April 2025

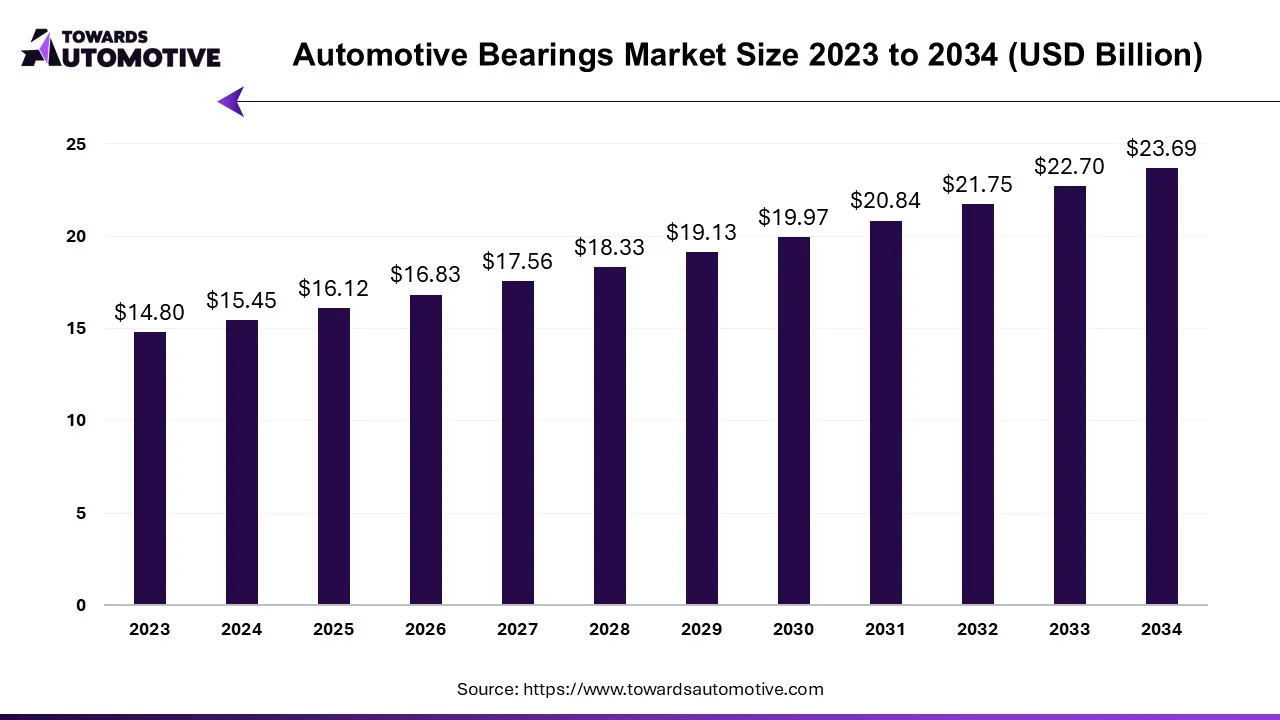

The automotive bearings market is projected to reach USD 23.69 billion by 2034, expanding from USD 16.12 billion in 2025, at an annual growth rate of 4.37% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

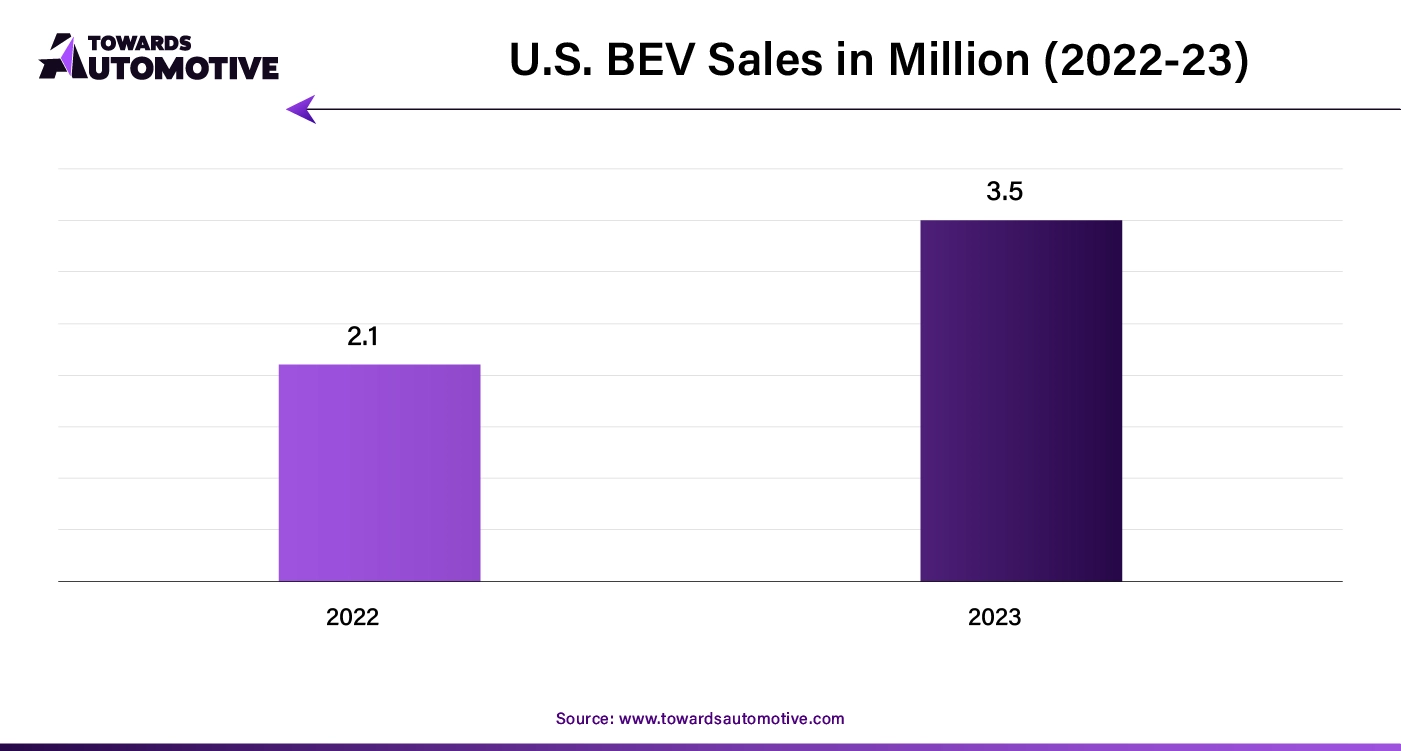

The automotive bearings market is a crucial segment of the automotive components industry. This industry deals in manufacturing and distribution of bearings for automotives. There are several types of products developed in this industry comprising of ball bearings, roller bearings and some others. It finds numerous applications in powertrain, chassis and some others. These bearings are used in different types of vehicles including passenger vehicles, light commercial vehicles and heavy commercial vehicles. The growing sales of electric vehicles in different parts of the world has contributed to the industrial expansion. This market is expected to rise drastically with the growth of the automotive industry across the globe.

In January 2024, Alagesan Thasari, the Director of SKF Automotive India and Southeast Asia, announced that, “By making our products lighter, more efficient, long lasting and serviceable, we help our customers achieve significant energy savings and carbon reductions. This Auto CO2 calculator tool is another example of how we are continuously developing solutions to help our customers understand and accelerate their journey towards sustainability."

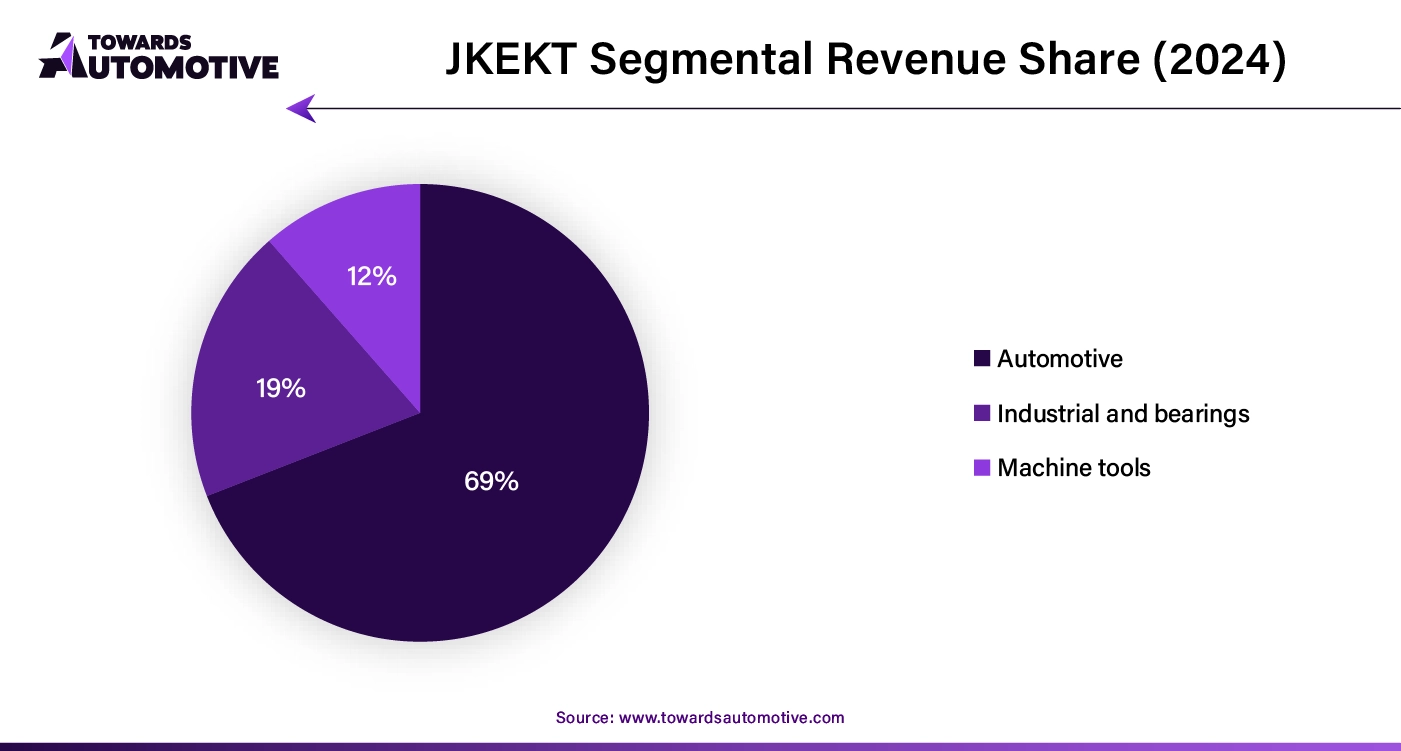

The automotive bearings market is a highly fragmented industry with the presence of several dominant players. Some of the prominent players in this industry consists of Schaeffler AG (Germany), NSK Ltd (Japan), JTEKT Corporation (Japan), SKF (Sweden), NTN Corporation (Japan) and some others. These companies are constantly engaged in developing high-grade bearings for automotives and adopting numerous strategies to maintain their dominant position in this market.

By Type

By Application

By Vehicle Type

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us