March 2025

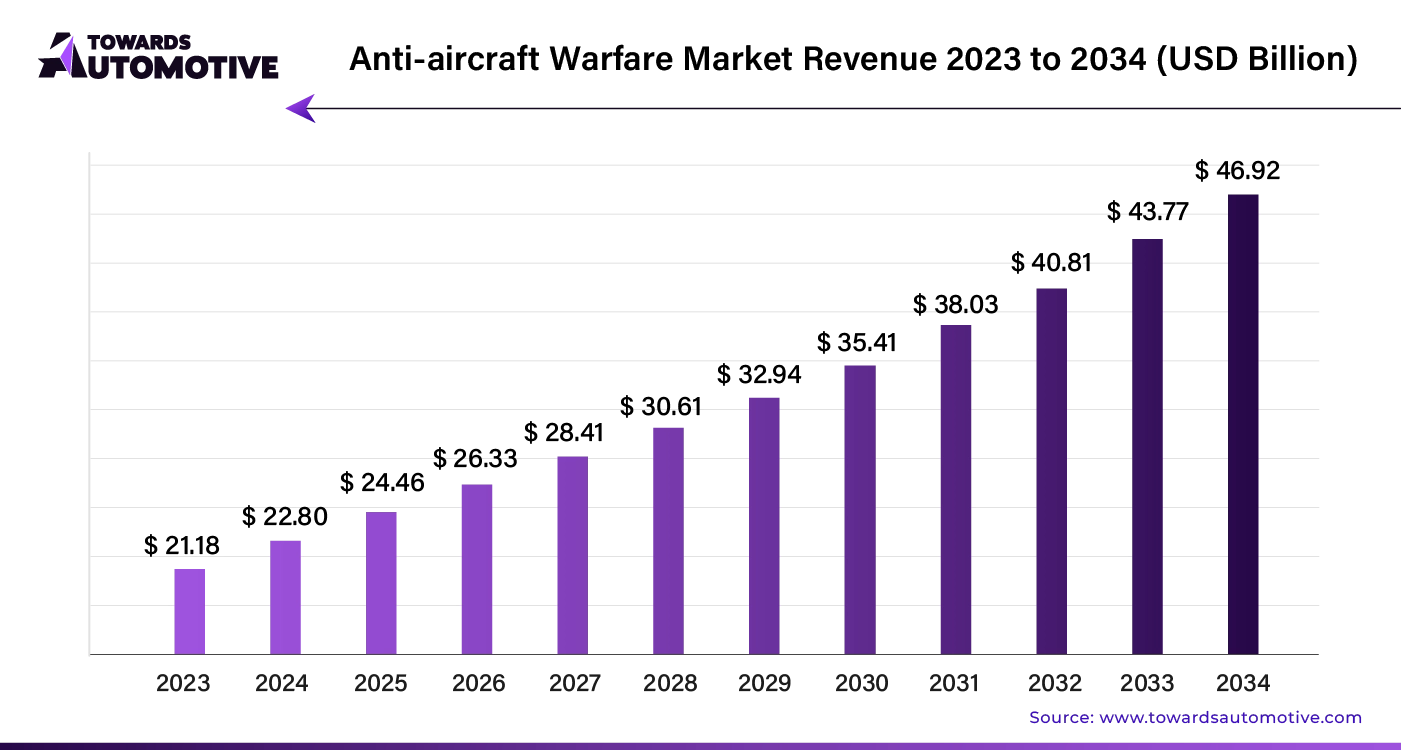

The global anti-aircraft warfare market size is calculated at USD 22.80 billion in 2024 and is expected to be worth USD 46.92 billion by 2034, expanding at a CAGR of 7.5% from 2023 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The anti-aircraft warfare industry is enhancing air defense by integrating cutting-edge technologies like advanced radar, missile defense systems, and network-centric capabilities. These advancements, including AI-driven real-time threat detection and interception, are transforming operations. Ongoing R&D efforts focus on improving the accuracy and range of anti-aircraft weapons to address evolving aerial threats. Additionally, international cooperation and defense funding are crucial in developing robust anti-aircraft capabilities.

Regional turmoil and geopolitical conflicts are driving growth in the anti-aircraft warfare market as nations seek to strengthen their air defense capabilities. The increasing demand for these systems is fueled by the need to protect airspace from emerging threats.

The integration of advanced technologies, including artificial intelligence, machine learning, and sophisticated radar systems, is enhancing the precision and effectiveness of anti-aircraft systems. The rise of autonomous and sophisticated aerial threats has further accelerated the evolution of air-based warfare, prompting countries to focus on bolstering their air defense strategies.

Modern missile defense systems now incorporate adaptive countermeasures and electronic warfare capabilities, improving the ability to intercept and neutralize various aerial threats. These advancements enhance the overall resilience and effectiveness of anti-aircraft defense systems. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

Anti-aircraft warfare encompasses strategies to defend against hostile aircraft or missiles. Active defense involves using ground- and air-based weaponry to eliminate threats, while passive defense relies on concealment and dispersion to mitigate the impact of aerial attacks.

The rise of stealth technology among potential adversaries is likely to reduce the effectiveness of traditional anti-aircraft systems. Additionally, the growing use of unmanned aerial vehicles challenges current systems, necessitating updates to counter smaller, more agile targets. As defense strategies shift towards addressing asymmetric threats and cyber warfare, the demand for conventional anti-aircraft systems may decline. Furthermore, the development of alternative technologies like directed energy weapons and hypersonic missiles could redirect focus and resources away from traditional anti-aircraft strategies.

The shift to network-centric warfare is transforming the anti-aircraft warfare market by enhancing real-time communication and coordination across defense systems. This approach integrates sensor data and intelligence, enabling rapid decision-making and optimized deployment of anti-aircraft assets. As a result, situational awareness improves, leading to faster responses to aerial threats and driving demand for advanced anti-aircraft infrastructure.

The escalating need for missile defense systems is a significant driver in the global anti-aircraft warfare market. With rising geopolitical tensions, countries are increasingly investing in sophisticated missile defense technologies. Government support and defense budgets are fueling research, development, and procurement of these systems, ensuring a stable and growing market.

International collaboration in defense strategies is propelling the anti-aircraft warfare market. Shared intelligence on aerial threats and joint development efforts are leading to cost-effective solutions and the adoption of advanced technologies. Enhanced interoperability among defense systems encourages nations to invest in cutting-edge anti-aircraft equipment, ensuring a coordinated and robust response to evolving threats.

Support Capabilities Lead the Anti-Aircraft Warfare Sector

The support capabilities segment is set to lead the anti-aircraft warfare market with a projected CAGR of 7.4% from 2024 to 2033. This growth is driven by the increasing need for advanced support systems to enhance air defense. Key factors include:

Weapon Systems Surge in the Anti-Aircraft Warfare Industry

Weapon systems are emerging as a key focus in the anti-aircraft warfare market, with a steady CAGR of 7.1% from 2024 to 2033. The demand for these systems is fueled by:

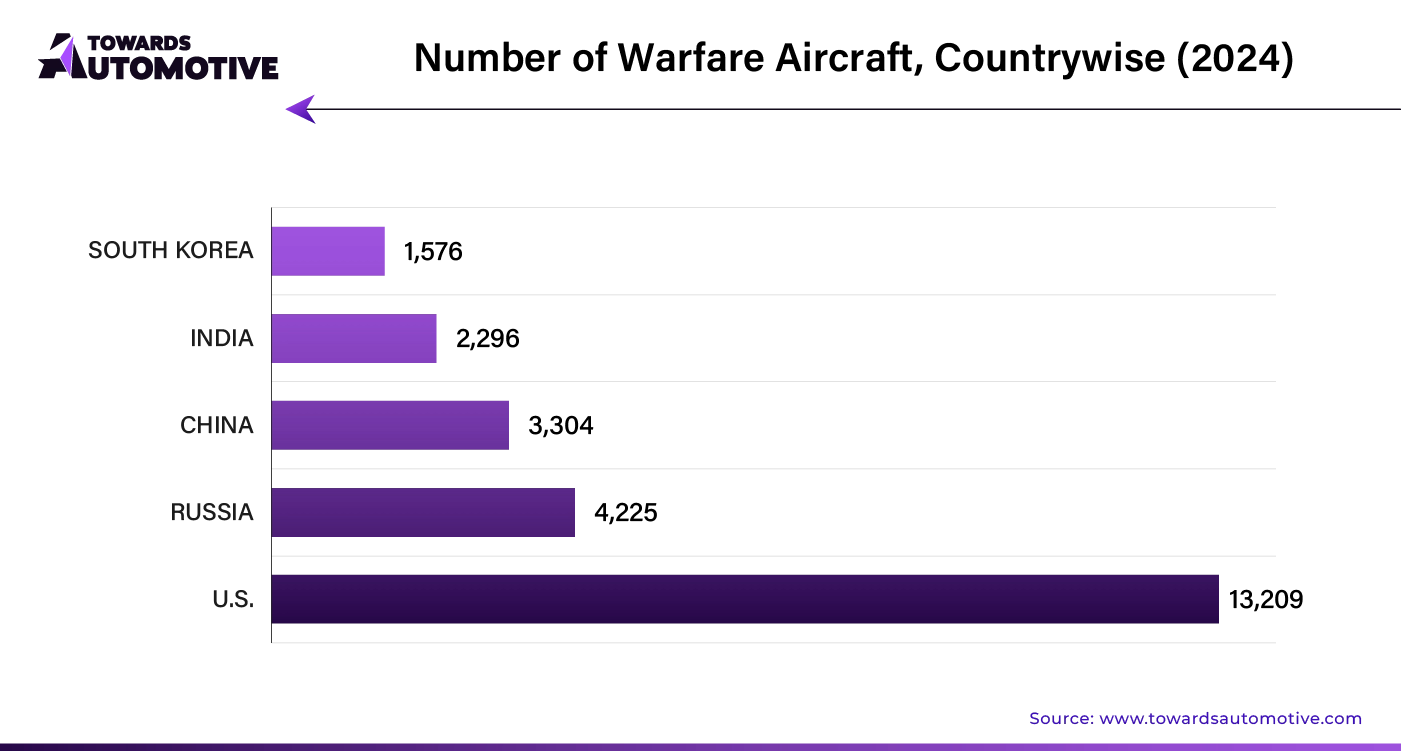

The anti-aircraft warfare markets in key countries, including the United States, Japan, South Korea, China, and the United Kingdom, are witnessing robust growth, driven by technological advancements and strategic defense initiatives.

United States: Advanced Aerial Defense Systems on the Rise

The U.S. anti-aircraft warfare market is projected to grow at a CAGR of 7.4% through 2034, reaching a market value of $8.4 billion. This growth is fueled by the increasing demand for advanced aerial defense systems integrated with modern command and control infrastructures. The focus on AI-driven targeting capabilities and electronic warfare countermeasures is a direct response to evolving threats.

Japan: Digital Transformation in Defense

Japan's anti-aircraft warfare market is expected to achieve a CAGR of 8.8%, reaching a valuation of $5.3 billion by 2034. Government support, including funding programs and research grants, is accelerating the adoption of digital technologies in defense. Japan is focused on enhancing its aviation security and adapting to global shifts through smart warfare strategies.

China: Modernization and Indigenous Production

China’s anti-aircraft warfare market is projected to grow at a CAGR of 8.1%, with an anticipated value of $7.0 billion by 2034. The Chinese government’s investment in advanced systems and ongoing military modernization are key drivers. A strong emphasis on domestic production aims to reduce reliance on foreign suppliers, fostering innovation in the market.

United Kingdom: Expanding Air Defense Capabilities

In the U.K., the anti-aircraft warfare market is set to grow at a CAGR of 8.7%, reaching $2.0 billion by 2034. Geopolitical tensions are prompting an expansion of air defense capabilities, with the U.K. focusing on integrated defense systems. The development of exportable anti-aircraft systems is creating new economic opportunities.

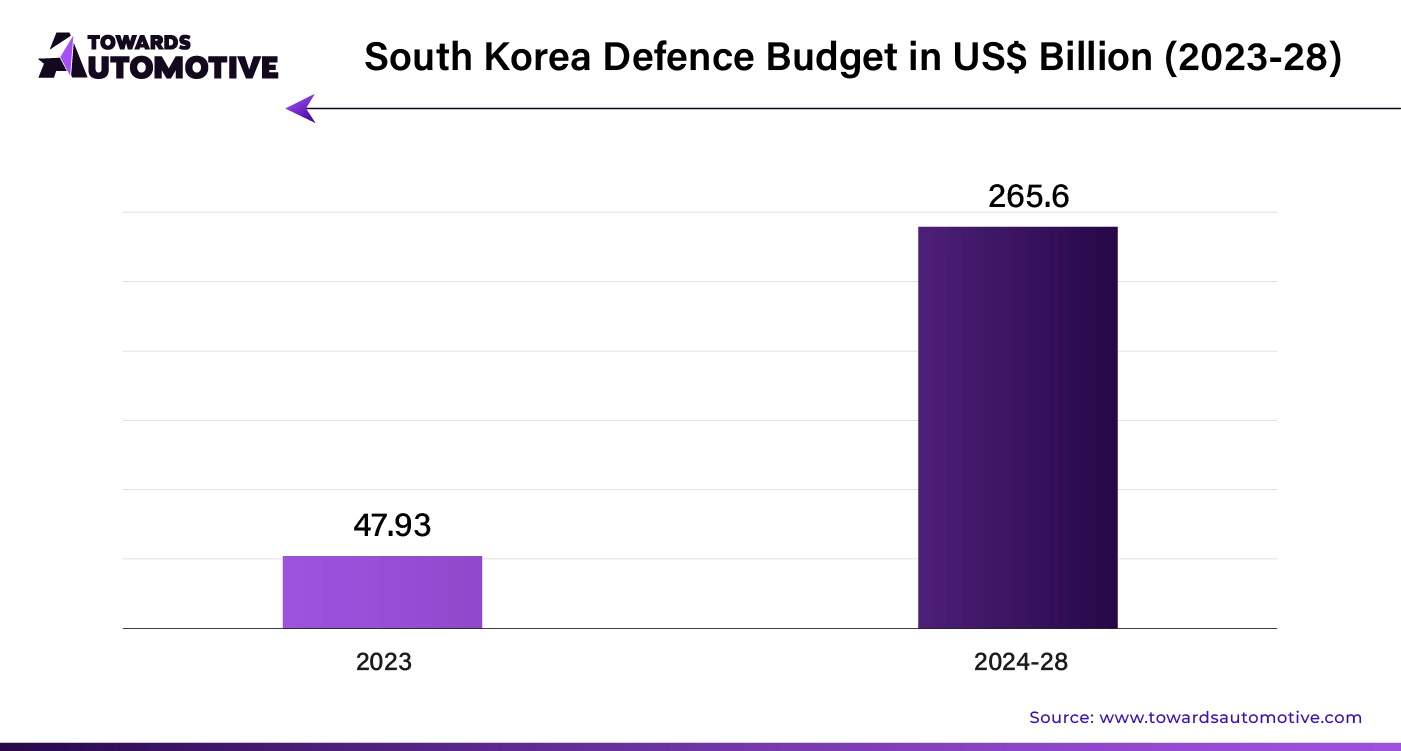

South Korea: Strengthening Regional Influence

South Korea's anti-aircraft warfare market is forecasted to grow at a CAGR of 8.6%, reaching $3.1 billion by 2034. Significant investments in R&D are enhancing South Korea’s combat capabilities, strengthening its strategic position in East Asia. The focus on modernizing defense systems is driven by rising geopolitical tensions.

Key players in the anti-aircraft warfare industry are driving the sector forward through innovation, strategic partnerships, and a focus on modern defense needs. Companies like Lockheed Martin and Raytheon Technologies lead the charge, investing heavily in research and development to advance radar systems, precision-guided missiles, and electronic warfare.

Collaborations between industry giants such as MBDA and Northrop Grumman enhance international cooperation, resulting in sophisticated and interoperable anti-aircraft systems. These companies are also expanding their global reach, boosting defense capabilities in allied nations through strategic exports.

The development of integrated, multi-layered air defense solutions is a priority, addressing diverse threats and ensuring comprehensive protection. Leaders like BAE Systems are pushing the envelope by incorporating artificial intelligence and autonomous systems, aiming for faster threat detection and response.

The emphasis on indigenous manufacturing reflects a growing trend toward self-sufficiency in defense, reducing reliance on foreign suppliers. These efforts collectively propel the anti-aircraft warfare market, ensuring that defense capabilities continuously evolve to counter complex airborne threats.

By Capability

By System

By Platform

By Range

By Region

March 2025

February 2025

January 2025

January 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us