April 2025

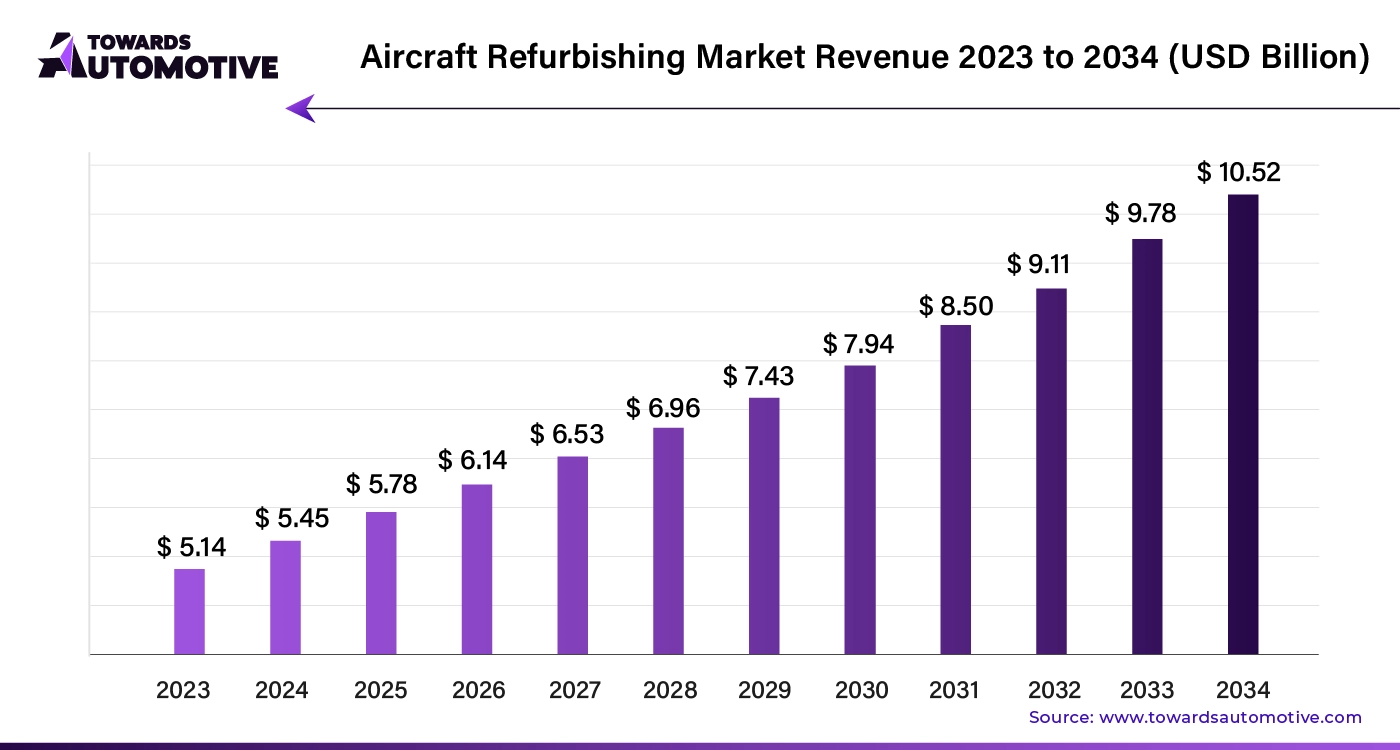

The aircraft refurbishing market is predicted to expand from USD 5.78 billion in 2025 to USD 10.52 billion by 2034, growing at a CAGR of 6.12% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Investments in Next-Generation Technologies Transform Aircraft Refurbishment

Aircraft refurbishing companies are increasingly adopting advanced technologies to modernize older aircraft. By integrating cutting-edge systems such as autonomous capabilities and smart flight decks, these firms are enhancing fleet efficiency and safety. Retrofitting older airplanes with the latest aviation systems not only boosts operational efficiency but also reduces maintenance costs and improves overall aircraft performance.

A notable example of this trend is Thales's recent contract with Air India. In February 2024, Thales secured a US$ 400 million deal to retrofit Air India’s Boeing 777 and 787 aircraft. This significant investment will update these older models with state-of-the-art flight entertainment and safety technologies, effectively rejuvenating them to meet modern standards. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

Expanding Opportunities in Developing Regions

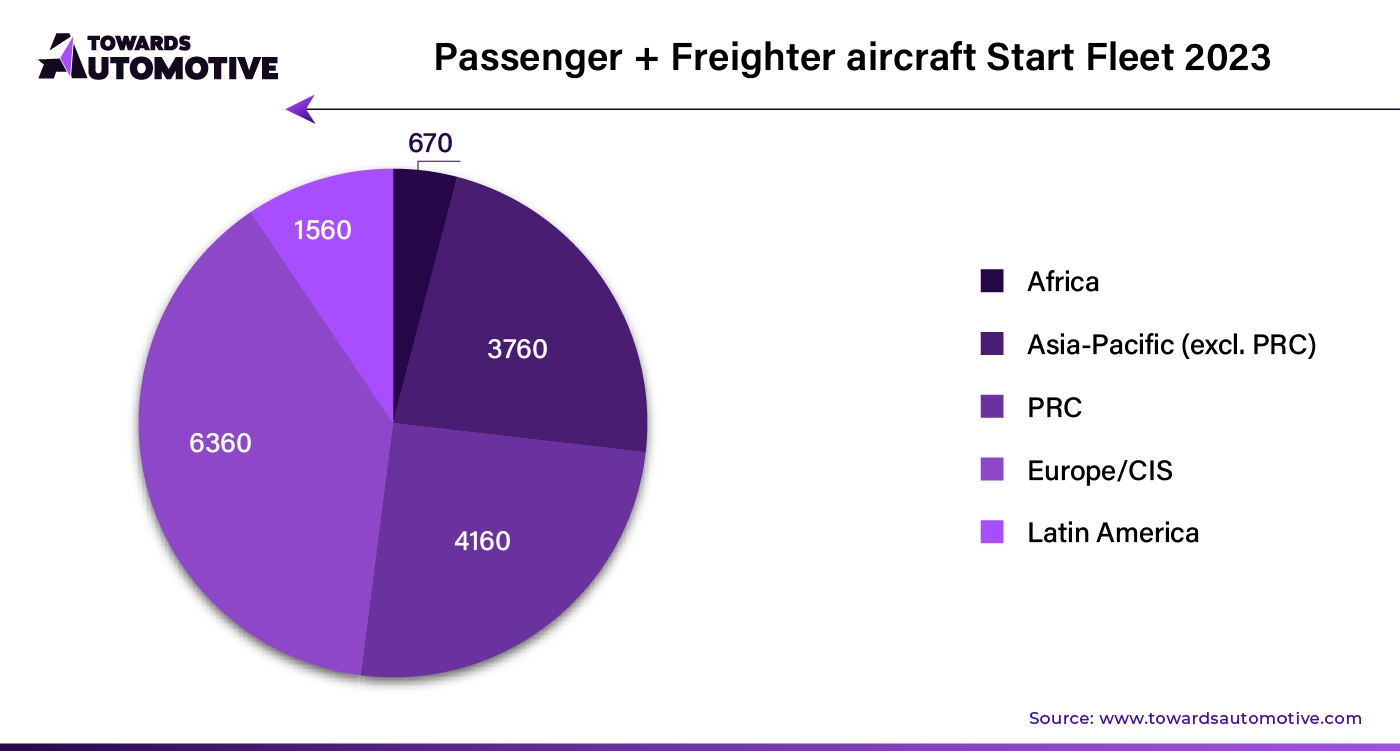

The aviation industry is witnessing robust growth in developing regions like the Middle East and Asia-Pacific. Rising disposable incomes and increased demand for air travel are driving fleet modernization and refurbishment in these areas. As a result, aircraft refurbishment businesses have ample opportunities to expand their market presence and achieve long-term success.

For instance, India has seen its number of operational airports more than double from 74 in 2014 to 148 by April 2023. The Indian government has invested approximately US$ 11 billion to build new airports and upgrade existing ones, with a goal of having nearly 200 operational airports within five years. This significant infrastructure expansion presents substantial opportunities for aircraft refurbishing firms.

Latin America, while slightly behind, is also experiencing rapid growth in its aviation sector. Economic development in this region further enhances the market’s growth prospects.

Green Aviation Initiatives Fuel Demand for Refurbishment

Global emphasis on sustainability is pushing airlines to adopt more eco-friendly practices. As environmental concerns rise, airlines are under increasing pressure to operate responsibly. Refurbishing aircraft with green technologies—such as energy-saving equipment and eco-friendly materials—not only reduces fuel consumption and emissions but also helps airlines enhance their reputation as environmentally conscious operators.

One exciting development in this area is the partnership between Britten-Norman, the makers of the iconic Islander aircraft, and Cranfield Aerospace Solutions (CAeS), specialists in hydrogen-electric fuel cell propulsion. They have signed a Heads of Terms agreement to develop the world’s first fully integrated, zero-emission sub-regional aircraft, set to enter service in 2026. This groundbreaking project highlights the industry's commitment to sustainability and innovation in aircraft refurbishment.

Retrofit Leads Aircraft Refurbishing Market

In 2024, retrofit fittings dominate the aircraft refurbishing market, holding a significant 64.00% share. This trend highlights the growing importance of retrofitting due to several factors, including supply chain disruptions and delays in new aircraft deliveries. Retrofitting offers a quick and effective solution for airlines to address capacity constraints and meet the increasing demand for air travel while awaiting new aircraft arrivals.

Retrofitting also supports sustainability efforts. Upgrading older aircraft with modern, eco-friendly materials and energy-efficient systems not only improves fuel efficiency but also helps reduce emissions. This approach minimizes resource use and aligns with the aviation industry’s environmental goals.

Narrow Body Aircraft Leads Refurbishing Market

Narrow body aircraft account for a major portion of the aircraft refurbishing market, capturing 56.00% of the market share in 2024. Their appeal lies in their operational flexibility and lower acquisition costs compared to larger aircraft. Refurbishing narrow body aircraft allows emerging and expanding airlines to enter new markets and extend their route networks without the financial strain of purchasing new planes.

The competitive nature of the aviation industry, particularly among low-cost and regional airlines, drives the demand for narrow body aircraft refurbishment. Airlines are investing in modernizing their narrow body fleets with upgraded cabins, enhanced amenities, and advanced technologies to improve passenger experience and gain a competitive advantage.

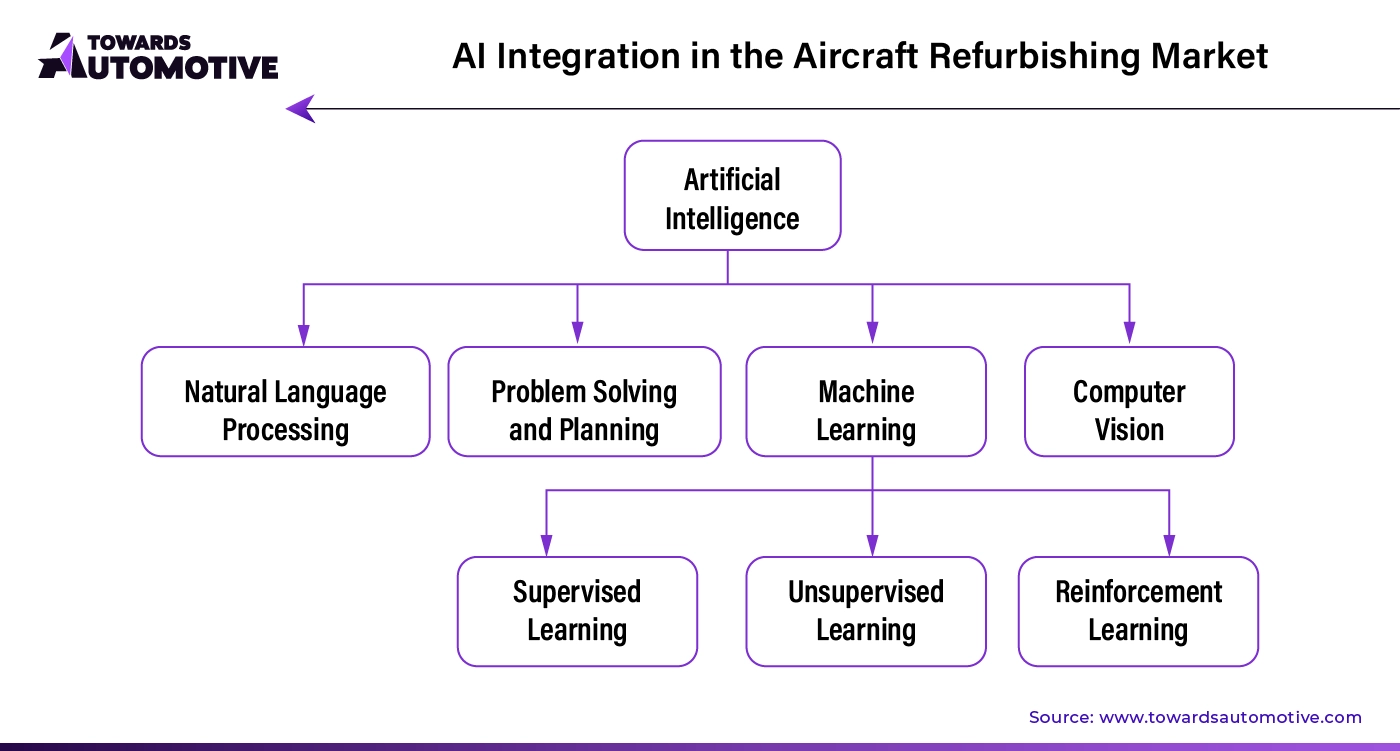

AI is set to revolutionize the aircraft refurbishing market by introducing advanced technologies that significantly enhance efficiency and accuracy. By leveraging AI, companies can streamline refurbishing processes through predictive maintenance, which anticipates and addresses issues before they escalate, reducing downtime and costs. AI-driven analytics allow for precise monitoring of aircraft conditions, enabling tailored refurbishments that extend aircraft lifespans and improve performance.

AI also enhances quality control by utilizing machine learning algorithms to detect anomalies and defects that may be missed by human inspectors. This leads to higher safety standards and more reliable refurbishing outcomes. Additionally, AI-powered automation in tasks such as parts replacement and system upgrades accelerates the refurbishing process, allowing for quicker turnaround times and increased throughput.

The integration of AI fosters data-driven decision-making, optimizing resource allocation and operational efficiency. It empowers refurbishing teams with valuable insights and predictive capabilities, ultimately driving growth and innovation in the market. As AI technologies continue to evolve, they will unlock new opportunities and set new benchmarks for the aircraft refurbishing industry.

In the aircraft refurbishing market, the supply chain plays a crucial role in ensuring efficiency and quality. The process begins with procurement, where suppliers provide essential parts and materials such as avionics, engines, and interior components. These suppliers must meet stringent quality standards to ensure safety and performance.

Once procured, these components move through a series of stages, including inspection, storage, and assembly. Aircraft refurbishing centers, equipped with specialized facilities, carry out inspections to verify the condition of the parts. Effective inventory management systems help track these components, minimizing delays and ensuring that all required materials are on hand when needed.

Next, the refurbishment process involves disassembling the aircraft, replacing or repairing parts, and reassembling it to meet updated safety and performance standards. Coordination among various teams—engineering, procurement, and logistics—is essential to streamline operations and avoid bottlenecks.

Finally, quality assurance teams conduct thorough inspections to ensure the refurbished aircraft meets all regulatory and safety requirements before delivery. This seamless integration of supply chain elements enhances overall operational efficiency and customer satisfaction in the aircraft refurbishing market.

The Aircraft Refurbishing market thrives on several critical components that ensure aircraft stay in top condition and comply with regulations. The core elements of this market include interior refurbishments, such as updating cabins, seats, and galleys, and structural enhancements, which focus on maintaining and upgrading the aircraft's frame and systems.

Leading companies significantly contribute to this ecosystem. For instance, Lufthansa Technik specializes in comprehensive aircraft maintenance and interior refurbishments, enhancing passenger comfort and safety. ST Aerospace focuses on both line and heavy maintenance, ensuring that aircraft remain operational and efficient. AAR Corp provides parts and repair services, supporting the overall infrastructure required for effective refurbishing. Meanwhile, Bombardier offers specialized solutions tailored to its aircraft models, addressing unique refurbishing needs.

These companies drive the market by offering a range of services from routine maintenance to extensive overhauls. Their expertise helps extend the lifespan of aircraft, optimize performance, and ensure compliance with aviation standards. The collaboration between these key players and their innovative solutions is essential for the dynamic and evolving Aircraft Refurbishing market.

The global aircraft refurbishing market is experiencing varied growth across different countries, driven by distinct regional demands and trends. Here’s a closer look at the factors influencing market growth in the United States, Germany, Japan, China, and India.

United States: Expanding Business Aviation Drives Growth

In the United States, the aircraft refurbishing market is projected to grow at a CAGR of 5.50% from 2024 to 2034. The burgeoning demand for business aviation is a key driver, as private jets and executive aircraft become increasingly popular among businesses, high-net-worth individuals, and charter operators. To meet the rising demand, U.S. aircraft refurbishment companies are offering specialized services to maintain and enhance these aircraft to the highest standards.

The U.S. military’s regular refurbishment and modernization of its aircraft fleet also play a significant role. With contracts from the Department of Defense for updating military aircraft like fighter jets, transport planes, and helicopters, refurbishment firms benefit from steady revenue streams and opportunities for innovation.

Germany: Strong OEM Presence and Supplier Network Fuel Expansion

Germany’s aircraft refurbishing market is set to expand at a CAGR of 5.80% through 2034, bolstered by the country’s robust network of aerospace suppliers and original equipment manufacturers (OEMs) such as Airbus and Dassault Aviation. The presence of these major OEMs provides German refurbishment firms with easy access to a wide range of parts, supplies, and expertise, streamlining the refurbishment process and fostering market growth.

Partnership opportunities with these OEMs and the efficient supply chain further contribute to the expansion of the aircraft refurbishing sector in Germany.

Japan: Rising Demand for Regional Connectivity Drives Refurbishment Needs

Japan’s aircraft refurbishing market is expected to grow at a CAGR of 5.40% from 2024 to 2034. The expanding domestic and regional air travel markets, driven by increased demand for regional connectivity, are fueling this growth. Japanese airlines are focusing on modernizing their regional aircraft, such as turboprops and regional jets, to enhance passenger experiences and operational efficiency.

Refurbishment services are crucial for upgrading and maintaining these aircraft to meet the evolving demands of regional air travel.

China: Surge in MRO Services Boosts Market Growth

In China, the aircraft refurbishing market is projected to grow at a robust CAGR of 7.30% through 2034. The country’s rapidly developing commercial aviation sector is driving the need for aircraft maintenance, repair, and overhaul (MRO) services. As airlines expand their fleets and seek to minimize maintenance costs while adhering to stringent safety regulations, the demand for refurbishment services is on the rise.

Chinese refurbishment businesses are capitalizing on the growing need for interior upgrades, avionics system renovations, and component replacements to support the commercial aviation industry’s expansion.

India: Low-Cost Carrier Boom Spurs Refurbishment Demand

India’s aircraft refurbishing market is anticipated to grow at a CAGR of 6.90% from 2024 to 2034. The rise of low-cost carriers (LCCs) catering to the expanding middle class is a significant driver. LCCs operate large fleets of narrow-body aircraft for short- to medium-haul routes, and there is a growing need to refurbish and modernize these aircraft to remain competitive.

As LCCs invest in upgrading cabin furnishings, seating arrangements, and amenities to enhance passenger experience, the refurbishment market in India is poised for substantial growth.

The aircraft refurbishing market is fiercely competitive, with major players like Lufthansa Technik AG and ST Aerospace leading the field. Their dominance is attributed to their extensive global reach and comprehensive service offerings. These industry giants benefit from their established reputation and ability to provide a full range of refurbishing solutions.

In contrast, smaller niche companies are carving out their own space by focusing on specialized areas such as luxury aircraft interiors or military aircraft restoration. These businesses leverage their expertise to cater to specific market segments, offering tailored solutions that set them apart from larger competitors.

The market environment is continually evolving due to several factors. Technological innovation is a key driver, with companies investing heavily in research and development to stay ahead. Additionally, adherence to regulatory standards is crucial, as compliance ensures that refurbishing processes meet safety and quality requirements. Consumer preferences also play a significant role, influencing demand for bespoke and customized refurbishing solutions.

To maintain a competitive edge, firms are increasingly forming strategic partnerships and alliances. These collaborations not only enhance their market position but also foster innovation and contribute to overall market growth.

By Fitting Type

By Aircraft Type

By Refurbishing Type

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us