April 2025

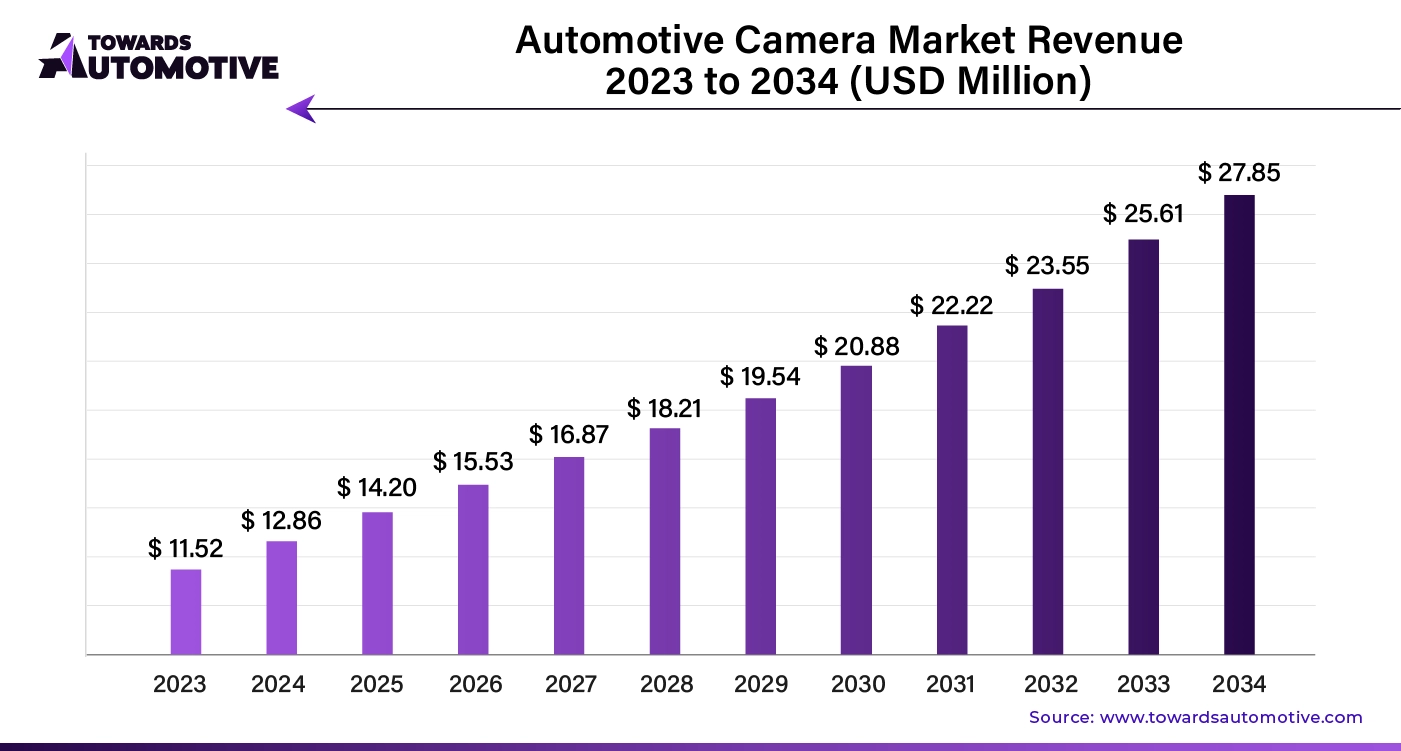

The global automotive camera market is projected to reach USD 27.85 million by 2034, expanding from USD 14.20 million in 2025, at an annual growth rate of 11.49% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive camera market is experiencing significant growth, driven by the increasing demand for advanced driver-assistance systems (ADAS) and the rising focus on vehicle safety and security. Cameras play a crucial role in enabling features such as lane departure warning, adaptive cruise control, parking assistance, and collision avoidance, enhancing overall driving experience and safety. As regulatory bodies worldwide implement stringent safety standards, the adoption of automotive cameras has surged, making them essential components in modern vehicles.

Technological advancements in camera systems, such as high-resolution imaging, improved low-light performance, and integration with artificial intelligence (AI), are further propelling market growth. These innovations enable vehicles to perceive their surroundings more accurately, leading to more effective safety systems. Additionally, the growing trend of autonomous vehicles necessitates the incorporation of multiple camera systems for comprehensive environmental sensing, driving up demand in the market.

The rise of electric vehicles (EVs) also contributes to the automotive camera market, as manufacturers increasingly integrate advanced technology to enhance vehicle features. As automakers prioritize connectivity and automation, the automotive camera market is poised for continued expansion, with manufacturers focusing on developing next-generation imaging solutions that meet evolving consumer and regulatory expectations.

Artificial intelligence (AI) plays a pivotal role in advancing the capabilities of the automotive camera market, particularly in enhancing safety, driving automation, and overall vehicle intelligence. AI algorithms process vast amounts of data from automotive cameras in real time, enabling advanced driver-assistance systems (ADAS) to make rapid, informed decisions. AI enhances object detection, lane recognition, and traffic sign recognition, allowing cameras to accurately identify and analyze their surroundings. This technology improves the performance of safety features such as lane-keeping assist, adaptive cruise control, and collision avoidance by enabling more precise recognition of obstacles, pedestrians, and other vehicles.

AI also enables computer vision in automotive cameras, which allows vehicles to “see” and interpret visual information more effectively. This is especially critical for autonomous driving, where real-time decision-making is required for navigation, obstacle avoidance, and adherence to traffic rules. Additionally, AI can improve image processing, allowing cameras to function better in challenging conditions such as low light, rain, or fog, enhancing the safety and reliability of the vehicle’s systems.

Moreover, AI facilitates predictive maintenance for automotive cameras by analyzing their performance and detecting potential failures before they occur, thereby increasing the system's longevity and reliability.

The growing demand for 360-degree cameras is significantly driving the expansion of the automotive camera market, as consumers increasingly seek enhanced safety and convenience features in vehicles. 360-degree camera systems provide a comprehensive view of the vehicle’s surroundings, eliminating blind spots and improving situational awareness during maneuvers such as parking and lane changes. This panoramic perspective is especially valuable in urban environments where tight spaces and pedestrian traffic can pose challenges for drivers. As automakers integrate advanced driver-assistance systems (ADAS) into their vehicles, the demand for 360-degree camera solutions is surging, aligning with safety regulations and consumer preferences for enhanced vehicle protection.

Moreover, technological advancements in camera resolution and image processing are elevating the effectiveness of 360-degree systems, making them more appealing to consumers. The adoption of these systems is further supported by the rising trend of electric and autonomous vehicles, where comprehensive environmental awareness is critical for safe navigation. Additionally, the growth of the ride-sharing and car rental sectors has increased the demand for vehicles equipped with advanced camera systems, as companies prioritize safety and user experience. As a result, the proliferation of 360-degree camera technology is not only enhancing vehicle safety but also propelling the overall growth of the automotive camera market.

The automotive camera market faces several restraints that may impede its growth. High production costs associated with advanced camera systems can lead to increased vehicle prices, limiting affordability for consumers, particularly in emerging markets. The complexity of integrating and calibrating multiple cameras poses technical challenges for manufacturers, potentially affecting system reliability. Additionally, concerns regarding data privacy and security are growing, as connected vehicles collect and process vast amounts of camera data. Finally, competition from alternative safety technologies, such as radar and ultrasonic sensors, may hinder the widespread adoption of camera systems in vehicles, impacting market growth.

Thermal imaging and night vision technologies are creating significant opportunities in the automotive camera market by enhancing vehicle safety and operational capabilities in low-light conditions. As road safety becomes an increasingly pressing concern, especially during nighttime driving or in adverse weather conditions, these advanced camera systems provide critical advantages. Thermal imaging cameras detect heat emitted by objects, allowing vehicles to identify pedestrians, animals, and other obstacles that may not be visible to standard cameras. This capability is particularly valuable in reducing accidents and improving overall road safety, making thermal imaging an attractive feature for both consumers and manufacturers.

Moreover, night vision technology, which amplifies low-light images, enables drivers to see further down the road in darkness or poor visibility, improving situational awareness. As regulatory bodies implement stricter safety standards and consumers demand more advanced safety features, the integration of thermal imaging and night vision systems in vehicles is expected to rise. These technologies are also being increasingly adopted in autonomous vehicles, where accurate perception of the environment is crucial for safe navigation. Overall, the growing emphasis on safety, combined with technological advancements in thermal imaging and night vision, is driving innovation and expanding opportunities in the automotive camera market, ultimately enhancing the driving experience and reducing accident rates.

The park assist system segment held the largest share of the market. The growth of the automotive camera market is significantly driven by the increasing adoption of park assist systems, which enhance the safety and convenience of parking maneuvers. As urbanization intensifies and parking spaces become more limited, drivers are seeking solutions that simplify the parking process. Park assist systems utilize multiple cameras positioned around the vehicle to provide a 360-degree view of the surroundings, allowing drivers to identify obstacles, pedestrians, and other vehicles while parking. This technology not only minimizes the risk of collisions but also alleviates the stress associated with tight parking spaces.

The integration of advanced imaging technologies, such as high-resolution cameras and sensors, enhances the effectiveness of park assist systems, making them more appealing to consumers. As automotive manufacturers strive to meet rising safety standards and consumer demands for innovative features, the incorporation of park assist systems equipped with sophisticated camera technologies is becoming increasingly common in new vehicle models.

The stereo segment held a dominant share of the market. The integration of stereo camera systems is driving significant growth in the automotive camera market by enhancing vehicle perception and safety features. Stereo cameras utilize two or more lenses to capture images from slightly different angles, mimicking human binocular vision. This technology enables precise depth perception, which is crucial for advanced driver-assistance systems (ADAS) and autonomous driving applications. By accurately assessing distances to obstacles, vehicles, and pedestrians, stereo cameras enhance features such as collision avoidance, adaptive cruise control, and lane-keeping assistance, thereby improving overall road safety.

Moreover, as consumers increasingly demand vehicles equipped with cutting-edge safety technologies, automotive manufacturers are compelled to adopt stereo camera systems to remain competitive. The ability of stereo cameras to provide real-time, three-dimensional images significantly enhances the effectiveness of driver-assistance features, fostering consumer confidence in advanced safety systems.

Additionally, advancements in image processing algorithms and artificial intelligence are further optimizing the performance of stereo camera systems, making them more reliable and efficient. As regulatory bodies enforce stricter safety standards, the demand for stereo cameras is expected to rise, driving their integration into a broader range of vehicles. Consequently, the growth of stereo camera technology is becoming a pivotal factor in the evolution of the automotive camera market, shaping the future of safe and efficient driving.

The digital camera segment led the market. The adoption of digital cameras is a key factor driving the growth of the automotive camera market, significantly enhancing vehicle safety, functionality, and user experience. Digital cameras provide high-resolution imaging capabilities that improve the accuracy of various advanced driver-assistance systems (ADAS) and other safety features. With their ability to capture clear, detailed images in real-time, digital cameras enable functionalities such as lane departure warning, collision detection, and adaptive cruise control, which are essential for modern vehicle safety standards.

As consumers increasingly prioritize safety and convenience, automotive manufacturers are integrating advanced digital camera systems into their vehicles to meet these demands. The versatility of digital cameras also supports a wide range of applications, from rearview cameras for parking assistance to forward-facing cameras for advanced monitoring of road conditions.

Moreover, advancements in digital imaging technology, such as improved low-light performance and enhanced image processing capabilities, further enhance the effectiveness of automotive camera systems. The rise of electric and autonomous vehicles, which rely heavily on sophisticated camera systems for navigation and safety, also contributes to the growing demand for digital cameras in the automotive sector. Overall, the expansion of digital camera technology is pivotal in driving innovation and growth in the automotive camera market, shaping the future of safe and efficient driving experiences.

The passenger cars segment held the highest share of the industry. The growth of the automotive camera market is significantly driven by the increasing demand for passenger cars equipped with advanced safety and convenience features. As consumers prioritize safety while making purchasing decisions, automotive manufacturers are responding by integrating sophisticated camera systems into passenger vehicles. These cameras play a crucial role in advanced driver-assistance systems (ADAS), providing features such as blind-spot monitoring, parking assistance, and collision avoidance, which enhance overall driving safety and ease.

Moreover, the rising consumer awareness of road safety, combined with stringent regulatory standards across various regions, has compelled manufacturers to incorporate more advanced camera technologies into their passenger car offerings. As a result, the market for automotive cameras is witnessing substantial growth as manufacturers aim to comply with safety regulations while meeting consumer expectations for enhanced features.

Additionally, the ongoing trend towards electric and hybrid vehicles, which often include cutting-edge technology and safety features, further fuels the demand for automotive cameras. As manufacturers continue to innovate and develop new camera applications, such as 360-degree views and integrated imaging systems, the automotive camera market is poised for sustained expansion. Ultimately, the increasing emphasis on safety and technology in passenger cars is a major driver of growth in the automotive camera market.

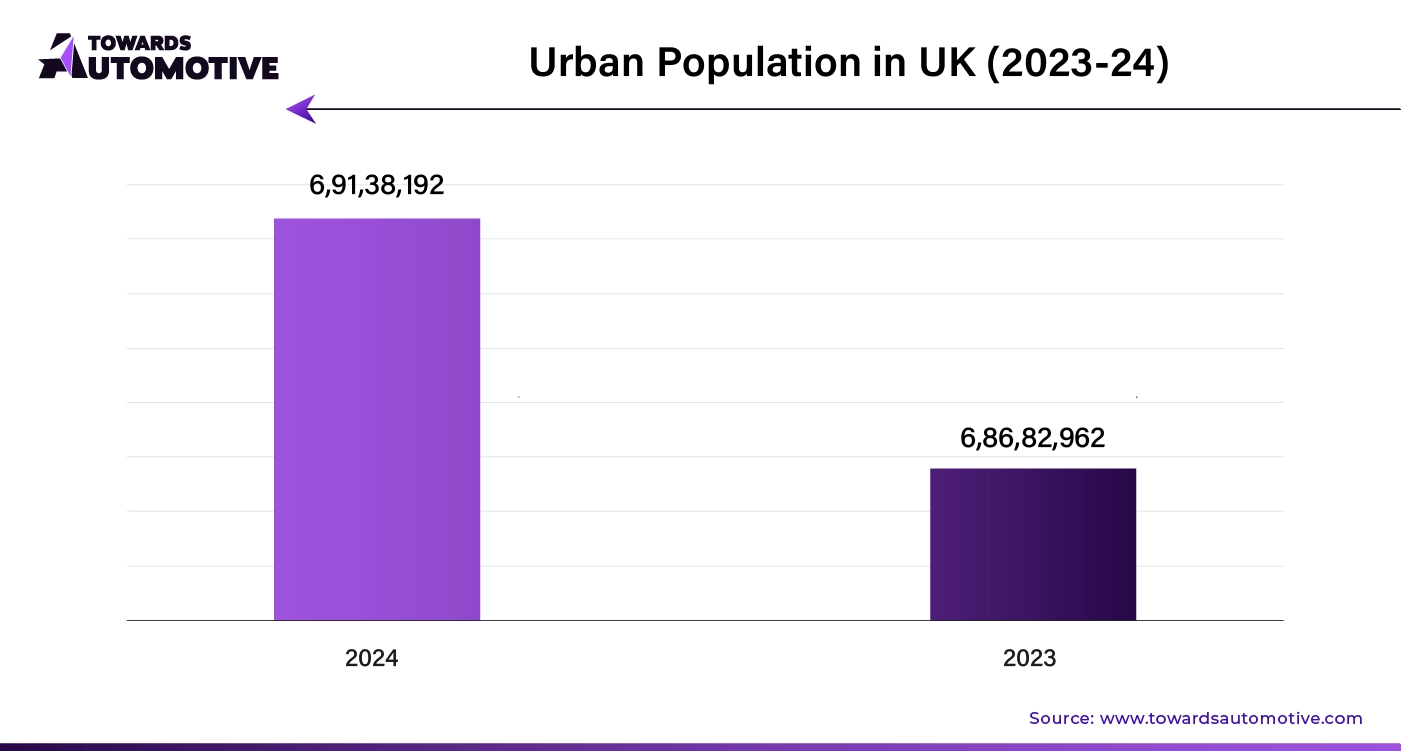

Europe dominated the automotive camera market. The automotive camera market in Europe is experiencing significant growth driven by the rising demand for advanced driver-assistance systems (ADAS), technological advancements, and urbanization. The increasing focus on road safety has led consumers to seek vehicles equipped with innovative safety features, such as adaptive cruise control, lane-keeping assist, and automatic emergency braking. These features rely heavily on automotive cameras to provide accurate data for real-time decision-making, fostering a robust demand for advanced camera systems.

Technological advancements in camera resolution, image processing, and artificial intelligence are further enhancing the capabilities of these systems, allowing for improved object detection, night vision, and overall performance in various driving conditions. As manufacturers continue to innovate, they are integrating higher-quality cameras into their vehicle designs, thereby boosting market growth.

Additionally, the ongoing trend of urbanization in Europe is contributing to the demand for automotive cameras. With increasing traffic congestion and the need for efficient navigation, drivers are increasingly reliant on features that provide enhanced situational awareness and support safe maneuvering in dense urban environments. Collectively, these factors are driving the expansion of the automotive camera market in Europe, positioning it as a crucial component in the evolution of modern vehicles.

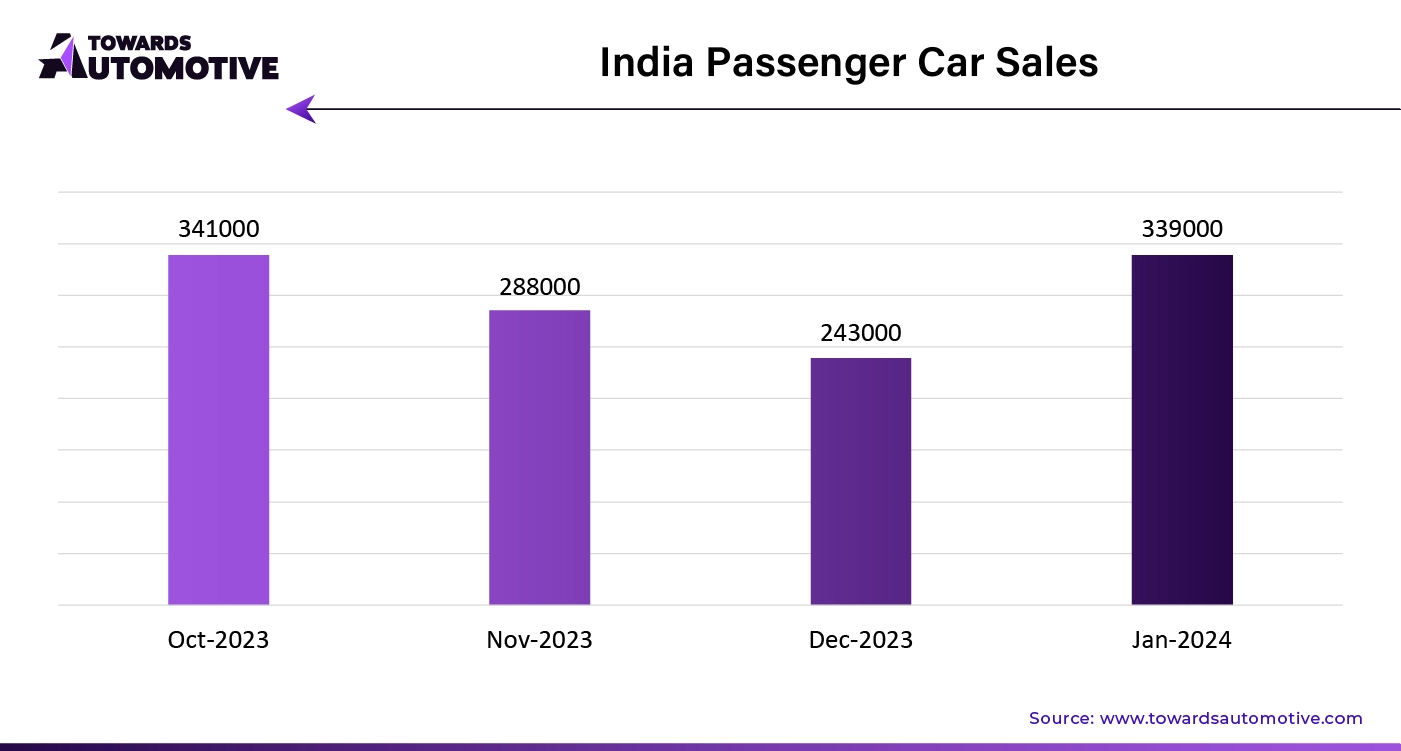

Asia Pacific is expected to grow with a significant CAGR during the forecast period. The automotive camera market in the Asia Pacific region is witnessing robust growth driven by the expansion of electric and autonomous vehicles, rising vehicle production and sales, and growing awareness of road safety. As countries like China and India invest heavily in electric vehicle (EV) infrastructure and production, the demand for advanced safety features becomes paramount. Automotive cameras are integral to these vehicles, providing essential data for features like lane departure warning, adaptive cruise control, and collision avoidance systems, which are crucial for enhancing driver and pedestrian safety.

Additionally, the overall rise in vehicle production and sales in Asia Pacific contributes to the increased adoption of automotive camera systems. As more consumers enter the automotive market, manufacturers are incentivized to incorporate advanced technologies into their vehicles to meet consumer expectations and comply with regulatory requirements.

Furthermore, there is a heightened awareness of road safety among consumers and governments, leading to stricter regulations mandating the inclusion of safety features in new vehicles. This trend promotes the integration of automotive cameras into various vehicle models, driving market growth. Together, these factors are shaping the automotive camera landscape in the Asia Pacific region, fostering innovation and enhancing safety on the roads.

By Type

By Application Type

By Technology Type

By Vehicle Type

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us