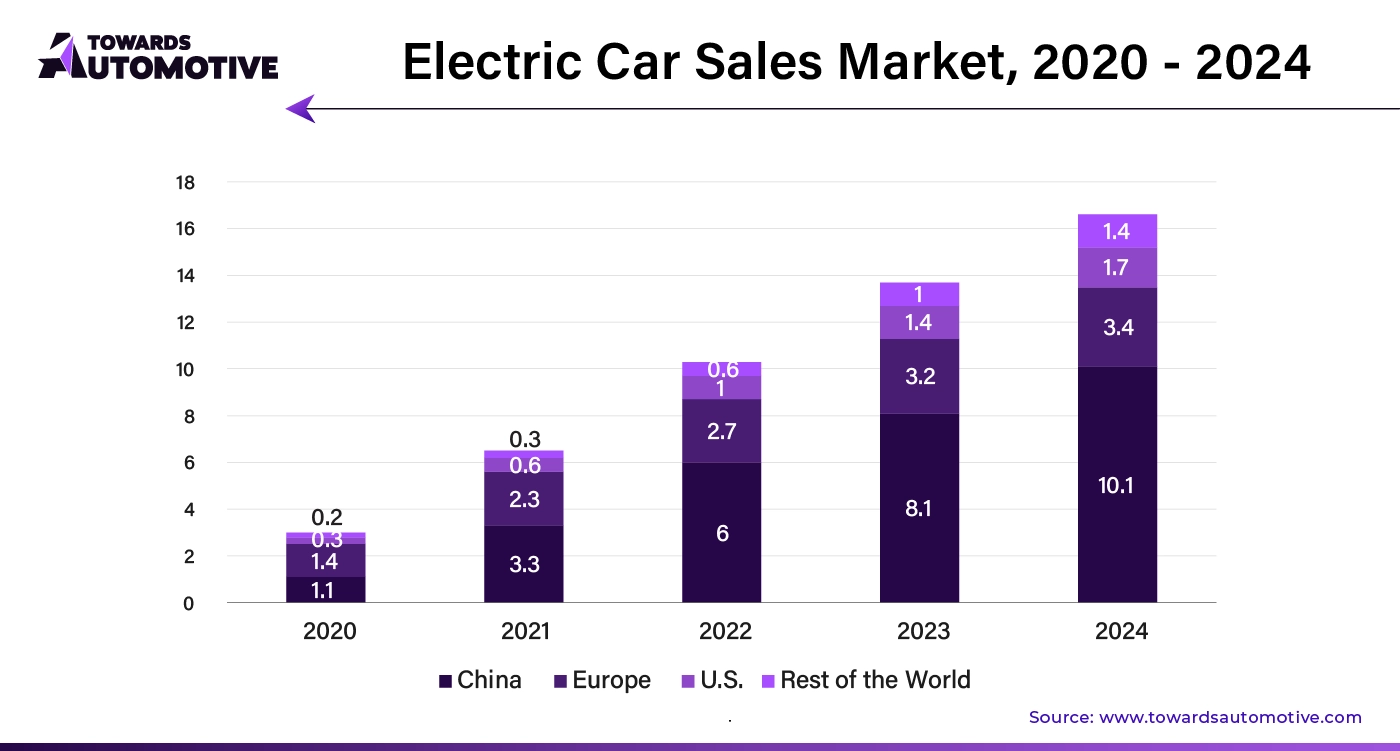

The market in Asia Pacific is anticipated to expand rapidly in the coming future. China is the largest producer of electric vehicles globally. Many countries in Asia Pacific, including South Korea, China, India, and Japan, have introduced supportive policies to encourage the adoption of zero-emission vehicles. These include purchase incentives, tax breaks, and support for charging infrastructure development

For instance,

By Vehicle Class

By Price

By Vehicle Type

By Vehicle Drive Type

By Speed

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us