April 2025

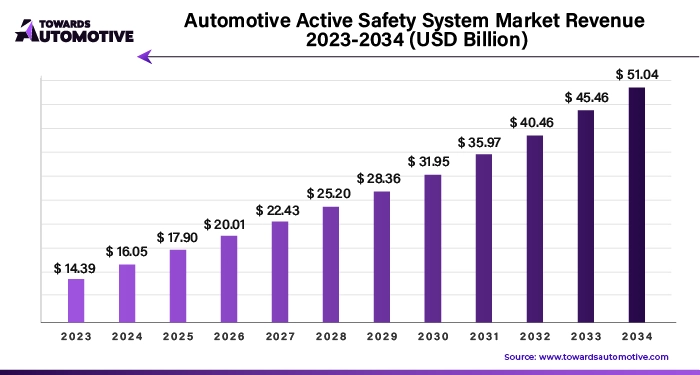

The automotive active safety system market is projected to reach USD 51.04 billion by 2034, expanding from USD 17.90 billion in 2025, at an annual growth rate of 11.6% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive industry is witnessing a transformative shift as augmented reality (AR) technology revolutionizes vehicle displays, significantly enhancing driver awareness and safety. AR technology integrates crucial information directly onto the vehicle's windshield or head-up display, allowing drivers to access real-time data without taking their eyes off the road. This innovation helps drivers stay alert to potential hazards, follow navigation prompts, and receive lane departure warnings by overlaying these elements onto their actual driving environment.

With AR's ability to highlight dangers and provide guidance in real-time, drivers can respond more swiftly to threats and maintain better situational awareness, effectively reducing the risk of accidents. As AR technology continues to evolve and become more affordable, its integration into active safety systems is anticipated to increase, promising a more immersive and intuitive driving experience.

Another significant advancement driving growth in the automotive active safety system market is the integration of biometric monitoring. These systems utilize sensors to track the driver’s physiological state, including heart rate, eye movement, and skin conductance. By monitoring these indicators, biometric systems can detect signs of fatigue, stress, or medical emergencies and provide real-time alerts. For example, if the system detects drowsiness, it can trigger audible alerts or cause the steering wheel to vibrate to rouse the driver. This continuous monitoring adds a critical layer of safety by addressing driver impairment issues that traditional systems might overlook.

Additionally, blockchain technology is emerging as a key trend in enhancing the security and reliability of automotive active safety systems. Blockchain’s decentralized and immutable ledger capabilities ensure that data from vehicle sensors and communication systems remains secure and tamper-proof. As vehicles become increasingly connected and dependent on real-time data for safety-critical decisions, the utilization of blockchain technology provides an extra level of protection against data breaches and fraud. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

AI and Machine Learning Drive Demand for Enhanced Vehicle Safety

Artificial Intelligence (AI) and Machine Learning (ML) are transforming the global automotive active safety systems market. These technologies are revolutionizing vehicle safety by boosting predictive capabilities, enabling real-time decision-making, and personalizing safety features.

AI and ML systems process vast amounts of data from various sensors, including cameras, radar, and Lidar, to predict potential hazards more accurately than traditional systems. By analyzing patterns and predicting the behavior of other road users, these technologies significantly enhance the effectiveness of safety interventions. For instance, AI-driven systems make split-second decisions crucial for features like automatic emergency braking, collision avoidance, and adaptive cruise control. As these systems continuously learn and adapt to new data and scenarios, their accuracy and reliability improve over time. This evolving capability not only enhances safety but also fosters consumer and regulatory trust in the technology.

Growing Demand for Vehicle-to-Everything (V2X) Communication Technologies

A notable trend in the automotive active safety systems market is the rise of Vehicle-to-Everything (V2X) communication technologies. V2X includes vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), vehicle-to-pedestrian (V2P), and vehicle-to-network (V2N) communications.

V2X technology enables vehicles to exchange information with each other, traffic signals, road signs, pedestrians, and network infrastructure. The primary aim of V2X is to enhance road safety and efficiency by facilitating real-time data exchange, which helps predict and prevent potential hazards. The adoption of V2X is being accelerated by advancements in 5G connectivity, which provides the low latency and high data transfer rates necessary for real-time communication. With 5G, vehicles can share complex information almost instantaneously, such as sudden braking, road conditions, or emergency vehicle presence. This rapid data exchange leads to more coordinated and timely responses, thereby reducing the likelihood of accidents. For example, if a vehicle detects icy road conditions, it can instantly broadcast this information to nearby vehicles, prompting them to take precautionary actions.

Advanced Sensor Technologies and Algorithms Enhance Safety Systems

The development and integration of advanced sensor fusion technologies are creating new opportunities in the automotive safety systems market. Sensor fusion significantly boosts the accuracy and reliability of active safety systems by combining the strengths of different sensor types.

As vehicles become more automated, the demand for precise object detection and classification grows. Each sensor type offers unique benefits: cameras provide high-resolution imaging and object recognition, radar excels in range and velocity measurements, and Lidar offers depth perception and 3D mapping. Integrating data from these sensors through sensor fusion technologies delivers a more accurate representation of the driving environment. This advancement is crucial for the effectiveness of active safety features such as adaptive cruise control, lane-keeping assist, and automatic emergency braking.

High Costs and Integration Complexity Challenge Market Growth

Despite the advancements and opportunities in the automotive active safety systems market, several challenges could impede growth. One major issue is the high cost associated with developing and integrating advanced safety technologies.

Active safety systems often rely on expensive components like radar, Lidar, high-resolution cameras, and advanced computing platforms. These costs can be prohibitive, especially for budget and mid-range vehicles. Consequently, manufacturers must balance the price of these technologies with vehicle affordability, limiting the widespread adoption of advanced safety systems in cost-sensitive markets.

Another significant challenge is the complexity of integrating these systems with existing vehicle architectures. Modern vehicles already feature numerous electronic systems and control units. Integrating advanced safety technologies requires seamless compatibility with these components to ensure optimal performance and reliability. The integration process can be technically challenging and time-consuming, often necessitating extensive testing and validation. Any incompatibility or technical issues can lead to system malfunctions, affecting safety performance and eroding consumer trust in these technologies.

The supply chain in the automotive active safety system market operates through a complex network of manufacturers, suppliers, and distributors, each playing a crucial role in delivering advanced safety technologies. It begins with the sourcing of raw materials and components, where suppliers provide high-quality sensors, cameras, and control units essential for active safety systems. These components are then assembled into functional systems by manufacturers who integrate cutting-edge technologies to ensure reliability and performance.

Once assembled, these systems move through a distribution network that ensures timely delivery to automotive OEMs (Original Equipment Manufacturers). OEMs then incorporate these active safety systems into their vehicle models, enhancing safety features like collision avoidance, lane-keeping assistance, and adaptive cruise control.

After integration, finished vehicles are distributed to dealerships and, eventually, to end consumers. Throughout this process, effective communication and coordination among all stakeholders are vital to address any supply chain disruptions and meet market demand. Advanced logistics, real-time tracking, and strategic partnerships are key to maintaining an efficient supply chain, ensuring that automotive active safety systems are delivered on time and meet the highest standards of safety and quality.

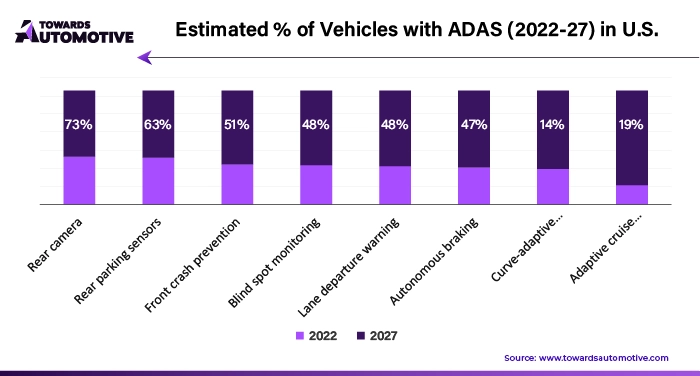

Automotive Active Safety Systems are crucial for preventing accidents and enhancing vehicle safety. These systems include several key components: advanced driver assistance systems (ADAS), collision avoidance technology, lane departure warnings, adaptive cruise control, and automatic emergency braking.

Leading companies contribute significantly to the market ecosystem by developing and integrating these technologies into vehicles. For instance, Bosch and Denso are renowned for their advanced sensor technologies, which play a vital role in collision avoidance and adaptive cruise control. Continental and Valeo offer comprehensive ADAS solutions, incorporating features like lane-keeping assist and automatic emergency braking. Companies like Mobileye, with its expertise in computer vision and machine learning, provide critical algorithms that enable real-time data processing for collision detection and avoidance.

These companies work collaboratively with automotive manufacturers to embed safety systems into new vehicle models, ensuring that drivers benefit from the latest advancements in active safety technology. Their continuous innovation and integration efforts help drive the growth and evolution of the Automotive Active Safety System market, making vehicles safer and more reliable on the road.

In the United States, strict government regulations are driving growth in the automotive safety system market. Agencies like the National Highway Traffic Safety Administration (NHTSA) are enforcing rigorous safety standards. Recent mandates require that new vehicles come equipped with advanced safety features, such as automatic emergency braking and lane departure warnings. These regulations aim to reduce traffic fatalities and injuries, creating a strong incentive for automakers to adopt cutting-edge safety technologies.

In China, rising awareness about vehicle safety ratings is fueling demand for active safety systems. As consumers become more informed about how safety features can prevent accidents and enhance protection, their purchasing decisions are increasingly influenced by the presence of these technologies. This heightened awareness is prompting automakers to integrate advanced safety features into their vehicles to meet consumer expectations and stay competitive in the market.

Germany is seeing a surge in demand for active safety systems due to technological advancements. The rapid development and application of artificial intelligence, machine learning, and sophisticated sensors have significantly improved the effectiveness and reliability of these systems. Consumers in Germany prioritize the reliability and functionality of safety features, such as adaptive cruise control, collision avoidance, and pedestrian detection. As these technologies become more accurate and their costs decrease, they are becoming accessible to a wider range of vehicles, not just luxury models.

The global demand for adaptive cruise control (ACC) solutions is expected to surge through 2034, driven by increasing concerns about road safety and the desire for enhanced driving convenience. ACC systems, which adjust a vehicle's speed based on traffic conditions, are becoming a crucial component of automotive active safety systems. This trend is primarily fueled by the need to address the persistent issue of road traffic accidents and improve overall driving safety.

As road safety continues to be a major global concern, there is a growing emphasis on technologies that can prevent collisions and reduce their severity. ACC's ability to maintain a safe distance from the vehicle ahead and adjust speed accordingly significantly lowers the risk of rear-end collisions caused by driver distraction or poor judgment. This makes ACC an appealing feature for consumers who prioritize safety.

Passenger car manufacturers are increasingly incorporating active safety systems into their vehicles to enhance the driving experience. The rise in consumer awareness regarding vehicle safety, coupled with the availability of advanced technologies, has led many buyers to prioritize safety features when selecting a new car. This shift in consumer preference is prompting automakers to include active safety systems as standard or optional features in their vehicle lineups. As a result, the adoption of these systems is expected to grow, thereby expanding the market for automotive active safety technologies.

To enhance vehicle safety, investing heavily in the development of automotive systems and devices is crucial. Vehicle design focuses on both passive and active safety measures. Passive safety involves features like seat belts and airbags that protect occupants during a crash. Active safety, on the other hand, addresses factors that prevent accidents, such as brake performance, stability, and handling. Toyota's data shows that 20% of serious accidents are due to loss-of-control situations, with two-thirds involving issues like wheel blocking, skidding, or sudden changes in road conditions. Active safety systems can significantly reduce or prevent these problems.

The effectiveness of Electronic Stability Control (ESC) in reducing fatal crashes and accident rates has been studied in various countries. In the United States, between 1997 and 2004, ESC reduced fatal crashes by 36% to 70% in cars and light transport vehicles. In Japan, between 1995 and 2000, ESC reduced accident rates by an estimated 35% for single-car accidents and 30% for head-on collisions. The United Kingdom saw an 11% reduction in serious crashes and a 25% reduction in crashes with fatalities between 2000 and 2005.

Moreover, ESC has shown to be effective in reducing accident rates on different road conditions. In the UK, between 2000 and 2005, ESC reduced accident rates by 20% on icy roads, 9% on wet roads, and 5% on dry roads.

In New Zealand and Australia, ESC reduced car crash rates of all severities by 27.6% and car rollover crashes of all severities by 55.6% between 2001 and 2008. Finally, in the European Union, until 2006, ESC reduced single-vehicle accidents by an estimated 40% to 50%, and multi-part accidents by an estimated 10%.

To maintain their competitive edge, key players in the automotive active safety system industry are increasingly forming strategic alliances, partnerships, and joint ventures. These collaborations facilitate technology sharing, reduce development costs, and accelerate time-to-market. Notably, traditional automotive companies are partnering with tech firms to integrate advanced safety solutions, creating fresh opportunities for innovation and market expansion.

As government regulations and safety standards tighten worldwide, the adoption of active safety systems is becoming more imperative. Companies that swiftly adapt to evolving regulations, such as the European Union's General Safety Regulation—which mandates the inclusion of several Advanced Driver Assistance Systems (ADAS) features in new vehicles—are gaining a significant competitive advantage. This regulatory push is driving the market and encouraging companies to innovate and comply with new safety standards.

In addition to established industry leaders, the market is witnessing an influx of start-ups and emerging companies that focus on niche technologies and innovative solutions. These new entrants are poised to disrupt the market with groundbreaking technologies and adaptable business models, challenging the status quo and driving further advancements.

By Product Type

By Vehicle Type

By Offering

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us