March 2025

The global Agricultural Tractors Market is projected to grow steadily from 2023 to 2034, driven by increasing mechanization in farming, rising demand for high-efficiency agricultural equipment, and government initiatives supporting modern farming techniques.

The agricultural tractors market is an integral sector of the automotive industry. This industry deals in manufacturing and distribution of tractors for agricultural operations. These tractors come in different engine options consisting of less than 40 HP, 41-100 HP, more than 100 HP and others. Some of these tractors are equipped with 2WD while some others are integrated with 4WD systems. It is available in various propulsion comprising of electric and ICE. The growing development in the agricultural sector has contributed to the industrial expansion. This market is expected to rise significantly with the growth of the agricultural sector in different parts of the world.

Unlock Infinite Advantages: Subscribe to Annual Membership

In August 2023, Mr. Vikram Wagh, CEO of Farm Division at Mahindra & Mahindra Ltd announced that, “The OJA tractor range introduces a paradigm shift in Indian agriculture. With 4WD capabilities as standard, pioneering automation controls amplify precision and performance across the range. Reducing operator effort and elevating farm productivity enables us to further embrace fast growing segments like horticulture and grape farming to redefine mechanized farming. Featuring three advanced technology packs – PROJA, MYOJA, and ROBOJA – we proudly present OJA as India's global innovation. OJA will be exclusively made in Zaheerabad, our youngest tractor manufacturing facility. The range will be available for customers in India starting October."

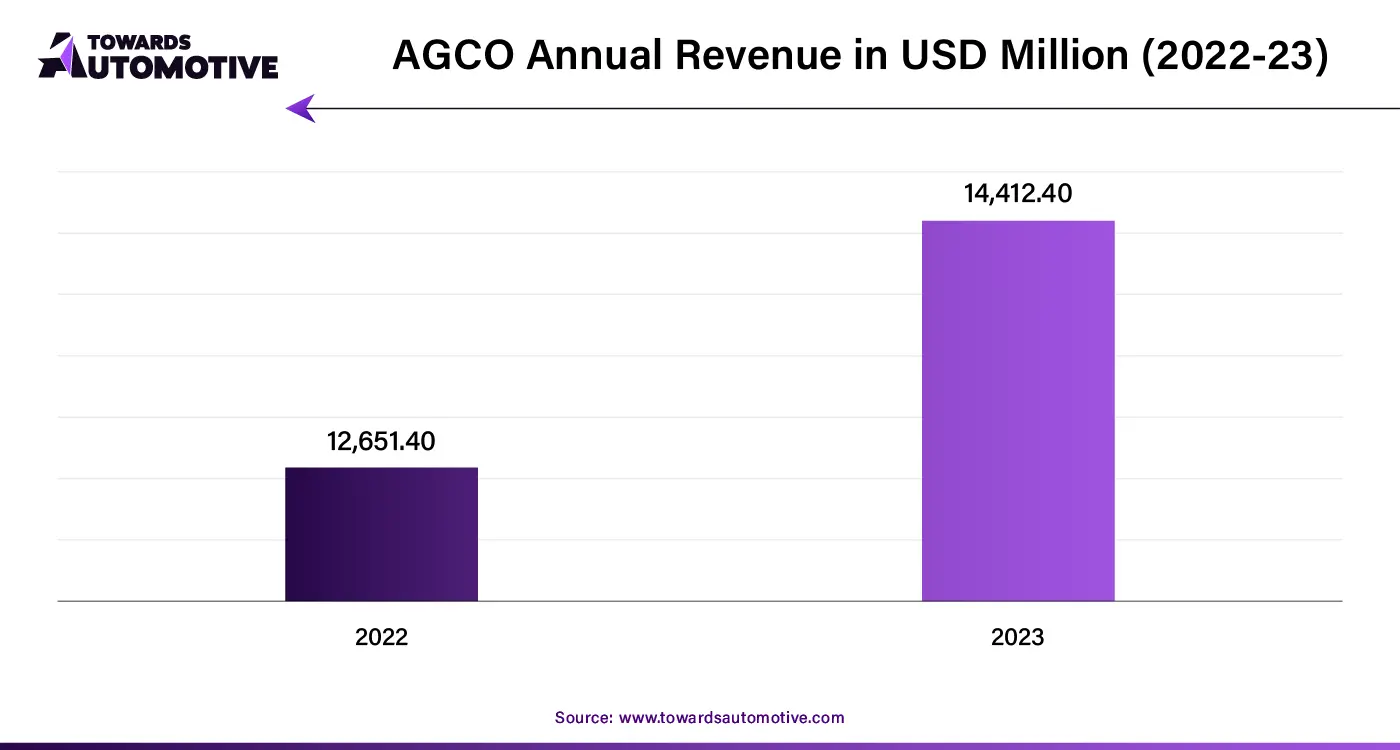

The agricultural tractors market is a developing industry with the presence of various dominant players. Some of the prominent companies ruling this industry comprises of AGCO Corporation; CLAAS KGaA mbH; CNH Industrial N.V.; Deere & Company; Escorts Limited; KUBOTA Corporation and some others. These market players are constantly engaged in developing agricultural tractors and adopting several strategies to sustain their dominant position in this industry.

By Engine Power

By Driveline

By Propulsion

By Region

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us