February 2025

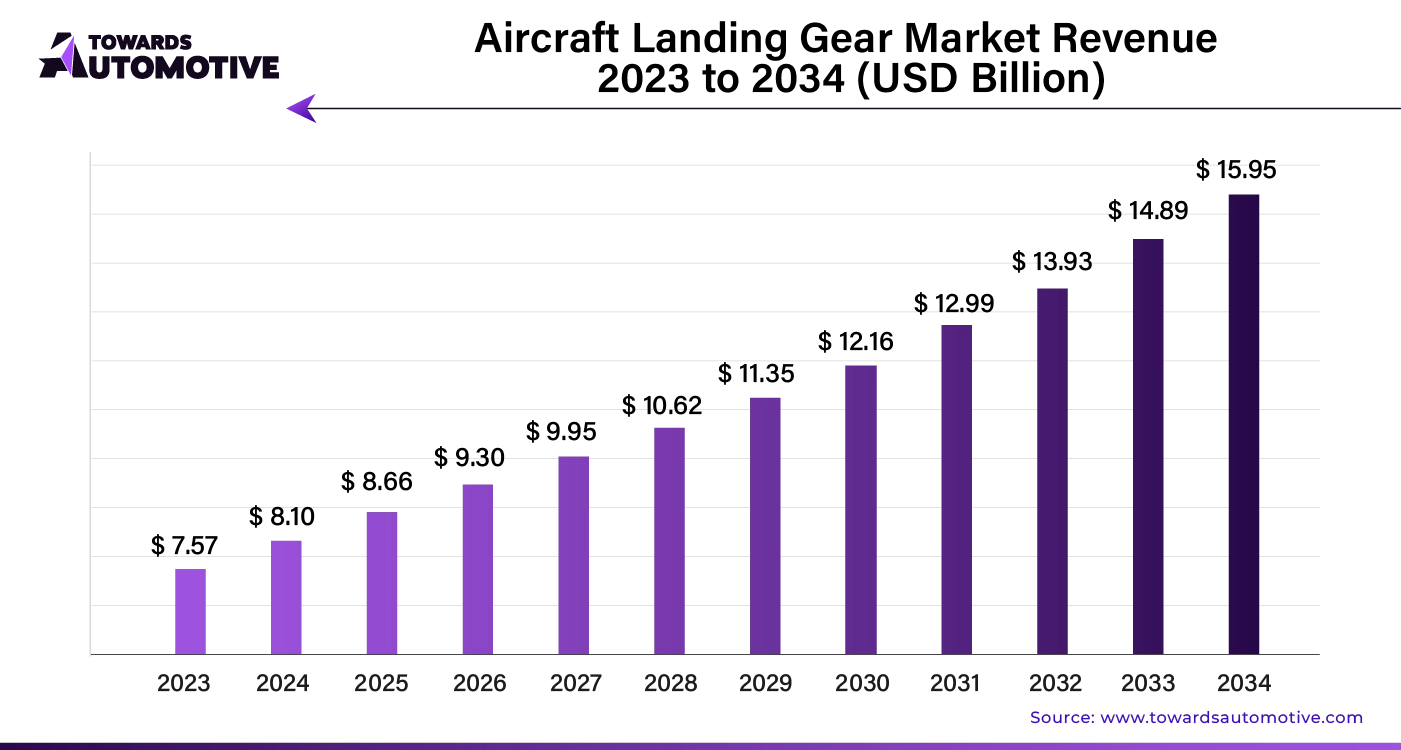

The global aircraft landing gear market size is calculated at USD 8.10 billion in 2024 and is expected to be worth USD 15.95 billion by 2034, expanding at a CAGR of 7% from 2023 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

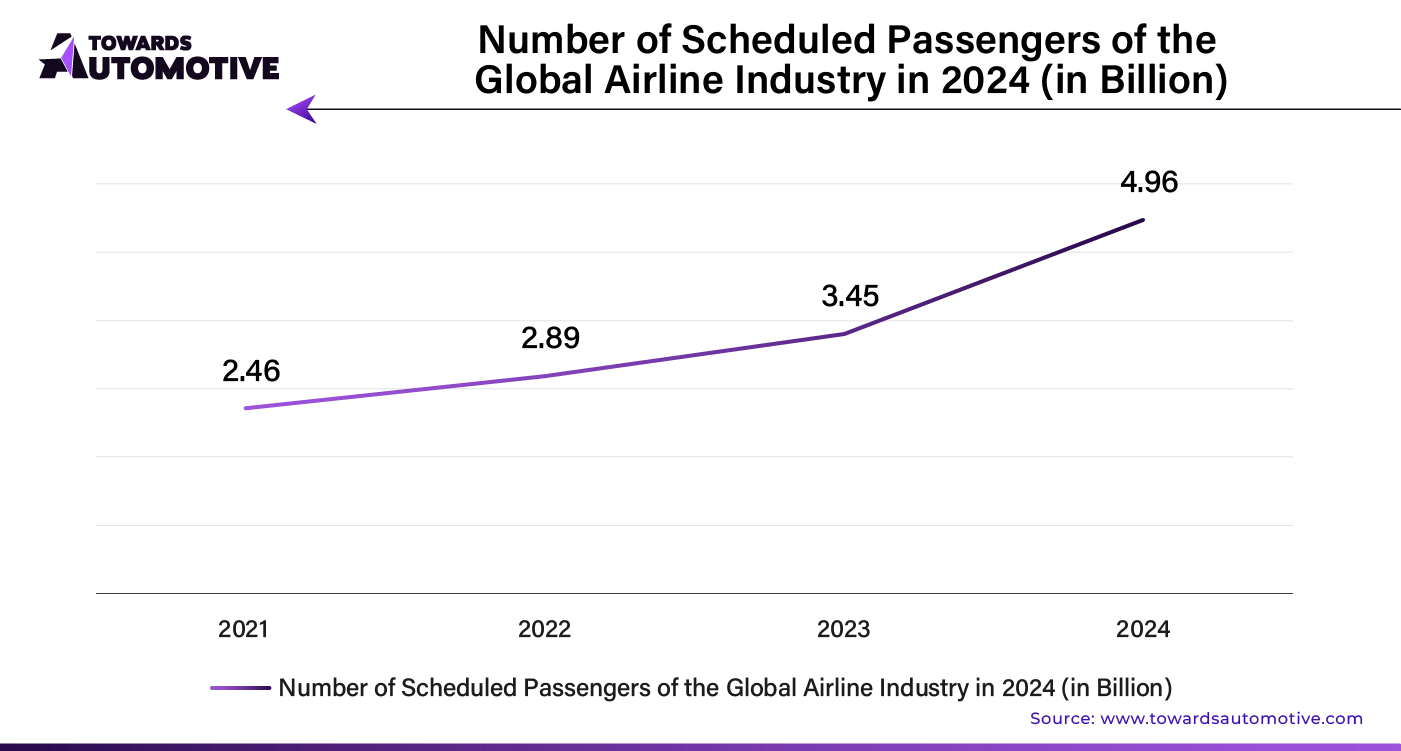

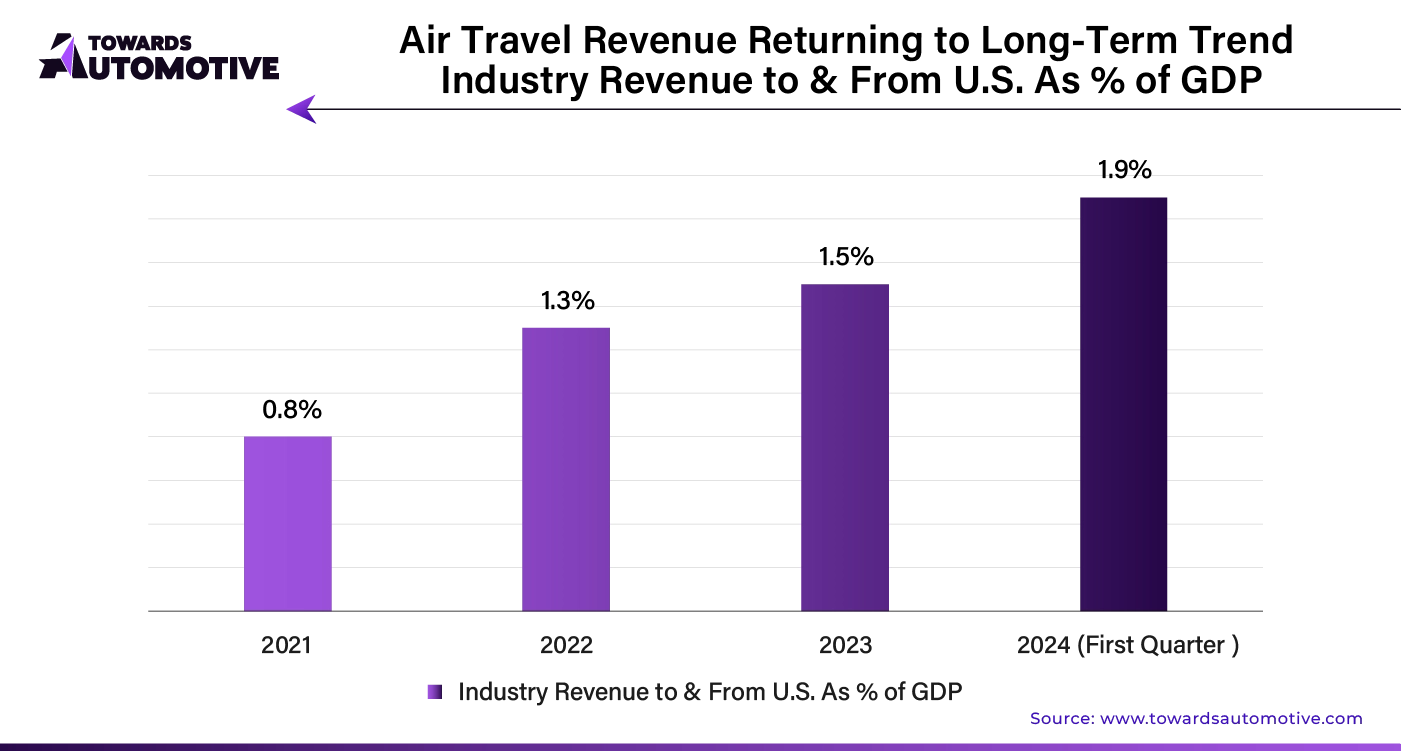

The growing demand for global air travel is driving airlines to expand and modernize their fleets, leading to increased investments in advanced landing gear technologies. The shift towards lightweight materials, enhanced sensors, and improved designs is accelerating market growth. Aging aircraft fleets require frequent maintenance and eventual landing gear replacements, further contributing to this trend. Regulatory mandates for aviation safety are compelling airlines to upgrade their systems, while increased defense spending is boosting the demand for advanced landing gear in military and dual-use aircraft. Additionally, the rise of low-cost carriers and regional airlines is creating a strong demand for new aircraft, which in turn fuels the landing gear market. Airlines are also retrofitting existing fleets with more efficient landing gear to extend aircraft lifespans and meet evolving performance standards.

The aircraft landing gear market is witnessing robust demand across several sectors. Commercial airlines are a primary driver, as they continually require landing gear for their expanding fleets of passenger and cargo aircraft. Military forces also play a significant role, utilizing landing gear for various military aircraft, including fighters, transport planes, and helicopters.

Aircraft manufacturers are increasingly adopting landing gear, integrating it into new aircraft during production. Additionally, companies leasing aircraft to airlines are involved in purchasing landing gear, both for aircraft maintenance and asset management. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

The aerospace research and development sector is another key consumer, acquiring landing gear for testing and prototyping. Government organizations responsible for national aviation and defense are also major players, procuring landing gear for military and governmental aircraft.

This growing adoption across various industries highlights the critical role of landing gear in aviation.

High upfront costs for acquiring and installing new landing gear systems present a financial hurdle for budget-conscious airlines and operators. Economic downturns, global crises, and extended aircraft grounding further reduce demand, stalling market growth. Additionally, rapid advancements in aviation technology shorten product lifecycles, deterring smaller companies from entering the market due to the continuous investment needed for R&D. Economic uncertainties also dampen air travel demand, limiting airlines' capacity and willingness to invest in new landing gear.

AI is set to revolutionize the aircraft landing gear market by enhancing efficiency and safety. By integrating AI-driven predictive maintenance, airlines can anticipate and address potential landing gear issues before they lead to costly downtime. This proactive approach minimizes operational disruptions and extends the lifespan of critical components.

AI's ability to analyze vast amounts of data in real-time enables more accurate load distribution and stress analysis, optimizing landing gear performance under various conditions. Additionally, AI facilitates the development of smart sensors that monitor landing gear health continuously, providing real-time feedback to pilots and maintenance crews. This integration not only reduces maintenance costs but also enhances overall flight safety, making AI a crucial driver of market growth in the aircraft landing gear sector.

The supply chain in the aircraft landing gear market is driven by a focus on efficiency, reliability, and cost-effectiveness. Manufacturers collaborate closely with suppliers to source lightweight materials and advanced components, ensuring quality and compliance with stringent industry standards. Strategic partnerships with specialized suppliers allow for the integration of cutting-edge technologies, such as advanced sensors and materials that enhance performance and durability.

Logistics play a critical role, with just-in-time delivery systems reducing lead times and minimizing inventory costs. Companies invest in robust supply chain management systems to monitor and optimize the flow of materials, ensuring timely production and assembly. Additionally, regulatory mandates require rigorous testing and certification processes, adding a layer of complexity to the supply chain.

As the demand for commercial and military aircraft increases, the supply chain must adapt to support higher production rates while maintaining quality and efficiency. The integration of digital tools, like predictive analytics, further refines supply chain operations, ensuring that manufacturers can meet market demands without compromising on safety or performance.

The aircraft landing gear market ecosystem revolves around three main components: landing gear structures, actuation systems, and control systems. Landing gear structures provide the crucial support during takeoff, landing, and taxiing, and are typically composed of lightweight yet durable materials like titanium and composites. Actuation systems, including hydraulic and electric systems, manage the deployment and retraction of the landing gear. Control systems ensure precise operation, integrating advanced sensors and software for real-time monitoring and adjustments.

Leading companies like Safran, Liebherr, and Collins Aerospace contribute significantly to this ecosystem. Safran focuses on lightweight composite materials, enhancing fuel efficiency. Liebherr excels in hydraulic actuation systems, offering robust performance across diverse aircraft models. Collins Aerospace integrates advanced sensor technologies, improving safety and operational efficiency. Each company's innovations play a pivotal role in advancing the overall reliability, safety, and efficiency of aircraft landing gear systems.

The aircraft landing gear market is experiencing significant growth, with the main landing gear segment projected to expand at an impressive 6.4% CAGR. This segment is in high demand due to its essential role in supporting the majority of an aircraft's weight during landing and ground operations. The performance of main landing gear is vital, as it directly influences the safety, efficiency, and operational capabilities of various aircraft. Advancements in materials, design, and manufacturing processes are further enhancing the efficiency of these systems, driving their widespread adoption.

In the sub-system category, actuation systems hold the leading position, dominating the market with a projected 6.2% CAGR. These systems are crucial for the controlled movement and positioning of landing gear components, ensuring safety and precision during take-off and landing. The growing air travel industry, along with ongoing technological innovations and strict safety standards, is boosting the demand for actuation systems in the aviation sector.

The global aircraft landing gear market is experiencing varied growth across different countries, with South Korea emerging as the fastest-growing market and the United States maintaining its dominance. Here's a closer look at how these key players are shaping the market landscape:

South Korea: The Fastest-Growing Market

South Korea stands out as the fastest-growing market for aircraft landing gear, with an impressive CAGR of 8.30% projected through 2034. This rapid growth is fueled by robust government initiatives and investments in the aerospace sector, which support technological advancements. The increasing demand for aircraft, driven by the need for enhanced regional and international connectivity, further propels the market's expansion in South Korea.

The United States: A Dominant Force

The United States continues to dominate the aircraft landing gear market, with a steady growth rate of 6.90% expected over the next decade. The presence of leading aviation companies like Boeing, Lockheed Martin, and Airbus significantly contributes to the demand for landing gears. Additionally, the substantial government spending on defense bolsters the market, as advanced landing gear systems are crucial for military aircraft modernization.

Japan: A Strong Contender in Asia

Japan remains a key player in the Asian market, with a CAGR of 7.80% projected through 2034. The country's emphasis on improving regional connectivity has led to an exponential expansion of its aviation sector, driving the demand for advanced landing gear technologies. Japan's commitment to environmental sustainability in aviation further encourages the adoption of innovative landing gear systems.

The United Kingdom: Leading in Europe

In Europe, the United Kingdom is a leading market, with an expected annual growth rate of 7.60% until 2034. The presence of aerospace clusters, such as the Farnborough Aerospace Consortium, fosters collaboration and innovation among industry players, pushing advancements in landing gear technologies. The UK's focus on modernizing its military aircraft fleets also drives the demand for high-performance landing gear systems.

China: A Rising Manufacturing Hub

China is emerging as a major player in the global aircraft landing gear market, with a projected CAGR of 7.00% through 2034. The rapid growth of China's aviation sector, driven by a rising middle class and increased connectivity, has led to a surge in demand for new aircraft and landing gear systems. Additionally, China's role as a key manufacturing hub for aerospace components strengthens its position in the international market.

The aircraft landing gear market is highly fragmented, with numerous international and domestic players vying for dominance. Leading companies such as Safran Landing Systems, Collins Aerospace, Liebherr-Aerospace, and Heroux-Devtek are heavily investing in research and development to advance lightweight materials, smart technologies, and enhanced sensors, all aimed at boosting performance, fuel efficiency, and safety.

By Type

By Sub-system

By Aircraft Type

By Region

February 2025

February 2025

February 2025

September 2024

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us